Visit our archives for more gold & silver articles.

The Federal Reserve will hold a two-day policy meeting on July 31 that is expected to yield no change in U.S. interest rates, but markets will analyze and dissect every word of Chairman Ben Bernanke for any clues that the central bank will do more to promote economic growth. Already it seems that three top Federal Reserve policymakers on Monday laid the groundwork for a third round of bond purchases by saying the U.S. recovery was weak and unemployment too high, but at the same time they said the situation is not bad enough to warrant another QE right now. In the June 22, 2012 Premium Update we wrote that Bernanke’s speech could be interpreted in the following way: the economy is not yet weak enough for QE III and we want to see lower stock and commodity prices before we make another move. Lower stock prices appear more probable from here. This is certainly up-to-date.

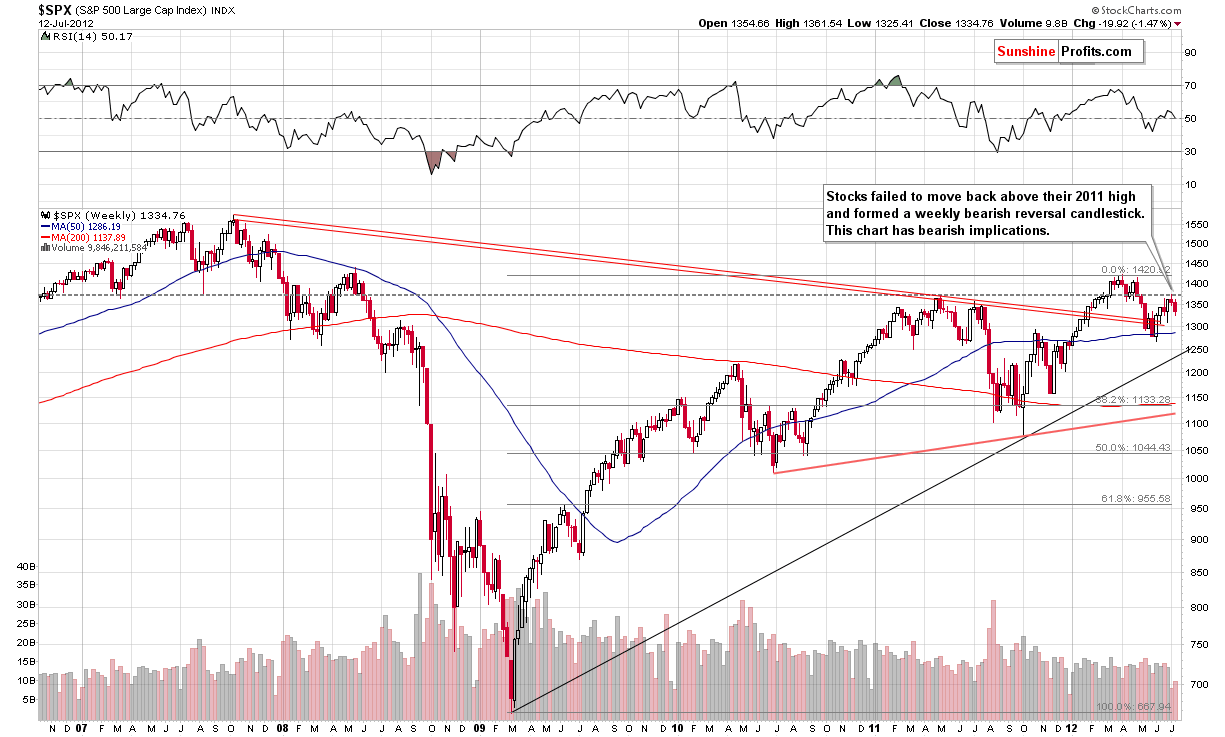

To see whether lower stock prices really are in the cards, let’s turn to today’s technical part with the analysis of the S&P 500 Index. We will then discuss the impact that this can make on gold and silver in the following weeks. Let’s start with the long-term chart (charts courtesy by http://stockcharts.com)

In the chart (please click the above chart to enlarge), we saw a bearish indication last week and we continue to see it today. Stocks did not verify the move above the 2011 highs and moved below this level once again. The lack of strength in holding above this level is a bearish sign for the weeks ahead. In fact, the way stocks topped – the reversal candlestick provides us with a bearish confirmation.

On the other hand, price is still above the rising black support line and the declining red ones, so one could say that the trend is still up. All in all, we view the above chart as moderately bearish at this point.

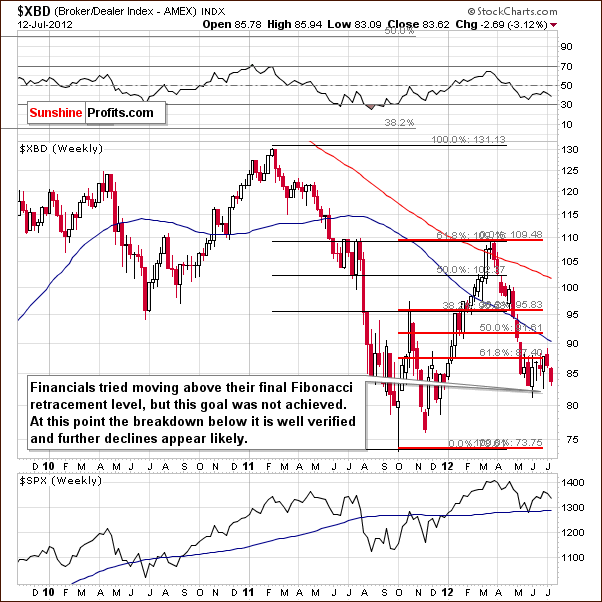

Let’s see how the financials did recently. After all, they have been a leading indicator for the general stock market for more than 4 years now.

In the Broker Dealer Index chart (a proxy for the financial sector) we see bearish implications once again. The financials have been consolidating for several weeks now. After a breakdown below the 61.8% Fibonacci retracement level, the situation is now clearly bearish. The breakdown has been confirmed and with several weeks of consolidation behind it, the index is likely to now move lower. This will further contribute to the bearish outlook for the general stock market.

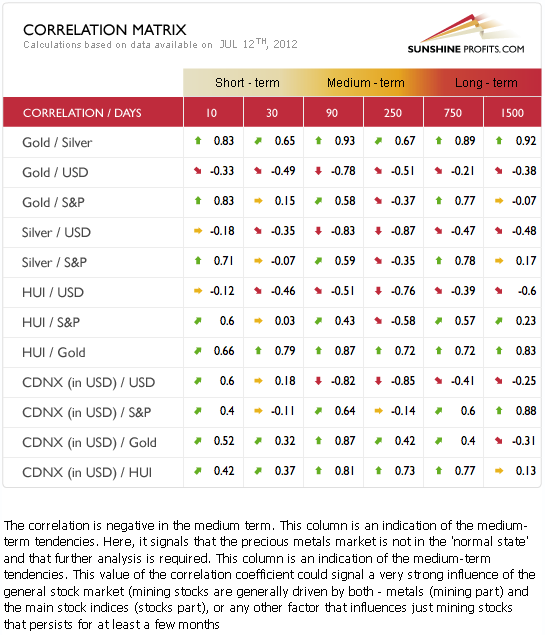

Now, let’s have a look at our own tool, that gauges the intermarket correlations, to see how the stock market can influence precious metals’ prices.

The Correlation Matrix is a tool which we have developed to analyze the impact of the currency markets and the general stock market upon the precious metals sector. The short-term coefficients were a bit unclear last week, especially those between the general stock market and the precious metals. Traditional values were seen in the medium-term, 90-day column with positive values between stocks and gold, silver, and the mining stocks. The overall picture based on the general stock market is bearish for the precious metals sector, because the outlook for stocks is bearish in the medium term.

Summing up, the situation in the general stock market is a more bearish than not based on the above charts. The most bearish factor that we currently see is Fed’s approach suggesting that stocks didn’t fall low enough to justify another round of QE. The implications for the precious metals market are rather bearish based on intermarket correlations. The most recent trends, however, suggest that the most important link to monitor is the one between precious metals and currencies: USD and EUR. The full version of this essay includes our detailed thoughts on that important topic. We also tell our subscribers what how to trade this tough environment.

Thank you for reading.

P. Radomski

--

While we examine many more markets and charts, we believe that examining Euro Index, USD Index, Crude Oil, Gold:Silver ratio and junior miners are absolutely essential for anyone considering investment in the precious metals sector and for those who trade these markets. Our latest Premium Update deals directly with these markets and each of them is analyzed with precious metals in mind. We suggest that you join us and read the full version of our analysis right away.