tools spotlight

-

A Momentary Selling Respite Can Help Gold Miners Jump

July 13, 2022, 9:32 AMWith our highly profitable short position in the GDXJ ETF now converted into a long position, a selling reprieve across Wall Street could help elicit a short-term bounce. For example, the Consumer Price Index (CPI) hit the wire this morning, and investors have been selling assets in anticipation of another scorching print. However, with market participants known to ‘sell the rumor and buy the news,’ the GDXJ ETF could be a major beneficiary.

Gauging Sentiment

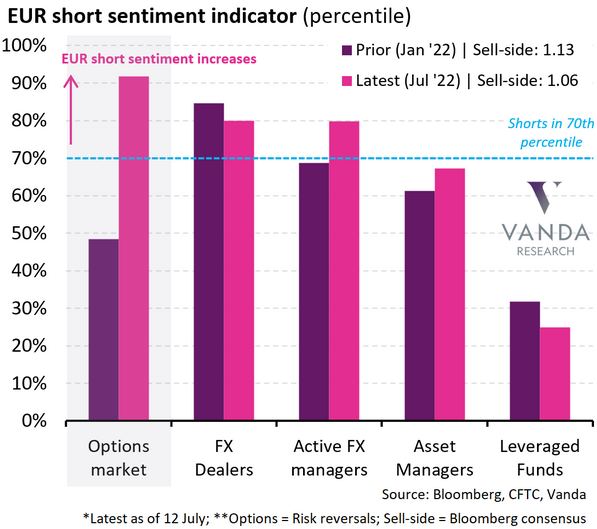

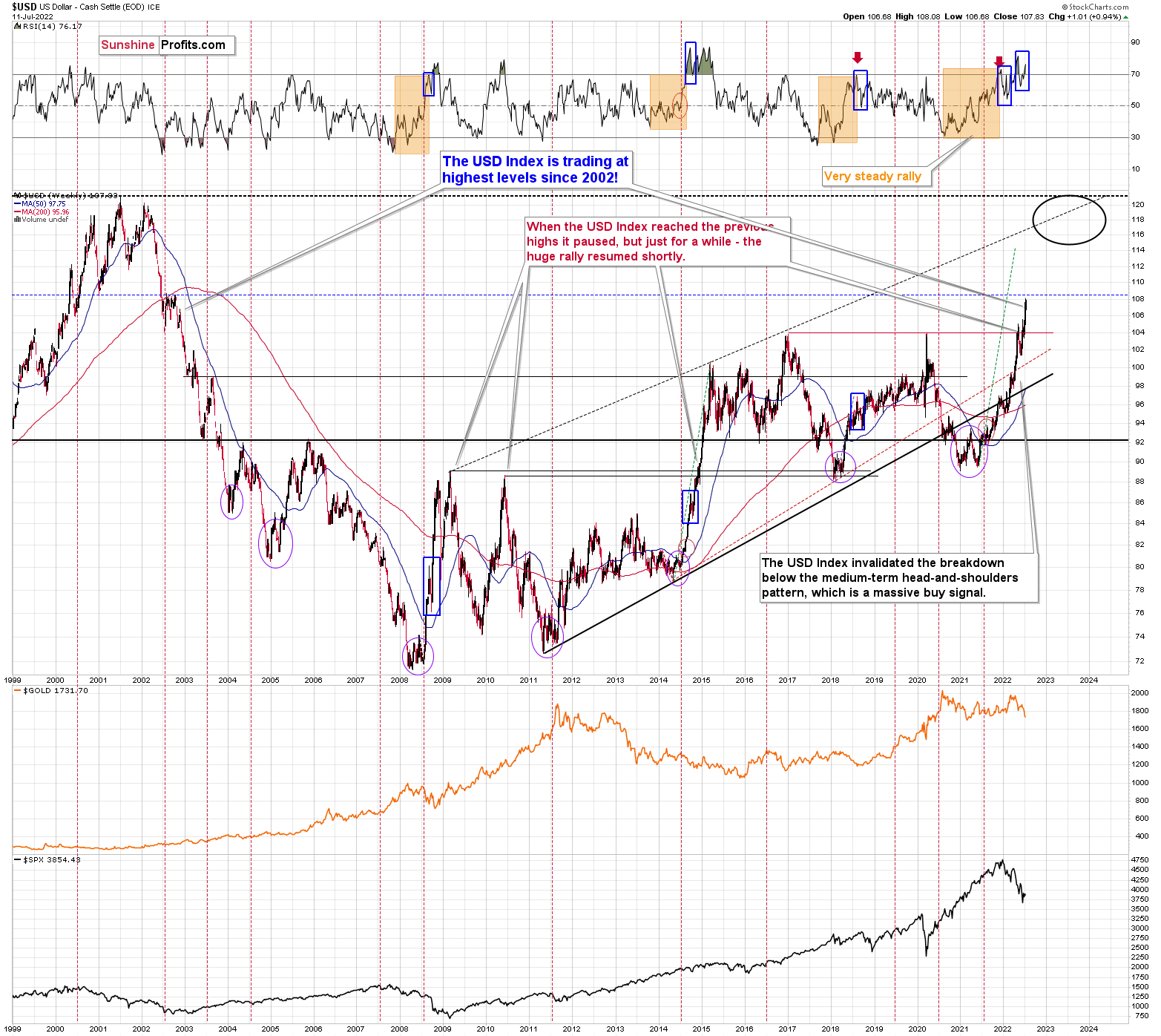

To explain, the euro collapsed to parity with the U.S. dollar on Jul. 12. Moreover, while I’ve been bearish on the EUR/USD for many months, the drawdown highlights how you can’t run from fundamental reality.

Please see below:

For context, I wrote on Mar. 12, 2021:

If you haven’t noticed, I spend a lot of time analyzing the EUR/USD because the currency pair accounts for nearly 58% of the movement in the USD Index. And due to Europe’s economic underperformance and the relative outprinting by the ECB, a sharp rerating of the EUR/USD could be the engine that drives the USD Index back above 94.5.

For some time, I’ve warned that the ECB’s bond-buying program was likely to accelerate. On Jan. 22, I wrote:

The ECB decreased its bond purchases toward the end of December 2020. Then, once January hit (2021), it was back to business as usual. As a result, the ECB’s attempt to scale back its asset purchases was (and will be) short-lived. And as the economic conditions worsen, the money printer will be working overtime for the foreseeable future.

Thus, while the Fed has run off six rate hikes (25 basis point increments) and begun selling assets on its balance sheet (QT), the ECB has done nothing. Therefore, the EUR/USD’s plight unfolded as expected.

However, with euro negativity now at extreme levels, investors that were bullish on the currency pair – and forecasting 1.30 – are now bearish. Thus, a short-covering rally in the EUR/USD could help uplift the GDXJ ETF.

Please see below:

To explain, the purple and pink bars above track the expectations/positioning of various market participants in January 2022 and now. If you analyze the changes, you can see that three of the five cohorts (pink bars) are more short the euro now than in January.

Furthermore, the pink bar furthest to the left highlights how options traders have nearly doubled their euro shorts. As a result, with momentum investors chasing the euro’s collapse rather than anticipating the fundamentals, over-positioning could result in a short-term reversion. Thus, the prospect is bearish for the USD Index and bullish for the GDXJ ETF.

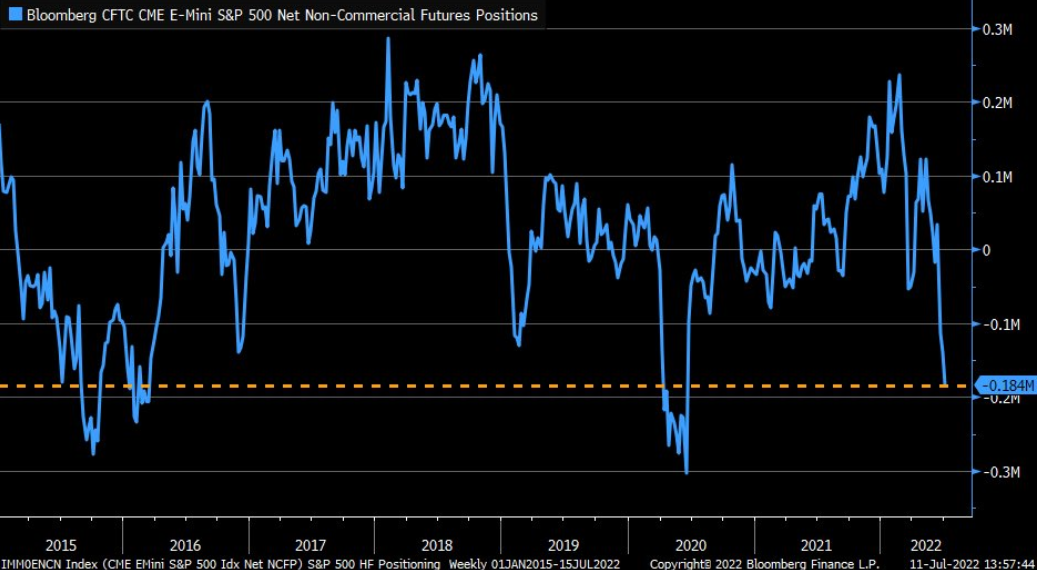

Second, hedge funds and speculative futures traders are all-in on a CPI sell-off.

Please see below:

To explain, the blue line above tracks non-commercial traders’ (based on the CoT report) net E-Mini S&P 500 futures positioning. If you analyze the right side of the chart, you can see that net shorts have ballooned to their highest level since the COVID-19 crash. Likewise, the current reading has surpassed the 2018/2019 sell-off but remains below the 2015/2016 growth scare.

As such, with investors heavily positioned for a risk-off outcome, a bout of short-covering may spur a relief rally across Wall Street. Moreover, with the GDXJ ETF collapsing recently, the junior miners should benefit from a potential sentiment shift.

For context, our expectation for a short-term rally doesn’t change the medium-term thesis: the PMs are likely far from their final bottoms, as is the S&P 500. However, asset prices don’t move in a straight line, and bear market rallies are born out of over-positioning. Thus, the conditions should be ripe for a short-term reversal.

The Ominous Months Ahead

Since technical analysis and sentiment are much more prescient in predicting short-term moves, they're better gauges of near-term price action than the fundamentals. However, while it took time for the EUR/USD to reflect its fundamental value, the PMs and the S&P 500 should suffer similar re-ratings as the Fed's rate hike cycle continues.

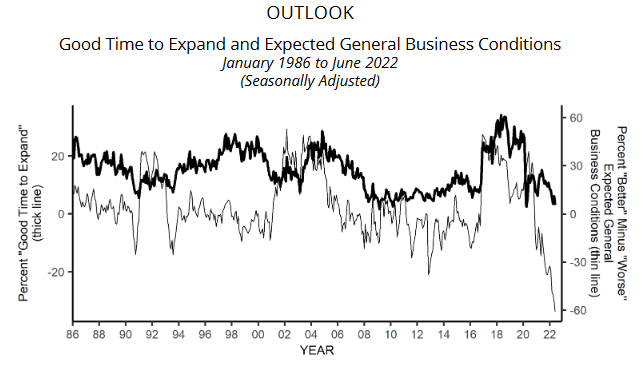

For example, the NFIB released its Small Business Optimism Index on Jul. 12. The headline index declined from 93.1 in May to 89.5 in June. The report revealed:

“Small business owners expecting better business conditions over the next six months decreased seven points to a net negative 61%, the lowest level recorded in the 48-year survey. Expectations for better conditions have worsened every month this year.”

Please see below:

To explain, the gray line above highlights how inflation has rattled U.S. small businesses. If you analyze the right side of the chart, you can see that the gray line has plunged to an all-time low. Therefore, recession fears are rampant on Main Street.

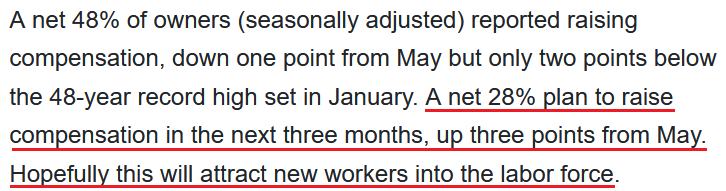

However, I noted previously that the NFIB’s Small Business Jobs Report (released on Jul. 7) was bullish for wage inflation.

Please see below:

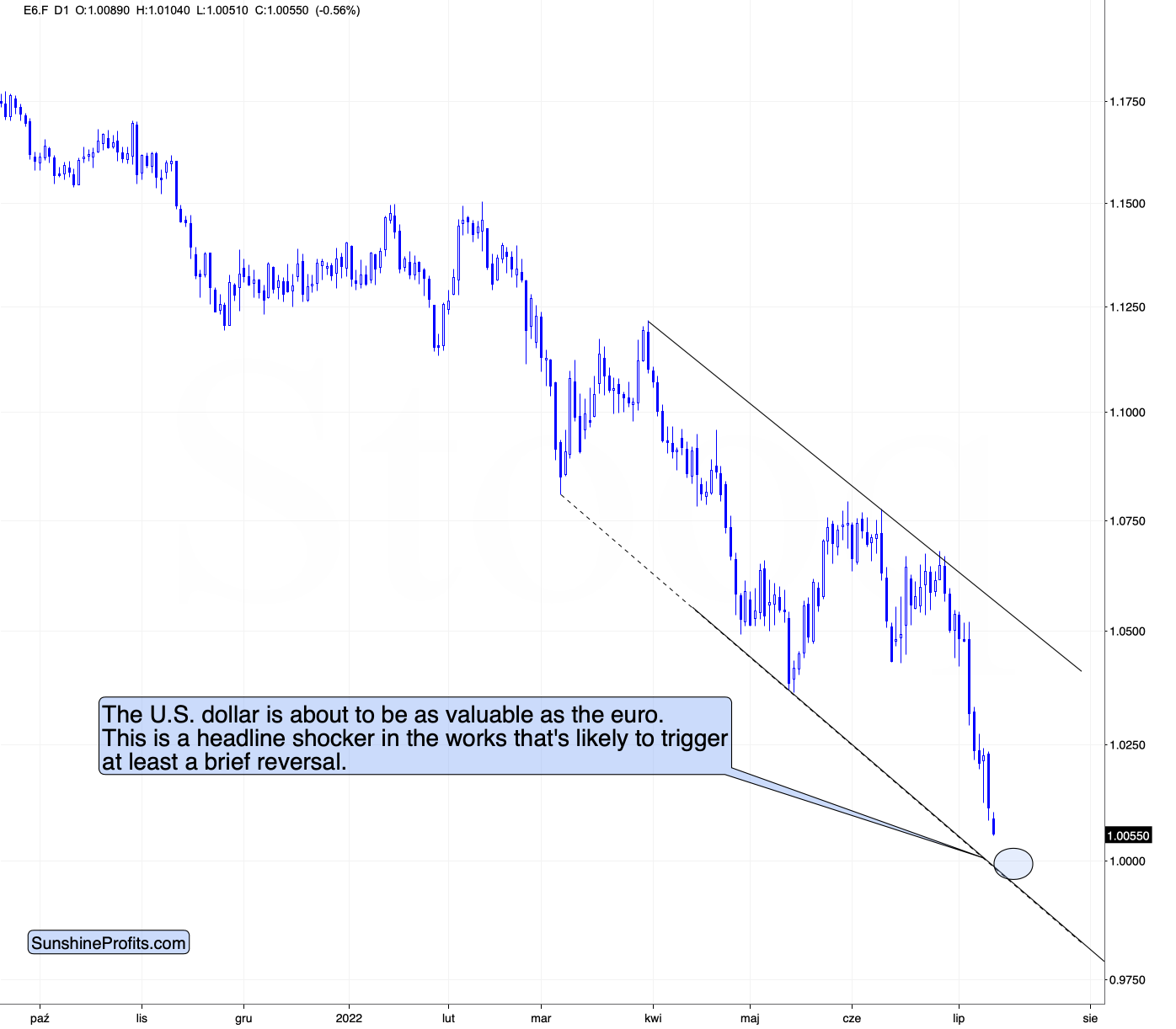

Moreover, the NFIB’s Jul. 12 report revealed:

“Inflation continues to be a top problem for small businesses with 34% of owners reporting it was their single most important problem in operating their business, an increase of six points from May and the highest level since quarter four in 1980.”

Thus, while six-month sentiment has fallen off a cliff, the overall report was profoundly bullish for Fed policy. For context, the U.S. will likely enter a real (not technical) recession as the Fed attempts to rein in inflation. However, the current economic backdrop is far from dreadful.

Yes, activity has slowed, but that’s expected when the Fed hikes interest rates six times. Furthermore, with small businesses’ current activity contrasting their expectations, the Fed should focus more on the former than the latter when conducting monetary policy.

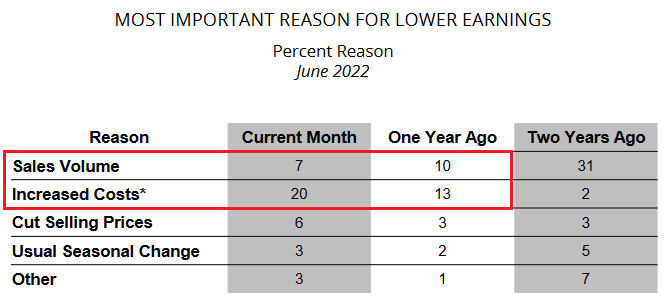

For example, only 7% of small business owners cited depressed sales volume as the reason for lower earnings. Moreover, the figure was three points lower than the 10% recorded in June 2021. Conversely, 20% of small business owners cited increased costs as the driver of lower earnings, an increase of seven points from June 2021.

As a result, the gloomy outlook on Main Street is a function of unanchored inflation, not evaporating demand.

Please see below:

As further evidence, I noted above how 34% of respondents cited inflation as their “most important problem.” Well, that figure is up from 13% in June 2021 and is only seven points below the all-time high of 41%.

In contrast, the percentage of small businesses lamenting poor sales declined from 7% in June 2021 to 4% in June 2022. Furthermore, the far-right column shows that the current reading is only two points above the all-time low of 2%.

Please see below:

Even more revealing, the blue rectangle above shows that only 1% of small businesses cite interest rates as their most important problem. Therefore, while the Fed has hiked interest rates six times in 2022, the figure matches 2021 and is only one point above the all-time low of 0%.

As such, sales volume is not a problem, interest rates are not a problem, and more small businesses are raising wages to “attract new workers into the labor force.” Therefore, does it seem like demand destruction has unfolded?

In reality, unanchored inflation has annihilated business confidence and has decision-makers bracing for the worst. As a result, the Fed needs to raise interest rates to curb inflation and restore predictability to the U.S. economy.

Think about it: how can CEOs make business decisions when they’re unsure of the cost of goods, labor, and whether or not demand will be present in the future. Moreover, when uncertainty reigns, the logical response is to become risk-averse and avoid decisions that could spur large potential losses.

Thus, while raising interest rates should elicit short-term pain and an eventual recession, I’ve warned on numerous occasions that not doing so would result in the worst possible outcome for Americans and the U.S. economy.

The Bottom Line

With asset prices selling off in advance of the CPI, today's release may result in a short-term reversal that catches over-positioned investors by surprise. Moreover, while it's happened many times in 2022, small bouts of positivity can amplify themselves when the shorts run for cover. Therefore, we may witness another re-enactment in the days ahead.

In contrast, the PMs' medium-term outlooks remain profoundly bearish. With the U.S. economy in better shape than the narrative suggests, inflation would have collapsed if demand had fallen off a cliff. Therefore, while sentiment has taken a plunge, the Fed will have to do the heavy lifting to make material progress on inflation.

In conclusion, the PMs declined on Jul. 12, as investors continued to front-run the CPI. However, with the markets often moving counterintuitively, pessimism can quickly turn to optimism. As a result, short-term upside should be on the horizon before the PMs continue their medium-term downtrends.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The USD Equals the Euro, Gold Is Not Willing To React

July 12, 2022, 8:27 AMThe dollar is so strong to hit the euro for the first time in 20 years, but gold shows no weakness. How to profit from gold being so bullish?

And so, after taking profits from our short positions in them, we’re long juniors once again. We saw some bullish signals yesterday, and we also see them today. In fact, we have a few extra.

The most important reason behind the long position – on top of what I wrote yesterday – is the strength that gold currently shows relative to what’s happening in the USD Index.

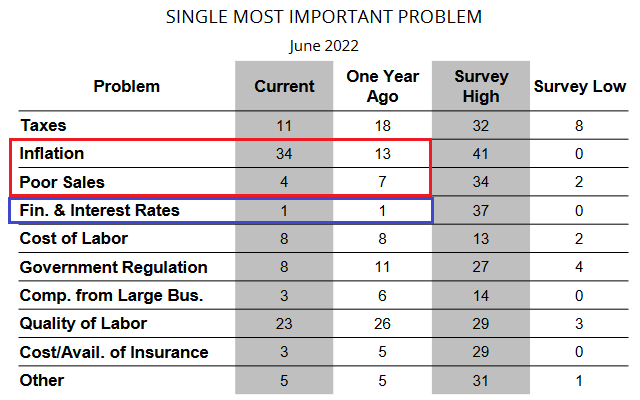

The latter is soaring.

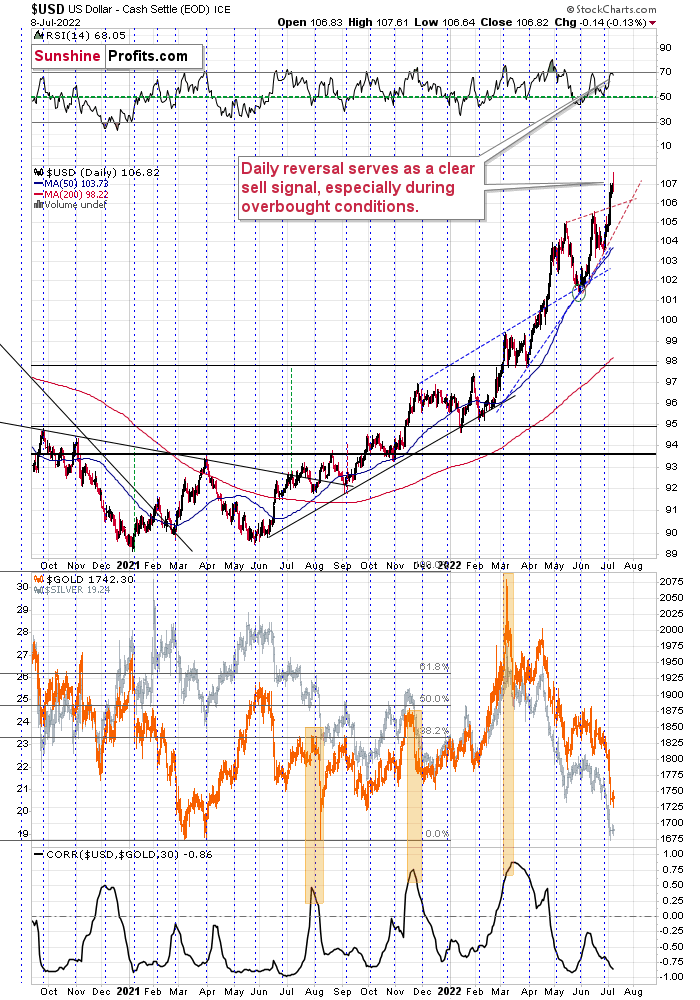

Yesterday’s intraday high was 108.08 and at the moment of writing these words, the USD Index futures are trading at 108.37. That’s very close to the long-term resistance level, which – especially given very overbought RSI – is likely to trigger at least a short-term pullback.

Let’s look under the hood.

The USD Index is a weighted average of individual currency exchanges, and the EUR/USD has the biggest weight (over 50%). Here is what it’s doing right now.

The euro futures (visible in the above chart) are plunging, and they are about to reach a very strong support level.

As you can see, the lower border of the declining trend channel is about to be reached, but there’s also something very special about the level at which it’s likely to be reached.

It’s the most important round number of them all: 1.

This means that if the trend continues, any hour now, the U.S. dollar is about to be as valuable as the euro!

This is a headline shocker in the words, and it’s very likely that it will trigger fresh buyers. “Enough is enough” they might say, not wanting to believe that the euro can be cheaper than the buck. Of course it can, but it’s unlikely that this level (and buyers) will allow that without a fight.

This fight is likely to trigger at least a brief reversal and a rally.

This, in turn, is likely to trigger a decline in the USD Index, which would be in perfect tune with what’s likely based on the USD’s long-term chart.

And since in today’s pre-market trading the USD Index is rallying and the euro is declining, gold is surely declining as well, right?

Wrong.

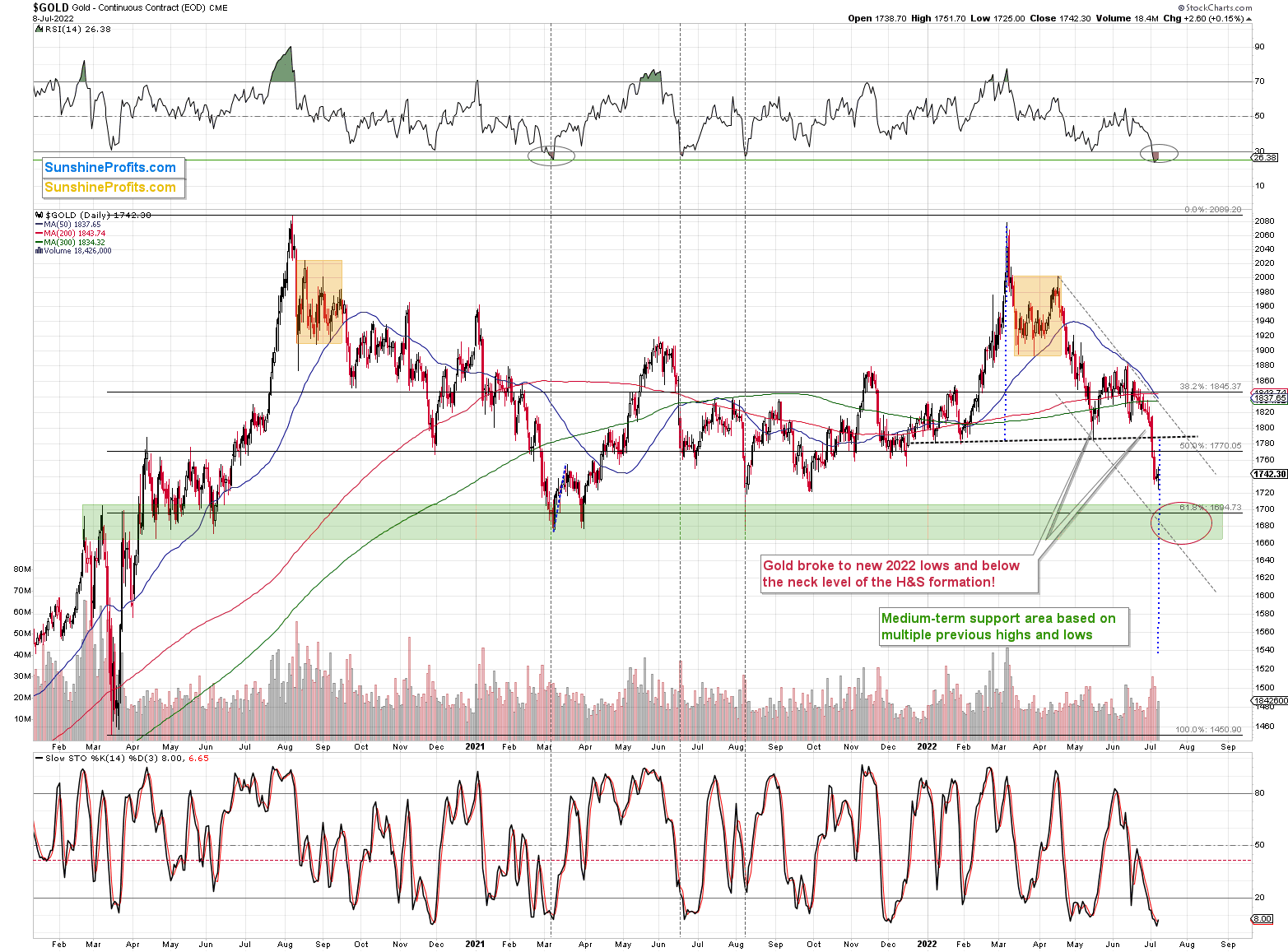

Gold declined initially, but then it reversed at its previous support level (that already worked several times), and it then moved back up despite the bearish forces coming from the forex market.

Instead of declining, gold showed strength and formed a reversal. This is a very bullish combination of factors. And the fact that it’s happening at the previous lows is notable also in light of the analogy to 2013 that I described yesterday.

Moreover, please note that gold’s Friday’s bottom formed right at gold’s triangle-vertex-based reversal. It moved slightly below Friday’s low today, but since it rallied back up, the breakdown was already invalidated. Overall, it seems that the bottom is either in or at hand.

So, we have a situation in which it seems that the USD Index is about to reach its top, but gold is not willing to react to the USD’s rallies. This is a very bullish combination for the short term. And there are ways to profit on this bullishness.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

These Signs May Indicate a Short-Term Reversal in Gold Miners

July 11, 2022, 8:52 AMAs you’ve read in Friday’s intraday Gold & Silver Trading Alert, we just took profits from our previous short positions, and as you know from Friday’s regular (flagship) Gold & Silver Trading Alert, the medium-term outlook for the precious metals sector remains down – it’s extremely bearish for junior mining stocks.

Here’s a quick recap: we entered this short position on May 26, when the GDXJ was trading relatively close to $40. We did that right after we took profits from our previous long position (entered on May 12, which was when we also took profits from the preceding short position). When I sent out the Alert on Friday (Jul 8), the GDXJ was trading at about $31.25.

So, in 28 trading days, you profited on the ~$9 decline in the GDXJ, which was a move lower by over 20% – quite a nice profit for just a bit more than one month.

During the same time, the leveraged proxy for the GDXJ, the JDST, moved from about $9.75 to about $14.37. That’s a gain of about 47%, and that’s on top of a previous gain (preceding long position), which in turn took place right after the previous gain (preceding short position).

Congratulations once again!

OK, what’s next?

While it’s still possible that miners will move lower in the very near term and then correct, I don’t think it’s justified to keep betting on this move at this time. The situation is simply too neutral. Yes, the medium-term factors point to decline’s continuation. However, there are three important signs pointing to a (short-term!) reversal as well.

The most important indication came from the USD Index.

It reversed in a profound manner. I previously wrote that the USDX could rally a bit above 108 and top there, but Friday’s intraday high of 107.61 is “close enough” for me to say that the target was “reached enough”.

You see, at a time when it’s obvious to everyone that a top will take place at a certain level, people (and institutions) place exit orders (and entry orders for short positions) below the topping level, in order to maximize the odds that they will enter the position at all. If enough capital is used for such bets, the top would effectively be formed lower, as those orders are executed.

This might or might not have happened on Friday, but the price was close enough to view this as a possibility. That’s just one thing about Friday’s session that has “caution!” written all over it.

The next, and perhaps most important indication, is the shape of Friday’s candlestick. It was a daily reversal. After an attempt to rally, the USDX reversed and ended the day lower. The USD Index is after a big, sharp upswing, so a correction is expected to happen eventually, and a daily reversal could be all it takes to trigger it.

Finally, the RSI based on the USD Index was just at the 70 level – something that has coincided with local tops in the USD many times in the recent past. For example, that’s what triggered the June correction.

Consequently, we have a situation in which the USD Index could continue to move higher, but it might also correct right away without any additional short-term upswing.

The latter would most likely imply a corrective rally in the precious metals sector.

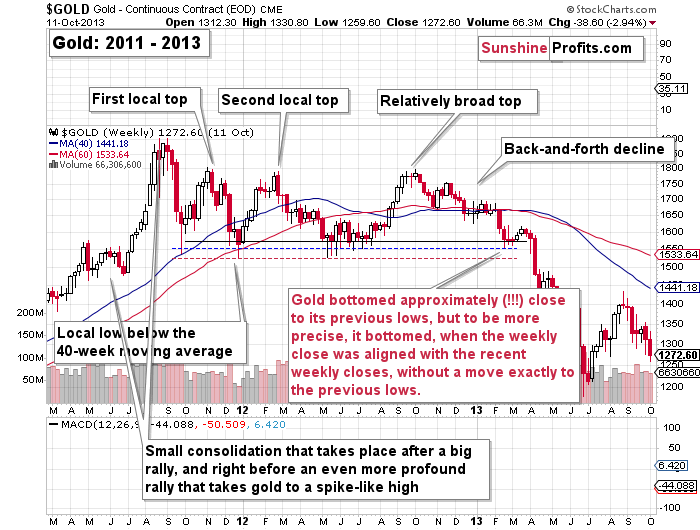

Wait, wasn’t gold supposed to decline all the way down to its 2021 lows because of the analogy to what happened in 2013?

Yes, that’s what I wrote.

However, I wasn’t very precise in describing the analogy. There was really no reason for me to be very precise because, after all, history tends to rhyme, not repeat itself to the letter.

The question here is, if a corrective rally from Friday’s levels would still be in tune with what happened in 2013, or would it invalidate it. Taking a closer look at what happened in 2013 reveals that it would remain in perfect tune with it. Thus, the link to 2013 doesn’t tell us whether we see a corrective upswing now or after an additional short-term decline. Let’s take a look at gold’s performance from 2013 for more details.

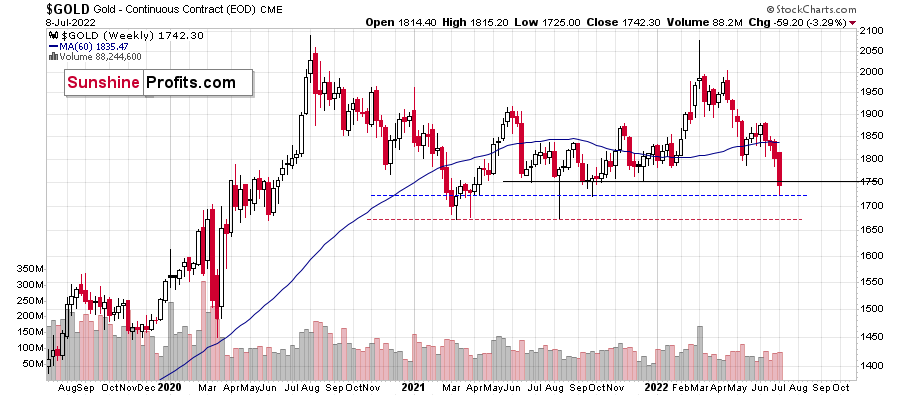

The gold price bottomed approximately (!!!) close to its previous lows. However,to be more precise, it bottomed when the weekly close was aligned with the recent weekly closes, without a move exactly to the previous lows.

What did we just see in gold?

It moved to one of the recent intraweek lows, but on a weekly close basis, it closed very near the previous weekly closes. I marked these levels with solid, black lines on the above charts.

Consequently, we might see a corrective upswing shortly – perhaps as early as this week.

Interestingly, it would perfectly fit the recent head and shoulders formation that could be verified thanks to the correction.

The H&S patterns are often followed by a move back to the neck level, which then – if it holds and serves as resistance – is followed by a decline that’s as big (approximately) as the size of the head of the pattern. If this line doesn’t hold, then it all serves as a gold buy signal.

Based on the indications that I’ve been writing about for weeks / months, the odds strongly favor the continuation of the medium-term decline. This means that it’s likely that the neck level will serve as resistance.

This means that if gold corrects here, I think that the ~$1,790-1,800 area would be the maximum (!) size of the correction. It might not even be as big.

The rally in mining stocks might be smaller still.

The latter would likely depend on the performance of the general stock market, though. If it rallies and gold does too, then juniors would be likely to soar in the very near term. If stocks don’t rally or decline, then the rally in juniors could still take place (based on how oversold they are from the short-term point of view), but it doesn’t have to happen in this case (at least it would not be very highly probable).

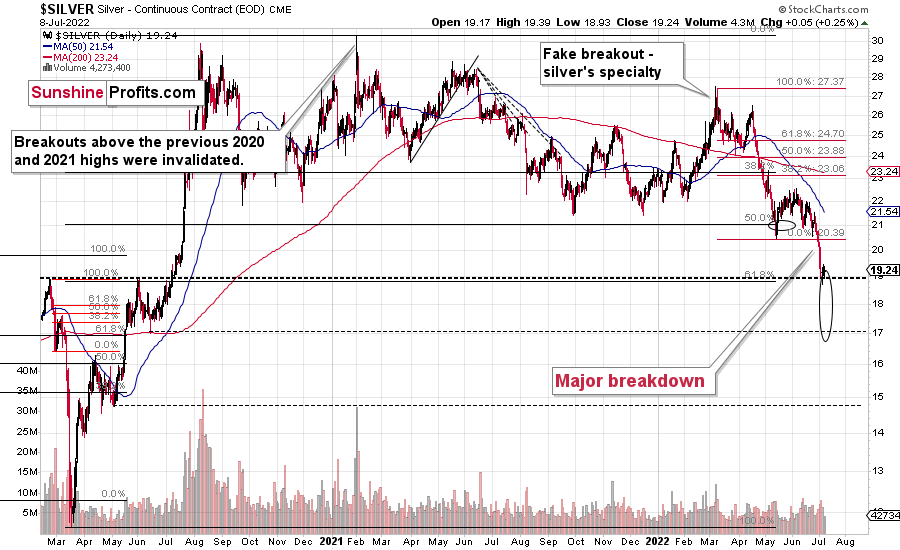

An additional “cautionary” signal comes from the silver market.

The signal itself is rather straightforward. Namely, silver’s price moved a bit higher after moving to the upper border of its target area that’s based on the early-2020 highs.

In the case of silver, a comeback to the previous 2022 low (at about $20.4) seems like a realistic scenario.

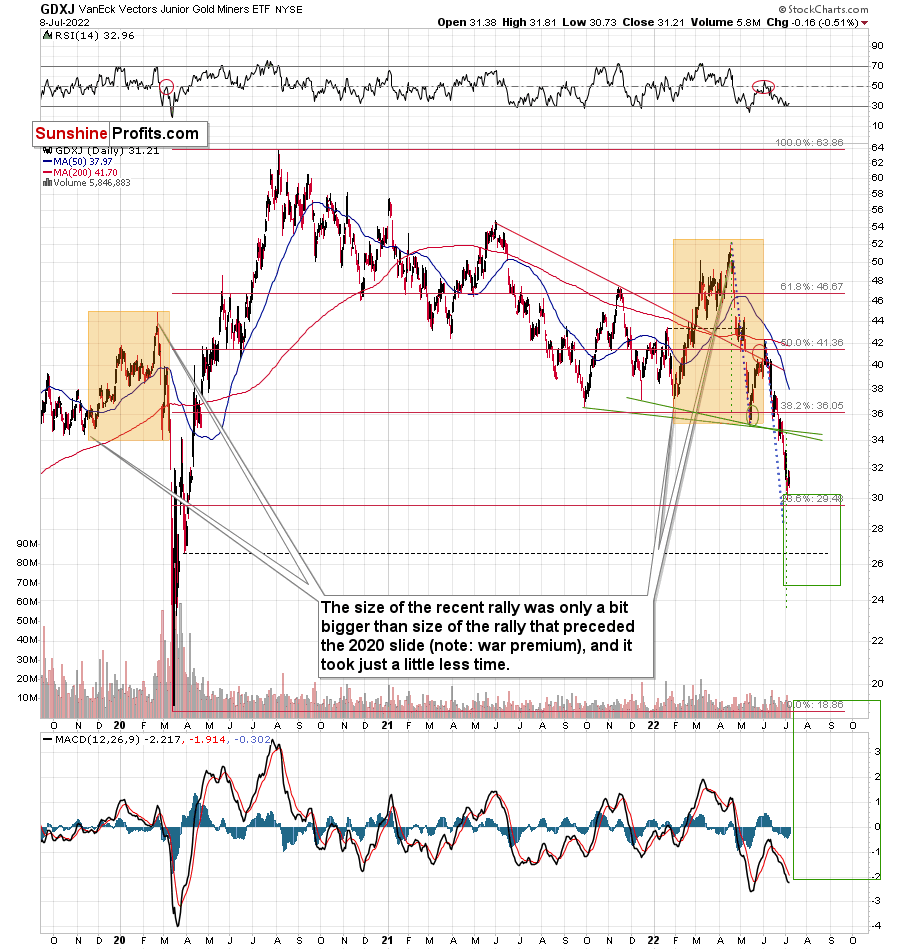

Let’s not forget that junior miners reached the upper part of their target area as well. The support was provided by the psychologically important $30 level and one of the Fibonacci retracement levels.

Based on the above chart, if gold corrects to the neck level of its previously-completed head-and-shoulders pattern, it wouldn’t be surprising to see something similar take place in the GDXJ.

In the case of the junior miners, the neck level (and thus the possible upside target) is slightly above the $34 level, so that’s where the GDXJ could rally. This level is also strengthened by the late-March 2020 top.

Please keep in mind that it could be the case that the GDXJ tops below that, especially if the general stock market declines soon.

So, for now, the old Wall Street saying seems to be the best summary of the short-term outlook and its implications – “when in doubt, stay out.”

As always, we’ll keep our subscribers informed.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM