Bitcoin Trading Alert originally sent to subscribers on May 28, 2014, 11:40 AM.

Very briefly: we don’t support any short-term positions in the Bitcoin market now.

Today, we read an interesting piece on CoinDesk on the potential of Bitcoin derivatives. The article discusses why derivatives might be needed for the Bitcoin market and how liquid derivatives markets might emerge for the cryptocurrency.

In the article, we can read:

Any new bitcoin derivatives exchange will have to be electronic with 24/7 availability in order to mirror the existing spot markets for bitcoin trading. Just as with commodity exchanges that trade gold, silver, wheat and soybeans, warehousing partners will need to be established to accommodate the safe storage of bitcoin necessary for exchange integrity.

(...)

We can learn a lot about bitcoin futures exchanges by studying (…) predecessors, especially in the areas of customer support, liquidity and counterparty risk. Neither ICBIT.se nor MPEx [two derivative exchanges currently in operation] serve as a clearinghouse for their customers’ trades, which is an essential element of a formal futures exchange. Furthermore, verifiable volume reporting will be critical as these futures exchanges will most likely play an important role for bitcoin price discovery.

So, there is a market for Bitcoin derivatives and hedgers might actually enjoy a possibility to lock in their Bitcoin price. On the other hand, existing derivative exchanges are far from perfect, particularly when it comes to the safety of funds.

All this might also be interesting for investors since derivatives offer the opportunity to bet on price declines. While currently one might have a hard time finding a secure venue for short selling, the development of derivative exchanges with clearinghouse facilities would make going short a lot easier.

Derivatives also offer leverage since you only have to cover part of a value of a contract but this is a double-edged sword – it might be risky if you don’t know what you’re doing. Only experienced traders should rely on them.

Overall, there’s need for Bitcoin derivatives since they might not only serve the purposes of hedgers but also provide a liquid market with shorting opportunities. Having said that, much development is needed before we see Bitcoin derivatives exchanges up to the standards of those quoting commodity futures.

Let’s have a look at the charts today.

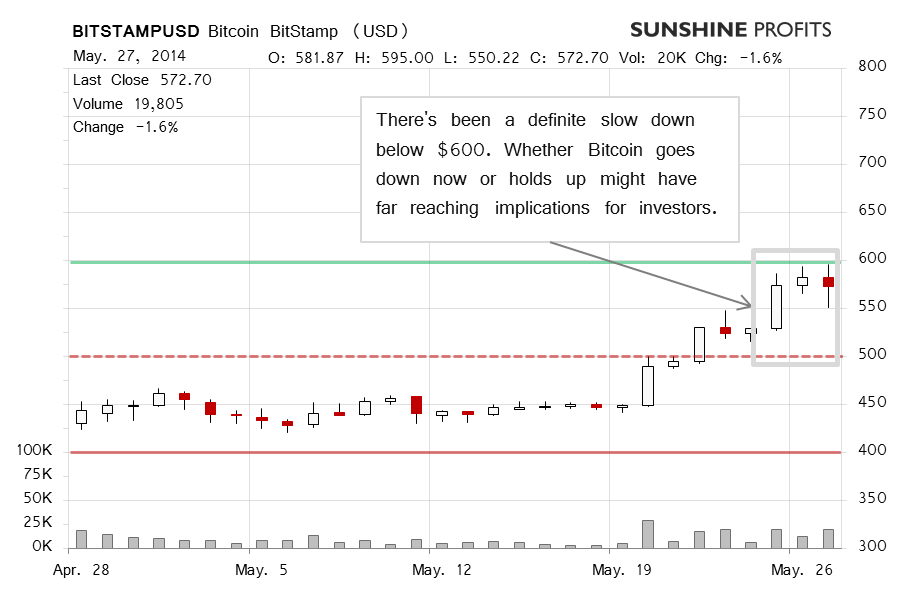

Yesterday, Bitcoin declined 1.6%, a first day of declines in four days. The move took place on relatively high volume. This move was fairly volatile with Bitcoin going to almost $600 (solid green line on the chart), then declining to $550 and rebounding to around $575. This was an important day since it pointed to a possible pause or decline in the recent rally. Also, the price stopped shy of $600, a bearish indication.

Yesterday we expressed the following view:

(…) our best guess at this time is that Bitcoin will consolidate between $500 and $600.

Today has turned out to confirm this point of view, with Bitcoin going down 1% on relatively weak volume (this is written before 10:00 a.m. EDT). This might be big news for the very short-term. First of all, the pause of yesterday has been confirmed so far which means that we might not see immediate strong upside action (the day is far from being over, though).

Whether we’ll see declines now is a different question. The price action today, despite being down, doesn’t quite suggest more depreciation is just around the corner. The best bet now in the very short-term, in our opinion, seems to be on the market consolidating below $600. Afterwards, we would expect Bitcoin to decline once again, possibly erasing all of the recent gains.

Let’s take a look at the long-term BTC-e chart.

Without being great fans of subjectively developed trend lines, we are currently seeing a possibly very important period for the Bitcoin market. Bitcoin briefly went below $400 in April which is still above our bet for the bottom but not far from it. Right now, we’re seeing a period quite unlike anything we’ve seen since the beginning of the year. Bitcoin consolidated above $400 and started a strong rally without prior declines. Combine that with the fact that the rally is very near to the $600 level (solid green line in the chart) and we have a situation with possibly important consequences.

From a technical perspective, Bitcoin has either broken out above a declining trend line or is testing it (depending on the line you choose to consider valid). We tend to think that because this period is definitely different than what we’ve seen recently, one needs to pay special attention precisely at this point. Our bet now is that Bitcoin will trade sideways before retracing below $500. The situation, however, is tense enough to change the short-term outlook from bearish to bullish given a confirmed breakout above $600.

Right now, it seems we’re at major crossroads. More than that. If Bitcoin in fact stays under $600 but doesn’t decline, the situation might become even more tense in the nearest future.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market at the moment.

Trading position (short-term, our opinion): no positions. If Bitcoin actually confirms a move above $600 the short-term outlook might change. On the other hand, if we see a move above $600 followed by an immediate decline, the situation might become bearish and there might be a shorting opportunity.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts