tools spotlight

-

What Needs to Happen for the GDXJ to Hit New Lows?

July 8, 2022, 9:26 AMAlthough the general stock market has risen, this trend may soon reverse. Since it often moves along with gold stocks, junior miners can face a fall too.

Mining stocks declined significantly this week, but they haven’t severely underperformed gold. There is a good reason for it – the general stock market moved higher recently.

What would have to happen for the mining stocks (in particular, junior mining stocks) to decline in a more profound manner and slide well below $30 (in the GDXJ)? For example, the trend in the stock market could reverse.

Guess what – that’s exactly what’s likely to happen based on what’s going on in the S&P 500 chart.

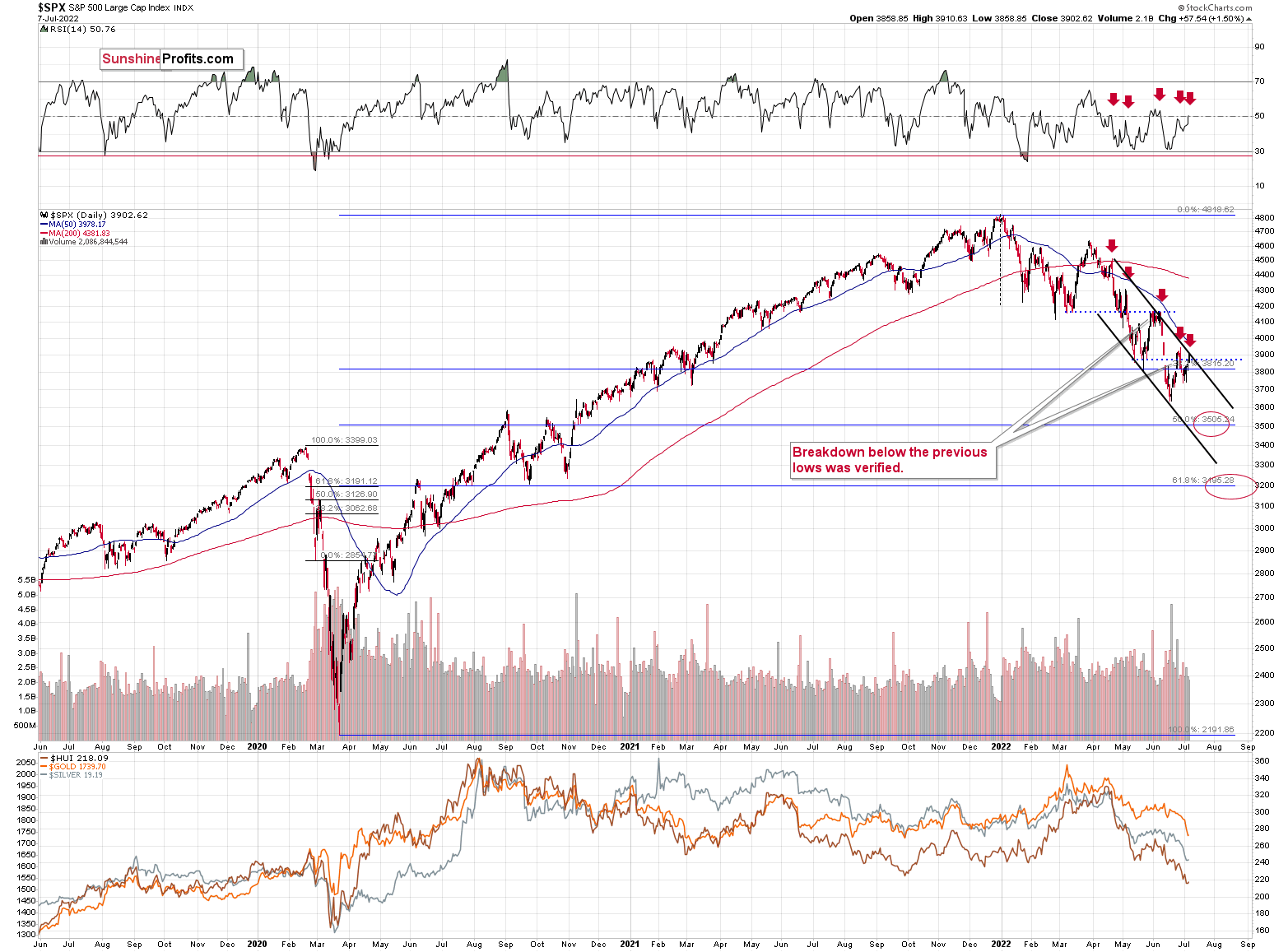

The S&P 500 just moved to the upper border of its trading channel, which means that it’s now likely to reverse its course. This scenario is supported by the action in the RSI indicator.

As you can see on the above chart (marked with red arrows), when the RSI moved to or close to 50 in recent months, it meant that the corrective rally was either over or about to end. The RSI just moved to 50.76.

In all recent cases, the declines that followed this RSI-close-to-50 sell signal were sharp. All of them, except the last one, were quite significant from the short-term point of view. In fact, if the S&P 500 does exactly what it did after the previous signals, it will likely move close to the 3,500 level, which has been my target area for some time now. That’s where we have the 50% Fibonacci retracement based on the entire 2020-2022 rally.

Most interestingly, though, such a decline would likely have a devastating effect on the prices of mining stocks (especially junior mining stocks) and silver. There might be some impact on gold, too.

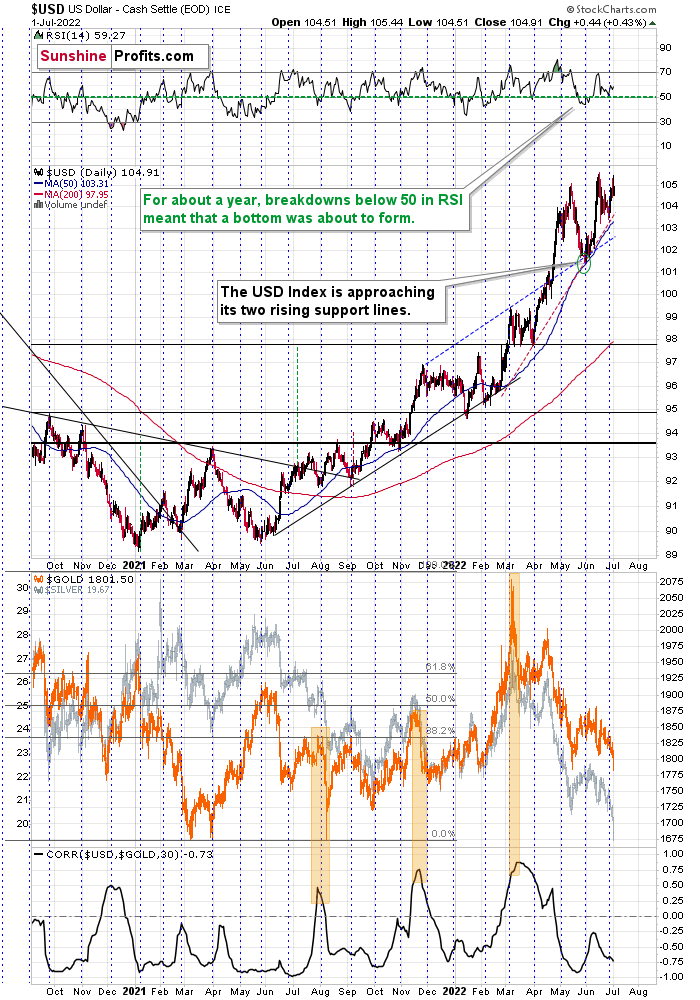

The above would also be in tune with an extra rally in the USD Index. After all, less competitive exports are not that favorable for the U.S. economy.

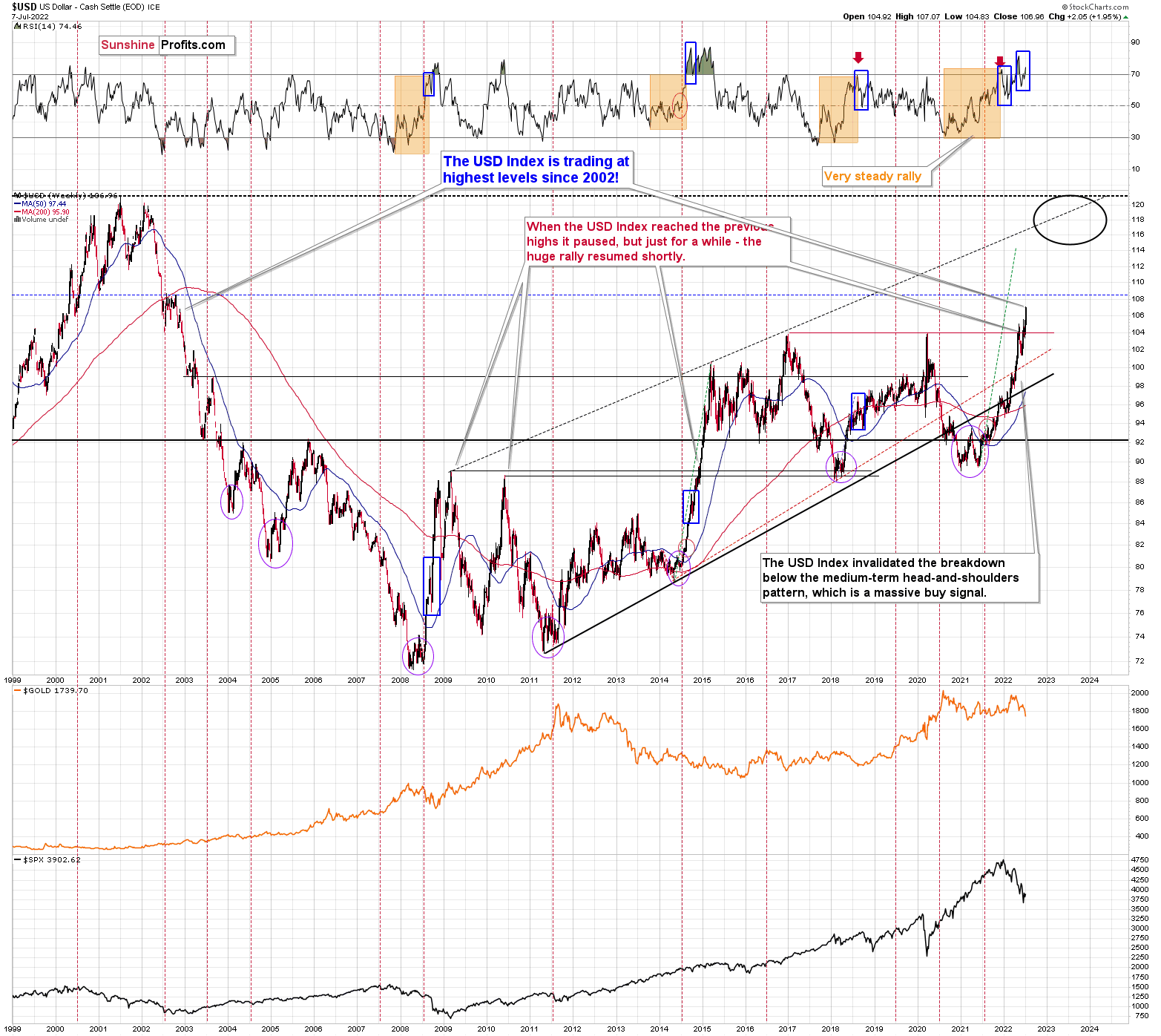

Speaking of the USD Index, after invalidating the breakout below the multi-year head-and-shoulders pattern, the USDX was poised to soar, just like I’ve been expecting it to do for more than a year, and that’s exactly what it did. And now it’s as high as it hasn’t been that high in 20 years!

The USD Index just broke above the previous highs, and it did so after correcting, which means that it just completed a massively bullish cup-and-handle pattern. This pattern is likely to send the USD Index much higher. However, since no market moves in a straight line, either up or down, let’s see where we have potential resistance levels.

The nearest resistance is provided by the 2002 high, and it’s slightly above the 108 level.

This means that the USD Index could easily rally by another 1 index point or so, which in turn could easily trigger another profound decline in gold.

This could happen this week (or early next week), so please stay tuned.

Whether this triggers a massive decline in junior miners or not is a different matter. It might, but it also might trigger a move back to this week’s intraday lows or just somewhat below them, and then miners could show strength. Either of the above – if accompanied by gold’s move to/below $1,700 – would serve as a signal for closing one’s current short positions and taking our massive profits off the table.

If the general stock market declines along with a rally in the USD Index, then the scenario in which the junior miners decline profoundly will likely be realized. I think it’s the more likely scenario here.

Do I plan to enter a long position once I close the current short position? Yes (just like I did at the end of the previous big correction), but only if gold declines below $1,700. If it doesn’t, and it moves higher right now, then I most likely won’t make any adjustments to the current short position. Remember – it’s not the point to catch each and every price move – in fact, it’s impossible to do so. The point is to select those trades that have the best risk-to-reward ratio and then enter trades while waiting out (i.e., ignoring) possible trades that don’t have a very favorable risk-to-reward ratio.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Will the US Treasury Yield Reach Its All-Time High This Year?

July 7, 2022, 8:06 AMWhile the U.S. 10-Year Treasury yield rallied sharply on Jul. 6, the benchmark has declined materially from its 2022 highs. Moreover, with the USD Index marching to another new 2022 high, the divergence may seem strange. However, the U.S. dollar and U.S. Treasuries are safe-haven assets, and with recession fears intensifying, it’s logical that both would catch a bid. To explain, I wrote on Sep. 22, 2021:

With the USD Index and U.S. Treasury yields the main fundamental drivers of the PMs’ performance, some confusion has arisen due to their parallel and divergent moves. For example, sometimes the USD Index rises (falls) while U.S. Treasury yields fall (rise), and sometimes the pair moves higher/lower in unison. However, it’s important to remember that different economic environments have different impacts on the USD Index and U.S. Treasury yields.

The USD Index benefits from both the safe-haven bid (stock market volatility) and economic outperformance relative to its FX peers. Conversely, U.S. Treasury yields only benefit from the latter. Thus, when economic risks intensify (like what we witnessed with Evergrande on Sep. 20), the USD Index often rallies while U.S. Treasury yields often fall. Thus, the economic climate is often the fundamental determinant of the pairs’ future paths.

Therefore, with the Fed hawked up, recession risks amplified and the Eurozone in rough shape given its reliance on Russian oil and gas, safe-haven flows have benefited the U.S. dollar and hurt the U.S. 10-Year Treasury yield.

Please see below:

To explain, the red line above tracks Bank of America’s high yield option-adjusted spread (OAS). For context, the metric tallies the excess interest rate over Treasuries that investors demand to own junk bonds. In addition, the spread is adjusted to remove the basis point impact of high yield bonds’ call and put options.

If you analyze the right side of the chart, notice how the OAS has risen sharply in recent months. For context, the St. Louis Fed’s reading is delayed by one day, but you can see how the spread has surpassed its 2018 highs. As a result, recession fears and the prospect of corporate defaults have driven a risk-off mood in the bond market.

To that point, the performance of the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) highlights investors’ anxiety.

Please see below:

To explain, the candlesticks above depict the performance of the HYG ETF. If you analyze the right side of the chart, you can see that the ETF is trading at levels unseen since the COVID-19 crash and the global financial crisis (GFC). For context, HYG is the largest high-yield bond ETF in the U.S., and junk credit is only one notch above equities in the capital structure. Therefore, when investors dump high-yield bonds, their faith in the U.S. economy has all but evaporated.

Furthermore, the credit spread between junk bonds and lower-tiered investment-grade bonds is also widening.

Please see below:

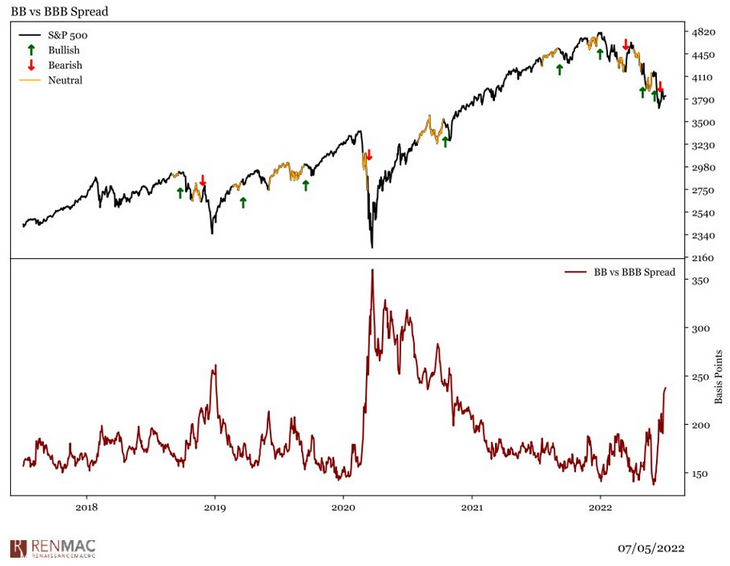

To explain, the black line at the top half of the chart tracks the S&P 500, while the red line at the bottom half tracks the credit spread of BBB investment-grade corporate bonds versus BB non-investment grade (high yield/junk) corporate bonds.

If you analyze the right side of the chart, you can see that the red line has increased dramatically. This means that spreads on high yield credit are rising faster than investment grade. In a nutshell: default fears have made investors less willing to finance risky companies. Moreover, the data shows that a rising red line is often bearish for the S&P 500. As such, if high yield credit spreads continue their ascent, a material drawdown of the S&P 500 should coincide with more safe-haven flows into the USD Index and U.S. Treasuries.

In addition, the EUR/USD has completely collapsed. Moreover, while I’ve been bearish on the currency pair for many months, the EUR/USD hit a new 2022 low on Jul. 6 and should reach parity with the U.S. dollar. As a result, risk-on currencies have been abandoned.

Please see below:

To explain, the candlesticks above depict the performance of the EUR/USD. If you analyze the right side of the chart, you can see that the currency pair is now at a ~20-year low. Thus, the stock market’s tranquility contrasts with the fear in the bond and currency markets.

As evidence, while the Cboe Volatility Index (VIX) – which measures stock market volatility – closed lower again on Jul. 6, the Cboe Interest Rate Volatility Index (SRVIX) rose and has surpassed its 2020 highs. As such, there is plenty of fear in assets outside the S&P 500.

The Real Story

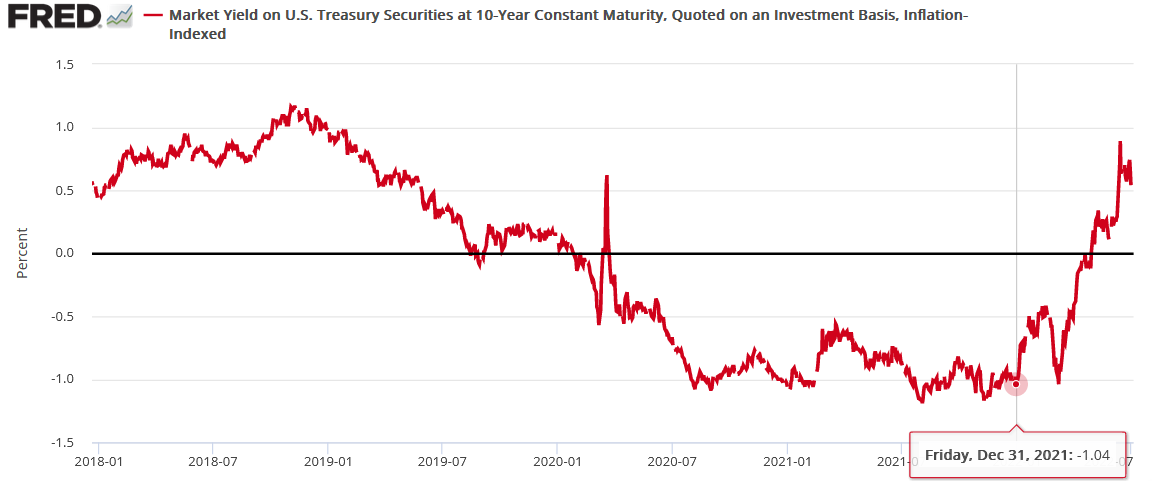

While all of the above helps explain the fundamental forces pushing the U.S. 10-Year Treasury yield lower, it’s important to remember that lower nominal yields are still bearish for the PMs in this environment. To explain, I wrote on Apr. 20:

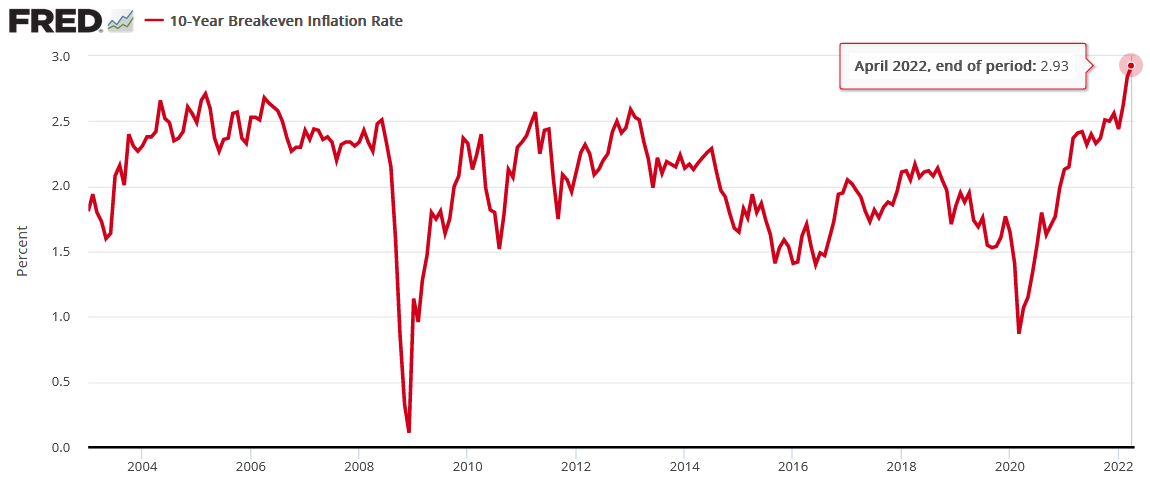

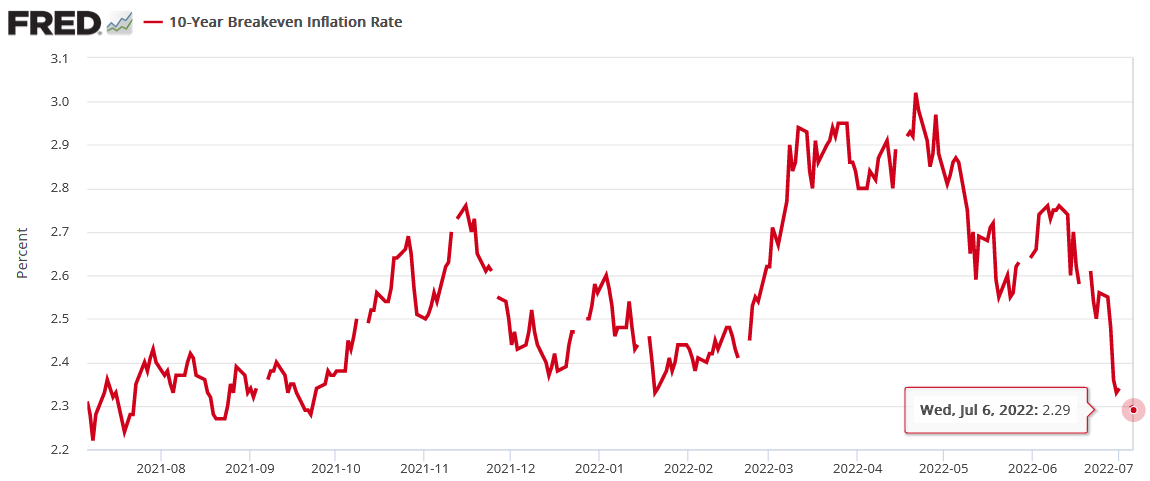

The next leg higher for the U.S. 10-Year real yield may occur for the opposite reasons. For example, I noted above that we don’t need nominal yields to rise for real yields to rise. Moreover, while the U.S. 10-Year Treasury yield was undervalued in 2021 and was poised to move higher, the U.S. 10-Year breakeven inflation rate is overvalued in 2022 and is poised to move lower.

Please see below:

To explain, the U.S. 10-Year breakeven inflation rate ended the Apr. 19 session at 2.93%, only slightly below the all-time high of 2.95% set in March. However, like the PMs, investors’ long-term inflation expectations remain in la-la land.

To that point, with the U.S. 10-Year breakeven inflation rate ending the Jul. 6 session at 2.29%, the metric remains in free fall.

Please see below:

Moreover, notice how the GDXJ ETF has almost mirrored the U.S. 10-Year breakeven inflation rate’s movement over the last 12 months.

Furthermore, with the U.S. 10-Year Treasury yield closing at 2.93% on Jul. 6, the U.S. 10-Year real yield is still materially elevated at 0.64%. For context, the metric ended 2021 at -1.04%. As a result, the 2022 ascent has been rapid, and the movement of nominal yields is less important than the movement of real yields.

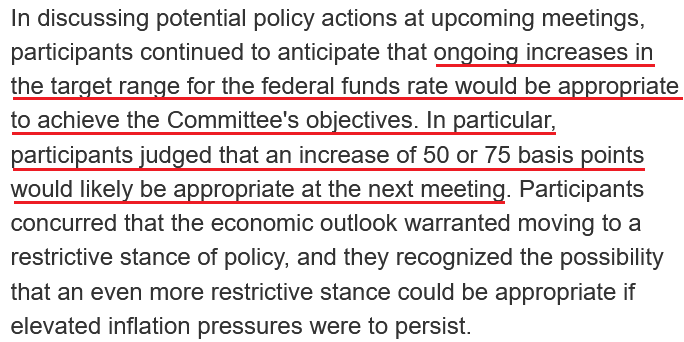

Fed Minutes

With the Fed releasing the minutes from its Jun. 14-15 monetary policy meeting on Jul. 6, the results were profoundly bullish for the USD Index and U.S. real yields. For example, an excerpt read:

"Participants concurred that the economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist."

In addition:

“Participants recognized that policy firming could slow the pace of economic growth for a time, but they saw the return of inflation to 2 percent as critical to achieving maximum employment on a sustained basis.”

Moreover, officials cited the long-term ramifications of letting inflation rage:

“Many participants judged that a significant risk now facing the Committee was that elevated inflation could become entrenched if the public began to question the resolve of the Committee to adjust the stance of policy as warranted.”

As a result, while the Fed has already hiked interest rates six times in 2022 (25 basis point increments), “ongoing increases” should be expected in the months ahead.

Please see below:

The Bottom Line

While the move in nominal interest rates may seem material, the plight of the U.S. 10-Year breakeven inflation rate has offset the damage. Moreover, with history showing that the U.S. 10-Year Treasury yield peaked after seven and nine rate hikes in 2000 and 2018, the current tally of six puts us near those historical thresholds. Furthermore, with the count poised to reach eight or nine in the coming weeks and a recession likely on the horizon, the action in the bond and FX markets signals that the U.S. 10-Year Treasury yield may have already reached its precipice.

For context, it’s not that the benchmark can’t move higher. It’s that the risk-reward of higher yields is no longer a sure thing. In 2021, inflation was out of control and Treasury yields were at or near their all-time lows. Therefore, the prospect of higher interest rates was a near certainty. In contrast, commodities have collapsed over the last 30 days (which should reduce inflation) and the U.S. 10-Year Treasury yield hit its highest level since 2011 before the recent pullback. As a result, lower long-term nominal yields may be the path of least resistance.

However, please remember that we’re concerned about real yields, not nominal yields. Thus, with the U.S. 10-Year breakeven inflation rate still above the Fed’s 2% target and higher real interest rates needed to cool inflation, the fundamental outlook (for the following weeks/months, not years!) for the PMs remains profoundly bearish.

In conclusion, the PMs were mixed on Jul. 6, as silver escaped the slaughter (it simply took a breather after breaking to new yearly lows in the previous days). However, the Fed’s job is far from over, as 8%+ annualized inflation won’t abate on its own. Therefore, more commodity carnage should materialize in the months ahead and culminate with a recession that pushes the PMs to their final lows.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold’s Inability to Pass the $2000 Mark Is a Very Bearish Clue

July 6, 2022, 9:39 AMGold and silver stocks have fallen in such a way that investors will rather understand why it is not worth taking a bullish stance on them.

Gold, silver, and mining stocks (major proxies for them) have all moved to new yearly lows during yesterday’s trading, and they are not back up (they’re rather flat) in today’s pre-market trading.

This is a significant bearish development, and it will finally convince many traders and investors that something is wrong with the bullish case for gold and the rest of the sector..

Why on earth would gold move to new yearly lows despite the ongoing war in Europe, the pandemic, and soaring inflation?

Because all of the above was already discounted in price, gold was still unable to move decisively above the $2,000 level. In fact, it failed to stay above its 2011 high, and that’s just gold. Silver and mining stocks were not even close to moving to their analogous price levels.

Gold’s failure to launch a proper rally was a massive indication that it’s not yet ready to move higher – it needs to decline massively first, which is what I’ve been writing for many months, but as new black swans kept popping up, gold was unable to complete its regular cyclical decline beforehand. So, it’s going now.

As real interest rates and the USD Index continue to climb, precious metal prices are likely to continue to decline – at least for several weeks. At some point, I expect gold, silver, and mining stocks to stop reacting to this bearish reality and show strength, thus indicating that the final long-term bottom is in. However, we are not there yet.

Based on analogies to how precious metals and mining stocks declined in the past, we have much lower to go, and we have much more money to make on our short positions. Speaking of which, if you are positioned in tune with what I’m describing as my general opinion in my Gold & Silver Trading Alerts, i.e., you are positioned to profit from a decline in junior mining stocks, you just made a lot of money yesterday, and in the last couple of weeks in general. This adds to the profits that you reaped on the preceding long position, which adds on top of the profits from the preceding short position. Congratulations!

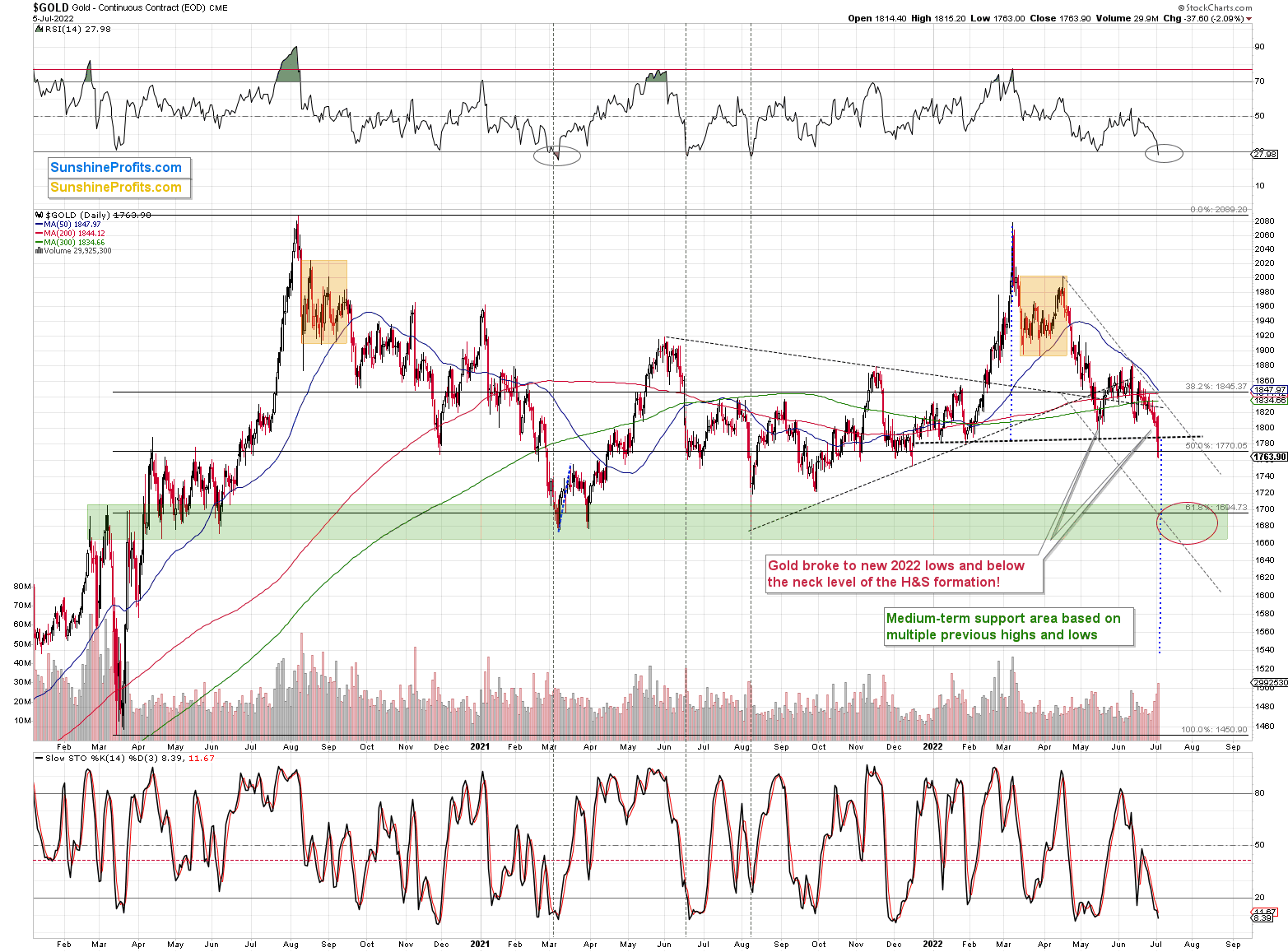

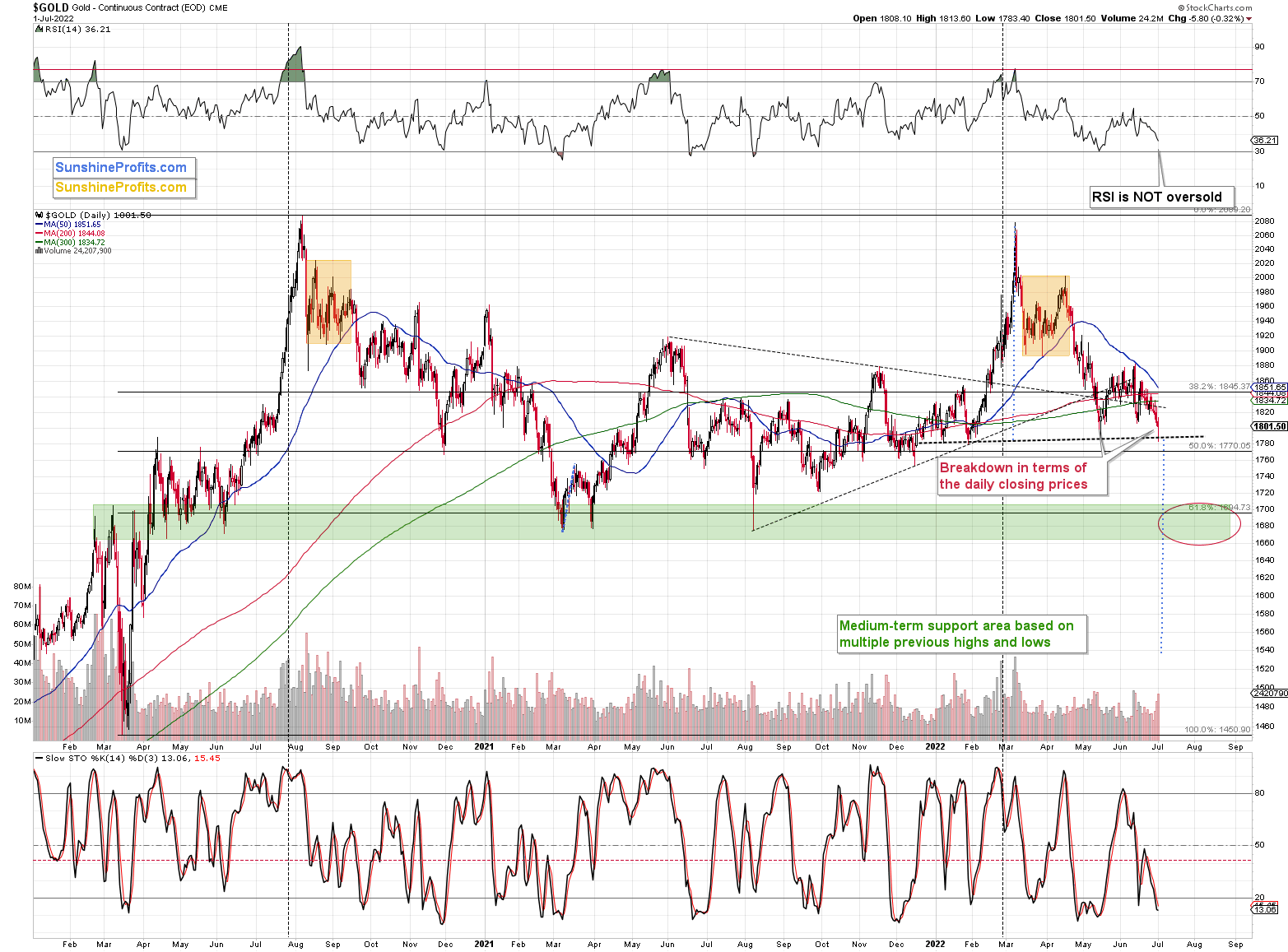

After this lengthy introduction, let’s take a look at gold.

Gold just moved below the neck level of the previous head and shoulders pattern and also to new 2022 lows. The breakdown took place at a hisgh volume, so it appears believable.

However, at the same time, the RSI moved below 30, which is a classic buy signal. I marked the previous similar signals with vertical dashed lines. In all three previous cases, gold was either bottoming or about to bottom.

In particular, the early-2021 situation appears similar, because the preceding price action is also similar. The failed attempt to rally above $2,000, the consolidation (marked with orange rectangles), and the subsequent decline that also included a consolidation are all present in both cases.

Back in 2021, gold continued to decline until it moved below $1,700, and while it doesn’t guarantee the same thing right now, the fact that both declines started from highs at very similar price levels makes it quite likely.

So, what’s likely to happen next? Well, I see two likely short-term outcomes:

- Gold corrects a bit, thus verifying the breakdown below the neck level of the H&S formation and the previous 2022 low,. and it then continues to decline after the correction.

- Gold slides to or slightly below $1,700 right away - or almost right away, but quite possibly this week.

In the case of scenario 1, junior miners would be likely to correct slightly as well, and then slide.

In the case of scenario 2, junior miners would be likely to slide right away, possibly showing some kind of strength right before gold moves to its $1,700 target.

In both cases, I plan to keep the short positions intact until GDXJ or gold reaches its targets lower – I don’t plan to trade the rebound from scenario 1. Not all moves are worth trading, just like you’ll probably agree that Friday’s daily rally wasn’t worth trading. Those who attempted to trade it have probably missed or even were hurt by yesterday’s decline instead of profiting on it.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Don’t Be Fooled by the Momentary Spurt of Junior Miners

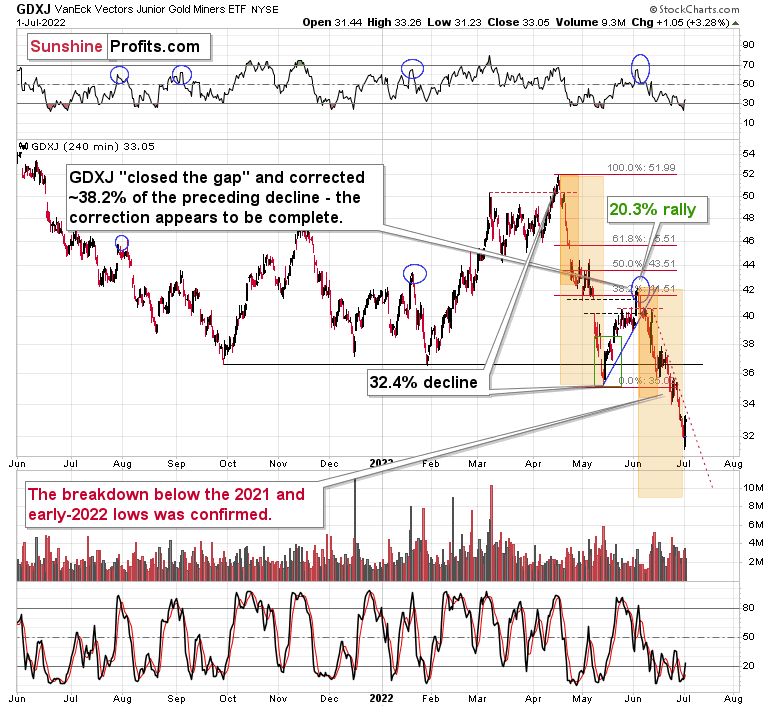

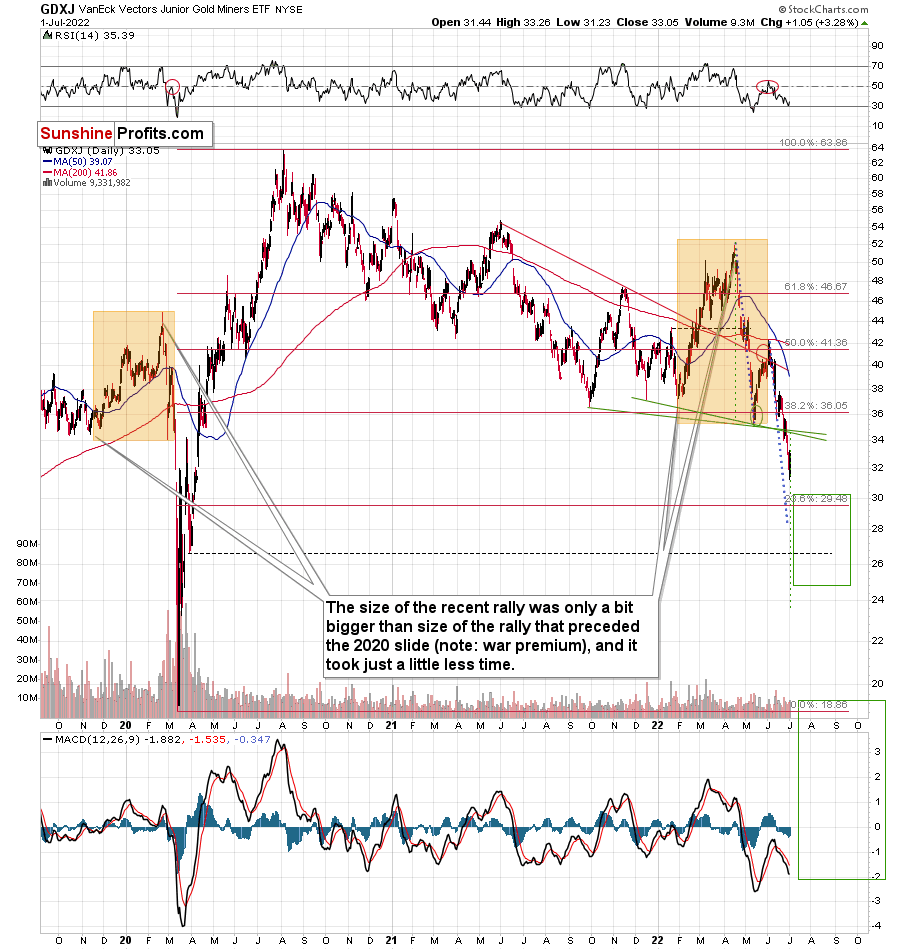

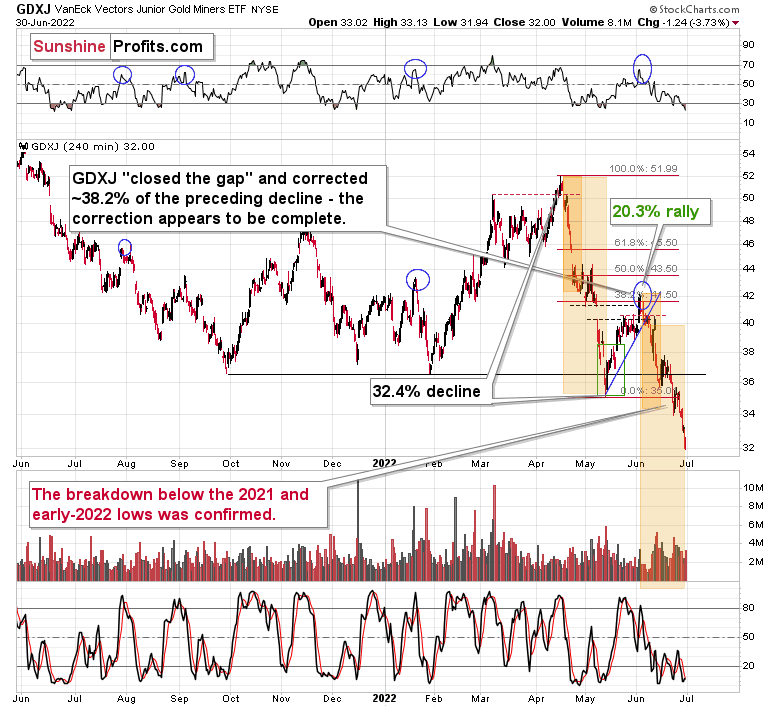

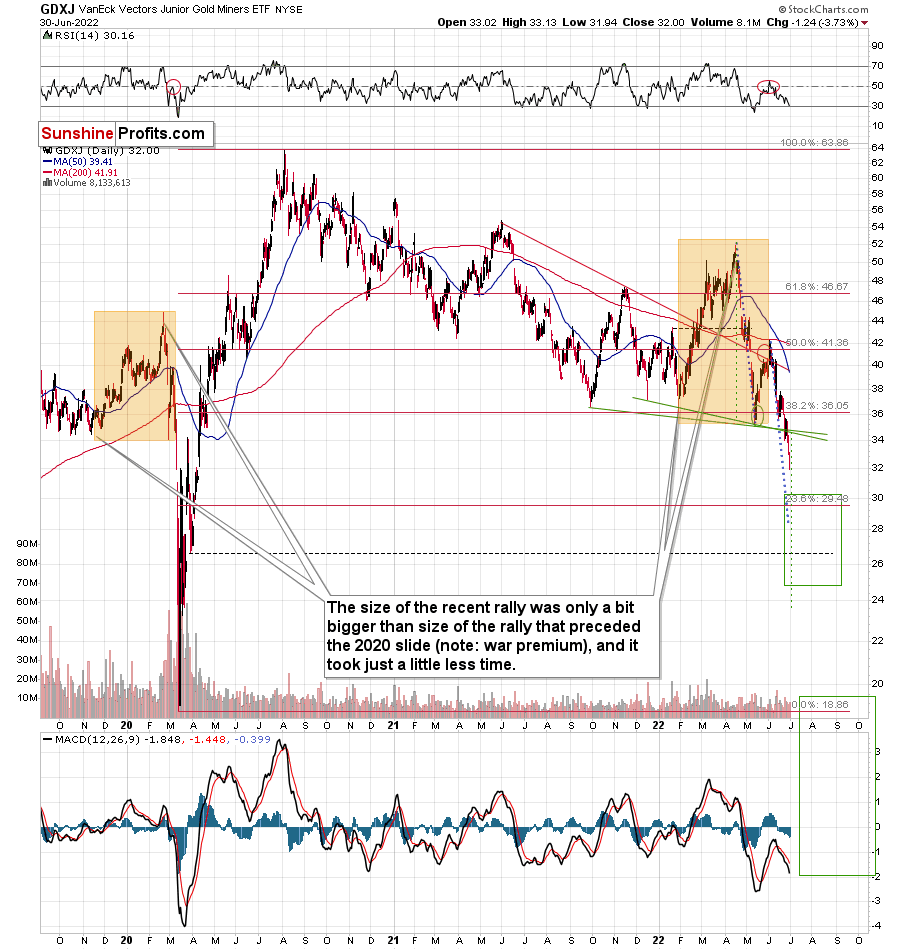

July 5, 2022, 8:05 AMMining stocks moved higher on Friday, and you might be wondering if this was anything more than a daily breather – so let’s start today’s analysis with the GDXJ ETF.

In short, so far, we haven’t seen a good indication that the rally is anything more than a normal daily rebound. Even the very sharp declining, red, dashed resistance line remains unbroken.

Consequently, the trend remains down.

Now, the bigger of the orange rectangles that you see on the above chart just ended, which means that, based on the time analogy to the April-May decline, we might see a bigger corrective upswing shortly. However, it’s not very likely that this is going to be the case. The reason is that this time the decline was visibly smaller than it was before, and thus the GDXJ is not as severely oversold.

Additionally, there are good reasons (like the situation in the USD Index) to think that the precious metals sector is about to move much lower instead of rallying. I covered many of them in Friday’s flagship Gold & Silver Trading Alert.

So, won’t there be any corrective upswing this time? Well, based on Friday’s 3% upswing, it’s obvious that we already saw one, and based on the following chart, it seems that even seeing an additional small upswing would be a part of a bigger bearish pattern.

The GDXJ is after a breakdown below the head and shoulders formation, which is a very bearish fact for the following weeks. However, on a very short-term basis, it’s important to remember that breakdowns below those formations tend to be followed by a corrective rally back (or almost back) to the previously broken neck level.

That’s exactly what we saw on Friday, and if we see a move even closer to the neck level, it won’t make the situation bullish – it’s all part of a big, bearish pattern with a downside target slightly below $24.

Moreover, please keep in mind that despite Friday’s small upswing, the GDXJ just closed the week at the lowest level since the first half of 2020.

Amazingly bearish, isn’t it? So much money has been printed in the last 2 years, and there’s a war in Europe, yet junior miners are trading at lower levels.

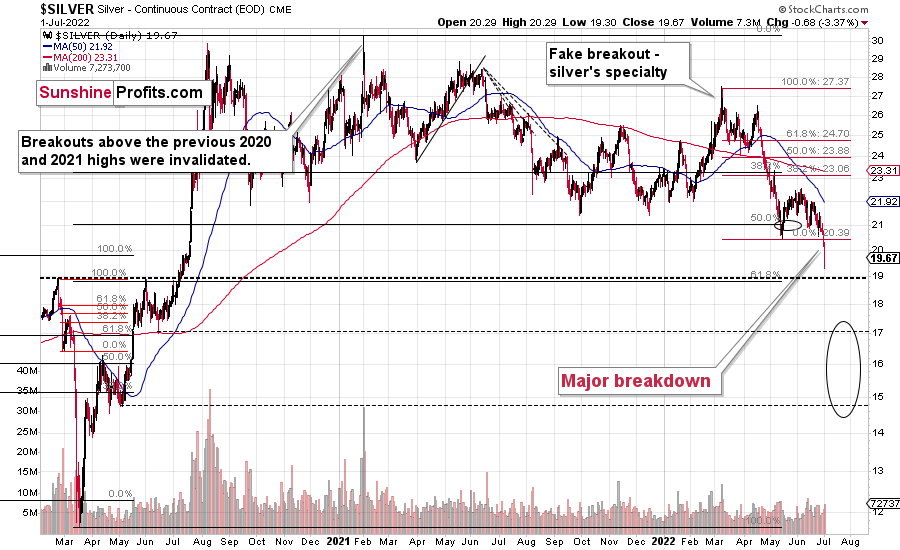

Speaking of weakness and major breakdowns, here’s what silver did recently.

The white metal corrected part of its decline, but it still ended $0.68 lower on Friday, which was the lowest daily and weekly close since mid-2020. This is profoundly bearish.

Remember when everyone and their brother thought that silver was about to soar to the moon in early 2021? When (with silver close to $30) I warned that while I agree that it’s eventually likely to do it, it’s very unlikely to happen without a bigger decline first?

While silver might correct this breakdown and move back to $20.5 or so, it’s quite likely that the breakdown will hold.

The real bearish fireworks are likely to start once gold breaks below its own head and shoulders pattern, though.

Gold touched the neck level based on the previous lows on Friday (July 1), but it didn’t break below it. Once it does, it’s likely to fall significantly. The target based on the formation is about $1,540. However, since we have a strong support area close to the 2021 lows, I think that seeing an interim bottom close to them is a likely outcome.

If only there was some kind of trigger that could push gold prices lower and make them complete the H&S formation.

Oh wait, there is one – a major one.

The USD Index is trading very close to the 105 level, and while it didn’t manage to break to new highs on Friday, its persistence is quite clear. It only has to confirm the breakout once for the bullish floodgates to be opened.

Given the rising real interest rates in the U.S. that are rising at a faster pace than the ones in the Eurozone, it seems that the USDX will continue to move to higher levels in the following weeks and months.

Therefore, it seems that the breakout and its confirmation are just a matter of time, and given that the corrective downswings after the attempts to break above the 105 level are getting smaller and smaller, it’s likely that we won’t have to wait too long for the USDX to show this material strength.

This, in turn, means that gold would be likely to break below its head and shoulders pattern, and junior miners would be likely to continue their massive slide after a brief correction. While I can’t promise any kind of performance, it seems that the profits on our short positions in junior miners are likely to increase even more.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Stocks’ New Short-Term Lows Can Only Mean One Thing

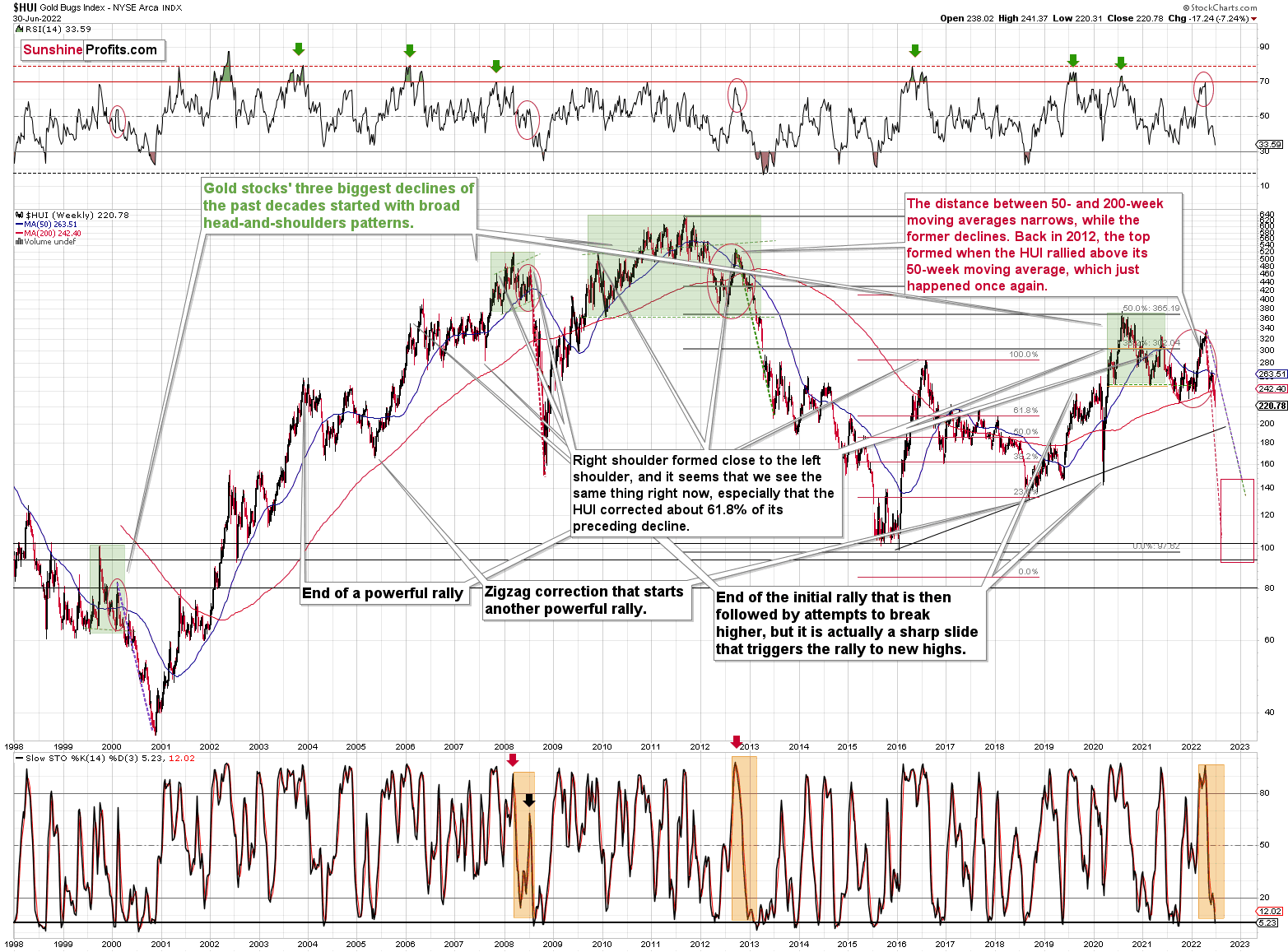

July 1, 2022, 9:30 AMIf not for the war, there would’ve probably been a repeat of the 2008 gold market. However, there is something similar: the bearish outlook for miners.

Gold stocks are declining similarly to how they did in 2008.

The Russian invasion triggered a rally, which was already more than erased, and if it wasn’t for it, the self-similarity would be very clear (note the head-and-shoulders patterns marked with green). Since the latter happened, it’s not as clear, but it seems that it’s still present. At least that’s what the pace of the current decline suggests.

I used a red dashed line to represent the 2008 decline, and I copied it to the current situation. They are very similar. We even saw a corrective upswing from more or less the 200-week moving average (red line), just like what happened in 2008.

We saw a breakdown to new short-term lows, which means that the volatile part of the slide is likely already underway.

Today’s decline in silver prices to new yearly lows definitely supports the above.

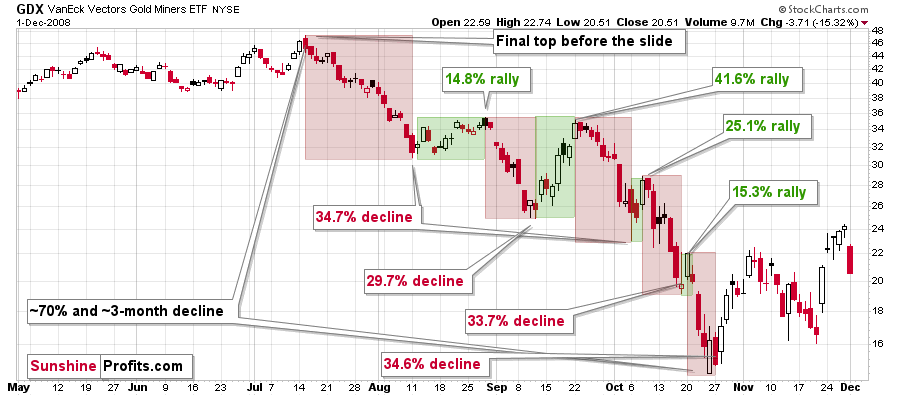

All right, let’s zoom in and see how mining stocks declined in 2008.

Back then, the GDXJ ETF was not yet trading, so I’m using the GDX ETF as a short-term proxy here.

The decline took about 3 months, and it erased about 70% of the miners’ value. The biggest part of the decline happened in the final month, though.

However, the really interesting thing about that decline – that might also be very useful this time – is that there were five very short-term declines that took the GDX about 30% lower.

I marked those declines with red rectangles. After that, a corrective upswing started. During those corrective upswings, the GDX rallied by 14.8-41.6%. The biggest corrective upswing (where GDX rallied by 41.6%) was triggered by a huge rally in gold, and since I don’t expect to see anything similar this year, it could be the case that this correction size is an outlier. Not paying attention to the outlier, we get corrections of between 14.8% and 25.1%.

The interesting thing was that each corrective upswing was shorter (faster) than the preceding one.

The first one took 12 trading days. The second one took seven trading days. The third one took 2 trading days, and the fourth and final one took just 1 trading day.

Fast forward to the current situation. Let’s take a look at the GDXJ ETF.

The GDXJ ETF declined by 32.4% and then corrected – it rallied by about 20.3%. The corrective upswing took 14 trading days.

The above is in perfect tune with the previous patterns seen in the GDX during the 2008 slide.

What does it tell us? It indicates that history can be rhymed, and while it will not be identical, we should pay attention to the indicators that worked in 2008. The next corrective upswing (a notable one, that is) might start when the GDXJ ETF declines by about 29-35% from its recent top. To clarify, I don’t claim that the above technique would be able to detect all corrective upswings, or that I aim to trade all of them. For instance, in my view, it was a good idea to enter a long position on May 12 and switch to a short position on May 26, but I wasn’t aiming to catch the intraday moves.

GDXJ could also decline a bit more than 29-35%, as let’s keep in mind that previous statistics are based on the GDX ETF and we are discussing the GDXJ here, and the latter is likely to decline even more than GDX as juniors are more correlated with the general stock market (and the latter is likely to slide).

So, let’s say that the GDXJ might decline between 29% and 40% from the recent high before triggering another notable corrective upswing (one that could take between 5 and 10 trading days based on how long the last one took and how big those corrections were in 2008).

The recent high was formed with the GDXJ ETF at $42.19. Applying the above-mentioned percentages to this price provides us with $24.78-29.32. And yes, the above would be likely to take place along with a big decline in gold prices.

Now, is there any meaningful support level in this area that could stop the decline?

Yes!

The late-March 2020 low is at $26.62, and it provides significant short-term support within the analogy-based target area.

Additionally, the above corresponds – more or less – to the size of the decline that would match the size of the April-May decline. It would be only somewhat bigger.

Let’s keep in mind that gold stocks don’t necessarily move on their own, but rather move along with gold. So, if gold moves to its strong medium-term support provided by the 2021 lows and then starts a brief rally, the same action would be likely in mining stocks.

The head and shoulders pattern confirms that the downside target is well below $30, perhaps even as low as ~$24.

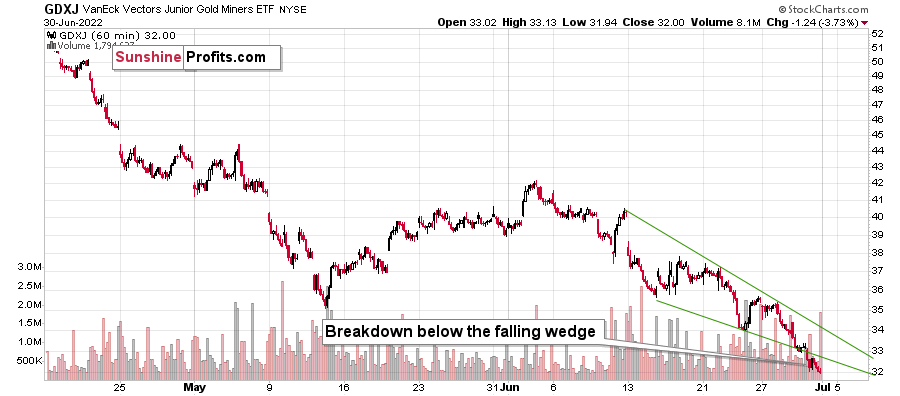

There’s also an additional detail present on GDXJ’s very short-term chart.

The GDXJ just broke below the declining wedge. While falling wedges are usually a bullish sign, they only become such after a break to the upside. What we witnessed was a relatively uncommon occurrence: a breakdown on the downside. The implications are therefore bearish instead of being bullish, and the profit potential for the current short position remains enormous.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM