Bitcoin Trading Alert originally sent to subscribers on February 6, 2014, 10:23 AM.

In just a few words: unless Bitcoin falls below $800, we won’t think of readjusting positions.

Matthew O’Brien, in a rather provocatively titled piece “Bitcoin Is Broken—Here's a Simple Plan to Fix It” outlined the possibility of Bitcoin becoming a quick payment system for laymen. He sees “Bitcoin’s genius” in its decentralized structure of the currency but fears that it won’t work as a currency with “this much deflation.” We touched upon the deflation problem in our yesterday’s Bitcoin commentary O’Brien continues:

Bitcoin (…) needs a company that can immediately turn a buyer's dollars into bitcoins and then immediately turn a seller's bitcoins back into dollars—all for a lower fee than traditional intermediaries charge. You wouldn't have to worry about buyers not being willing to spend their bitcoins, because it wouldn't be their bitcoins. Nobody would even realize they were using bitcoins: buyers would pay with dollars and sellers would get dollars back. In other words, Bitcoin would stop trying to be a currency and start being a financial architecture.

This is a particularly interesting point as it could bring Bitcoin closer to people who don’t care much about virtual currencies, to the mainstream public. This could also solve some of the problems currently besetting Bitcoin transactions, such as problems with volatility, if there are companies willing to take on the exchange of bitcoins for dollars (or other currencies).

There might be some other technological hurdles in the way of such intermediaries, such as the necessity to hold bitcoins and, possibly, regulatory issues, but this might be the way in which Bitcoin evolves. Of course, this is only one possibility.

For now, let’s focus on the Bitcoin market itself as there’ve been some important developments of late.

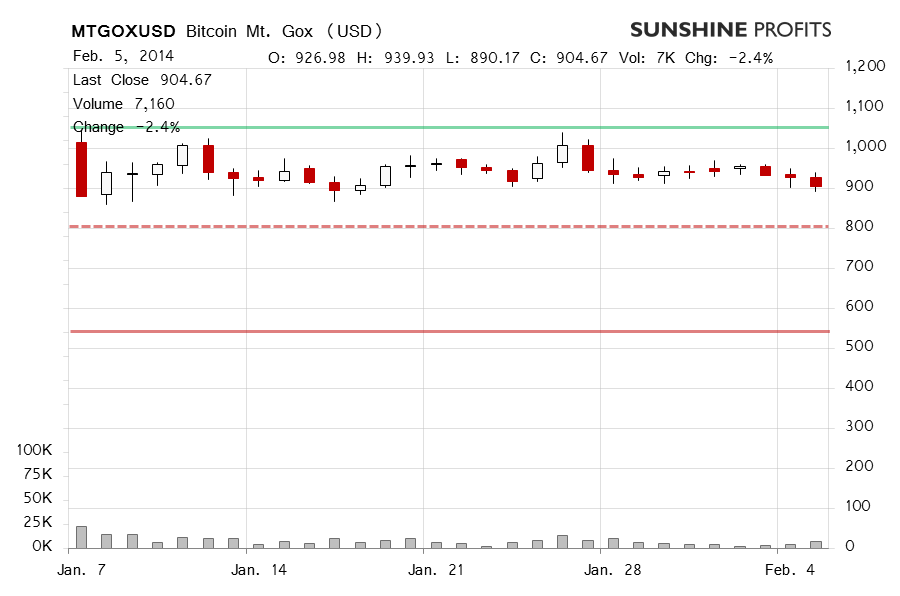

Yesterday, Bitcoin showed some weakness and ended the day 2.4% down. The volume increased markedly but there were no worrying developments.

Today, however, is a completely different story. The volume has already doubled compared with yesterday and is already highest since Jan. 7 (this is written a couple minutes after 8:00 a.m. EST). The action has been mostly down, with the currency reaching $801 at its lowest, which was only $1 above our stop-loss level. The stop-loss hasn’t been triggered and Bitcoin has recovered to $858.00 since then. Consequently, there has been no change in outlook and we’re of the opinion that long positions might still be the way to go.

The momentum is down, but with a possible reversal right before our eyes. Because of this, we won’t make any rushed moves now. If Bitcoin goes under $800, we will change our opinion on market positioning. Additionally, if we don’t see such a move, but witness the currency stabilizing below $900, we will likely also change our take on the short-term outlook. Since none of this has happened yet, the outlook hasn’t changed, that’s our opinion.

Today and tomorrow might be the most crucial days in some time now, so a special level of caution might be suitable.

Bitcoin is still between $800 (dashed red line on the chart) and the $1,000-1,100 (solid green line), but the situation has deteriorated, particularly that the currency reached $801 at one point today.

Even if there is no breakdown below $800, we will observe the next couple of days closely. If Bitcoin gets stuck below $900, we will most likely reconsider our short-term view on the market. On the other hand, there still seems to be a good chance of a reversal bringing Bitcoin to the $1,000 area and currently we’re betting on such a move.

Summing up, if Bitcoin doesn’t plunge below $800 today, our view on the market won’t change immediately.

Trading position (short-term; our opinion): long, stop-loss at $800. We are waiting to see if Bitcoin comes back above $900 before reconsidering positions.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts