Bitcoin was spoken about at the Sohn Investment Conference. On CNBC we read:

Dan Morehead, chairman of digital currency exchange Bitstamp, said bitcoin and other digital currencies will likely become assets serious investors will want in their portfolios.

"Bitcoin's essentially going to revolutionize currency, or money," Morehead said on Wednesday at the Sohn Investment Conference in San Francisco, which was attended by portfolio managers and asset allocators.

"If it does work, the upside is so high, it's a rational, expected thing to have in your portfolio," he said.

First of all, Morehead is obviously interested in the success of Bitcoin as he heads up a digital currency exchange. So, you have to take his assertions with a pinch of salt. Having said that, there are parts of this assessment we agree with. The most important one might be that “serious investors” will indeed want to hold Bitcoin. Actually, they might want to hold Bitcoin already. While it might not be public knowledge, it might be the case that as much as 5% of hedge fund managers have small stakes in Bitcoin. At the same time, only 0.5% of hedge funds would actually hold the currency. This might be indicative of the interest of “smart money” in Bitcoin. Hedge funds might be very interested in including Bitcoin in their portfolio but they either don’t have the technical means to do so or are wary of unclear legal status of the currency. If you recall what happened with gold after the first large gold ETF was set up in 2004, this might be the kind of thing to expect from Bitcoin. So, if we do see a Bitcoin ETF, we might see a lot more buying fueled by people who currently want to hold Bitcoin but cannot.

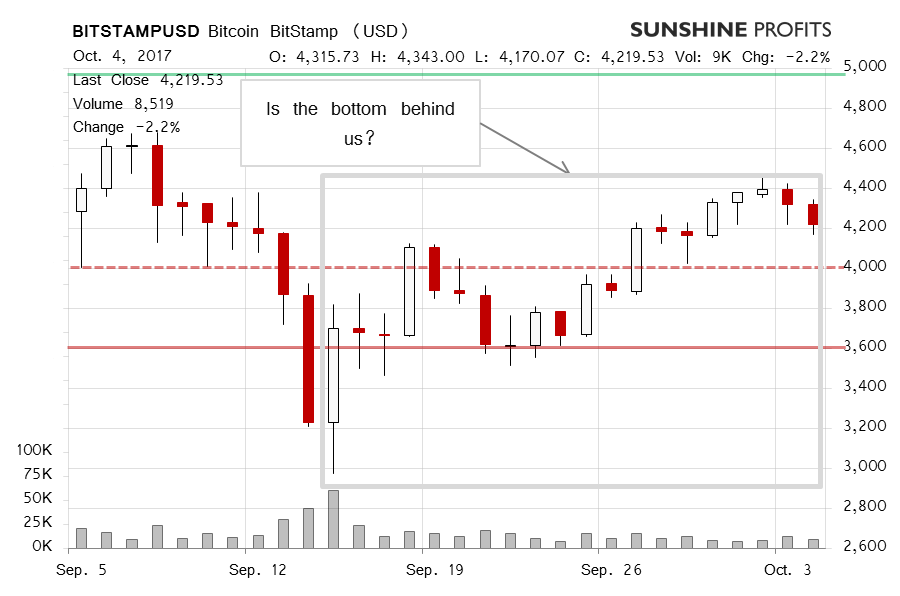

For now, let’s focus on the charts.

On BitStamp, we saw a period of depreciation. This came on the heels of a rebound. Recall our recent comments:

There is no change in that Bitcoin has stayed above the 38.2% retracement in a visible way. The outlook is now more bullish than before, at least for the short term, as the currency has held up above the support. The one change that we saw was the move above the 23.6% retracement which is a bullish indication. Based on the current price, we wouldn’t rule out a move to the recent all-time high, or even slightly above it.

The depreciation we have seen has brought Bitcoin back to the 23.6% retracement and even slightly below it. The tiny breakdown is not verified and we wouldn’t draw serious conclusions from this fact but rather wait for a confirmation. Right now, it seems that the situation is slightly less bullish than it was a couple of days ago but the environment hasn’t changed enough to consider speculative positions.

On the long-term Bitfinex chart, we see the tiny pullback from the recent move up. In our previous alert, we wrote:

The more significant move above the 38.2% retracement is not yet visible from the long-term perspective. Also, most of the action to the upside has transpired today (this is written after 12:00p.m. ET). Currently, the situation seems slightly more bullish than was the case previously since the currency is above the 38.2% level, above the recent downtrend and also the currency hasn’t broken down below this level convincingly for some time now. So, we might be seeing more strength in the market. The problem with that is that the volume is clearly low in relative terms and not much action to the downside could result in the conclusions being reversed. (…)

As noted earlier, the move to the upside extended and we not only saw the move above the 38.2% retracement but also above the 23.6% retracement. At the moment, we might see a move back to the all-time high as the move below several retracements has been invalidated. If this is in fact the case, $5,000 might be the level defining whether we see yet another extension or a reversal.

Bitcoin is below the 23.6% retracement but this doesn’t necessarily have very strong implications for the next couple of days. Right now, our take is that Bitcoin might be in for further appreciation since the currency has managed to stay above several support levels for some time now. At the same time, any move forward might be limited by the recent all-time high. At the moment, it seems that Bitcoin is showing strength, but this conclusion might be reversed relatively quickly.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign me up!.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts