Yesterday, the price of Bitcoin surpassed $16,000. What does it mean for the gold market?

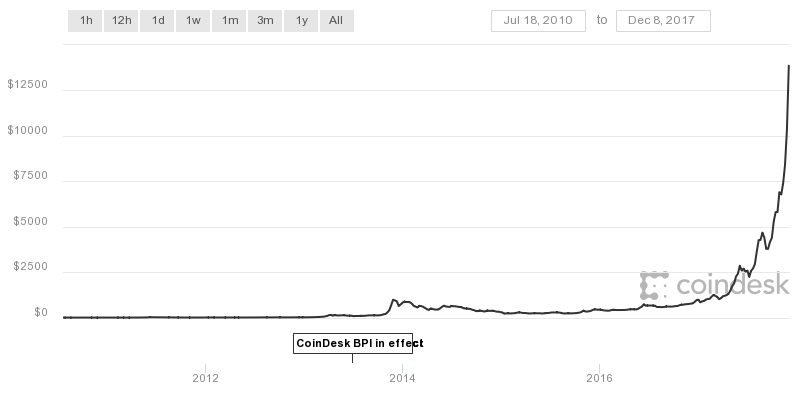

The rally in Bitcoin continues. On Thursday, the cryptocurrency climbed above $16,000, gaining about 60 percent in one week and more than 2000 percent over the last year. As one can see below, the chart of Bitcoin prices is probably the most vertical chart in history.

Chart 1: Bitcoin prices from July 2010 to December 2017.

We are agnostic whether there is a bubble in Bitcoin. On the one hand, the exponential rally and the media hype about this cryptocurrency strongly suggest it. Indeed, there is a significant divergence between the price of Bitcoin and the number of transactions with this cryptocurrency. On the other hand, markets are forward-looking and the blockchain technology (it’s not the same as Bitcoin, but try to explain it to the investors who fear missing out) is probably the most disruptive invention in the finance sector since the Internet. Another issue is that Bitcoin is a kind of currency, so there are some network effects here: the more individuals use it, the more its utility rises. In other words, rising demand with limited supply growth has to boost prices.

The general problem is that Bitcoin is neither an asset, nor a commodity. Hence, it is impossible to determine its fundamental value. How we can, then, say that there is a bubble? Thus, the rally may continue for a while and the price of Bitcoin may climb even higher, but we would not invest in it now, as we do not see value at this level and the volatility is too high. Please be aware that markets that move exponentially higher over a short period of time typically crash at some point. If you are interested in Bitcoin trading, you should read our Bitcoin alerts – you will find there a lot of insightful analyses.

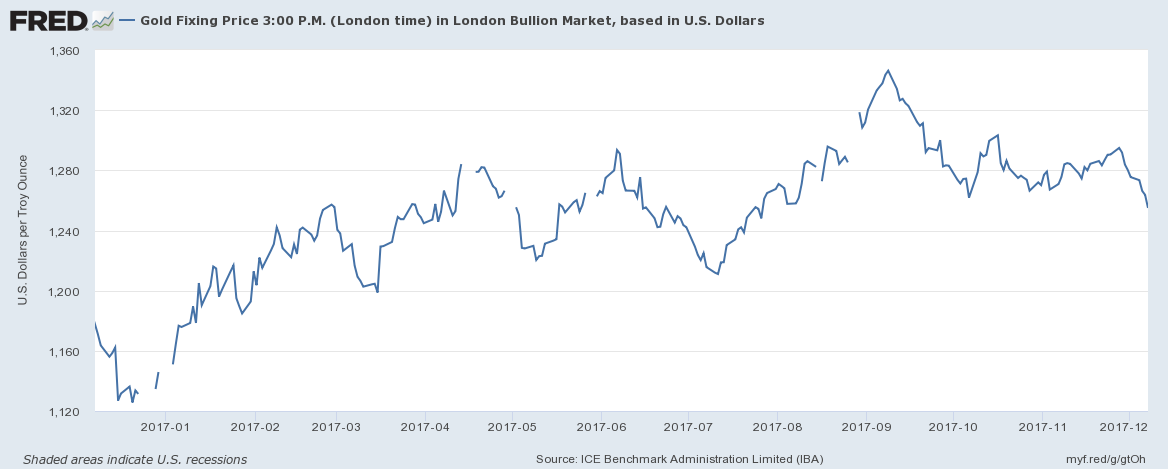

Here, we would like to discuss briefly the link between Bitcoin and gold, as some analysts claim that Bitcoin has taken the shine out of gold. Well, the cryptocurrency definitely has become a competitor for the dollars that could go into bullion. In a sense, Bitcoin can even be called “gold for millenials” as these consumers use cryptocurrencies to hedge against governments and the global financial system. However, we would not overstate this substitution: Bitcoin is simply too young and too volatile to compete with historical stores of value, such as gold. Although the price of gold has been declining this week, it remains in its 2017 trading range despite the impressing rally in Bitcoin, as the chart below shows.

Chart 2: Gold prices over the last twelve months.

In some sense, the recent Bitcoin rally may be positive for the gold market. Assuming that there is a price bubble, it will pop one day. It does not have to happen soon – the mania could continue for some time, as not all retail investors poured their money into it yet, but it will happen at some point. If this scenario occurs, the scared money is likely to flow into gold, the ultimate safe-haven asset. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview