The full version of our analysis (with comments particularly valuable for Precious Metals Traders) is available to our Subscribers. Visit our archives for more gold & silver articles.

While a majority of investors, analysts and experts dwelt on gold and (to a lesser extent silver) in 2010, sister precious metals platinum and palladium notched up significant gains matching gains in the investment safe havens. While gold and silver gained close to 30% and 80% respectively, platinum and palladium were nowhere lagging gaining in the region of 20% and 100% in that order. We inspect long-term prospects of these lesser invested metals in this essay. A strong case for platinum and palladium makes for diversification of precious metals funds into these metals. This diversification of funds is of particular importance when Investors are being suggested to wait for medium-term corrections before stocks become investable again.

Automobile Demand Key Support for Platinum, Palladium

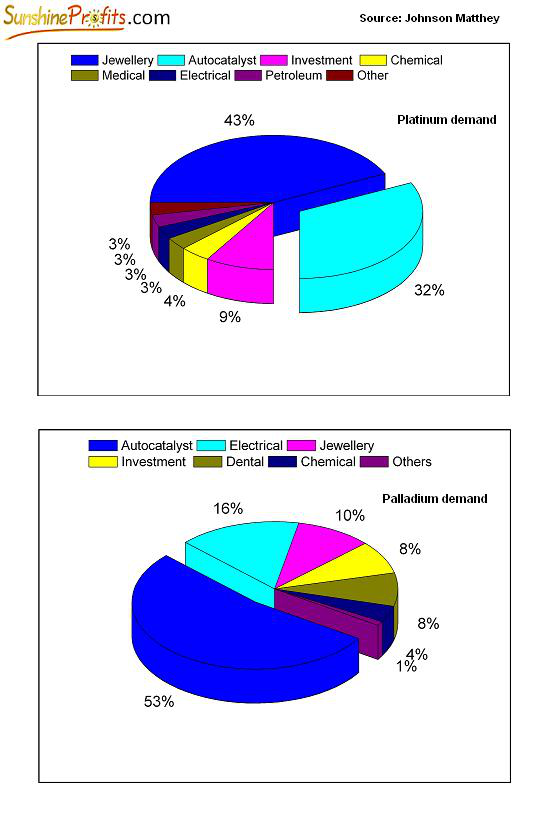

More than investment demand and close to jewelry fabrication, platinum draws well over a third of its overall demand from industrial applications in the automotive industry. Its use as an autocatalyst and extensive use in vehicle emissions control devices makes its demand fundamentals strongly linked to the demand of automobiles. This also makes platinum more sensitive to economic, industrial and market conditions. Palladium is also extensively used as catalytic converters in the auto industry - even more so than platinum.

Given the dependence of platinum and palladium on a sector like auto, prices of these precious metals react almost immediately to auto demand changes. While the recession hit auto sales in the US, platinum and palladium started to plunge way before most other commodities started correcting. With recovery in sales, platinum group metals have soared significantly in the past year or so. Not surprisingly, when we talk about these metals, we first talk about auto sales.

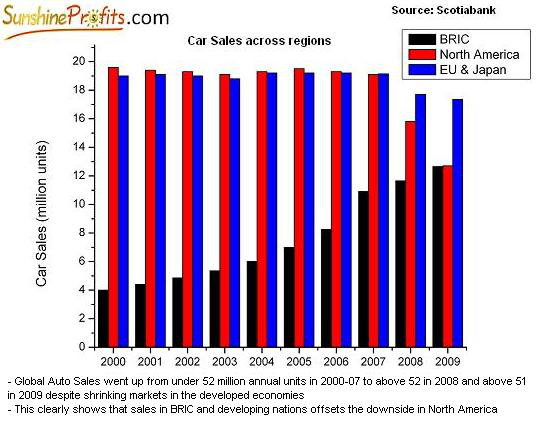

One of the key developments for the platinum group metals over the past few years has been Chinas rise to dominance as the largest auto market. China, along with India and the other BRIC nations (Brazil and Russia) has witnessed robust auto sales despite a drop in the US and Europe during the recession.

Turnaround in auto sales in the West has also been swift, thanks to government initiatives such as the cash-for- clunkers programs. The overall sales figures in 2010 have been encouraging and it can be safely concluded that the worst is behind us. The upcoming years will yet witness growth in auto sales, particularly in the developing world, which in turn renders prospects for the platinum group bullish.

Although, the removal of subsidy, rising fuel prices and stricter new registration laws are likely to hit the Chinese auto markets in 2011, China will remain a primary support for automobile manufacturing for the next few years. Another oriental economy touted to have the potential to replicate Chinas growth story in the auto market is India. Both India and China have registered robust sales numbers while the auto market remained damped elsewhere in 2009 and progressed by leaps and bounds in 2010. India is home to well over 40 million passenger vehicles a healthy 26% sales growth was registered in 2009 while the rest of the bigger auto markets were reeling, making India the second fastest growing automobile market globally.

Long-term auto sales data shows that the saturation in the auto sector in the US and Europe is more than compensated by a growing market in China and India. Additionally, unlike what looked apparent during the recession, sales in the developed markets will not plunge as sharply as expected. The health of the auto sector augurs well for platinum and palladium we do not foresee any perceptible change in the dynamics of the auto sector at least for the next 2-3 years, which is as far as suggested long positions will aim.

Emission Norms to Boost Platinum Group Metals in US and Europe

Platinum and palladium are used in catalytic converters which reduce harmful emissions from automobiles. With even developing countries becoming conscious about cutting down vehicle emissions, the demand for catalytic converters with palladium and platinum should increase further.

The ailing automobile industry in the US just returned to profitability in 2010. Automakers are optimistic that recovery from one of the biggest downturns in history is gaining steam and will sales will remain strong for some years now. Sales figures in Europe were still damp in 2010; however, expectations are of a better year ahead with strong support from the regions biggest market Germany. The biggest support though from a saturated market in the West is its increasing emphasis on stricter emission norms.

The U.S. administration has revised the target of achieving a 35.5 mpg (miles per gallon) or 6.7 liters/100 km fuel economy to 2016, four years earlier than the initial target of 2020. The ambitious 40% rise in fuel economy, from the present standards, implies that even if fuel efficiency improves by half of the target, it would exert a positive influence on the demand for PGM.

The calculations numbersare only for the U.S., while standards that are even more stringent are intended for Europe, Australia and Japan. While Europe has targeted a fuel economy of 42 mpg by 2016, Australia is aggressively pursuing the 34 mpg target by 2010. These fuel economy standards are expected to impact industrial metals demand over the next five years. It is estimated that, approximately 15% of the automobiles will comply with the standards by 2012.

Is the Threat from Hybrid Vehicles Real?

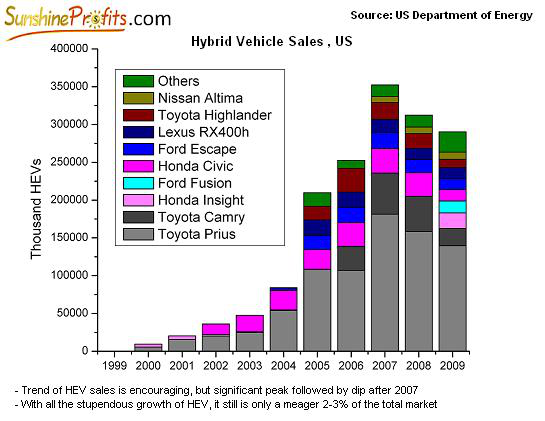

Another key development in the auto industry, witnessed in the past few years, is the advent of electric/hybrid vehicles. There has been talk of hybrid vehicles rendering demand for PGM lower. Approximately USD 150 billion of the USD 787 billion stimulus package had been earmarked for green energy initiatives, including investment for the development of hybrid cars. With the auto majors such as GM, Honda and Toyota releasing various versions of hybrid electric vehicles (HEVs), it is expected to have a significant influence on the demand for PGM.

However, the good news (for platinum and palladium Investors) is that currently, HEVs constitute only a small proportion (less than a 3% market share) of the auto market approximately 1.5 million units per year. The U.S. Department of Transportations expectations that, by 2012, the market penetration of HEVs will be approximately 30% of the total production, is surely not on track.

Given the current demand trends for hybrid vehicles, a slow to medium penetration will be the probable scenario in the next few years. Currently, HEVs do not present any price advantage over the non-hybrid cars implying that the market penetration will depend on the technological advancements, which could improve the financial viability of these vehicles for both manufacturers and consumers. Therefore, the penetration of HEVs is expected to be a slow process, which may take four to five years to take off in a big way.

Interestingly, despite claims of a dampening of PGM demand from the invasion of hybrid vehicles, some car makers are of the opposite view. Hybrid vehicles use a combination of a battery and a standard internal combustion engine. The use of a combustion engine requires the use of a catalytic converter. In fact, in many cases the catalysts used in hybrid electric battery/internal combustion engine vehicles use more PGMs than regular vehicles. Clearly, the threat is not due to hybrid vehicles but fully electric vehicles which have an even lower penetration level.

Overall, the threat from hybrid vehicles (if any) is compensated by a growth in demand for platinum and palladium due to stricter emission norms. And to think, the developing regions are yet to enforce strict emission norms as in the US and Europe. Once the developing regions also jump into the emission norm bandwagon, the threat from a not so fast expanding hybrid vehicles market will likely be well overcome. Add to that an expanding car market and a shrinking supply side and the outlook at least for the next few years is bullish.

Fundamentally, prospects for the PGM group are positive for the long-term. Investors may time their entry after minor corrections in the short-term due to a run-off from sister precious metals and a pause in the current rally.

To keep yourself up-to-date with movements in the precious metals markets, we encourage you to subscribe to our Premium Updates, providing in-depth analysis and cutting edge observations. We also have a free mailing list (sign up today) that provides free 7 day access to our website, and you can unsubscribe at any time. Remember, as the gold rally enters this critical phase, investors will be well armed if well informed.

Thank you for reading.

Mike Stall

Sunshine Profits Contributing Author