This commentary is based on a Market Update which has been sent on March 1st.

In the previously sent Market Update, and in my latest essay, I have stated that we will most likely see lower precious metals prices in the coming days. This has indeed taken place and since many readers have asked me to write an additional essay on the current market situation with emphasis on how low can we go – here we are.

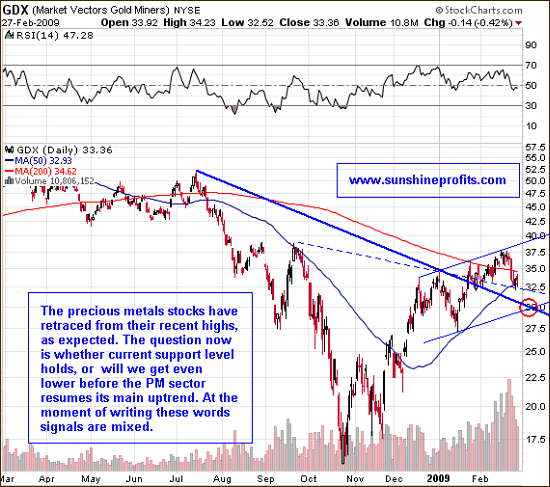

Let's begin with a medium-term chart (charts courtesy of www.stockcharts.com ) of the GDX ETF, which is being used as a proxy for precious metals stocks.

The precious metals stocks have corrected and are now at the minor support level, which is combination of a minor trend line and 50-day moving average. The drop here was rapid, but most corrections need more time to complete than just a few days. Knowing that PM stocks often correct in the zigzag (or a-b-c-) fashion, one can infer that the precious metals stocks will experience at least one more small decline. That would ideally correspond to the $30 GDX level or HUI at 250-260. In order to confirm this initial assumption, let's take a closer look:

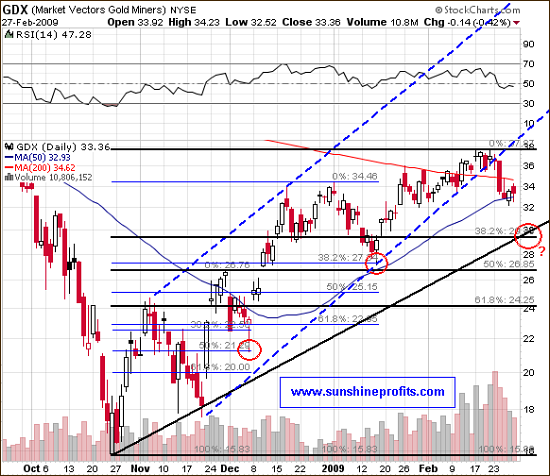

Fibonacci retracement levels have so far (during this rally) proven a very good indication of where the correction will ultimately end - please take a look at the areas marked with red circles. This does not mean that this particular tool is perfect, but it seems that it is currently one of the best that we can use. For this correction, the first retracement level is just under the previously mentioned $30 level. The second one corresponds to the previous local low around the $27 level. Should the first retracement level not hold PM stocks, the second one (-50%) will most likely do.

Let me digress here - my previous update/essay was not a call to sell your long-term holdings, but if you have interpreted it this way, reentering the market at today's price is not a bad idea in my opinion.

Another factor that needs to be considered here is the recent performance of the general stocks market. It is again testing the critical support level and with all the negativity in the media right now it is likely that it will not be broken. This is generally positive for gold stocks and especially for silver stocks, as the general stock market has a short-term impact on prices of PM stocks.

Dow Jones Industrial Average has fallen to new lows, however the decline has been stopped by the medium- and short-term support lines. Please take a look at the volume, which has been very high in the recent days. As you may see above, the days when the value of DJIA declined on a very high volume were the local turning points. Rallying immediately is not guaranteed, but it is probable.

Generally, rising stock market has been lately a positive environment for PM shares. However, very recently gold and silver stocks managed to rise even despite declining stock indices. This has been most likely caused by investors who purchased precious metals stocks as a hedge against the falling stock market. In other words, very recently PM stocks and the general stock market became negatively correlated. I expect this to change in the not too distant future, but at the moment this tendency remains in place. Therefore, if the general stock market does indeed bounce from here, this could serve as a catalyst for the second downleg of this correction in the PM stocks that I previously referred to.

Bouncing world stock market indices have particularly positive implications for base metals, and for silver, because of its industrial part of demand. The technical picture for the white metal is also favorable.

As mentioned on the above chart, silver has formed one of the most bullish formations – cup with (small) handle. The longer the "cup" forms, the stronger the buy signal is. The above "cup" has been forming for about 5 months, which is quite long, at least for a short, to medium-term trading signal. Right now the "handle" is just being created. It's a tough call to say how low can it go temporarily, but $11-$12 is not out of the question. However what is most important here is not how low it will go temporarily, but rather what happens after the handle is complete.

The "cup and handle" formation is a powerful pattern that usually sends the price of a particular asset much higher, once the "handle" is complete. Please consider the enormous "cup" that formed from 1996 to 2004 in the gold market. The massive multi-year rally that followed took gold much more than 100% higher. In other words, if I did not own any silver yet, I would not wait too long to make my purchase.

Before you ask - yes, I do believe the abovementioned factors create favorable conditions for most commodities and corresponding equities. High (topping?) value of the U.S. dollar and bottoming general stock market create a positive environment for commodity stocks. Moreover, this sector has on average refused to go any lower despite negative influence from both USD and general stock market. You can read more on that topic in the Market Update that I have been referring to

Summing up, we will most likely see more short-term weakness in silver, gold and in the PM stocks. The long-term picture remains bullish, however, currently in my view better opportunities for short-term speculation may be found outside of the precious metals sector.

Of course the market might prove me wrong, as nobody can be right 100% of the time. Should my view on the market situation change substantially, I will send an update to the registered Users along with suggestions on how to take advantage of it. Register today to make sure you won’t miss this free, but valuable information. You’ll also gain access to the Tools section on my website. Registration is free and you may unregister anytime.

Again, if you already are one of our registered Users but you do not receive Market Updates from us due to technical reasons, you can read these messages in the Weekly Commentary section.

P. Radomski

Back