Bitcoin Trading Alert originally sent to subscribers on September 26, 2016, 11:33 AM.

In short: no speculative positions.

The treatment of Bitcoin by asset management firms is slowly changing. The digital currency is by no means as popular as traditional assets, however, investment companies sometimes approach Bitcoin as a new asset class, one that might be on its way to maturity. Money Morning cites a report on Bitcoin by Needham & Co.:

Needham's case for boosting its Bitcoin price prediction is based on three central ideas: that it is increasingly behaving like other investment classes; that adoption is accelerating; and that changes to the software itself will make it more useful.

Bitcoin has endured a lot of criticism for its flaws compared to conventional investments, particularly its high volatility and limited liquidity. But that's been changing, Needham found.

"Bitcoin's daily volatility is now comparable to small-cap equities," Bogart wrote.

Where Bitcoin's volatility is about 3.3%, the Standard & Poor's Small Cap 600 is 2.6%. The report also notes that some tech stocks and oil prices are slightly more volatile than Bitcoin now.

Regarding liquidity, Bogart [author of the report] wrote that "Bitcoin's daily dollar volume roughly resembles that of a U.S. mid-cap security," even just using the top five Bitcoin exchanges where the digital currency can be traded for U.S. dollars.

Liquidity — the ability to buy and sell an investment as needed — is a vital consideration, as no one wants to be stuck in a position they cannot exit. Bogart noted that investing in Bitcoin even has some advantages in terms of liquidity, as the Bitcoin exchanges are open 24/7.

Another appealing aspect of Bitcoin is that its price moves have virtually no correlation with other investments. That makes it appealing as an investing hedge to guard against sudden price drops in other asset classes.

Our general comment here is that Bitcoin is still very far from being an asset class like precious metals. This is mainly because digital currencies are not accessible via traditional broker channels. The few exceptions, like the Bitcoin Investment Trust, have been just that so far, exceptions. Things might change with the advent of new Bitcoin ETFs but these have been in the works for years now, so there’s not that much to get excited about just now.

The report highlights that Bitcoin has been slowly converging toward the volatility we might expect of traditional asset classes. Whether this trend is here to stay is not at all clear, events in the like of the Mt. Gox failure might still shake the market violently, particularly as Bitcoin is not traded on traditional exchanges. On the other hand, the general trend seems to be one in which Bitcoin is still volatile but not quite as volatile as it was in, say, 2013.

For now, let’s focus on the charts.

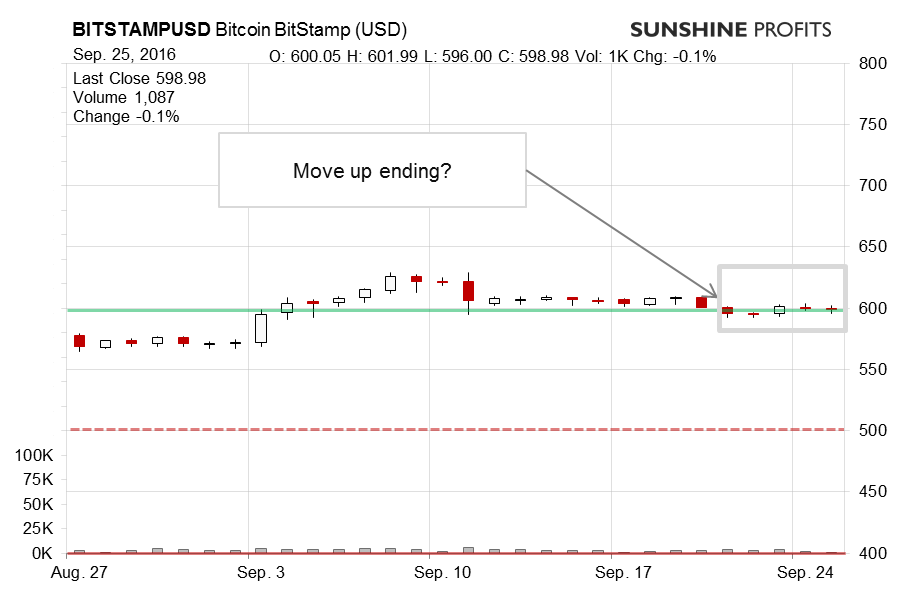

On BitStamp, we see that Bitcoin came back from under $600. Is this a very important bullish development? Recall what we wrote previously:

So, the currency has stayed above $600. This is a weak bullish indication, possibly a lot weaker than might seem at first sight. The first point to make is that Bitcoin hasn’t really moved much since the recent decline. Actually, the price action has been really muted. Another point is that the volume hasn’t been pronounced. These are potentially bearish developments. On the other hand, Bitcoin is still above the 38.2% Fibonacci retracement levels. As such the situation is still not very well defined any way.

As the situation plays out, we have seen virtually no changes apart from the fact that Bitcoin has now stayed in the consolidation pattern for longer. The volume has been particularly low recently. The implications remain largely unchanged. One remark here is that we don’t have to see much action to the downside for the situation to switch to bearish as far as the short term is concerned.

[Later alert] If the previous developments weren’t strongly indicative of either a bearish or bullish trend, today we see some clarification. The most visible change is that Bitcoin is now below $600 and the move below this level took place on increased volume, not explosive but slightly nonetheless. Does this mean that the situation is bearish enough to go short?

So, Bitcoin is above $600 at the moment of writing (around 11 a.m. ET). Yesterday’s close was below $600. Overall, the currency is dancing around $600 without a decisive move. This possibly means that today’s action is not confirmed. Even more the case if we have a peak at the volume which has been very tiny today. It wasn’t high in the last couple of days either. Taking these indications and putting them together doesn’t actually leave us with very strong bullish hints.

On the long-term BTC-e chart, we see Bitcoin’s jittery movement around $600. Our previous comments:

We have just seen a first symptom of the beginning of a possible move lower. Is this enough to go short? In our opinion, it isn’t. First of all, even if Bitcoin closes below $600 today, this will only be a second close below this level. Also, the actual move below $600 hasn’t been quite pronounced. In other words, Bitcoin still looks like “glued” to $600. If we see more daily closes below this level, we might be inclined to consider shorts. Now, we are relatively close to the 38.2% retracement based on the decline from the June top but not yet at this moment. Now this means that a decline might occur any day now, but there are not enough indications to open hypothetical short positions at the moment. This might change in the next couple of days.

The bearish indications we saw previously are somewhat weakened as Bitcoin is now further away from the 38.2% retracement level. The situation is not yet bearish enough to go in and open hypothetical short positions. The situation might change in a matter of days, however, as we’re not very far from a possible starting point.

Summing up, in our opinion not having speculative positions might be favorable at the moment.

Trading position (short-term, our opinion): no positions.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts