In the latest commentary regarding the situation on the market, I suggested that we might get a very rapid pull-back in the precious metals stocks, along with the turnaround in the general stock market. So far this turnaround did not materialize, but instead we’ve experienced a monster rally in the USD, which naturally puts the pressure on the prices of precious metals and corresponding shares. As a result we have plunging prices of even the best precious metals stocks.The amount of U.S. dollars that was created lately is really enormous, so I view the rally in the USD as purely emotionally-driven and as such, I believe it is only temporary. When (not if) this short-term trend will reverse, the prices of precious metals and corresponding shares will be rallying once again.

For now, the precious metals stocks remain highly correlated with the general stock market. This has been the case in the past, but only ‘locally’. This means that there are times when HUI and SPX move together and there are times, when they move in the opposite directions. In the long term, gold stocks are driven by the price of gold and silver stocks are driven by the price of silver, but in the short term emotions decide whether stocks are under- or overvalued.

Currently, we have a positive correlation, meaning that PM stocks move together with the general stock market: SPX falls – the HUI declines, SPX pulls back – the HUI rises. Moreover, it seems that in the recent weeks it is the general stock market that drives the price of gold stocks more than gold does! We have gold near its 2006 highs, and the gold stocks (HUI) are over 2 times cheaper than they were at that time. Did the fundamentals change? The precious metals market still has excellent fundamentals, but the emotional approach toward all equities changed recently. As people get scared, they sell anything regardless of its true value.

This has at least two implications. First, precious metals stocks have been sold because of the emotional reasons and this spells a buying opportunity for those, who believe in the fundamentals of this sector (naturally, the author of this publication falls into this category). Second, the HUI could bottom together with the general stock market (SPX).

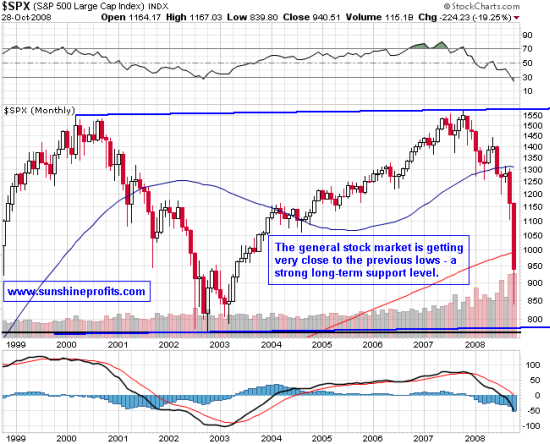

With regard to the second implication, I have prepared three charts for you (courtesy of stockcharts.com), in which I will tell you where I think the bottom will be. The first chart presents the S&P Index from a long-term perspective.

As you may see, this decline started from the levels similar to the levels that the SPX achieved in the year 2000. Back then the plunge ended, when the index moved below the 800 level. As the history tends to repeat itself (or rhyme, as some prefer to say), we may have the bottom around that level once again. Depending on whether we draw the support line as horizontal line, or as a lower border of a rising trend channel – we get the 770 – 790 level as a very strong support. This is where I expect this devastating decline to end. This level might seem far away from the current value of the index, but only if we don’t take a closer look.

If we zoom-in to the recent months, it is obvious that the 800 level is not out of the question, due to the volatility and the up-to-date size of the decline. After all – it would be only 50-60 points lower than the previous, local bottom.

Although it seems that the S&P Index broke out of the declining trend line, please note that it was not accompanied by a very high volume – which makes us think that this rally may not last long.

On the last chart I will show you what implications the 800 level on the SPX would have on the precious metals stocks.

The chart above features the medium-term trend line and the short-term trend channel. This ratio has fallen very low, very fast, so a rebound here is likely, even without a dramatic upswing in the price of gold/silver. Naturally, the ratio could go lower, but I doubt that it will go much below the thick trend line, perhaps to the 0.15 level. This would correspond to the 115 level in the HUI Index, as the SPX bottoms below 800. However, I doubt that the PM stocks will go this low, and I plan to add to my long-term holdings and open speculative positions with the HUI at the 125-135 level. This may not be the exact bottom, but very close to it, and at the same time the risk of not realizing the transactions should be quite low.

This commentary is based on the Market Update that was sent to the registered Users on 27-th Oct. In this Update I also mentioned what kind of confirmation one should look for when the HUI reaches the aforementioned levels. If you are interested in receiving these Updates in the future, please register today. It’s free and you can unregister anytime.

P. Radomski

Back