tools spotlight

-

Will Powell’s Dovish Comments Help Gold and Miners Jump?

July 27, 2022, 8:17 AMWith Powell taking center stage today, intraday volatility may be amplified. However, with risk assets often rallying during Powell’s pressers, another re-enactment would help our long position. Moreover, if he decides to talk down the USD Index and U.S. Treasury yields, it would only brighten the GDXJ ETF’s short-term outlook. As such, while unanchored inflation should shift sentiment over the medium term, we still expect higher prices in the days ahead.

The PMs were mixed on Jul. 26, as gold ended the day in the red. However, with mining stocks showcasing relative strength in the face of a stock market sell-off, the outperformance should have more room to run. Therefore, we remain bullish for the short term, while remaining very bearish for the following weeks/months.

Technically Speaking

The fundamental background provides a good basis for what’s been likely to happen for some time now. Namely, that we’re going to see a short-term upswing that’s followed by a bigger downswing.

The upswing could be triggered by Powell’s dovish remarks, and the following downswing (that would start in a couple of days or so – or maybe earlier) could be caused by people realizing that regardless of what Powell said and how dovish it seemed, they will ultimately keep hiking interest rates, and that they might need to do so at a faster pace than the market currently expects.

Does it fit the technical picture? Yes, it does.

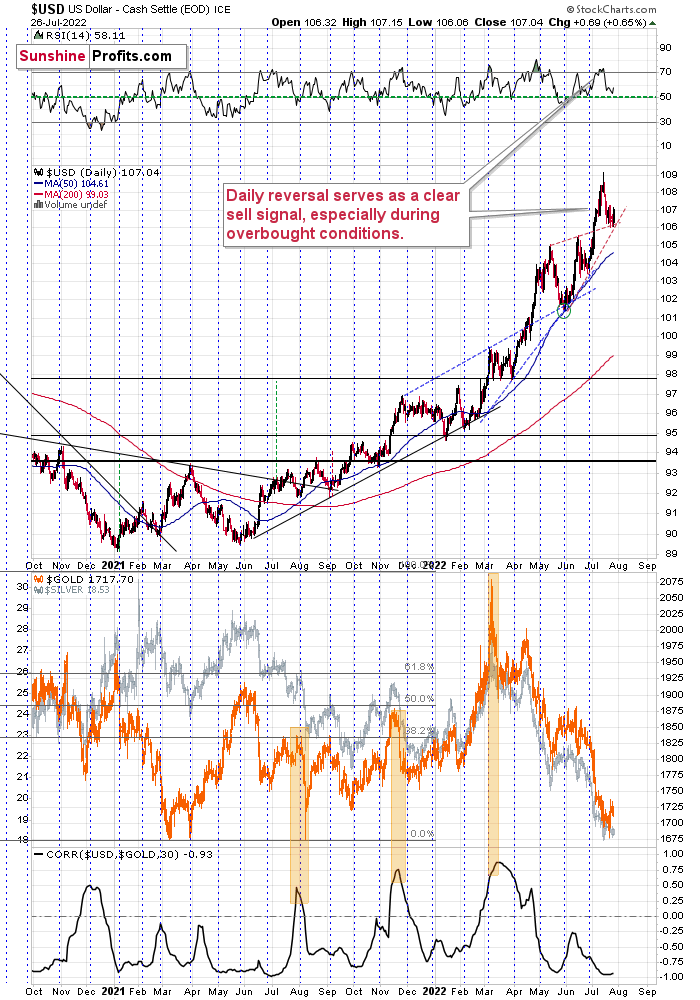

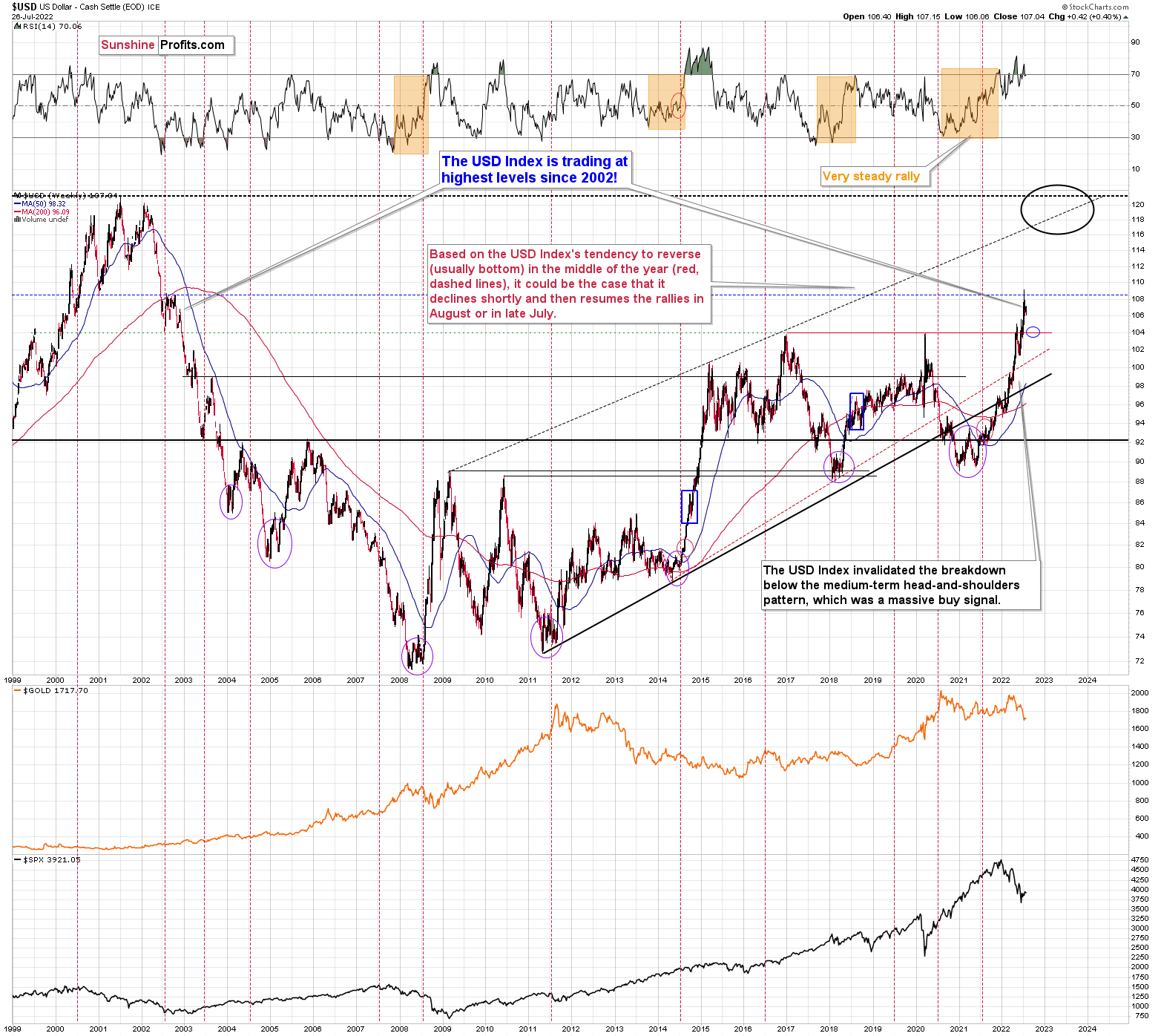

First of all, the above would fit the scenario in which the USD Index declines briefly and bottoms very close to the end of the month – for example, on Friday or Monday.

This would be in perfect tune with USDX’s tendency to form reversals (usually) bottoms at the turn of the month (or close to it – as visible on the above chart), and also – from a broader point of view – in the middle of the year.

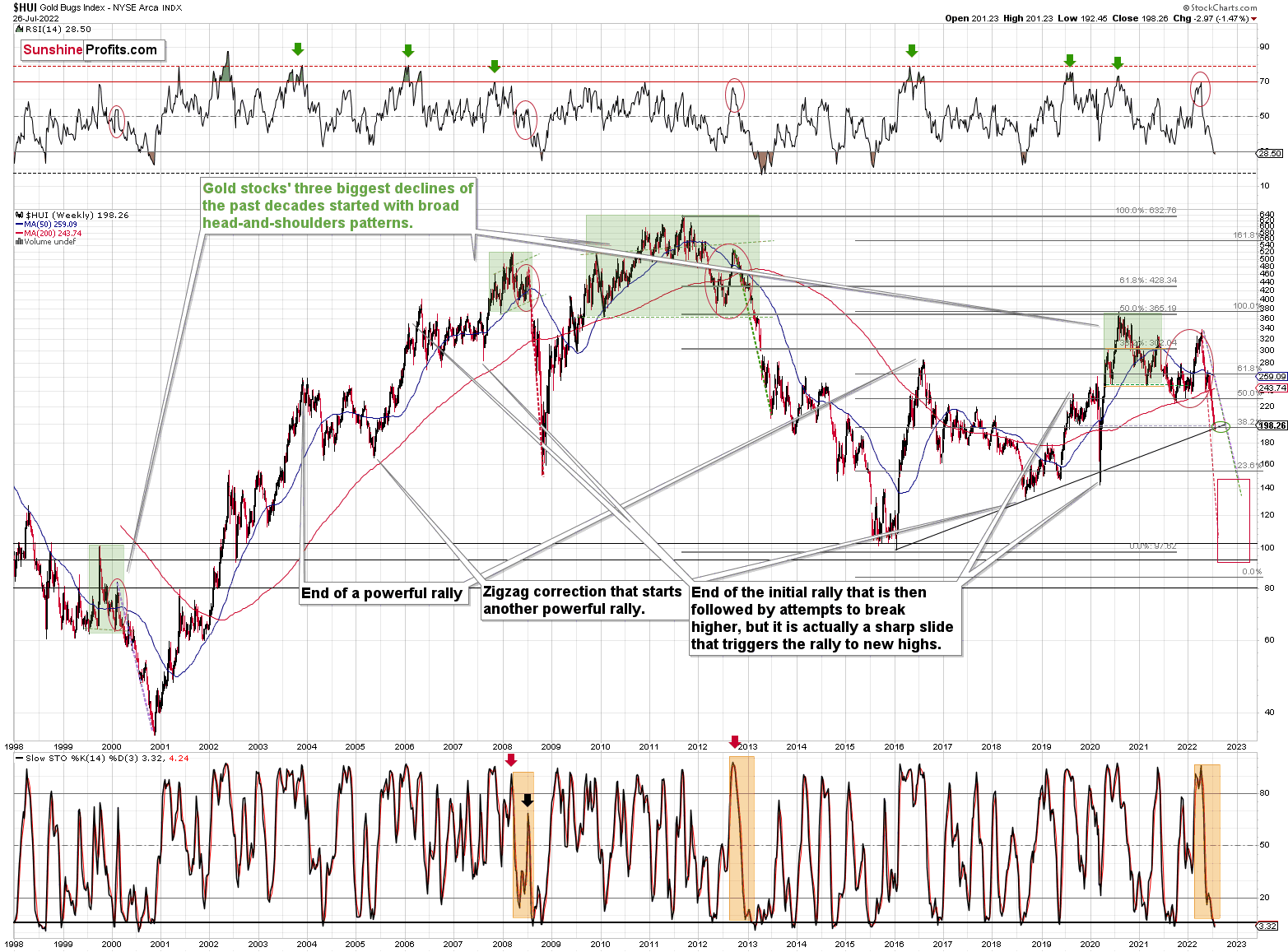

It would also perfectly fit the signal that we just saw in the HUI Index.

In yesterday’s analysis, I commented on the above chart in the following way:

Namely, the gold stocks moved slightly below their Fibonacci retracement and the rising, long-term support line. The latter was broken only once previously. It was in early 2020, and when that happened, a very sharp rally followed practically immediately. Will we see the same thing this time? That’s quite likely. However, I don’t think the rally would be that significant.

Consequently, it could be the case that we’re going to see more strength in the precious metals market before the big move lower continues.

Indeed, the flagship proxy for gold stocks invalidated its small breakdown below its rising long-term support line, which served as a short-term buy signal.

Here Today, Gone Tomorrow

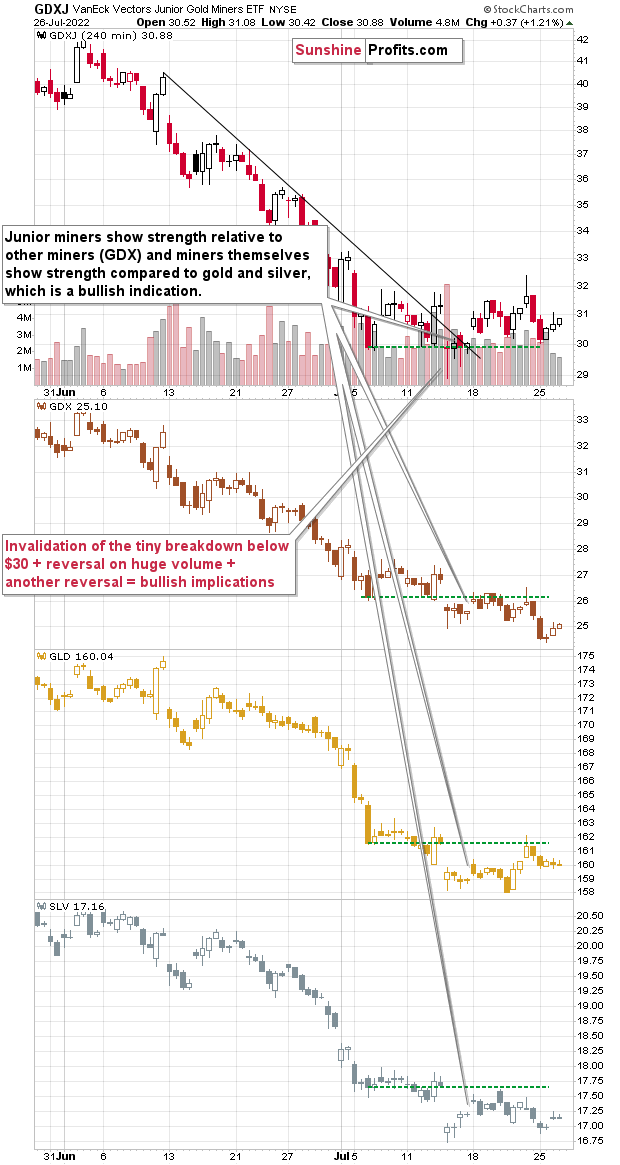

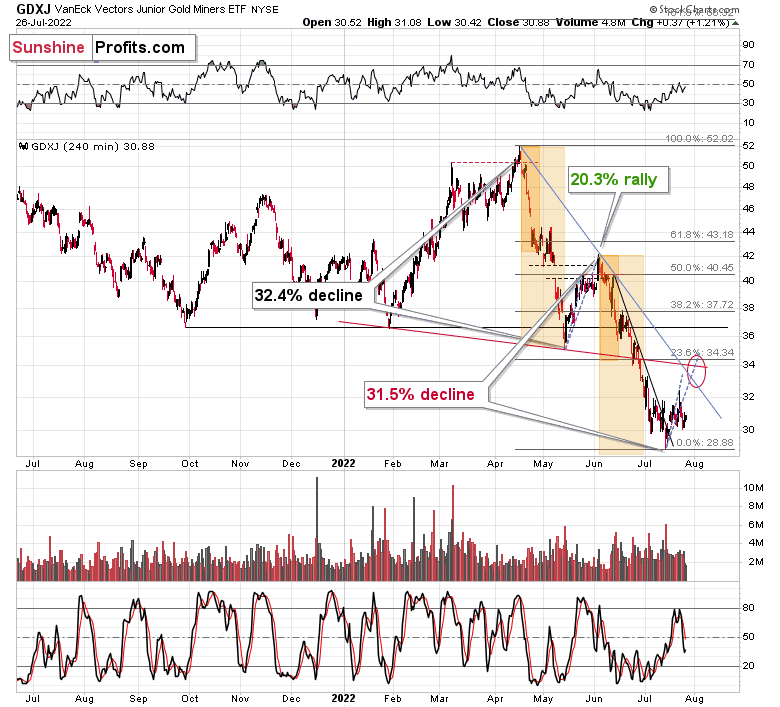

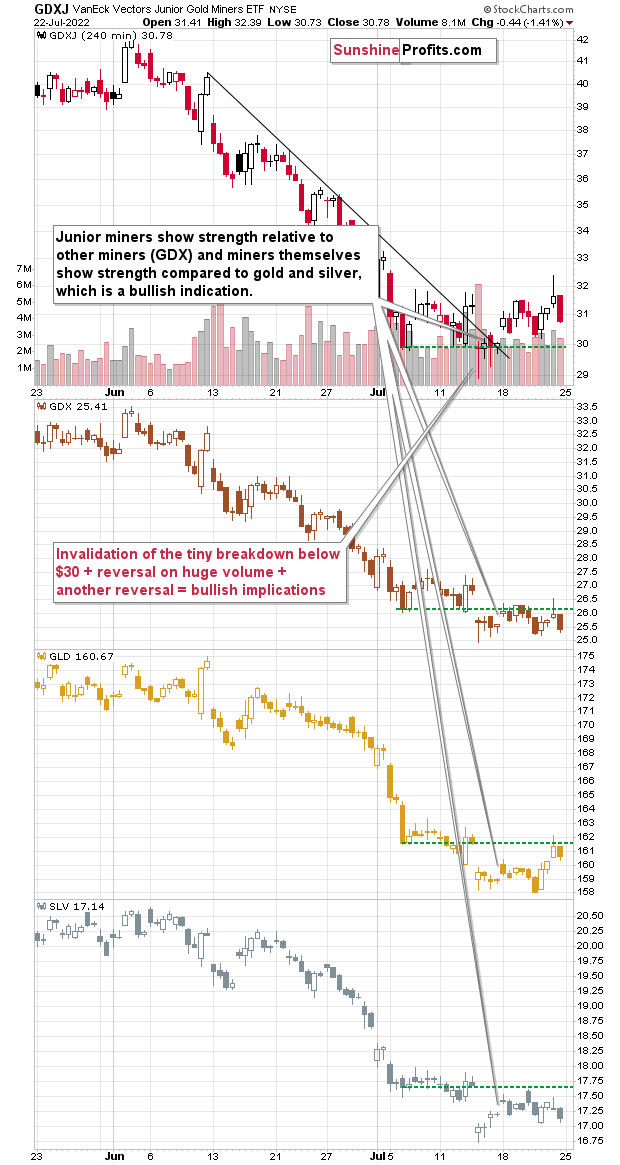

The GDXJ ETF – a proxy for junior miners – rallied by 1.21% yesterday, which means that it rallied more than it had declined the previous day, when Newmont’s decline triggered declines in the GDX ETF and HUI Index.

Since the GDXJ is up over 2% in today’s London trading (while gold futures are up by just 0.25%), it seems that its outperformance of the rest of the precious metals sector hasn’t ended yet.

It remains likely that the GDXJ ETF moves higher in the very near term, likely topping close to one of its declining resistance lines. One of those lines is based on the previous tops (the blue line) and the other (the red line) is the neck level of the previously broken head and shoulders pattern.

When we zoom in even more, we see that sudden upswings are not that uncommon in the case of junior miners.

We saw one in early June. If gold jumps higher on dovish remarks from the Fed, juniors would be likely to jump, too.

The resistance line based on the previous July highs could be viewed as a neck level of an inverse head-and-shoulders pattern, which – when broken – would support a rally to the $34-34.5 area.

Gold’s intraday picture also supports such a quick upswing.

Based on the symmetry of how gold recently performed after a local bottom (sharp rally and then a correction), it seems that we’re on the verge of a sharp move higher.

The black lines that I marked on the above chart are identical – I copied the previous lines connecting the bottom with the following top and bottom, and I pasted them on the current situation, attaching them to the recent bottom. Interestingly, the timing of the recent immediate-term top and bottom aligns almost perfectly. This makes it quite likely that the follow-up action will also be similar.

Please note that just because the about-to-be-seen rally is likely to be sharp, doesn’t mean that it’s likely to be a medium-term game-changer. To clarify, a $30-80 rally is what I think is likely to follow, nothing more. The $1,745-$1,770 area seems to be the most reliable short-term target in my view.

As always, I’ll keep my subscribers informed.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The Markets Hold Their Breath Awaiting the Fed’s Decision

July 26, 2022, 8:56 AMWith investors unsure of how Big Tech’s earnings will perform this week and how hawkish or dovish Fed Chairman Jerome Powell will be during his press conference on Jul. 27, the financial markets were in a state of cautious paralysis on Jul. 25. However, with the narrative slowly shifting and investors prone to hearing what they want to hear, their preference for jubilation could help uplift the GDXJ ETF in the days ahead.

For example, with the consensus often more influenced by price than fundamentals, here are some of the headlines that hit the wire on Jul. 25:

Moreover:

Patiently Waiting

Thus, because "volume speaks volumes," the price action – combined with the S&P 500's ability to hold up despite weak economic data – has investors assuming that peak bearishness is in the past.

To that point, Mike Wilson, Chief U.S. Equity Strategist at Morgan Stanley, predicted that the S&P 500 would bottom at ~3,400 amid a soft landing and at ~3,000 during a recession. However, with signs of uncertainty creeping in, he told clients on Jul. 25 that the S&P 500's recent strength does beg the question: “is there something going on here we are missing that could make this a more sustainable low and even the end of the bear market?"

He added:

"iF the market is starting to think the Fed is about to pause rate hikes after next week’s move, this would provide the best fundamental rationale for why equity markets have rallied so sharply over the past few weeks and why it might signal a more durable low.”

Therefore:

“With equity markets seemingly shrugging off bad news on the economy and earnings, we explore the idea that it may be trying to get ahead of the eventual pause by the Fed that is always a bullish signal.”

Now, to be fair to Wilson, he also stated that he doesn’t buy the narrative. He wrote:

“The problem with this thinking beyond a near term rally is that it’s unlikely the Fed is going to pause early enough to kick save the cycle (…). The Fed is looking more like the ECB this cycle in that they are likely to still be tightening when recession arrives this time making the window to trade the pause much shorter than usual with less upside as well."

Thus, while his overall conclusion aligns with our medium-term thinking, the doubt showcased by prior skeptics is material. I’ve noted on numerous occasions how bearish positioning has become extremely stretched recently.

As such, with everyone panicking about rampant inflation and an impending recession, their freak-outs were contrarian bullish. In a nutshell: no one is left to sell when all the bears have sold, no matter how weak the incoming fundamental data is. Then, when the shorts cover and systematic funds (CTAs) enter the mix, counterintuitive rallies like the ones we’re experiencing unfold.

However, while the GDXJ ETF hasn’t benefited much from the S&P 500’s relative strength, decent earnings prints from Big Tech (Microsoft and Alphabet report after the bell on Jul. 26) could supercharge investors’ optimism. Moreover, with heavyweights like Visa, Coca-Cola, and McDonald’s reporting in the morning, investors may find something they like.

Furthermore, if Fed Chairman Jerome Powell strikes a dovish tone on Jul. 27, the outcome would be bearish for the USD Index and bullish for the S&P 500 and the GDXJ ETF. To that point, with the futures market expecting Powell to pivot, the front-running is in full swing.

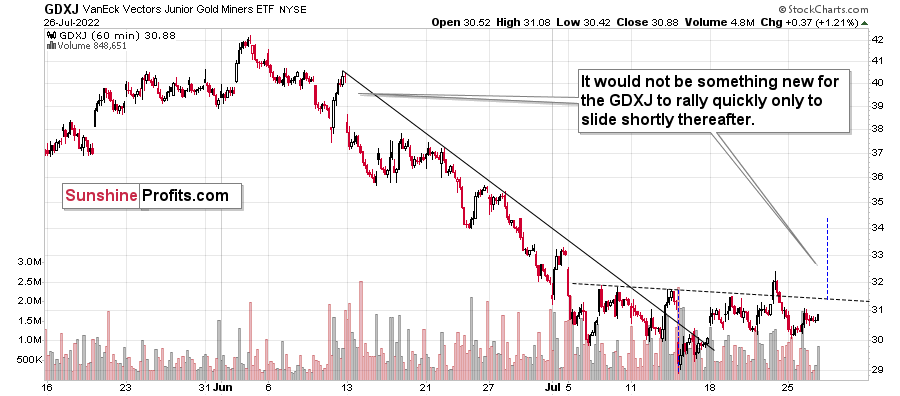

Please see below:

To explain, the light and dark blue bars above track the market-implied rate hikes on Jun. 13 and Jul. 25. If you analyze the height of the light blue bars, you can see that investors had priced in rate hikes through March 2023 (the final bar that reaches 25 bps).

However, the dark blue bars highlight how those expectations have materially decelerated. For example, market participants now expect the Fed to be done hiking by December 2022 and to begin cutting rates in 2023 (the negative dark blue bars).

Moreover, while a 75 basis point rate hike is considered a done deal on Jul. 27, the probability of a 50 basis point rate hike in September has dropped below 50%.

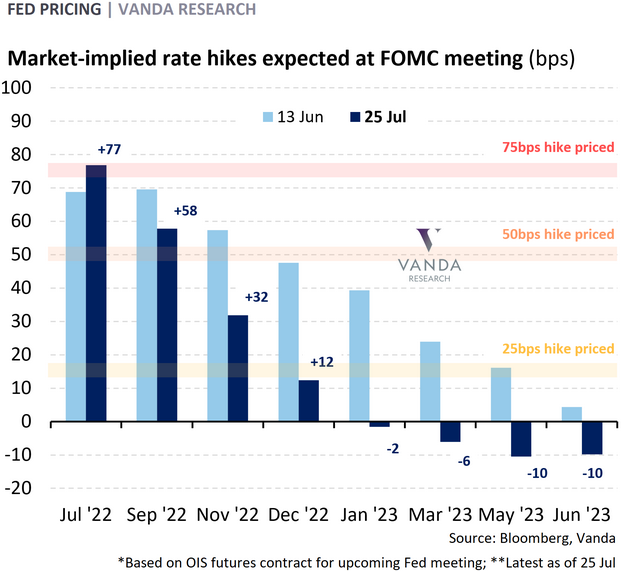

Please see below:

To explain, the blue line above tracks the market-implied probability of a 75 basis point rate hike this week (100%), while the orange line above tracks the market-implied probability of a 50 basis point rate hike in September (~47%). Moreover, the orange line has plunged in recent days.

Therefore, if these expectations materialize, then the USD Index is materially overvalued and the GDXJ ETF is materially undervalued. Right or wrong, the important point is that narratives move markets in the short term, and right now, the narrative is bullish for the GDXJ ETF.

Not So Fast

While investors’ misguided optimism is short-term bullish for the GDXJ ETF, the medium-term realities should have the opposite effect. For example, a 75 basis point rate hike on Jul. 27 would put the U.S. federal funds rate at 2.50%.

Moreover, if we add 25 basis points in September (since the market-implied probability of 50 basis points is less than 50%) and November, and then assume a pause in December (like the futures market expects), the U.S. federal funds rate would peak at 3%.

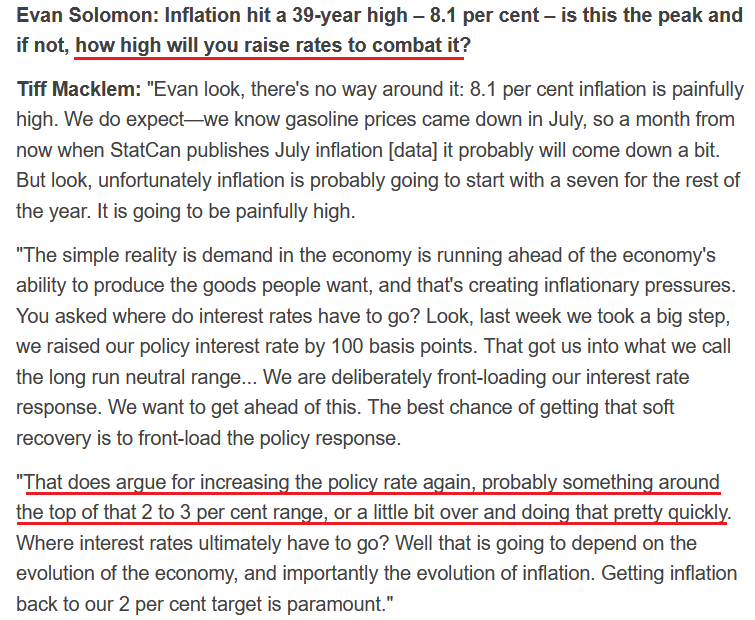

Likewise, it’s no surprise that investors have adopted these expectations. With Bank of Canada (BoC) Governor Tiff Macklem (Canada’s Jerome Powell) singing a similar tune, the new narrative is that a ~3% overnight lending rate will capsize inflation.

Please see below:

Thus, while these developments should help uplift the GDXJ ETF in the short term, the Fed, the BoC, and investors are in fantasy land. To explain, I wrote on Jul. 25:

I noted on Jul. 22 that earnings calls from Blackstone, Hasbro, and Tractor Supply highlight how inflation is entrenched in the U.S. economy. In addition, with more earnings calls showcasing how the situation continues to worsen, market participants don’t realize that the U.S. federal funds rate needs to hit ~4.5% or more for the Fed to materially reduce inflation. For context, the consensus expects a figure in the 2.5% to 3.5% range.

Furthermore, I warned on May 26 that all three are betting on an outcome that hasn’t materialized in 70+ years. I wrote:

With annualized inflation of [9%+], calming price pressures with such little action is completely unrealistic. In fact, it’s never happened.

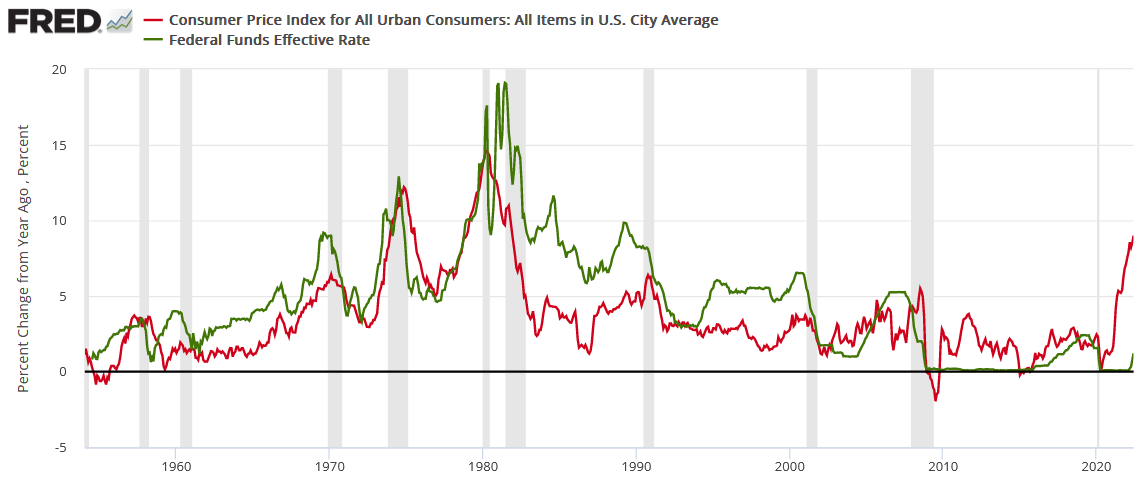

If you analyze the chart below, you can see that the U.S. federal funds rate (the green line) always rises above the year-over-year (YoY) percentage change in the headline Consumer Price Index (the red line) to curb inflation. Therefore, investors are kidding themselves if they think the Fed is about to re-write history.

In addition, notice how every inflation spike leads to a higher U.S. federal funds rate and then a recession (the vertical gray bars)? As such, do you really think this time is different?

More Earnings Calls

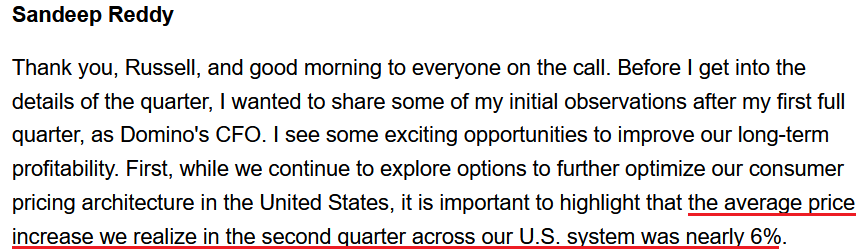

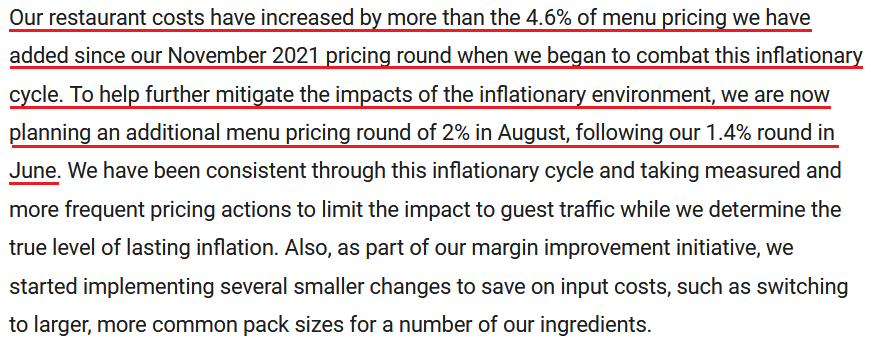

While I've noted in recent days how several earnings calls have been riddled with mentions of inflation and price increases, the chorus continues to sing. For example, Domino's Pizza released its second-quarter earnings on Jul. 21. For context, it's the largest pizza chain in the U.S.

Moreover, while Q1's pricing underperformance was notable, CFO Sandeep Reddy said during the Q2 earnings call:

“We have successfully pulled many pricing levers, including our standard menu pricing. Our national offers, our local offers and our delivery fees. This has helped us cover some of the cost increases we are incurring in both the food basket and labor market while also ensuring we continue to deliver terrific value to our consumers.”

As a result, it’s another sign that executives aren’t waiting around for the inflationary pressures to subside.

Please see below:

Source: Domino’s Pizza/Seeking Alpha

Source: Domino’s Pizza/Seeking AlphaLikewise, BJ’s Restaurants released its second-quarter earnings on Jul. 21. Moreover, while the company is smaller than Domino’s Pizza, the results are still material. During the Q2 earnings call, CEO Greg Levin said: “Inflationary pressure on our operating costs accelerated in the second quarter and is now running ahead of our earlier forecast (…). This food cost inflation equated to approximately 10% higher than in the second quarter of 2021 and 2% higher than what we experienced in the first quarter of this year.”

As a result:

Source: BJ’s Restaurants/The Motley Fool

Source: BJ’s Restaurants/The Motley FoolAlso noteworthy, Levin said:

“In the second quarter, we began to more closely track the underlying patterns of our guests, so we can identify any shifts in our guest behavior early. We measure not only overall sales and traffic trends, but deeper layers such as how often certain categories of guests visit and what is being ordered from our menu, and we review and analyze this data regularly.”

“The good news is that, to date, through July, we have not yet found any measurable changes in our guest behavior. In fact, traffic patterns are following a typical seasonal trend, and our guests are continuing to enjoy the usual amount of appetizers, drinks, and desserts in our restaurants. And we haven't seen any uptick in the usage of our value offerings, including our Happy Hour and Daily Brewhouse special menus.”

Thus, while BJ’s Restaurants continues to raise prices, consumers are not pushing back. Moreover, with many companies experiencing spirited demand despite higher prices, investors materially underestimate the resiliency of inflation. Therefore, they also underestimate how far the Fed will have to go to rectify the problem.

The Bottom Line

With the bulls regaining their confidence, their willingness to overlook inflation and their position for a soft landing is bullish for the GDXJ ETF. Moreover, with the USD Index, the U.S. 10-Year real yield and high yield credit spreads all coming down, more than a few investors believe we’re closer to March 2009 than March 2008. As a result, a tactical buying opportunity remains in place.

In conclusion, the PMs declined on Jul. 25, as the waiting game continued. However, with investors increasingly excited about the market outlook, it will only take a small bout of fundamental optimism to spark a material rally. Therefore, while we expect one to occur, we also view it as an opportunity to re-enter our shorts at higher prices.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

If Gold Continues Its Uptrend, Junior Miners Will Benefit

July 25, 2022, 6:58 AMDespite stocks' slight recent fall, their short-term outlook remains bullish. Unless gold truly plunges, junior miners have a chance to rise soon.

Bullish Indications

Overall, the precious metals sector didn’t do much last week. Gold was up by 1.4%, silver was up by 0.12%, GDX was down by 0.7%, and the GDXJ was up by 2.46%.

Junior miners are the bullish exception that reacts to gold’s recent strength. Seniors and silver are not really participating in the rebound – at least not yet. As a reminder, the above is not necessarily a sign that junior gold and silver miners are particularly strong – it’s likely the case that they have simply fallen the most recently, and therefore their rebound is the strongest.

As you may recall, silver tends to outperform gold close to the end of a given rally, and we haven’t seen this phenomenon this time, except for the last rally that ended on July 18. However, that was too early in the rally to really call this type of performance something close to the end of the rally – it was too close to its beginning.

Consequently, it could be the case that we’re going to see more strength in the precious metals market before the big move lower continues.

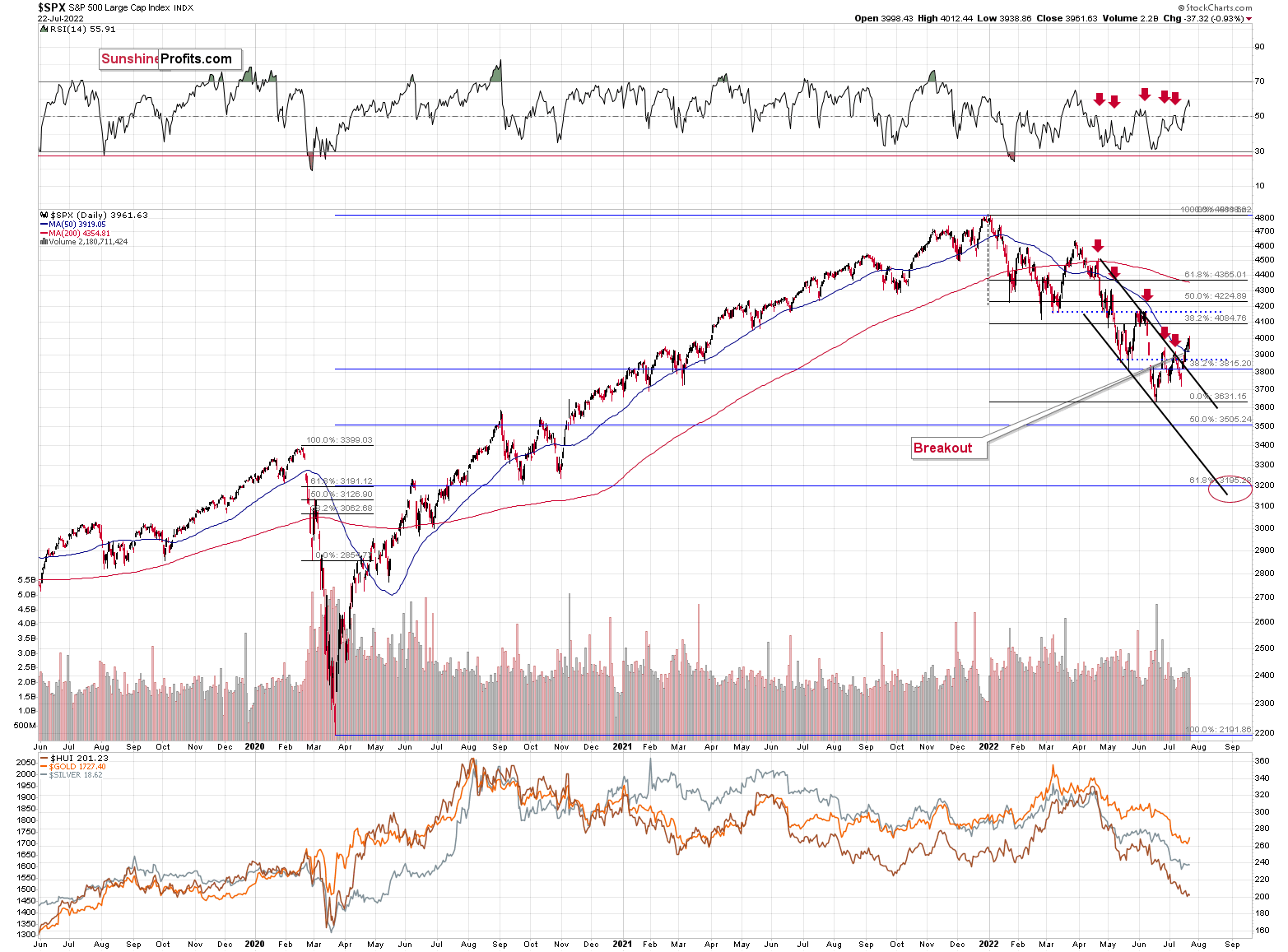

What we saw in the general stock market confirms this scenario.

Stocks declined somewhat on Friday, but overall, they ended last week visibly above their declining short-term trend channel and above their 50-day moving average. That’s simply a bullish combination for the short run.

This tells us that silver and mining stocks (and especially junior mining stocks) are likely to move higher unless gold truly plunges.

Gold Hasn't Stop Yet

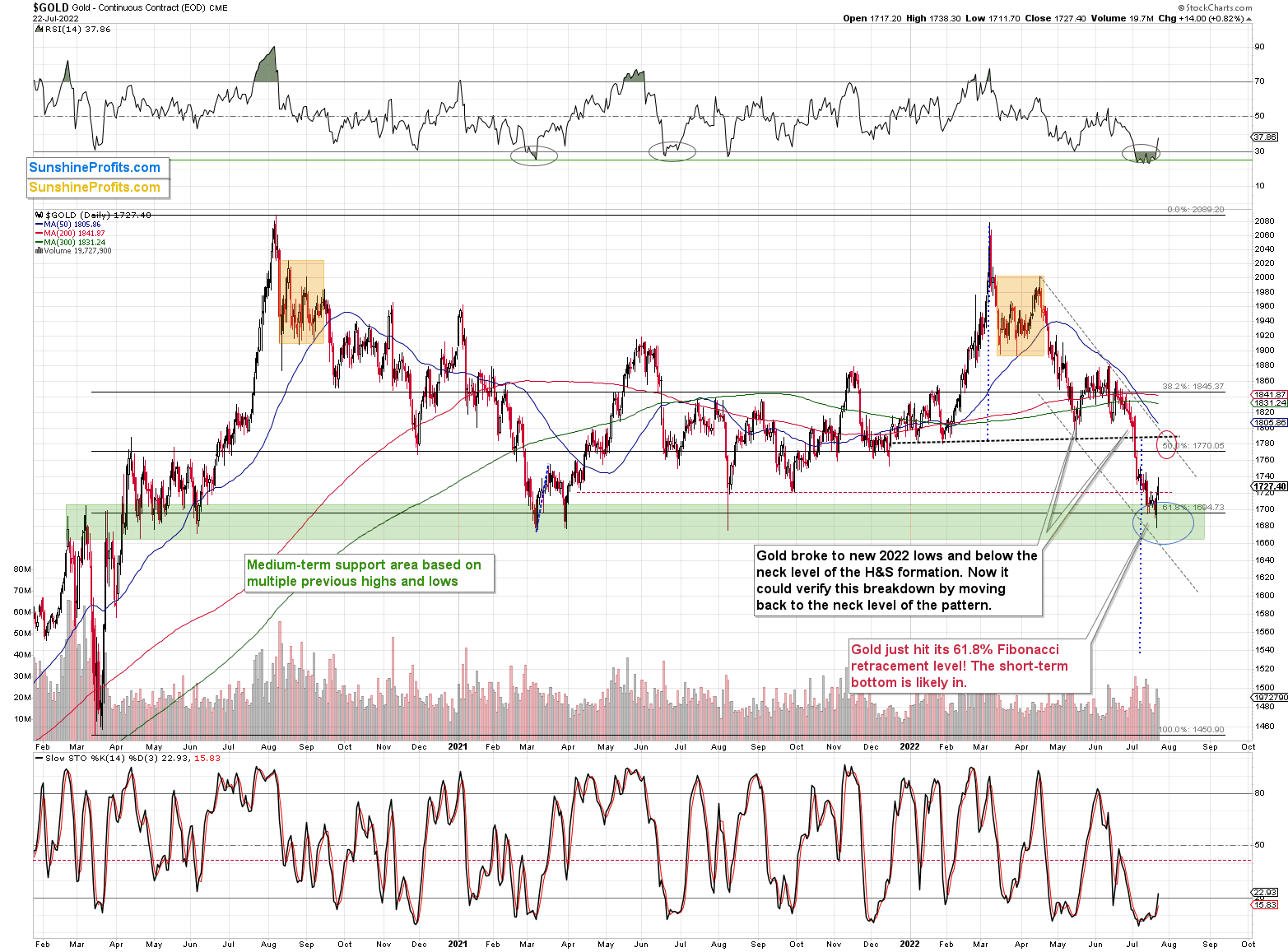

Gold is likely to move higher in the short term, not plunge. The reason is that it just invalidated the breakdown below its mid-2021 lows and the 61.8% Fibonacci retracement level based on the entire 2020 rally. The yellow metal did so after bottoming right in the middle of my target area, close to its previous lows.

Besides, in all recent cases when gold rallied after its RSI was below or very close to the 30 level, it then rallied at least until the RSI was close to 50. That’s not the case yet, so it doesn’t seem that gold is done rallying yet.

All in all, gold is likely to move higher within the next several days, and the same goes for the general stock market. Both are likely to contribute to higher prices in junior mining stocks. The latter are likely to rally, top, and then start another very powerful move lower. For now, however, the short-term outlook remains bullish.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Eurozone Recession Fears Didn’t Stop Gold Miners From Spiking

July 22, 2022, 6:00 AMThe Weekly Fundamental Roundup

While this week was a rollercoaster across all asset classes, unanchored inflation, a hawkish Fed, and recession fears in the Eurozone made large intraday swings more prevalent than usual.

However, with the GDXJ ETF rallying sharply and outperforming most risk assets on Jul. 21, the junior miners closed back above $31. Moreover, with equity optimism helping to lead the charge, I warned on Jul. 20 that predicable rallies with low volatility could enhance systematic funds’ appetites. I wrote:

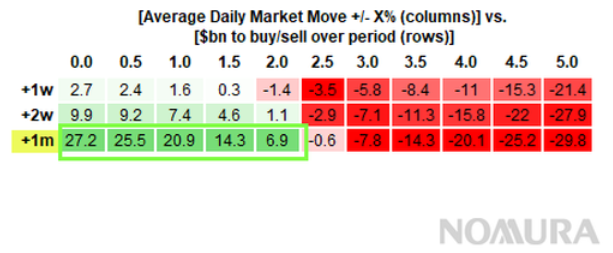

To explain, systematic funds apply strict volatility controls to prevent major drawdowns. Therefore, if calm prevails in the financial markets, systematic funds could enhance the upward momentum by increasing their risk exposure. For example, the green rows on the left highlight how average daily market moves of 0% to 2% should result in net purchases by systematic funds over the next month.

Moreover, average moves of 1% or less (most common) mean less volatility and often culminate in the largest inflows. In contrast, the red rows on the right show how large average daily swings of 2.5% or more often push systematic funds to the sidelines. As a result, “a ‘Summer doldrums’ environment” where a lot of the bad news is already priced in could provide the perfect backdrop for the GDXJ ETF to move higher.

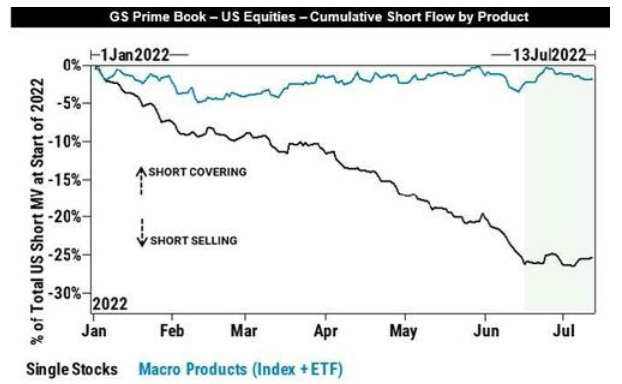

Thus, with the S&P 500 capping its gains at less than 1% during the last two sessions, the CTAs are back in business. Furthermore, I warned on Jul. 19 that the recent pullback caused short sellers to press their positions too much. I wrote:

To explain, the light blue line above tracks hedge funds’ short-selling activity across indexes and ETFs, while the dark blue line above tracks their activity across single stocks. If you analyze the right side of the chart, you can see that index positioning is roughly neutral, while stock-specific shorts are near their 2022 highs.

Therefore, if the macroeconomic data or this week’s earnings releases elicit a small bout of optimism, the fundamental fuel could help uplift the NASDAQ 100, the S&P 500, and the GDXJ ETF.

To that point, with the most shorted stocks materially outperforming the S&P 500, the short squeeze arrived as expected.

Please see below:

To explain, the black line above tracks the S&P 500, while the blue line above tracks an index of the 50 most shorted stocks as of Jul. 20. If you analyze the right side of the chart, you can see that the high beta, IPO, profitless tech, etc. companies have led the relief rally. Moreover, the basket increased by 3.72% on Jul. 20, while the S&P 500 rallied by 0.59%. Therefore, with a likely continuation unfolding on Jul. 21, liquidity-beneficiaries like the GDXJ ETF were supported by the re-rating.

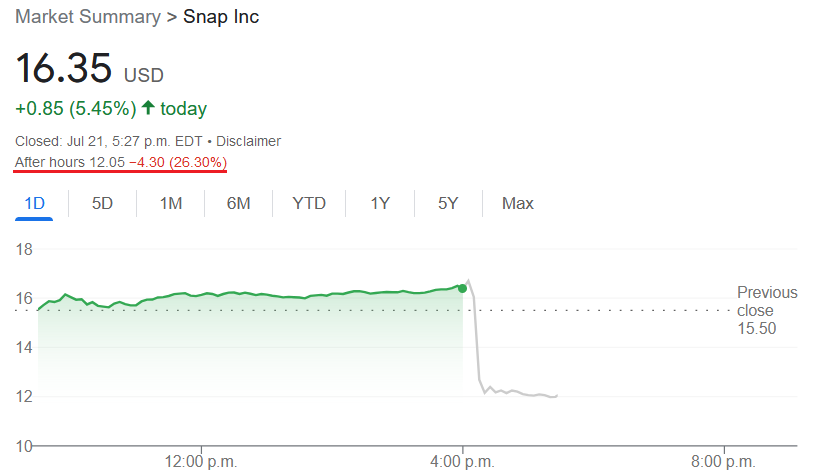

In addition, the technical backdrop remains supportive and signals higher junior miners’ prices in the days ahead. The only caveat is that weak corporate earnings from Snap Inc. sent ripples across the financial markets after hours on Jul. 21. For example, the stock declined by more than 26% after the bell and dragged down other online advertisers like Meta Platforms (Facebook) and Alphabet (Google).

As a result, while the negativity may impact today’s session, we still expect the GDXJ ETF to rally in the days ahead.

Inflation’s Alive and Kicking

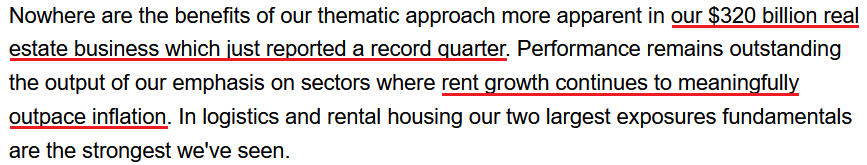

While many technical, sentiment, and positioning metrics point to higher prices for the GDXJ ETF in the short term, fundamental clouds are growing darker by the day. For example, Blackstone – one of the largest private equity firms in the world – released its second-quarter earnings on Jul. 21. CEO Steve Schwarzman said:

“We're cautious on inflation which we think could stay higher for longer than most expect and central banks will have to continue responding. It will be a difficult balancing act in combating inflation, while trying to minimize the negative impact on economies (…).”

“We've been preparing for an environment of rising rates and a normalization of market multiples for some time. And the facts on the ground across our global portfolio suggested inflation would be higher and more persistent than many believed.”

Thus, while I’ve been warning for months that inflation would surprise to the upside, please note that Blackstone has a $320 billion real estate portfolio. Moreover, with the Shelter Consumer Price Index (CPI) accounting for more than 30% of the headline CPI’s movement, Schwarzman’s revelation about “rent growth” is bullish for inflation.

Please see below:

Source: Blackstone/Seeking Alpha

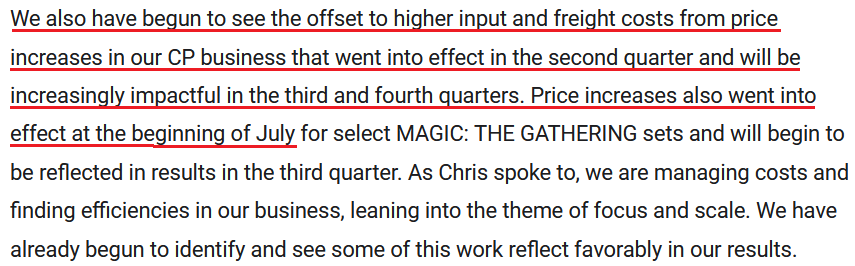

Source: Blackstone/Seeking Alpha Likewise, Hasbro released its second-quarter earnings on Jul. 19. For context, it's one of the largest toy companies in the world. CEO Chris Cocks said during the Q2 earnings call:

“We were very cognizant of the inflationary environment we were operating in, both from a consumer takeaway as well as its impact on our supply chain.” CFO Deb Thomas added, “While product and freight costs are up, we're beginning to see a reduction in port congestion delays. And lead times have come down, although they remain two times higher than historical levels.”

More importantly, with “price increases taken at the beginning of the quarter,” Hasbro executives aren’t waiting for the inflation environment to normalize. For context, “CP” stands for consumer products, and the segment accounted for 55% of Hasbro’s Q2 net revenue.

Please see below:

Source: Hasbro/The Motley Fool

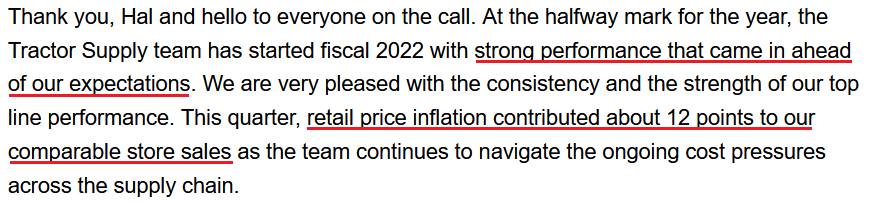

Source: Hasbro/The Motley FoolSending a similar message, Tractor Supply – which sells products for home improvement, agriculture, lawn and garden maintenance, livestock, equine and pet care – released its second-quarter earnings on Jul. 21. CEO Hal Lawton said during the Q2 earnings call:

“On inflation, I would start by just saying it continues to be persistent and consistent. Certainly, seeing some moderation, if you look at a few of the metrics, fuel costs, slightly down, spot rates on containers, down a bit, commodities moderating, but still, if you look at even on a year-over-year (YoY) basis and certainly on a two-year and three-year basis, kind of record highs.”

He added:

“I think the thing we are both watching at a very high macro level is [the Producer Price Index]. And PPI has got to come down first, just generically speaking, across retail before CPI is going to come down.”

“It’s going to take [time] because retailers got to turn through their higher cost inventory for two months, three months, four months at a minimum before you start to see any reduction on the CPI retail side. So, I think inflation is going to hold and continue to be consistent really through the CPI kind of retail level, certainly through the balance of this year.”

Thus, with Tractor Supply executives not waiting for the inflation environment to normalize either, the company raised its prices by ~12% in Q2. As a result, does it seem like inflation is about to ride off into the sunset?

Source: Tractor Supply/Seeking Alpha

Source: Tractor Supply/Seeking AlphaThe Bottom Line

While the GDXJ ETF should continue its ascent in the days ahead, weakness from Snap Inc. may depress overall sentiment somewhat. However, we still remain short-term bullish. In contrast, the medium-term outlook continues to worsen, as inflation should keep the Fed hawked up. Moreover, while the consensus assumes that a 2.5% to 3% U.S. federal funds rate will be enough to calm the pricing pressures, the data suggests otherwise.

In conclusion, the PMs rallied on Jul. 21, and the GDXJ ETF led the charge. Moreover, with a tactical buying opportunity still in place, the junior miners should enjoy more upside before their medium-term downtrend resumes.

What to Watch for Next Week

With more U.S. economic data releases next week, the most important are as follows:

- Jul. 25: Dallas Fed manufacturing survey

The Dallas Fed’s survey is a leading indicator of inflation and employment activity in Texas.

- Jul. 26: Richmond Fed manufacturing and Dallas Fed services surveys

Both regional surveys will highlight the growth, employment, and inflation dynamics in their respective regions. Therefore, they are also leading indicators of future government data.

- Jul. 27: FOMC meeting, Chairman Jerome Powell’s press conference

With the FOMC meeting headlining the week, a 75 basis point rate hike is widely expected. However, with Powell previously noting that he wants positive real interest rates “across the curve” (which hasn’t materialized at the short end), his comments will be of immense importance.

- Jul. 28: Q2 GDP, KC Fed manufacturing survey

It will be interesting to see if the U.S. economy is in a technical recession or not. With the Atlanta Fed’s latest estimate predicting another quarter of negative real growth, a realization may materialize. In addition, the KC Fed’s data will provide insights similar to the other regional surveys.

- Jul. 29: PCE Index, Chicago PMI

While the CPI and the PCE Index are roughly interchangeable, the latter is the Fed’s preferred measure of inflation. As such, it’s essential to monitor the results. Likewise, the Chicago PMI is another regional survey that helps paint a portrait of the U.S. employment and inflation outlooks.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Despite a Stumble, the GDXJ’s Short-Term Outlook Remains Bullish

July 21, 2022, 8:16 AMWith the GDXJ ETF underperforming the general stock market on Jul. 20, the PMs didn’t rally alongside other risk assets. However, with investors’ daily recalibrations likely to reverse in the near future, more upside should confront the PMs in the days ahead.

Please see below:

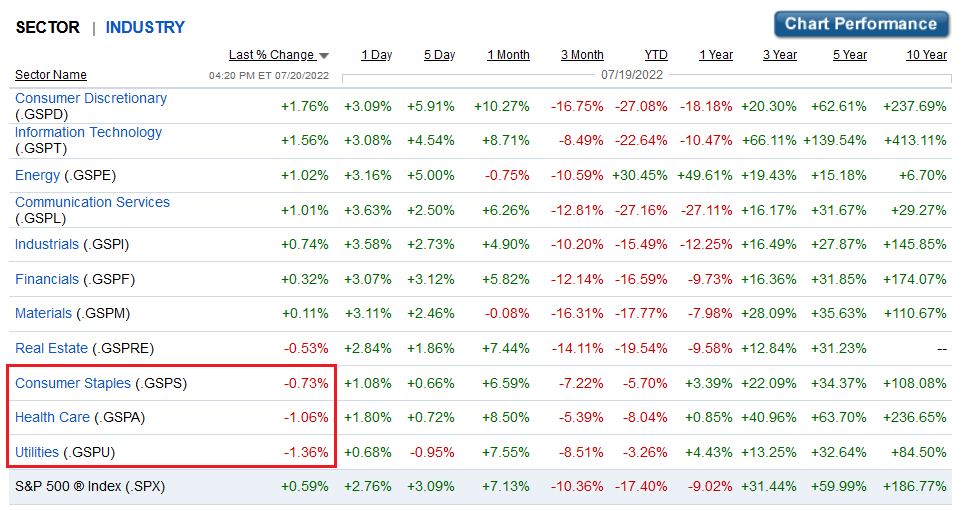

To explain, the bottom row highlights how the S&P 500 rallied by 0.59% on Jul. 20. However, utilities, health care, and consumer staples closed in the red and were the worst-performing sectors. Therefore, while all three are risk assets, they’re considered defensive risk assets; and with earnings optimism pushing investors into high beta risk assets like technology and consumer discretionary, they rotated out of low volatility sectors and into high volatility sectors.

Rotation Ripples

As a result, the PMs suffered from this rotation as gold is also considered a defensive risk asset. However, with the worst performers on one day often the best performers on the next, the PMs should benefit in the days ahead.

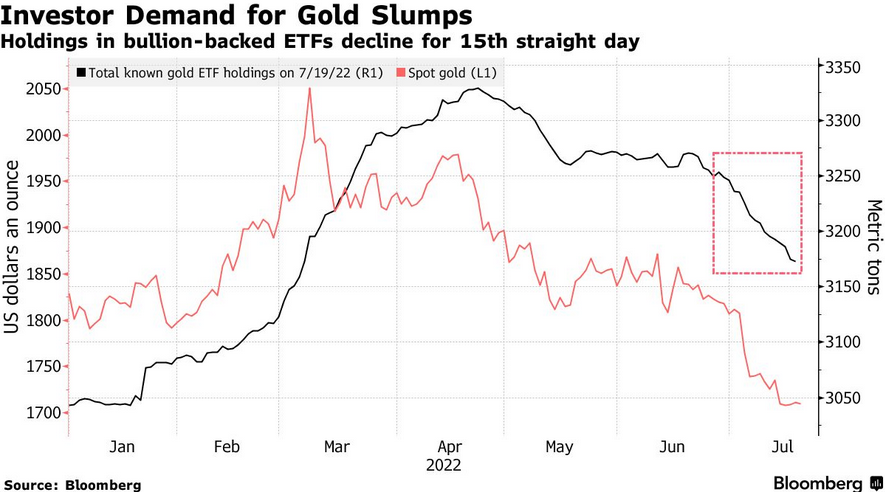

Likewise, I’ve noted how oversold conditions support a short-term rally for the GDXJ ETF. Moreover, with fund flows emphasizing the technical conclusions, it’s important to remember that too much bearishness is often bullish.

Please see below:

To explain, the red line above tracks the spot gold price, while the black line above tracks gold-backed ETF holdings as of Jul. 19. If you analyze the right side of the chart, you can see that gold-backed ETFs have suffered 15-straight days of outflows. Moreover, with the PMs declining on Jul. 20, the tally is likely at 16 days.

Furthermore, Suki Cooper, a precious metals analyst at Standard Chartered Plc, said: “There’s actually scope for a relief rally coming up to the July FOMC meeting where we can see a little bit of a bounce and perhaps prices heading back toward $1,750 in the near term.” As such, with the next FOMC meeting scheduled for Jul. 26-27, a reversal should materialize sooner rather than later.

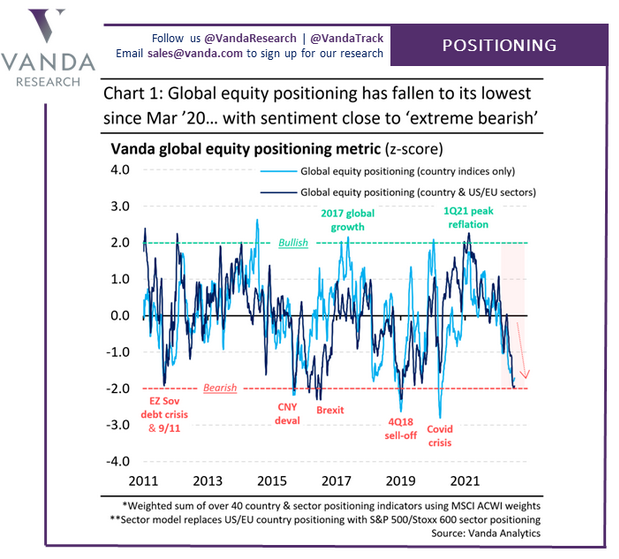

To that point, while I’ve noted that too many bears expecting drawdowns is bullish for the S&P 500, and therefore, the GDXJ ETF, data from Vanda Research signals more room to run for the S&P 500’s relief rally.

Please see below:

To explain, the light and dark blue lines above track investors’ global equity positioning at the country and country plus U.S/Eurozone sector level. If you analyze the right side of the chart, you can see that the lines are near or at two standard deviations below the average. Furthermore, while positioning can still move lower, we’re in an area of extreme pessimism that often marks short-term turning points.

As a result, since the GDXJ ETF is more correlated with the general stock market than its precious metals peers, a reversal of the pessimism is bullish for junior miners.

Medium-Term Trouble

Because asset prices don’t move in a straight line, we expect the GDXJ ETF to muster a short-term relief rally. However, with the PMs stuck in medium-term downtrends, their final lows will likely materialize in the months ahead.

For example, the financial markets move in counterintuitive ways. Therefore, while investors assumed that high inflation was bullish for the PMs (conventional wisdom), I warned on numerous occasions that unanchored inflation rattles the bond market and wakes up central banks. Thus, while inflation rose sharply in 2021 and 2022, it’s no surprise that the GDXJ ETF collapsed.

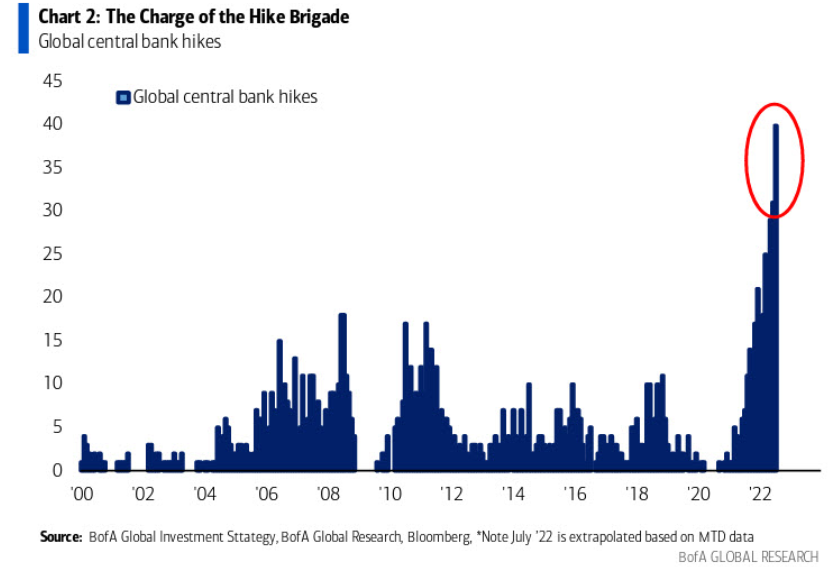

Moreover, with the liquidity drain still in the early innings, more pain should confront the PMs as central banks accelerate their war against inflation.

Please see below:

To explain, the blue bars above track the cumulative number of rate hikes administered by global central banks. If you analyze the right side of the chart, you can see that the current liquidity drain dwarfs all other comparable periods over the last ~22 years. As such, assets that benefit from QE and lower real yields are caught in central banks' crosshairs.

However, with inflation still unanchored in many regions, central banks' hawkish policies have done little to alleviate the pricing pressures. For example, I've noted that Canada is the canary in the coal mine for future Fed policy. With the two regions closely aligned geographically and in economic trade, they often share in each other's prosperity and pain.

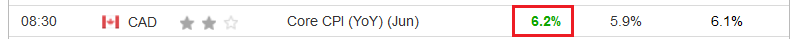

Moreover, while Canada's headline Consumer Price Index (CPI) underperformed expectations and came in at 8.1% year-over-year (YoY) versus the 8.4% YoY expected on Jul. 20 (though still a new 2022 high), the core CPI outperformed.

Please see below:

Thus, while the Bank of Canada (BoC), like the Fed, often cites supply-chain disruptions and the Ukraine war as the reasons for inflation, the core CPI excludes the impact of food and energy prices. As a result, demand has proven much stronger than central bankers expected, and I warned on Mar. 31 that the BoC and the Fed’s war on inflation would be one of attrition. I wrote:

There is a misnomer in the financial markets that inflation is a supply-side phenomenon. In a nutshell: COVID-19 restrictions, labor shortages, and manufacturing disruptions are the reasons for inflation’s reign. As such, when these issues are no longer present, inflation will normalize and the U.S. economy will enjoy a “soft landing.”

However, investors’ faith in the narrative will likely lead to plenty of pain over the medium term. For example, I’ve noted for some time that the U.S. economy remains in a healthy position. And with U.S. consumers flush with cash and a red hot labor market helping to bloat their wallets, their propensity to spend keeps economic data elevated (...).

U.S. households have nearly $3.89 trillion in their checking accounts. For context, this is 288% more than Q4 2019 (pre-COVID-19). As a result, investors misunderstand the amount of demand that’s driving inflation.

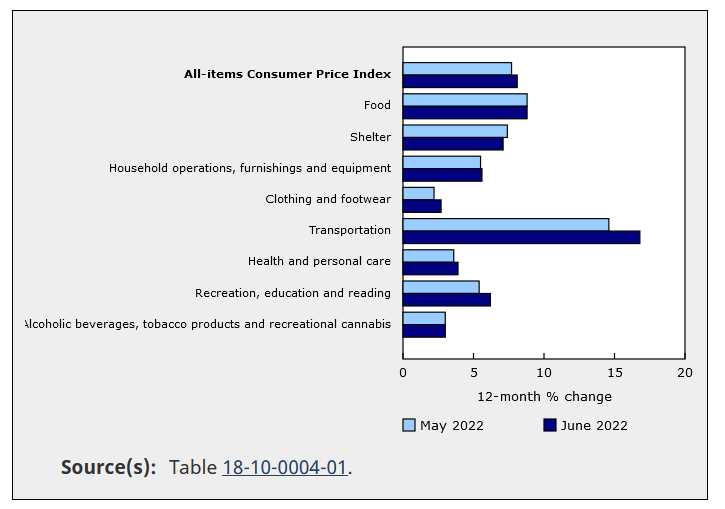

To that point, the official Statistics Canada release highlights the challenges that North American central banks confront. The report revealed:

“The easing of public health measures and the increase in tourism which followed has led to higher demand for travel-related services. Travellers across the country faced higher prices for accommodation (+49.7%) compared with June 2021 (…). Prices for air transportation rose 6.4% month over month in June, following a 0.8% decline in May.”

Therefore, while Statistics Canada was understandably light on details due to the troubling report, the key admission was that “price increases remained broad-based with seven of eight major components rising by 3% or more.”

Please see below:

To explain, the dark blue bars above show how costs for household furnishings, clothing and footwear, transportation, health and personal care, and recreation and education all increased relative to May. As such, inflationary pressures stretch far beyond food and energy, and too much demand is why inflation hasn’t subsided in 24+ months.

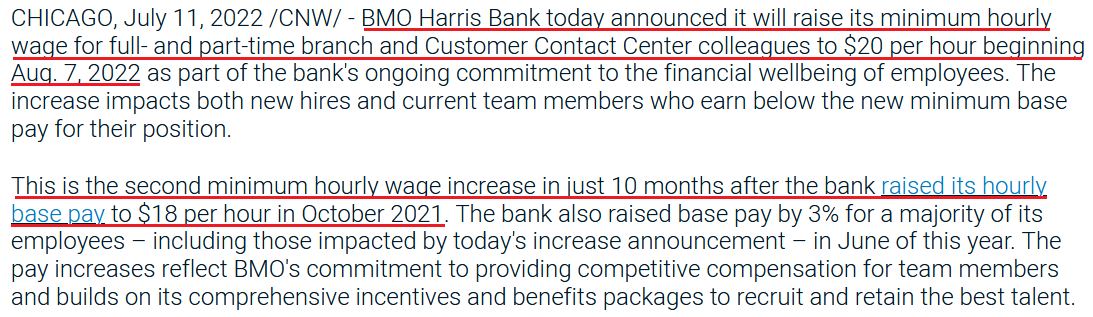

As further evidence, BMO Harris Bank announced on Jul. 11 that it “will raise its minimum hourly wage for full- and part-time branch and Customer Contact Center colleagues to $20 per hour beginning Aug. 7, 2022.”

Moreover, BMO Harris Bank has “more than 500 branches” in the U.S., and the 11.1% wage increase is on top of the “up to 20%” wage increase announced in October 2021. Thus, the data is profoundly inflationary and will only enhance employees’ spending ability.

Please see below:

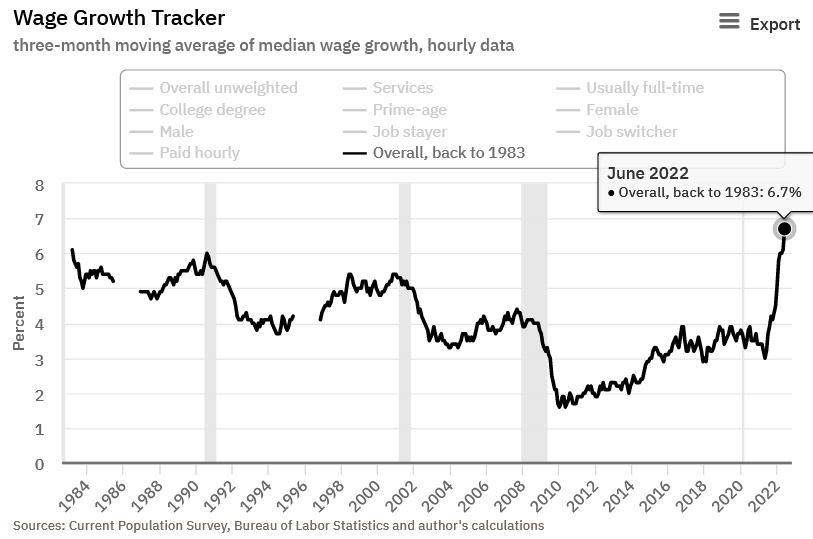

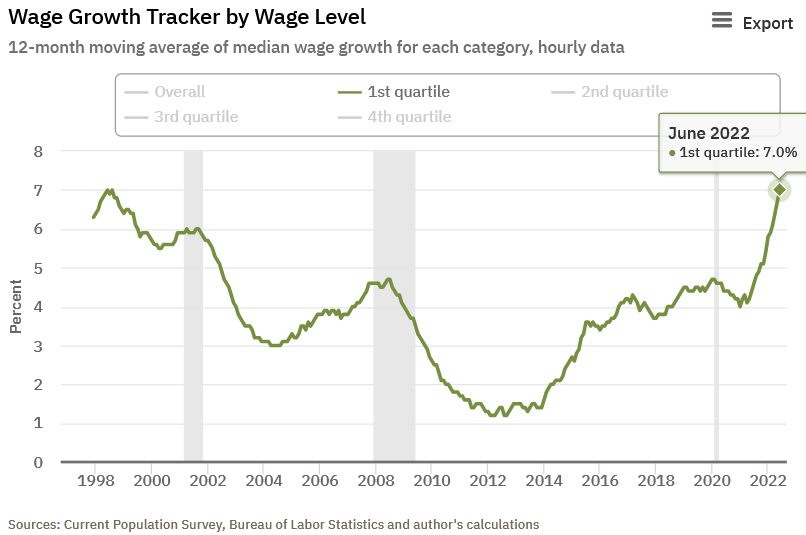

In addition, I noted on Jul. 15 that the Atlanta Fed’s measure of wage inflation is at record highs. I wrote:

The Atlanta Fed updated its Wage Growth Tracker on Jul. 14. And surprise, surprise, wage inflation hit a new all-time high in June.

Please see below:

Likewise, the lowest-earning Americans saw their wages increase by 7%.

Please see below:

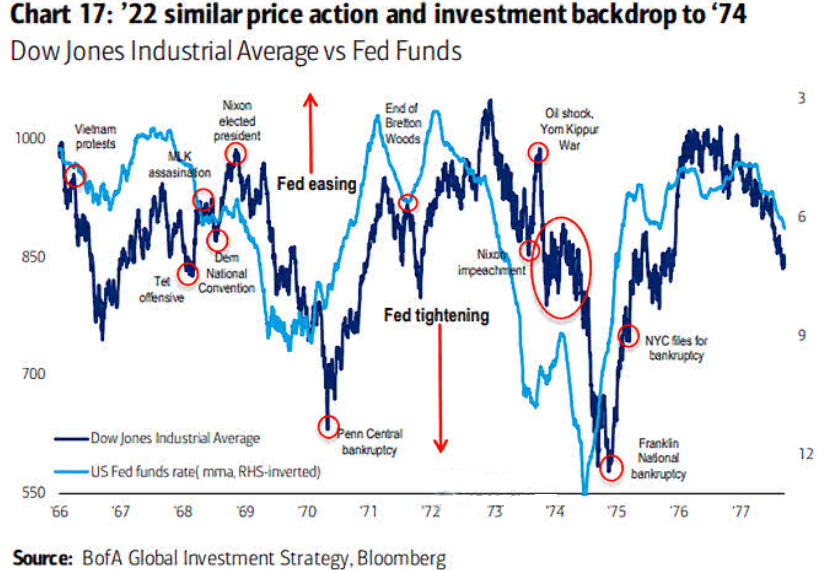

Thus, with a wage-price spiral unfolding and core CPI measures highlighting the ferocity of excess demand, the 1970s provide insight into the damage that unfolds when the Fed battles inflation.

Please see below:

To explain, the dark blue line above tracks the Dow Jones Industrial Average (DJIA) from the late 1960s to the late 1970s, while the light blue line above tracks the inverted (down means up) U.S. federal funds rate.

If you analyze the relationship, you can see that sharp drops in the light blue line (the Fed hikes rates) coincide with major drawdowns in the DJIA. Therefore, with unanchored inflation forcing the Fed into a similar corner today, we’re likely only halfway through the DJIA troughs that occurred in ~1970 and ~1975.

The Bottom Line

Technicals, positioning, and sentiment support a short-term uprising for the GDXJ ETF. Moreover, with persistent gold-backed ETF outflows highlighting investors' distaste for the PMs, it's important to remember that the best buying opportunities often emerge when everyone is selling. Therefore, rallies should be on the horizon. In contrast, the PMs' medium-term outlooks continue to worsen, as inflation is more stubborn than the consensus realizes. As such, the Fed is likely nowhere near a dovish pivot.

In conclusion, the PMs declined on Jul. 20, as defensive assets were left for dead. However, with a reversal of flows likely to occur, the PMs should catch bids in the days ahead. Thus, we still see the short-term outlook as positive.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM