tools spotlight

-

Despite the Falling USDX, Gold Is Spreading a Bearish Mood

August 2, 2022, 8:10 AMIn yesterday’s analysis, I wrote the following right below the USD Index charts:

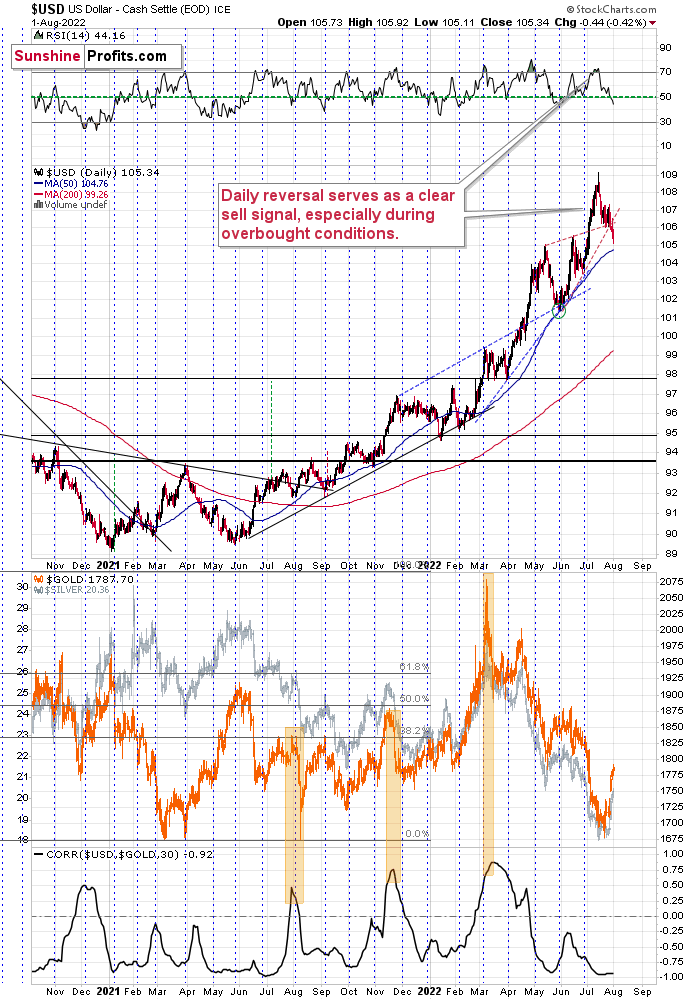

This move is in tune with what we saw at previous local bottoms. The RSI moved slightly below 50, and it’s the turn of the month – this combination was enough to trigger rallies in the U.S. dollar index.

Let’s keep in mind that the latter tends to form important bottoms close to the middle of the year.

So, the scenario in which the USD Index bottoms shortly (or that it just bottomed) seems quite likely.

There’s also the possibility that the USD Index keeps declining until it reaches the very strong support at about the 104 level – the previous long-term highs. Right now, it’s at about 105.5, which means that it could decline by another 1.5 index points or so. It doesn’t necessarily mean that gold, silver, and mining stocks would need to rally substantially if the above materialized. Conversely, since gold might now be reluctant to react to the USD’s lead and miners might be reluctant to react to gold’s lead, it seems that the possible upside for junior miners is very limited.

In other words, even if the big decline really picks up in a few weeks, I think that the risk-to-reward ratio already favors being on the short side of the precious metals sector. In particular, on the short side of the junior mining stocks.

That’s exactly what happened.

The USD Index declined quite visibly yesterday, almost reaching its 50-day moving average – and this average has been serving as reliable support for more than a year now.

While the USDX moved lower in a visible manner, gold didn’t move higher in a particularly meaningful way, and neither did silver.

Yes, it did end yesterday’s session higher, but it rallied by only $5.90 (it moved back from its intraday highs before the closing bell).

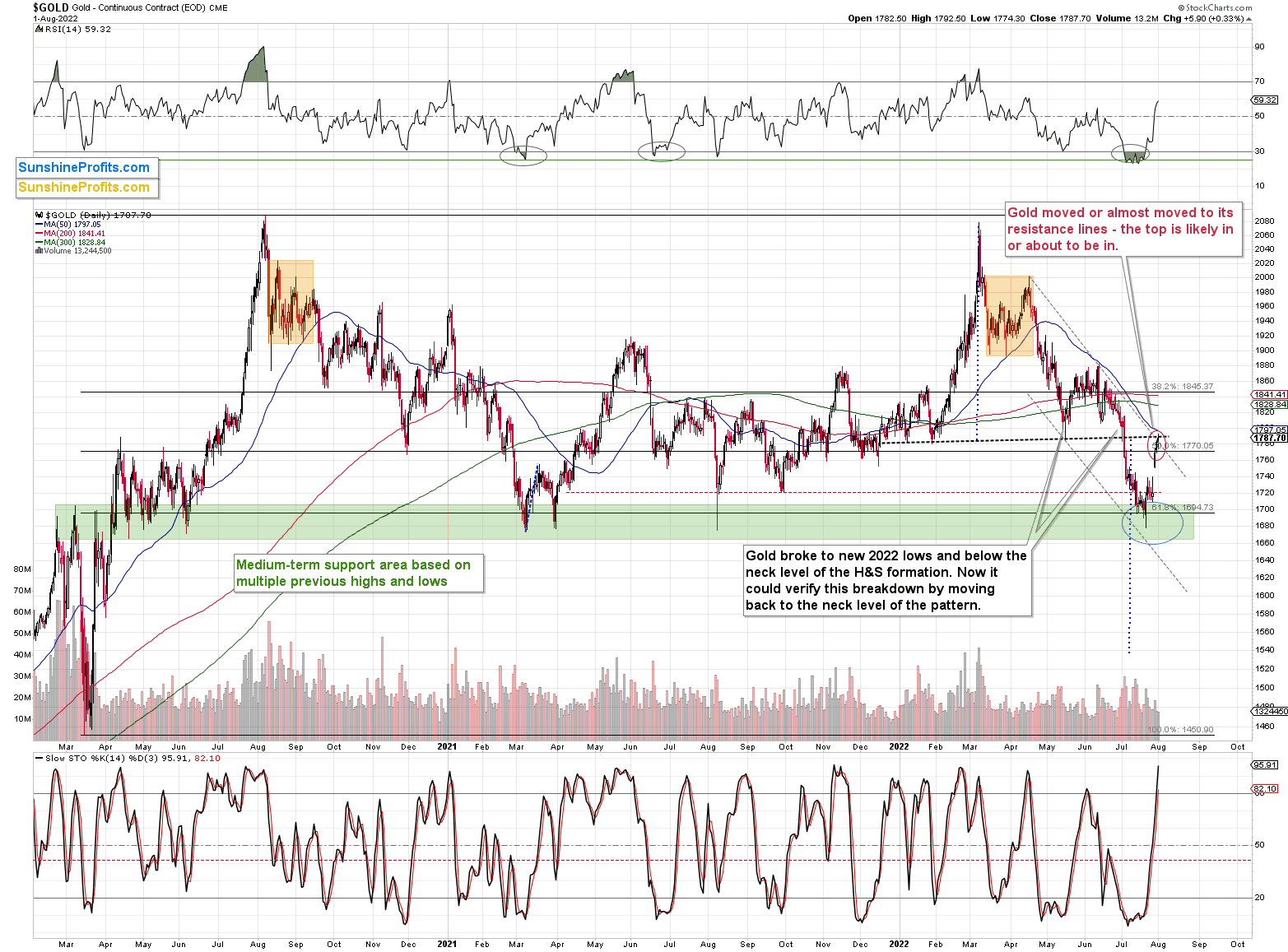

Based on the above, gold moved to the upper part of my previous target area, and it touched the neck level of the previously broken head-and-shoulders pattern.

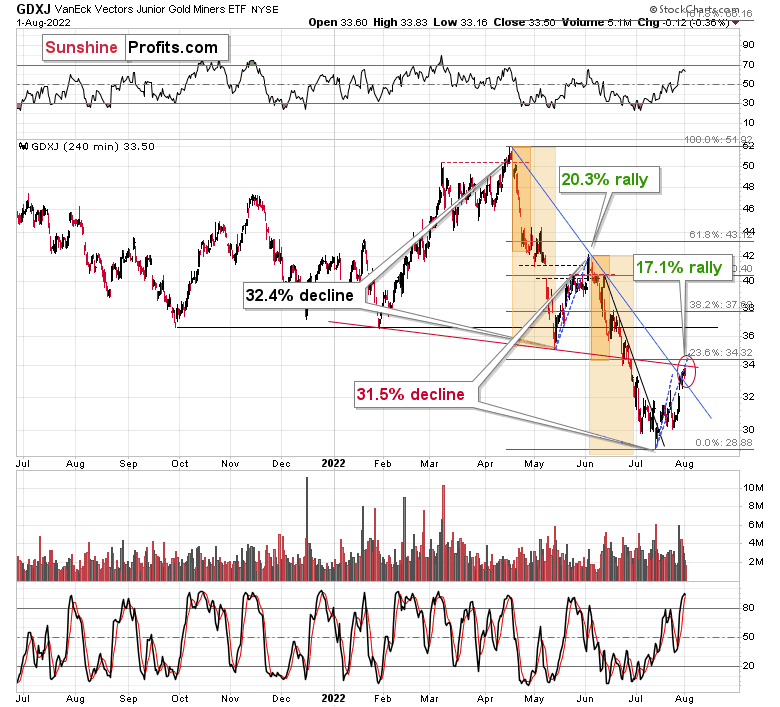

While gold moved insignificantly higher, junior miners actually declined.

Consequently, they are underperforming gold, which in turn is not really reacting to USDX’s bullish (for gold) indications. This is simply a bearish combination.

What’s also quite interesting on the above chart is the similarity between the recent upswing and the one that we saw in May and early June. In fact, even the timing relative to the days of the month is similar.

The previous rally started right before the middle of May, while the current upswing began just before the middle of July. The previous one consisted of two smaller rallies, which I marked with blue dashed lines and copied to the current situation. The first part of the move that we saw in July was not as big as in May, but the timing of the reversals was almost identical.

The second small rally is also aligned – at least so far. If this self-similar pattern is to continue, junior mining stocks are likely to top any day now, and the same goes for other mining stocks, silver, and gold. In fact, perhaps they have just topped.

Oh, and the previous rally ended with an RSI just below 70 – that’s where it is right now as well, which further adds to the credibility of the bearish case for the following weeks.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Don’t Be Misled by Gold’s Recent Upswing

August 1, 2022, 7:54 AMDespite gold’s latest move higher, its outlook remains bearish. If its 2012-2013 pattern is to repeat, it means gold is now preparing for a big fall.

Gold moved higher on Friday, so you might be wondering if this changed anything regarding the outlook. In short, it didn’t.

Let’s take a closer look at what happened.

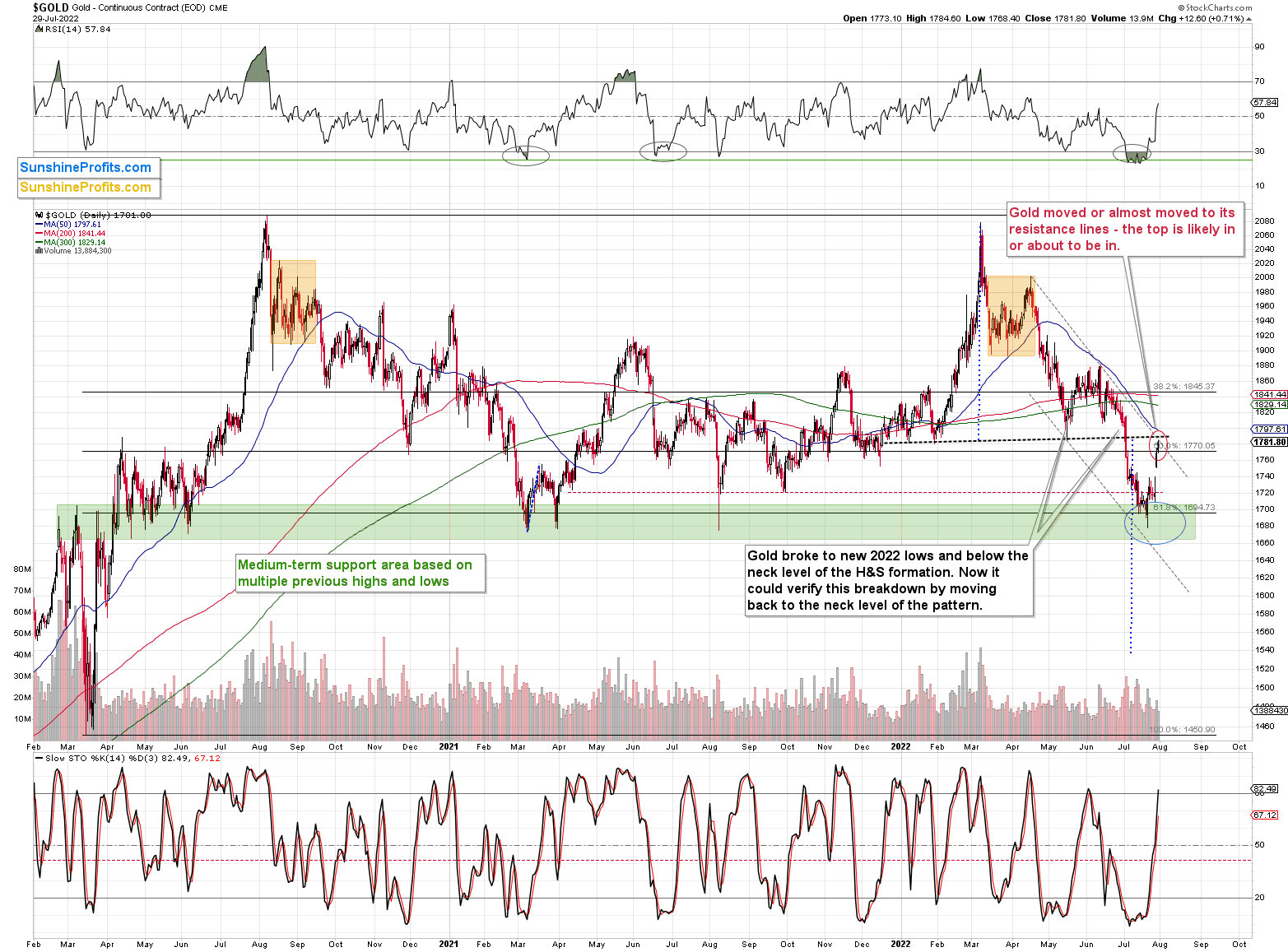

Gold futures moved higher by over $12, and this meant that they moved from the lower part of my previous target area to its upper part. In other words, it remained within the target area, which means that it kept doing what was – in my view – the most likely course of action for this particular market.

As such, it didn’t invalidate any previous expectations, let alone the broader outlook.

Gold stopped below the upper border of the declining trend channel, and it ended the week below the neck level of the previous head-and-shoulders pattern. Both remain unbroken, so the recent upswing doesn’t change the outlook, which turned bearish when we took profits from our previous long position on Thursday.

The RSI indicator is now visibly above 50 and close to the levels that triggered a top in gold in April and June 2022, and in July 2021.

As you may recall, gold is currently repeating its 2012-2013 pattern, and based on it, it’s likely just before the most volatile part of the decline. You can read more about it in Friday’s analysis (and in many previous analyses), and if the above is new to you, I strongly suggest that you take the time to read more – the self-similar pattern is truly astonishing.

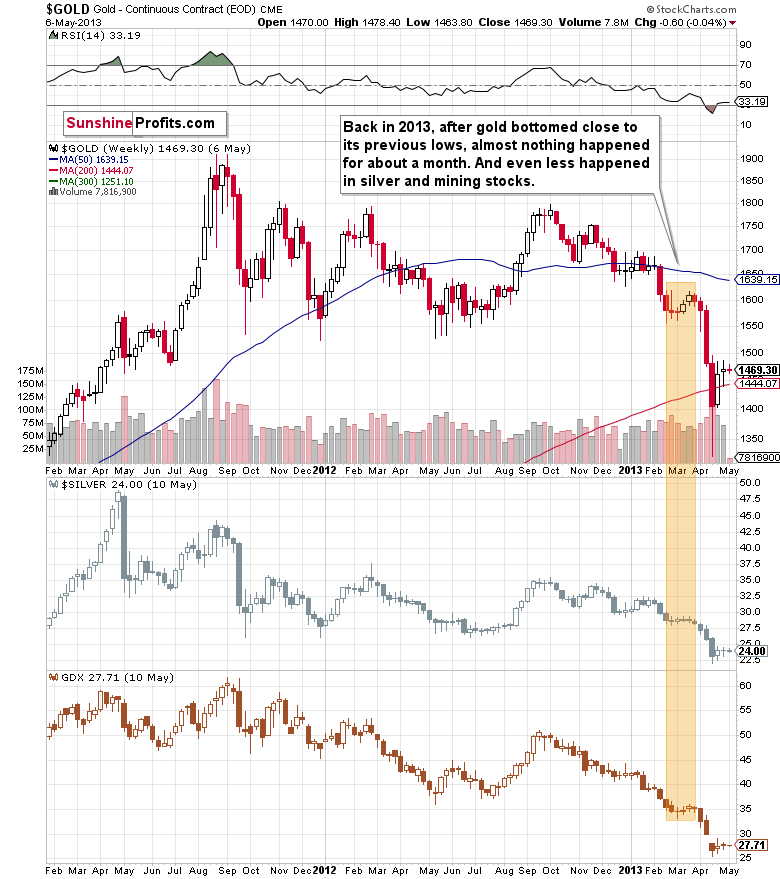

So, let’s check what gold did in 2013 at the analogous time.

Well, it consolidated for a few weeks and plunged only after that consolidation.

While it doesn’t guarantee that we’ll see a pause that’s as long as the one that we saw before the April 2013 slide, it’s a good indication that the huge decline might not start immediately, but rather we might see some “preparatory” action.

For now, investors and traders might view the current prices as temporary, and they might expect gold to soar back up. In fact, I saw multiple analyses indicating exactly that. This means that a week or a few weeks of back and forth trading close to the current price levels or between the current price levels and the recent lows would help to convince them that this move lower was not accidental.

This would make them much more likely to sell (and panic) once gold breaks below its recent lows.

Also, while the above chart doesn’t show it, because it’s based on weekly and not daily prices, gold topped in March 2013 when its daily RSI was trading just a little above 50 and close to its previous higs – just like what we see right now.

Getting back to the possible back-and-forth movement that we might see now, please note that the price “action” was even more boring in the case of silver and mining stocks (middle and lower parts of the above chart). They did very little during the consolidation, but when they finally moved lower, they truly plunged.

Oh, and don’t let the sizes of the moves fool you – the scale is linear in the case of silver and GDX, while it’s logarithmic in the case of gold. In reality, the mining stocks still declined the most, and silver’s decline was still bigger than the one seen in gold.

All in all, the short-term rally appears to be over or about to be over, and mining stocks’ lack of strength on Friday confirms it.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Stocks: It’s Time to Go Short Again

July 29, 2022, 6:09 AMAvailable to premium subscribers only.

-

Interest Rates Rose, but the Result Is Bullish for the GDXJ

July 28, 2022, 9:00 AMAs expected, the Fed raised interest rates again—and Powell's dovish stance was a gift to gold miners. The USD fell, giving the GDXJ more room to rise.

Powell Strikes Again

With all eyes on Fed Chairman Jerome Powell on Jul. 27, the central bank chief took his perpetually dovish rhetoric to a new 2022 high. Moreover, while the FOMC raised interest rates by 75 basis points – which was widely expected – Powell was Mr. Friendly. He said:

“While another unusually large increase could be appropriate at our next meeting that is a decision that will depend on the data we get between now and then (...). As the stance of monetary policy tightens further, it will likely become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.”

He added:

"Recent indicators of spending and production have softened. Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low."

Thus, while Powell reiterated comments like ‘rate hikes will continue’ and ‘we’re dedicated to achieving our 2% inflation goal,’ he continued to demonstrate his lack of inflation understanding. For example, he noted that “the public doesn’t distinguish between headline and core inflation,” and that a sustained period of supply shocks caused by bottlenecks and the pandemic “can start to undermine and work on de-anchoring inflation expectations.”

Therefore, he still assumes that inflation is mainly a supply-side phenomenon and that the Fed has to balance both sides of the equation delicately. However, while his uniformed assessment will likely be his undoing, the rhetoric is bullish for our GDXJ ETF long position.

Please see below:

To explain, the gold line above tracks the one-minute movement of the GDXJ ETF, while the red line above tracks the one-minute movement of the USD Index. If you analyze the vertical gray line, you can see that volatility struck when Powell began his press conference at 2:30 p.m. ET.

Moreover, with his dovish disposition sinking the dollar basket and uplifting the junior miners, the price action unfolded as expected. To explain, I wrote before the opening:

With Powell taking center stage today, intraday volatility may be amplified. However, with risk assets often rallying during Powell’s pressers, another re-enactment would help our long position. Moreover, if he decides to talk down the USD Index and U.S. Treasury yields, it would only brighten the GDXJ ETF’s short-term outlook. As such, while unanchored inflation should shift sentiment over the medium term, we still expect higher prices in the days ahead.

To that point, with Powell making it a trifecta and also talking down U.S. Treasury yields, the central bank chief made it his mission to loosen financial conditions.

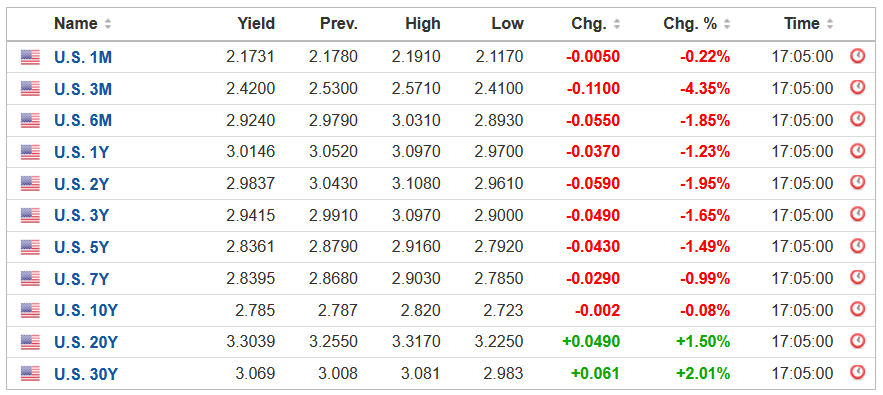

Please see below:

Thus, while Powell’s monetary missteps have been on display for 24+ months, he continues to repeat the same blunders. However, with the old Wall Street adage of ‘take what the market gives you’ proving prescient on Jul. 27, we don’t mind being long the GDXJ ETF and profiting from the short-term sugar high. Therefore, we expect the junior miners’ uprising to continue in the days ahead.

In contrast, with Powell’s preference for patience poised to prove extremely costly over the medium term, we’ll be careful not to overstay our welcome.

Powell’s Freight Train to Ruin

While Powell’s dovish rhetoric was met with applause on Jul. 27, his willingness to push up asset prices and loosen financial conditions is like offering needles to drug addicts. In a nutshell: he provides what they want, not what they need. Therefore, while sentiment moves markets and the current environment is bullish for the GDXJ ETF, the medium-term consequences should be dire.

For example, I’ve noted how billionaire hedge fund manager Bill Ackman aligns with our way of thinking about inflation. However, with our view in the extreme minority, the consensus sees things overwhelmingly differently. Moreover, Ackman was spot on when he wrote on Jul. 26 that “the biggest risk to the U.S. economy is not the Fed raising rates. It is inflation.”

Furthermore, while he referenced the sharp drop in U.S. Treasury yields, the drop in investment grade and high yield credit spreads, and the rise in stock prices, (add the USD Index decline, though Ackman didn’t mention that), he noted prior to the FOMC release on Jul. 27 that “financial conditions have eased materially, which has made the inflation problem worse.”

He added:

“What I don’t understand is why Powell is reluctant to say that the Fed will stop inflation in its tracks by raising rates and keeping them as high as they need to be for as long as they need to be until we have durable evidence (not a few months of lower inflation) that inflation has been licked. That is what it is going to take to kill off inflation and preserve the economy and the equity markets for the long term.”

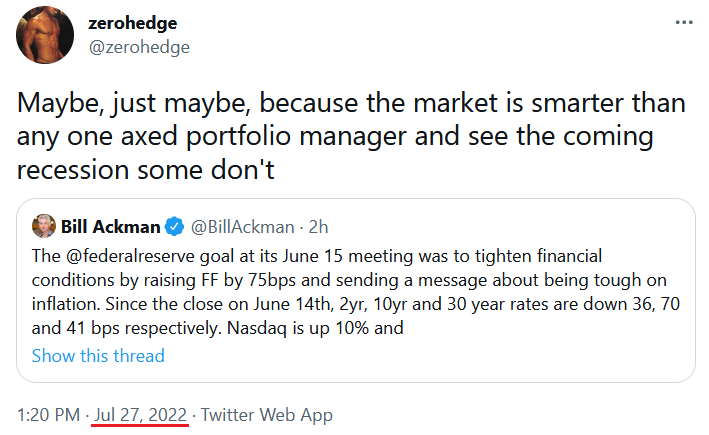

Thus, while Ackman should know that Powell always leans dovish during his press conferences, the six-to-12-month assessment should prove prescient. However, since opponents of the thesis believe that “the market is smarter,” the consensus (for some reason) opines that rampant inflation is preferable to a rate-hike-induced recession.

Please see below:

However, I warned on May 20 that investors should be careful what they wish for. I wrote:

With the consensus still fighting the hawkish realities that I warned about since 2021, the VIX is behaving as you might expect. I mean, why panic when the Fed is all bark and no bite? Therefore, everyone can relax because the Fed will turn dovish, inflation will rage, and in some alternative reality, this outcome is bullish for risk assets.

However, I’ve warned on numerous occasions that a dovish pivot would have dire long-term consequences for the U.S. economy. As such, Fed officials (should) know this, and a small short-term recession is much more attractive than a long-term hyperinflationary collapse. Yet, investors still assume that the latter option is more likely because the Fed can’t withstand falling stock prices.

However, with recency bias clouding investors’ judgment, they don’t realize that 1970s/1980s-like inflation is a completely different animal.

Thus, while the consensus follows the post-GFC ‘bad news is good news’ script and assumes that weak data will elicit a Fed pivot that solves all of the U.S.’s economic problems, the reality is that the recession train has already left the station.

As a result, the choice is between a rate-hike-induced downturn that quells inflation or a hyperinflationary malaise that leaves Americans in a worse position 12 months from now. Likewise, if investors assume that cutting rates or reigniting QE amid rampant inflation will have a positive outcome, they haven’t done their homework. As evidence, I warned on May 26 that the consensus is betting on an outcome that hasn’t materialized in 70+ years. I wrote:

With annualized inflation at [9%+], calming the price pressures with such little action is completely unrealistic. In fact, it’s never happened.

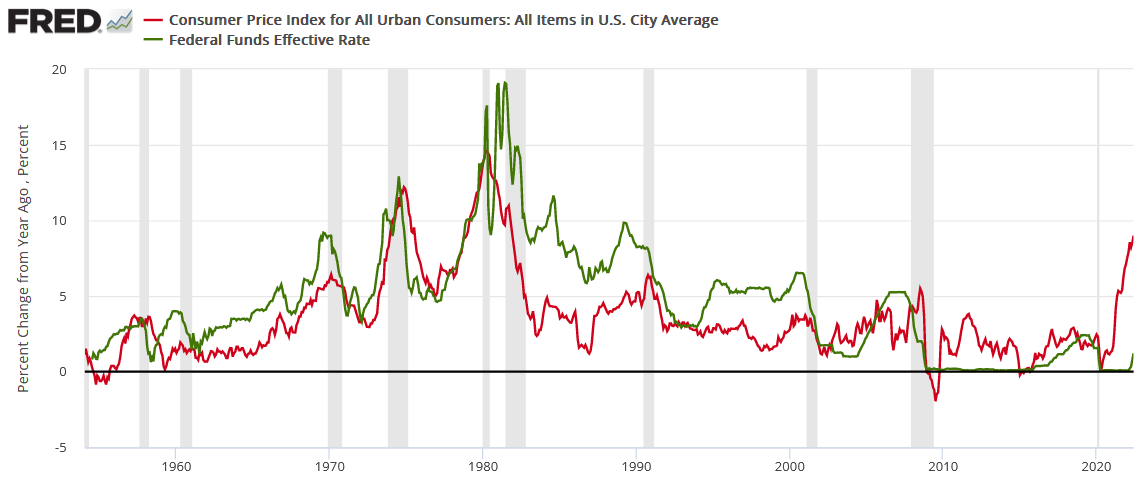

If you analyze the chart below, you can see that the U.S. federal funds rate (the green line) always rises above the year-over-year (YoY) percentage change in the headline Consumer Price Index (the red line) to curb inflation. Therefore, investors are kidding themselves if they think the Fed is about to re-write history.

In addition, notice how every inflation spike leads to a higher U.S. federal funds rate and then a recession (the vertical gray bars)? As such, do you really think this time is different?

What Inflation?

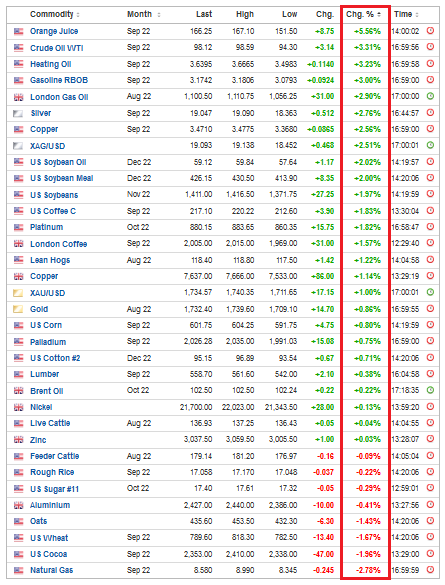

With Powell noting that the pace of future rate hikes will "depend on the data," his rhetoric was a green light for risk assets. However, with crude oil prices rallying sharply, most commodities took note of the dovish pushback. As such, Powell's words fueled month-over-month (MoM) inflation.

Please see below:

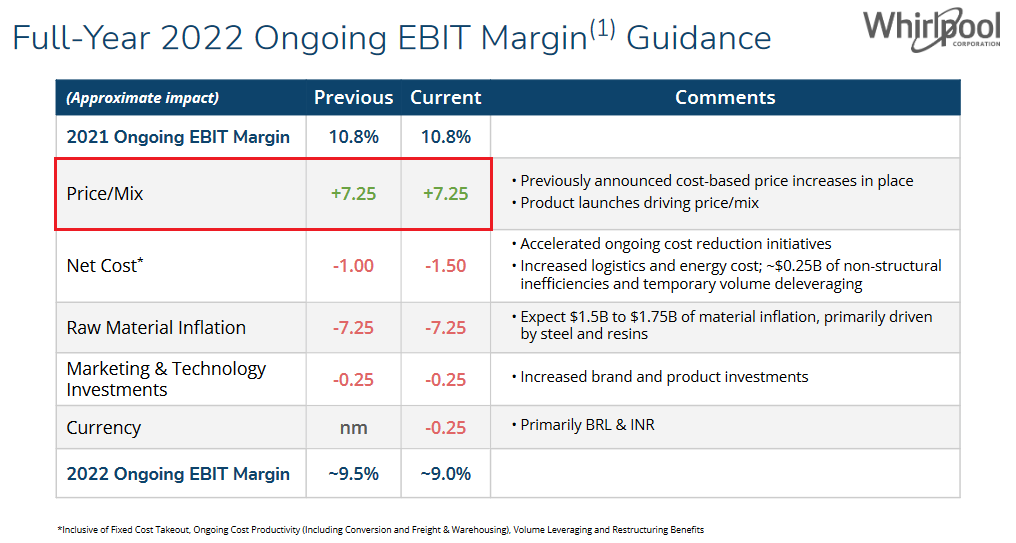

Likewise, while Q2 earnings calls and presentations have been riddled with mentions of inflation and price increases, the chorus continues to sing. For example, Whirlpool – a U.S. manufacturer of home appliances like dishwashers, fridges, ovens, and laundry equipment – released its second-quarter earnings on Jul. 26. CFO James Peters said during the Q2 earnings call:

“Our raw material inflation expectations remain unchanged, and we do expect raw material inflation to peak in the second and third quarter.” However, with higher prices “fully offsetting cost inflation,” price increases of 7.25% are expected for the remainder of 2022.

Please see below:

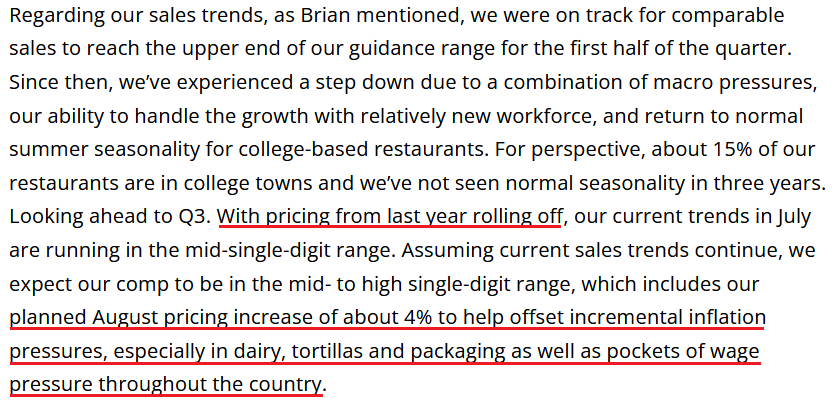

In addition, I noted on Jul. 27 that Chipotle Mexican Grill was a major winner after hours due to upbeat earnings. However, with price increases the primary culprit, investors responded positively to the company’s ability to protect its profit margins. An analyst asked during the Q2 earnings call, “Why seek more pricing now?” CEO Brian Niccol responded:

“Unfortunately, a lot of things have stuck versus gone away as far as inflation. And then we’ve got some key items that have frankly continued to be inflationary. And I think Jack highlighted it right. We’ve got avocados, we’ve got dairy, tortillas, some packaging. So, unfortunately, we were hoping we’d see some of the stuff pull back. We haven’t seen that.”

Moreover, when asked about construction costs for new stores, CFO John Hartung responded:

“In terms of inflation, it’s at least in the several percent range, maybe even more than that. The deals have varied throughout the country, but definitely our investment costs this year are much higher than they have been in the past and higher than we expected them to be.”

As a result, after raising prices by ~10% in the back half of 2021, another ~4% increase is scheduled for August.

Please see below:

Source: Chipotle Mexican Grill/AlphaStreet

Source: Chipotle Mexican Grill/AlphaStreetThus, Powell is flying blind once again. After raising prices for 24+ months, corporations continue to amplify inflation. Moreover, it’s Powell’s responsibility to normalize the pricing pressures, and corporations will do what they have to do to preserve their margins and keep their stock prices afloat. As such, Powell drastically underestimates the task at hand.

The Bottom Line

Since Powell’s lack of foresight is a gift to our GDXJ ETF long position, we think the upward momentum still has some room to run. Moreover, with the USD Index and the U.S. 10-Year real yield falling, looser financial conditions are bullish for junior miners. However, a reversal of fortunes should occur rather sooner than later (probably not later than a week from today).

In conclusion, the PMs rallied on Jul. 27, as it was off to the races for risk assets. Moreover, with the bulls exuding confidence, higher prices remain the path of least resistance. As a result, we remain on the long side for the time being, and profitably so.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM