This essay is based on the Premium Update posted on July 26th, 2009. Visit our archives for more gold & silver articles.

In the previous essay I wrote the following:

Recently the precious metals market has been influenced by developments in the general stock market, which contributed to a considerable extent to its recent downswing and subsequent rally. At the moment, the technical situation for the main stock indices is favorable, which means that precious metals are likely to move higher as well.

This week precious metals and corresponding equities rose (as mentioned earlier) at the beginning of the week, and then have been mostly trading sideways. But, before we sink our teeth into technical analysis of the PM markets, I want to bring you a piece of news regarding the investment demand for gold.

The report says that Swiss banks are running out of secure storage space for gold bullion held by investors and institutions. The story said that fears of hyperinflation, the grim economic news and the success of the gold ETF’s, has led to a run on the yellow metal and a shortage of safe places in which to store it. When you’re holding gold (especially at these prices) you need security guards, surveillance cameras and room, lots of it. One Swiss bank relocated its stored silver bullion to another site to make more room for gold.

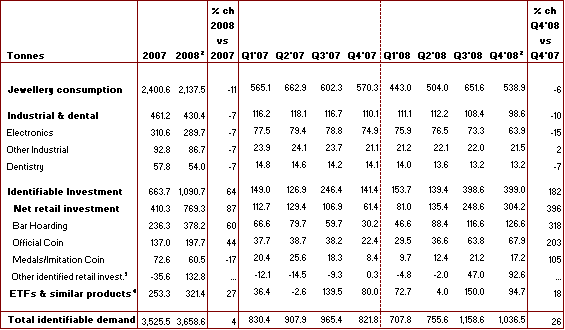

As you might have read in the Key Principles section of my website, I suggest keeping about 20% of capital in physical gold and silver, with the mix depending on your age, risk preferences and whether you believe inflation is in the cards. If you cannot hold it yourself in a safe place, I suggest being very careful where to store it. The story about the shortage of storage space in the vaults of venerable Swiss banks tells me that long-term gold investors are out in force and that gold is in its groove. The investment demand has become even more important driver of gold prices. Please take a look at the table (source: World Gold Council) below for details.

Not only has the investment demand increased by 64% in 2008, but also the news about the Swiss banks storage problem signals that investment demand is still rising, putting an upward pressure on gold prices.

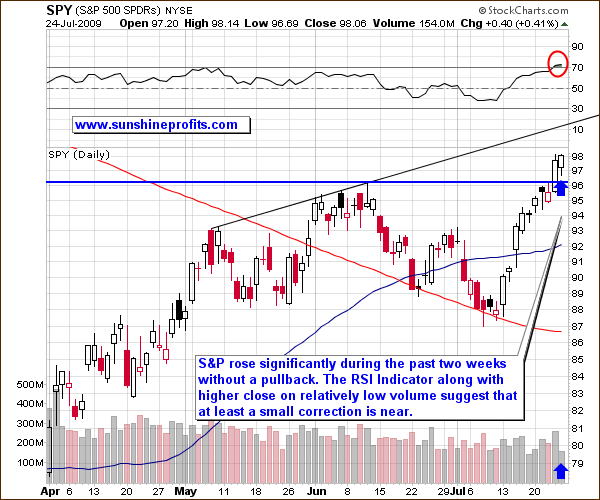

As far as the current situation on the market is concerned, we’ll begin with the general stock market (charts courtesy of stockcharts.com), which has moved higher almost on a daily basis during last two weeks.

General Stock Market

In the previous essay I wrote the following regarding the previous Friday in which prices barely moved, but the volume was relatively small:

Had we seen higher prices along with visibly declining volume, we could have inferred that a correction is likely.

This is exactly what took place this week. We have just seen higher values of main stock indices along with relatively low volume, so we might infer that a correction is likely. This would be confirmed by the high value of the RSI Indicator, as marked on the chart with a red ellipse. The most visible support level is currently just above the 96 level ($96.11) in the SPY ETF.

However, since this rally broke above its previous high of $96.11, we may need to wait for the SPY to go to the black, thin resistance line (about the 100 level) before it moves lower. The 100 level is a resistance level due to the fact that it is a round number and likely to draw media atttention. (The 96.11 level corresponds to 956.23 in the S&P).

The general stock market (along with other markets, which were covered in the Premium Update on which this essay is based) is likely to correct, but not necessarily immediately. Since in the previous weeks gold, silver, and corresponding equities were trading in the opposite direction to the U.S. Dollar, and in tune with the general stock market (strong correlation), we may expect precious metals to take a small breather soon as well.

Before making any specific calls, we need to analyze the precious metals themselves. This week, I will focus on silver.

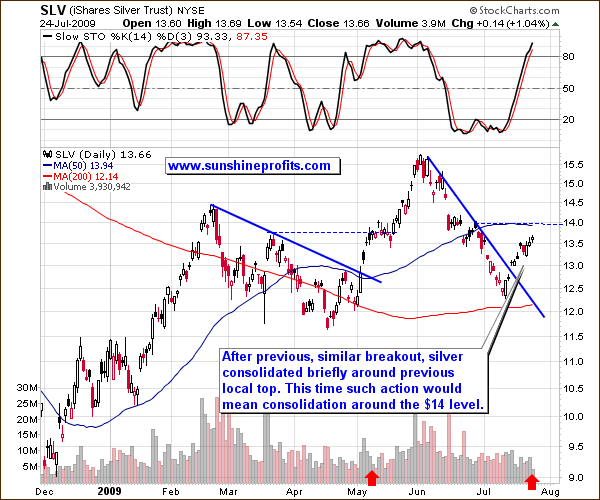

Silver

Silver has broken out of the delining trendling, but the low volume on Friday, suggests that we may see prices dip or consolidate before they resume their upward path. During a similar breakout in May, silver has consolidated around the price level corresponding to the previous local top - the $13 - $14 area. The analogical price level today is several cents higher - around $14.

The more similarities there are between two situations, the more probable it is that the history will repeat itself. The additional factor that suggests that the rally in silver is likely to take a pause is the action in volume. In May, slow volume after the breakout preceded the consolidation, so there is one more piece of the puzzle that fits the whole picture. With gold and silver suggesting a small consolidation, let’s take a look at the precious metals stocks.

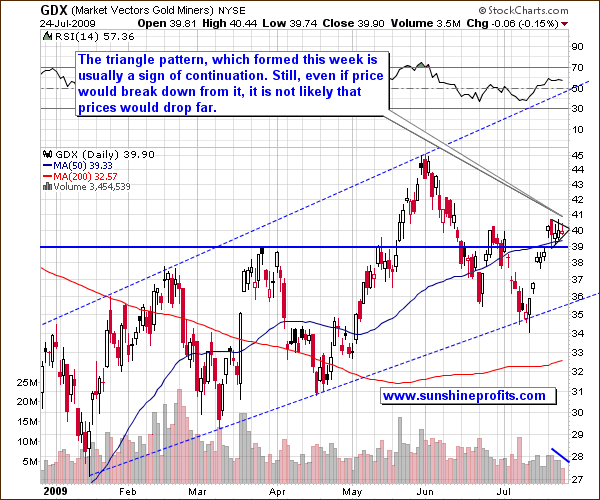

Precious Metals Stocks

Mining stocks have also consolidated in the middle of May, and now they formed a triangle pattern, which is usually a sign of trend continuation. The volume has been declining this week, as PM stocks were trading sideways, thus confirming the triangle pattern.

Taking into account points raised earlier, even if mining stocks break down from the triangle pattern, the following move should be rather insignificant - I don’t think that it would take the GDX ETF below 37 level. On the other hand, if we get a breakout to the upside, but gold and silver move lower soon, I would expect mining stocks to correct along with them, most likely once again to the upper border of the triangle - below 41 level.

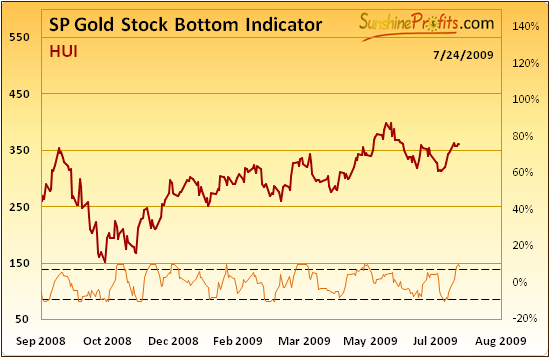

Moreover, one of our indicators signals that a pause is rather likely.

Please note that usually when SP Gold Stock Bottom Indicator broke above the upper dashed line it meant at least a brief pullback in the coming days. This has been the case during this week, so we may indeed see lower prices of PM stocks in the coming days.

Summary

Precious Metals are still in a favorable fundamental situation, and with the recent news confirming the strength of the investment demand, the overall picture is even more bullish. However, as far as timing is concerned, we may need to consolidate for several days. Once we see that the technical situation has improved in the USD Index and S&P 500, the precious metals should be ready to move much higher, probably above the $1000 level.

To make sure that you get immediate access to my thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time. Additonally, if you considered subscribing to the Premium Service in the past, but didn’t want to use monthly subscription type, we have good news for you - we have just introduced 90-day and yearly subscriptions which are available at a discount.

P. Radomski

--

This week we report on subtle clues about improving fundamental situation on the precious metals market, and discuss the short term situation. We put the emphasis on silver and PM stocks, which are have been recently highly correlated with the general stock market. We have discussed this phenomenon in the previous essay, but since we had technical problems last week, you might have not received a notification about this particular essay. We encourage you to read both: this week's essay and the previous one, as it should help to put this week's analysis into proper context.