Bitcoin Trading Alert originally sent to subscribers on July 11, 2016, 11:17 AM.

In short: no speculative positions.

There has been an important change in the way the Bitcoin network operates. Namely, mining rewards have been cut in half. This is not an unforeseen change, since there is a known halving schedule. On BBC News, we read:

The financial rewards for being involved with the Bitcoin virtual currency have been halved.

Before 9 July, a regular reward of 25 bitcoins was handed out to those who were first to verify which coins had been spent.

Now, the leading team of "miners" who verify a chunk of global transactions will receive only 12.5 bitcoins.

The halving of the reward is scheduled to take place every four years to limit bitcoin inflation.

The interesting thing is that there was no significant price action on the day. It might be argued that the changed had already been priced in before the actual change transpired. The decrease in mining rewards is most likely to affect mining companies, quite unsurprisingly. BBC reports on an instance where a Swedish miner filed for bankruptcy citing a fall in revenues following the cut.

The competition between Bitcoin miners just got tougher and more companies may go underwater in the wake of this event. On the other hand, the relative lack of action in Bitcoin following the implementation of the change might suggest that the Bitcoin trade is either not driven by mining rewards at the moment or that Bitcoin is showing strength.

For now, let’s focus on the charts.

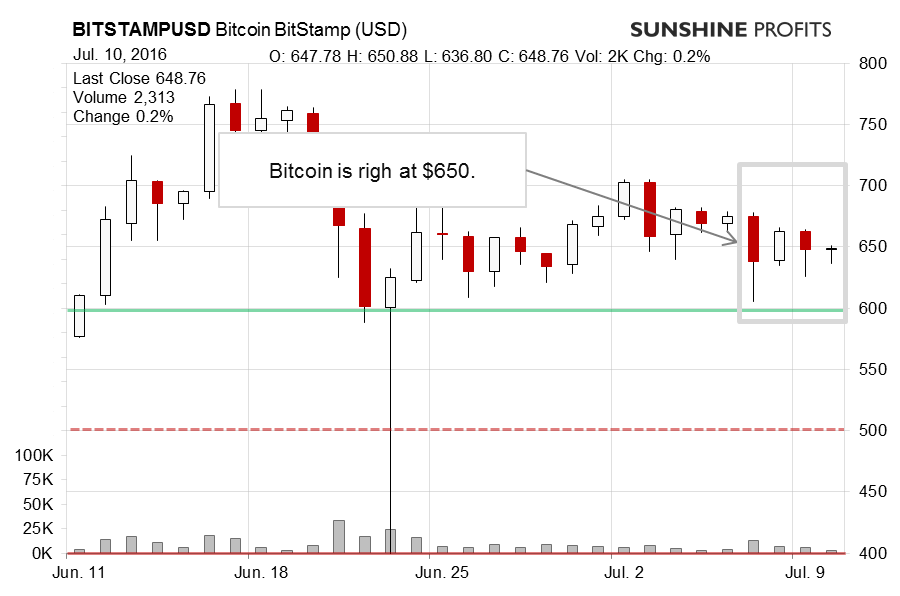

We see Bitcoin right at $650. Recall our recent comments:

(…) the market has put some time between the current price and the recent high without moving higher. This seems a bearish indication as Bitcoin hasn’t continued its march to the upside. On the other hand, the stagnation period is one with decreased volume. This might actually overturn the bearish conclusion. The picture is quite cloudy at the moment.

With the following swing to the upside being not particularly strong, we have a bearish hint. Additionally, Bitcoin failed to close far from its open on Saturday and moved down yesterday. This, too, are bearish hints.

The recent move to the upside weakens the previous bearish hints. On the other hand, the depreciation yesterday is a bearish event and the volume on which the move took place was higher than the volume during the upswing. All of this means that we are back to a cloudy picture.

The cloudiness remains (…), however, a little bit less so than was the case previously. Namely, Bitcoin has declined today and the currency is below $650 (...). This is a bearish development but is it bearish enough to go short, in our opinion? Not necessarily.

The general idea hasn’t changed much. Bitcoin is still at $650, which might be an important level (more on that later). One possibly significant bullish hint is that Bitcoin didn’t decline following the announcement of the halving of mining rewards. This might be a show of strength. The recent volume, however, has on the downside, which suggests that Bitcoin is yet to move a significant move in either direction from $650.

The long-term BTC-e chart looks like a double top formation. Recall what we wrote in our previous alert:

There’s still room for decline and we are still leaning toward the opinion that the next strong move will be to the downside. The action we see now is similar to what we saw back in 2013 and 2014 – a strong rally, sharp decline and a bounce up. Back then the action was followed by a lengthy period of depreciation. This doesn’t have to be the case now, but it might be a bearish hint. At present, we would prefer to see some more depreciation. Possibly even one day could do, depending on the magnitude of the move. Stay tuned.

A day of depreciation has materialized today, at least so far. Is it enough to go back on the short side of the market? We don’t think this is the case just yet. Bitcoin is now very close to the 38.2% Fibonacci retracement but still above this level. This means that we might be very close to getting a confirmation of a swing to the downside but are not there just yet. Again, stay tuned as the situation might change quite quickly now.

There hasn’t been much change since we wrote these words and the $650 level on BitStamp and the $630 level on BTC-e are still ones to observe as they coincide with the 38.2% Fibonacci retracement for the recent rally. The situation remains tense in the market and the next move might establish at least a short-term trend.

Summing up, in our opinion no speculative short positions are favorable at the moment.

Trading position (short-term, our opinion): no positions.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts