Hello! I’d like to introduce myself. My name is Paul Rejczak and I’ll be writing the daily U.S. stock market commentary as a contributor for SunshineProfits.com. My articles will encompass the current market situation and future predictions, based on both technical and fundamental analysis. Have a nice read!

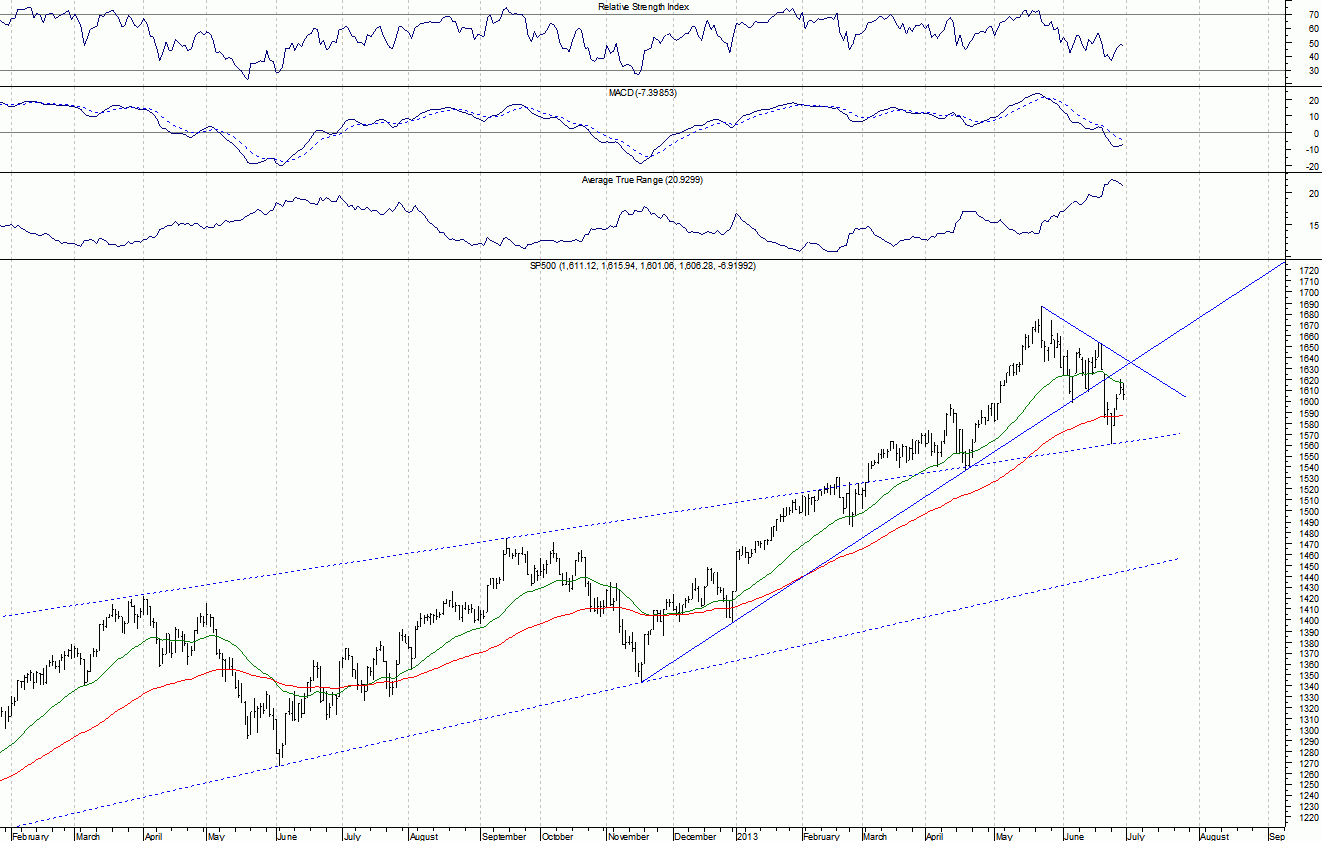

The main U.S. stock market indexes were mixed on Friday, with blue-chips weaker than technology stocks. Following several days of a rebound from the second half of June’s local bottom, the last trading session of the second quarter was marked by uncertainty. The S&P500 almost reached the 50% retracement level of its downward movement from the May 22 all-time high at 1,687.18 on Thursday (session’s high at 1,620.07 vs. the retracement level at 1,623.76) and then it moved sideways. The last week’s rebound stopped near the November-May upward trend line, as we can see on the daily chart:

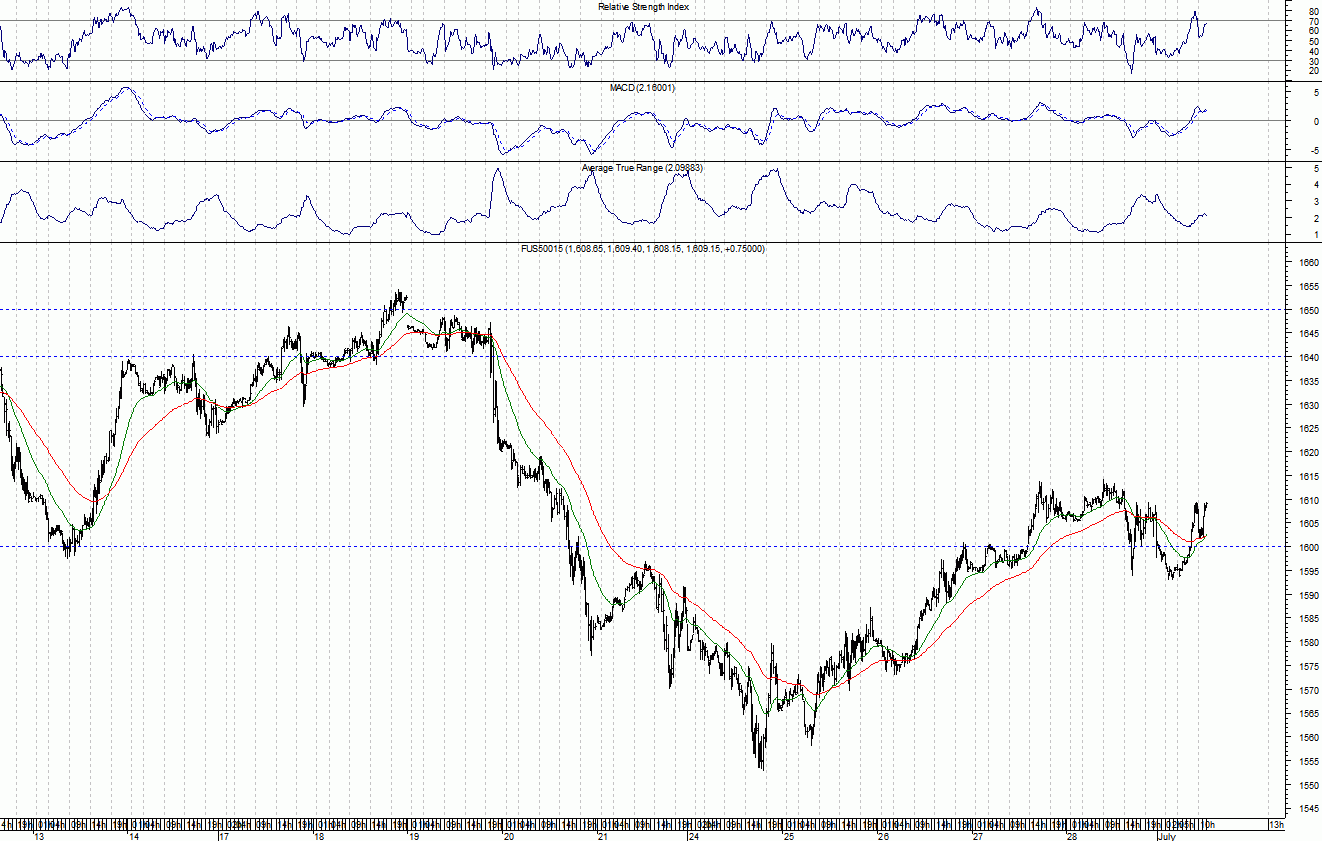

Both the resistance of the previously broken upward trend line and the correction’s 50% retracement level are the main technical reasons for the uncertainty in the last two trading sessions. On the other hand, the upcoming second quarter earnings releases season favors a positive outlook for stocks, as investors may start buying in hope of better than expected corporate earnings, after recent strong economic data. The U.S. stock futures point to a higher Monday’s session open, despite a rather mixed situation in the Asian and European stock markets. The first trading session of the third quarter of the year brings further short-term fluctuations around the level of 1,600 for the S&P500 futures contract (CFD). Its nearest resistance is at 1,610-1,615, with support at 1,590-1,595 (the recent consolidation’s boundaries), as the 15-minute chart shows:

Thank you,

Paul Rejczak

Back