tools spotlight

-

Gold Is Below $1,700 Again. Will It Repeat Its Fall to $1400?

October 10, 2022, 9:08 AMThe current situation of gold and its behavior in 2013 share many bearish analogies. Is the yellow metal only halfway through its massive collapse?

A Decade Ago

After we posted last week’s gold price forecast, gold, silver, and mining stocks declined in tune with the analysis. Is the rally over?

Let’s start by taking a closer look at gold.

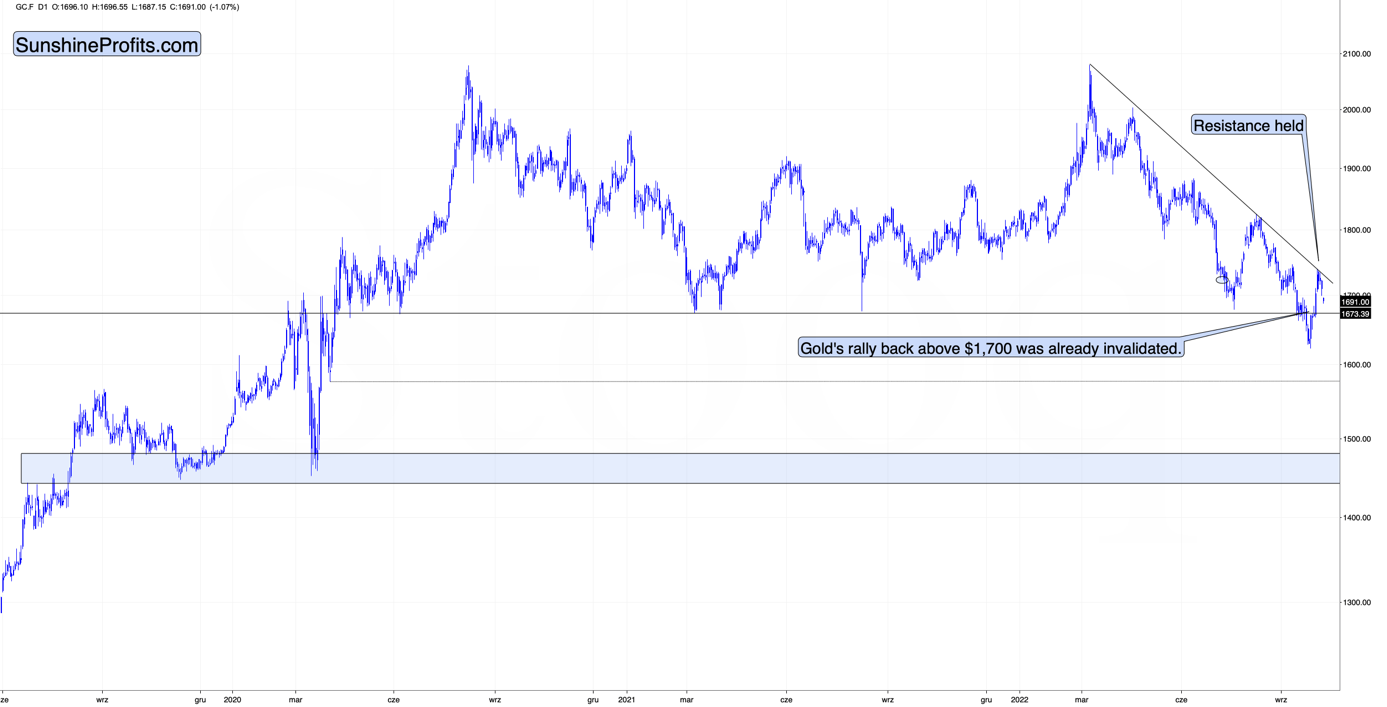

Gold declined after touching its declining, medium-term resistance line, and at the moment of writing these words it’s trading at about $1,690 – visibly below the important $1,700 level.

This means that the attempt to break above this level failed.

It’s bearish on its own, but it’s much more so when you compare the current situation to what happened in April 2013 at the analogous moment.

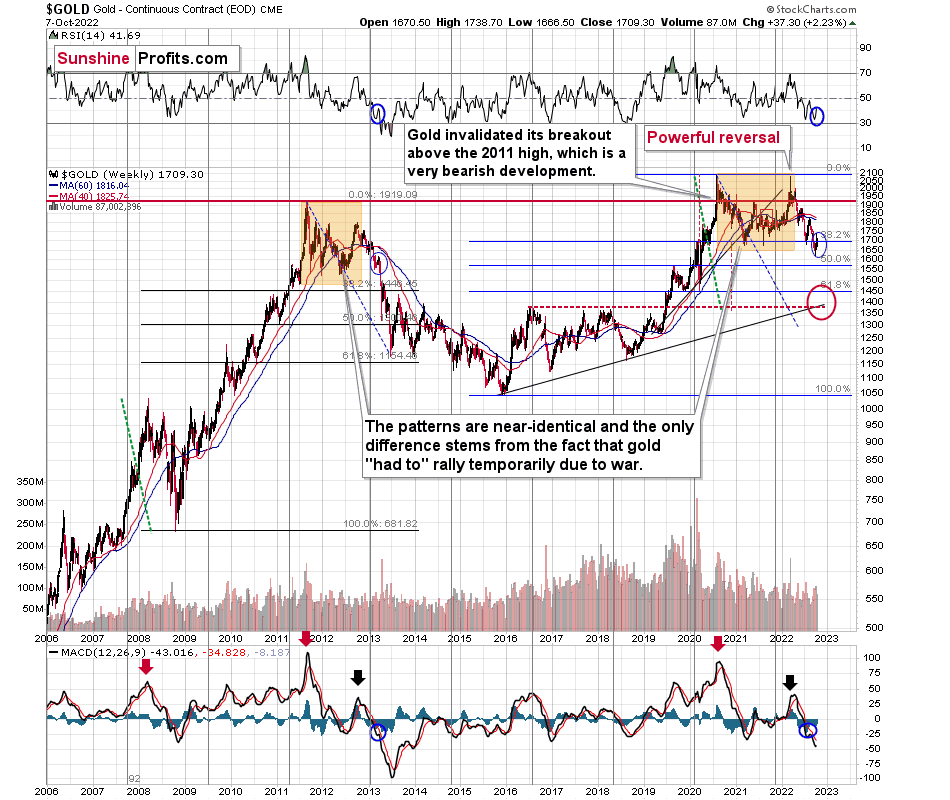

I’ve been writing about this important analogy for months, but if you haven’t read my previous analyses, please focus on the orange rectangles on the above chart – how the price behaved and what happened in the RSI and MACD indicators. The situations are near-perfectly aligned.

If you were monitoring the gold market back in April 2013, you might remember the overall feeling among gold investors and traders when gold rallied from the 2012 lows. Practically everyone and their brother were convinced that the bottom in gold is really in, and that it was about to soar to new highs.

Sort of like what we experienced recently.

However, it wasn’t the bottom. It wasn’t even the mid-point of the entire medium-term decline.

Sure, history doesn’t have to repeat itself to the letter, and the geopolitical and monetary situation now is different than it was back in 2013, but… Fear and greed work in the same way, and when people try to forecast the future by looking at previous price patterns (very few people look at the big picture; most just focus on the last year or so), they ultimately follow a similar emotional process. This leads them to repeat their past behaviors and, as a result, the price patterns continue to be similar.

Where Is the Line?

Actually, the situation regarding monetary policy now supports even a more profound slide than it did back in 2013. Still, due to geopolitics, the decline could be “only” similar to what we saw back then.

There’s very strong support just a bit below $1,400, and the decline to this level (approximately) would be in tune with the size of the 2011-2013 decline.

Can gold really slide that low? Absolutely.

Will it slide there immediately? There’s a good chance we’ll have some sort of correction in the meantime, and one of them might be tradable. The rebound from the 2020 lows seems quite likely at the moment, but I’ll keep monitoring the situation and report to my subscribers accordingly. I’ll also describe which part of the precious metals sector is likely to benefit the most from this decline. At this time, it seems that junior mining stocks are likely to decline the most (as they have so far this year), but this might change as prices move lower.

Either way, the short- and medium-term outlooks for gold are bearish.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Despite Geopolitical Boosters, Gold’s Surge Was Not Impressive

October 7, 2022, 9:14 AMAvailable to premium subscribers only.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

With the USDX Rallying Again, Are Lower Gold Prices in Sight?

October 6, 2022, 7:44 AMAlthough the dip buyers haven’t conceded yet, gold, silver, and mining stocks have started to decline. Is the precious metals upswing over?

A Reversal of Fortunes

While gold, silver, mining stocks and the S&P 500 bounced off their intraday lows, all four ended the Oct. 5 session in the red. Moreover, with the USD Index and the U.S. 10-Year real yield rallying sharply, a reversal of fortunes unfolded as reality re-emerged.

Please see below:

To explain, the red line above tracks the number of rate hikes priced in by the futures market, while the green line above tracks the inverted (down means up) number of rate cuts priced in thereafter.

If you analyze the right side of the chart, you can see that hike expectations decreased and cut expectations increased as the Fed pivot narrative gained steam. However, the far right side of the chart shows how hike expectations increased while cut expectations decreased over the last two days. Therefore, pivot prognostications are slowly fading, and a continuation of the trend is profoundly bearish for the PMs.

To that point, I’ve noted how Fed officials are united in their calls for a higher U.S. federal funds rate (FFR); and with more hawkish warnings hitting the wire on Oct. 5, officials continue to hammer home their message.

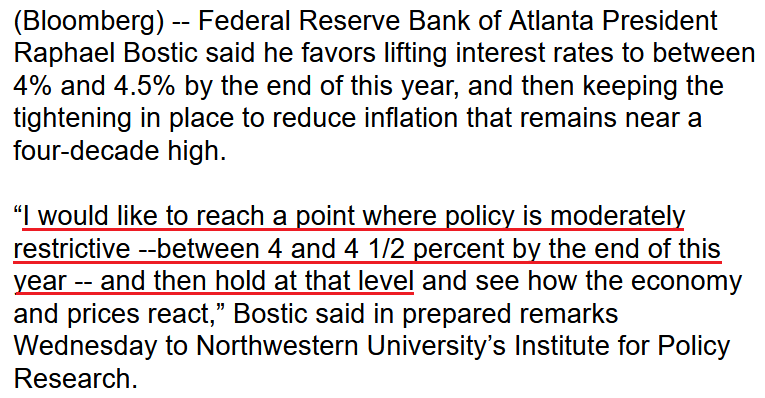

For example, Atlanta Fed President Raphael Bostic said on Oct. 5:

“The past couple of monthly inflation prints produced a mixed bag, with some evidence that the pace of month-to-month price increases has slowed. But the August inflation reports were a sobering reminder that price pressures remain broad and stubborn.”

He added:

“We should not let the emergence of [economic] weakness deter our push to lower inflation. We must remain vigilant because this inflation battle is likely still in early days.”

More importantly:

“I am not advocating a quick turn toward accommodation. On the contrary. You no doubt are aware of considerable speculation already that the Fed could begin lowering rates in 2023 if economic activity slows and the rate of inflation starts to fall. I would say: not so fast.”

Thus, with Bostic openly destroying the pivot narrative, it’s another example of how Fed officials remain unwavering in their fight against inflation.

No wonder – inflation is what the voters are most concerned with.

Please see below:

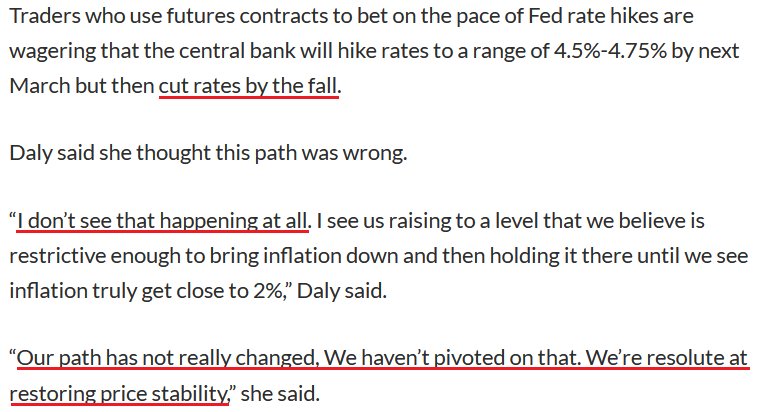

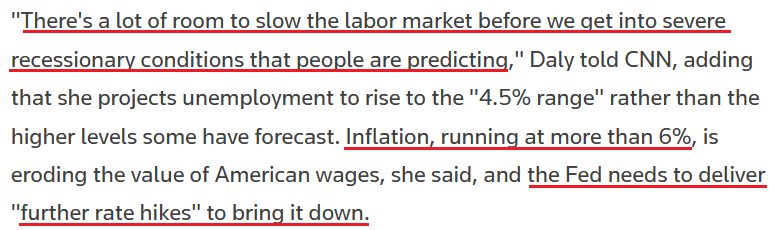

Echoing that message, San Francisco Fed President Mary Daly said on Oct. 5:

“The American people need confidence that we’re resolute.” If core inflation rises while employment cools, “well, that’s not very comforting to the American people, and I think then that the downshifting on the tightening would be a much harder decision to make.”

She added:

“I do see more rate increases as necessary. Remember, this is all about bringing demand – which is very strong – back in line with supply and bringing inflation down.”

Furthermore, she also went out of her way to quash the pivot narrative:

Please see below:

Thus, with the post-GFC crowd dealt another blow on Oct. 5, I’ve warned for months that as long as inflation and employment remain elevated, the Fed will keep its foot on the hawkish accelerator. In addition, it’s laughable to assume that initial declines in the Consumer Price Index (CPI) and JOLTS job openings signal the all-clear. In contrast, those metrics need to decline substantially to declare victory.

To that point, I wrote on Oct. 5 that while the pivot predictors gain confidence, the latest iteration is no different than their previously poor forecasts. As such, with Fed officials providing another reality check, gold, silver, mining stocks, and the S&P 500 should feel the pain over the medium term.

No Pivot: Part 2

With inflation well above the Fed’s 2% target and the U.S. labor market still on solid footing, the latter needs to collapse for the Fed to retreat from its inflation fight. Moreover, with the Institute for Supply Management (ISM) and S&P Global’s Services PMIs showing that we’re nowhere near that point, the FFR still has plenty of room to run.

For example, the ISM’s headline index decreased from 56.9 in August to 56.7 in September. However, the report revealed:

“Employment activity in the services sector grew in September for the second consecutive month after two previous months of contraction. ISM’s Employment Index registered 53 percent, up 2.8 percentage points from the August reading of 50.2 percent.

“Comments from respondents include: ‘organizational growth continues, although hiring continues to be a challenge’ and ‘cannot find qualified applicants; they require greater incentives because they have choices.’”

As a result, with demand still outweighing supply in the U.S. labor market, the Fed pivot predictors are materially out of touch with reality.

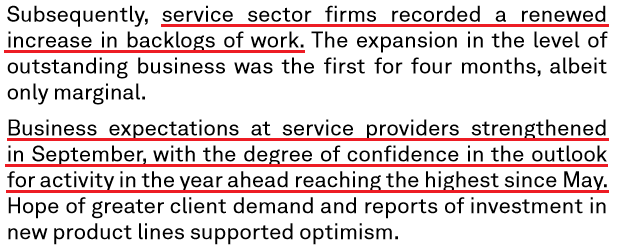

As further evidence, S&P Global’s U.S. Services PMI increased from 43.7 in August to 49.3 in September. The report stated:

“September data indicated only a modest rise in employment at service providers. The rate of job creation was the slowest since December 2021, as firms stated that challenges hiring new staff and difficulties offering high wages to retain certain employees hampered efforts to expand workforce numbers.”

Therefore, while input and output inflation slowed in both reports, employment is still increasing. Remember, "a modest rise in employment" is profoundly hawkish because the Fed needs a higher unemployment rate to cool wage inflation. As such, if firms are still increasing their headcount, demand destruction has not materialized, and the resiliency gives the Fed the green light to hammer inflation.

On top of that, S&P Global's service sector report showed that 12-month business confidence rose to its highest level since May, and the optimism is bullish for Fed policy.

Please see below:

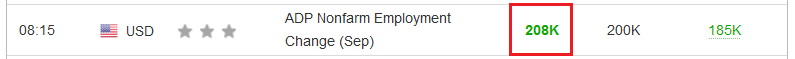

Also supportive, ADP released its private payrolls report on Oct. 5. For context, it doesn’t correlate well with U.S. nonfarm payrolls (which are released on Oct. 7). However, the results outperformed expectations and highlight the strength of the U.S. labor market.

Please see below:

To that point, Nela Richardson, Chief Economist at ADP, said:

“There are signs that people are returning to the labor market. We're in an interim period where we're going to continue to see steady job gains. Employer demand remains robust, and the supply of workers is improving, for now.”

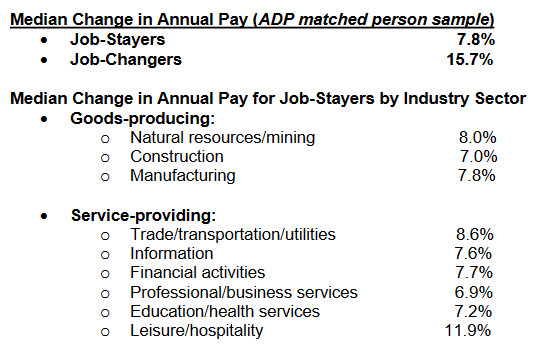

Furthermore, ADP’s wage inflation data shows why the pivot crowd is living in la-la land.

Please see below:

To explain, the figures above highlight the median percentage change in Americans’ annual pay, according to ADP. If you analyze the first two bullet points, you can see that job-stayers and job-changers enjoyed median annual wage increases of 7.8% and 15.7%, respectively.

Thus, while I’ve been warning for months that demand was much more resilient than the consensus realized, is it realistic for the CPI to decline to 2% if wages are running at ~8% plus? Of course not. The Fed needs these figures to decrease dramatically for the wage-price spiral to unwind. However, we’re not even close.

In addition, notice how all of the industries tracked by ADP have realized wage inflation of ~7% or more? As a result, the consensus misses the critical point: peak inflation is irrelevant, and the final destination of the FFR is what matters. Therefore, even if input, output, and wage inflation have peaked, reducing them to 2% requires much more economic weakness than the bulls realize.

The Bottom Line

With the USD Index and the U.S. 10-Year real yield resuming their uptrends on Oct. 5, the PMs headed in the opposite direction. Moreover, with Fed officials intentionally pushing back against the pivot narrative, investors are buying hope and selling reality. However, with 2021 and 2022 proving it's a losing strategy, the dip buyers should suffer mightily over the medium term. As such, while the unwinding of bearish bets may keep them supported in the short term, gold, silver, mining stocks, and the S&P 500 should hit lower lows in the months ahead.

In conclusion, the PMs declined on Oct. 5, as risk assets were under pressure. However, the dip buyers were active throughout the day, as the pivot camp has more than a few believers. So, while a consolidation period may ensue until the next catalyst emerges, the bear market is likely far from over. Still, it could be the case that the rally has already burned itself out and that lower precious metals values are just around the corner.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Continues to Rise, Fueled by Bullish Sentiment

October 5, 2022, 9:23 AMInvestors believing that the Fed will follow the BoE’s example continue to support the short-term gold rally. Their optimism, however, may end soon.

Tales That Fail

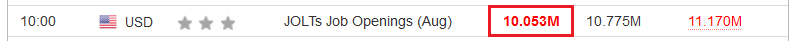

With gold, silver, mining stocks, and the S&P 500 continuing their short squeezes on Oct. 4, the Fed pivot narrative still dominates investors’ decision-making. Moreover, with JOLTS job openings declining by more than one million month-over-month (MoM) and missing expectations, a cooler U.S. labor market has the bulls assuming inflation and future rate hikes will slow.

Please see below:

In addition, a realization of the narrative would be profoundly bullish for the PMs. Fundamentally, fewer rate hikes should reduce real interest rates and suppress the USD Index. Therefore, the PMs’ primary fundamental adversaries would be on the defensive.

However, the narrative lacks credibility, and the post-GFC crowd is repeating the same mistake. Remember, when the headline Consumer Price Index (CPI) peaked year-over-year (YoY) in June, investors assumed the battle was won. However, I warned on numerous occasions that peak inflation was irrelevant. What matters is how high the U.S. federal funds rate (FFR) needs to go to normalize the metric to 2%.

Thus, after the consensus came around to our way of thinking, rate hike expectations rose dramatically, and the crowd realized how silly the peak inflation narrative was. Yet, we find ourselves in a similar situation now.

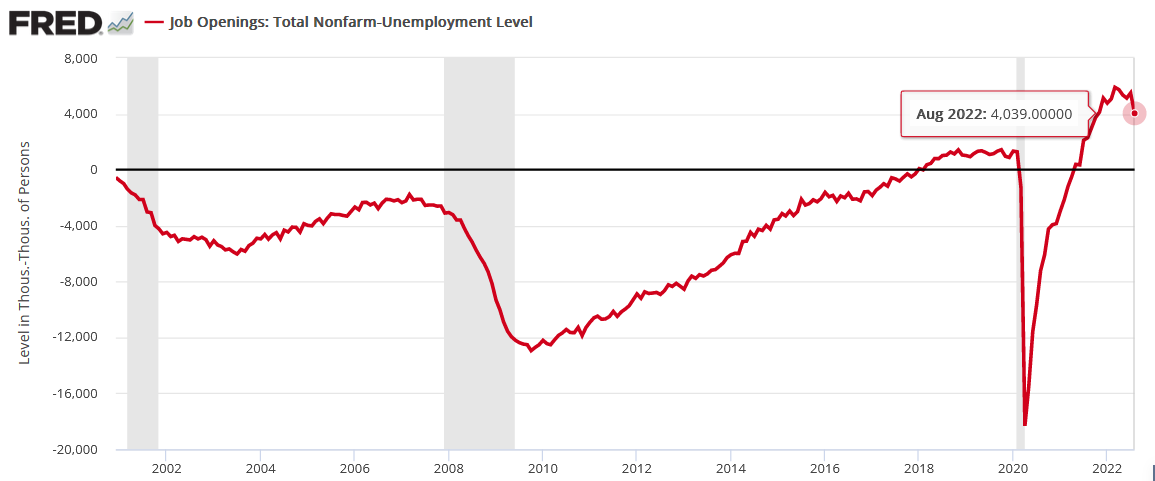

For example, with the weak JOLTS data emboldening the pivot predictors, the ‘bad news is good news’ mantra was on full display. However, the reality is that there are more than four million job openings compared to the number of the unemployed Americans. As a result, the supply/demand imbalance still favors employees and supports wage inflation.

Please see below:

To explain, the red line above subtracts the number of unemployed Americans from the number of U.S. job openings. If you analyze the right side of the chart, you can see that the metric is still well above any figure realized pre-pandemic. So, while an all-time high is no longer present, the spread is far from the low inflation levels witnessed from 2000 to 2020.

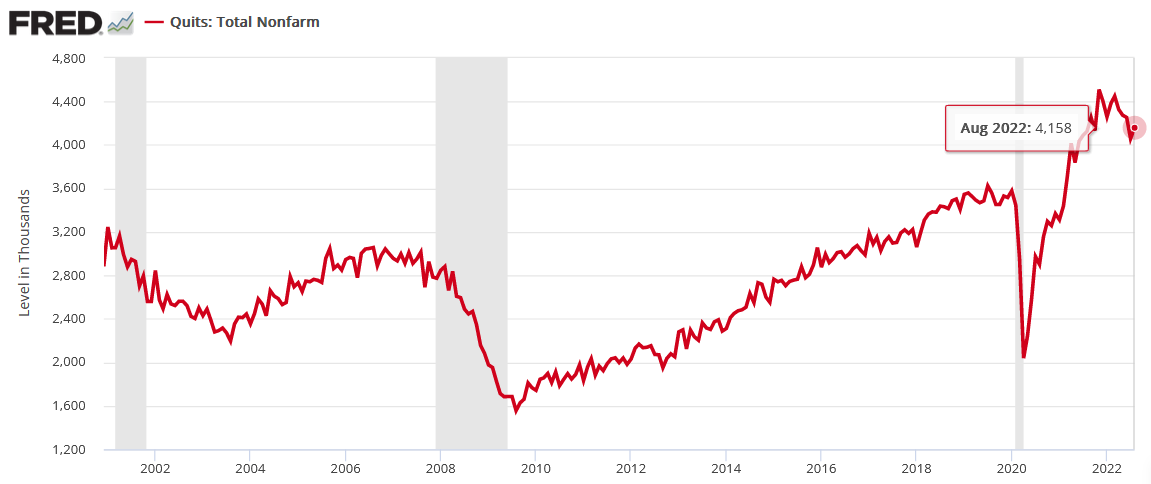

Second, while investors focused all their attention on the headline figure, they ignored that quits increased by 100,000 MoM.

Please see below:

To explain, the red line above tracks the number of Americans that quit their jobs each month. If you analyze the right side of the chart, you can see that the metric is down from its all-time high but increased in August.

Therefore, with more Americans resigning MoM, the data highlights how job opportunities remain plentiful. Think about it: employees don’t voluntarily leave their jobs unless better opportunities await them elsewhere. Moreover, the deciding factor is often higher pay.

Thus, with the JOLTS spread and quits still well above their pre-pandemic norms, the small progress is not enough for the Fed to pivot.

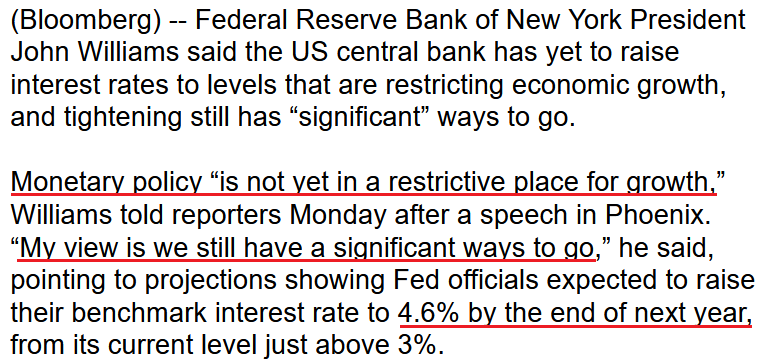

To that point, New York Fed President John Williams said on Oct. 3:

“Clearly, inflation is far too high, and persistently high inflation undermines the ability of our economy to perform at its full potential (…). We need to make sure that we take the actions to get inflation turned around, start bringing it back to our 2% goal.”

Also, when asked about Treasury market illiquidity and the stress of higher interest rates, Williams largely brushed off the issue. He said:

“We’ve seen enormous volatility in these markets, not just because of monetary policy, but because of the uncertainty around the outlook, global events. Hopefully, the volatility that we’ve seen in the last few weeks will come down somewhat, and that will help with that situation. But right now, I would say that trades are being made, market liquidity is definitely lower, but it’s still functioning.”

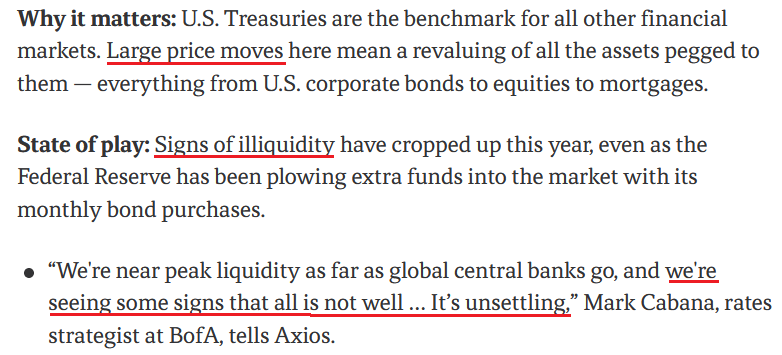

As such, while the consensus assumes the Bank of England’s (BoE) QE flinch will be mirrored by the Fed, Williams said that interest rate hikes still have a “significant ways to go.”

Please see below:

Likewise, San Francisco Fed President Mary Daly said on Oct. 4:

Inflation is a “corrosive disease; it is a toxin that erodes the real purchasing power of people. An inclusive economy goes both ways. It doesn’t mean just jobs, it means jobs and price stability.”

As a result, Daly projects a much higher FFR and wants the Fed to hold the policy in place until “we are truly done.”

Please see below:

Making three of a kind, Fed Governor Philip Jefferson said on Oct. 4 that reducing inflation is paramount and economic growth could be an unfortunate casualty.

“Inflation remains elevated, and this is the problem that concerns me most,” he said. “Inflation creates economic burdens for households and businesses, and everyone feels its effects.”

He added:

“Restoring price stability may take some time and will likely entail a period of below-trend growth (…). [But] it is important that we get back to [a stable] kind of economy, and that is what I think the intent of the Fed is.”

So, while the bulls price in a dovish pivot, Fed officials’ consistent hawkish message signals the exact opposite.

Please see below:

Thus, while the crowd engages in wishful thinking, the harsh truth is that inflation remains problematic and the U.S. labor market remains resilient. Furthermore, when data points decline from their cycle highs, the battle is not won. Sure, the financial markets react as if it's a major victory.

However, since it's taken 12 25 basis point rate hikes for the headline CPI and JOLTS job openings to come down from their peaks, investors underestimate how difficult it will be to bring them back to pre-pandemic levels. Therefore, the FFR should rise materially in the months ahead, and the USD Index and the U.S. 10-Year real yield should be substantial beneficiaries. In contrast, gold, silver, and mining stocks should head in the opposite direction.

Why All of the Short-Term Optimism?

Because asset prices don’t move in a straight line, countertrend moves are an unfortunate byproduct of medium-term investing. So, while the GDXJ ETF’s recent uprising is far from fun, bear market rallies are commonplace along the journey to a final low.

To that point, with precious metals pessimism increasing dramatically in recent weeks, the reversal should fail once sentiment normalizes.

Please see below:

To explain, the light blue bars above track weekly gold flows, while the blue line above tracks the four-week moving average. According to Bank of America, before the squeeze started on Oct. 3, gold funds suffered their longest streak of outflows since January 2014. As a result, the yellow metal was profoundly out of favor.

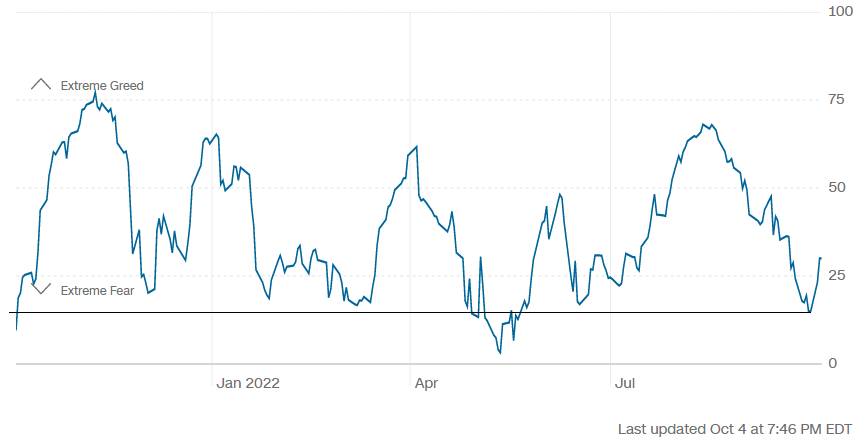

Second, CNN’s Fear & Greed Index hit abnormally low levels, which signaled extreme fear in the financial markets.

Please see below:

To explain, the blue line above tracks CNN’s Fear & Greed Index. If you analyze the horizontal black line, you can see that the index ended September at its lowest level since May. Thus, over-positioning helped fuel the S&P 500’s squeeze higher.

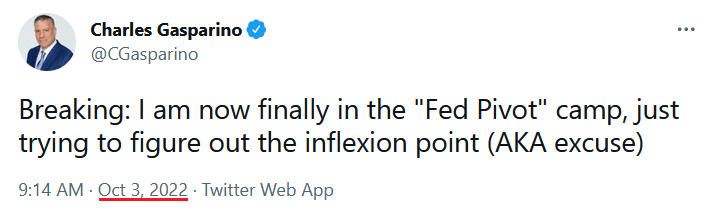

Finally, while the gold permabulls are perpetual predictors of a Fed pivot, disappointment should confront the hyper-inflationists in the months ahead.

Please see below:

To explain, the blue line above tracks the gold/copper futures ratio, while the red line above tracks the FFR. If you analyze the vertical gray rectangles, you can see that gold often outperforms copper when the Fed cuts interest rates. Or, when the red line peaks and declines, the blue line often rises.

Therefore, it’s no surprise that hopes of a dovish pivot have investors piling into the PMs. However, the FFR has not peaked, and the permabulls have lost money repeating this bet throughout 2022. Likewise, since inflation doesn’t die easily, the FFR should continue its ascent, and gold should hit lower lows before it’s all said and done.

The Bottom Line

While gold, silver and mining stocks continued their uprisings on Oct. 4, their rallies are built on foundations of sand. Moreover, while the pivot predictors gain confidence, the latest iteration is no different than their previously poor forecasts. In reality, inflation is nowhere near 2%, and Fed officials are united in supporting a higher FFR.

As a result, risk assets’ recent strength is more about positioning than medium-term fundamentals or technicals; and while the short term is always unpredictable, more reality checks should emerge in the months ahead.

In conclusion, the PMs rallied on Oct. 4, as the shorts ran for cover once again; and while positioning imbalances can fuel short-term upswings, 2022 highlights how these rallies fail when the fundamentals and the technicals don’t participate. As such, the bear market should resume sooner rather than later.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

What Factors Do Not Support the Fed’s Dovish Pivot?

October 4, 2022, 8:28 AMWishful thinking pushed gold stocks up again. Meanwhile, visualizing the dovish Fed may obscure what’s important for the medium term: fundamentals.

No Pivot

With short squeezes abound on Oct. 3, gold, silver, mining stocks and the S&P 500 rose sharply. However, while oversold conditions and one-sided positioning can lead to violent short-covering rallies, the ‘here we go again’ narrative is destined to fail.

To explain, after the Bank of England (BoE) resumed QE to help offset a liquidity crunch in the U.K. bond market, the post-GFC crowd hoped the Fed would be next. Then, with Credit Suisse’s credit default swap (CDS) rate soaring in recent days, rumors of insolvency poured gasoline on the pivot fire. In a nutshell: “if things blow up, the Fed will turn dovish”.

However, while market participants like to turn whispers into shouts, the new narrative contrasts fundamental reality. One, Sarah Cha, Financial Sector Specialist at Goldman Sachs, noted how colleague Jonathan Weetman described the Credit Suisse drama as “unwarranted.” She wrote:

“CS off 7% following online/social media speculation and multiple press articles over the weekend around what appears to be a risk-off market fueled negative feedback loop around capital position. Weetman calls the weakness in the stock unwarranted and walks through some of the considerations in his note this morning which includes:

- The liquid balance sheet

- No Equities Prime business

- Levered loans a very well covered bear point but that the composition & timing of a potential recap (he thinks consensus forming around CHF 4-5b) alongside IB restructuring the key question from investors.”

Thus, while one cannot be sure of Credit Suisse's financial health, Goldman Sachs has little incentive to support the bank. In fact, amplifying the panic, then purchasing the stock and waiting for a reversal would be more profitable for Goldman Sachs. Therefore, the rumors are likely more semblance than substance.

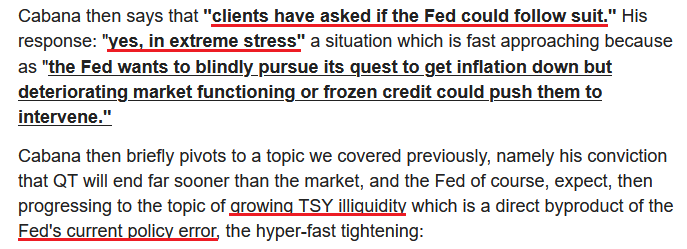

In addition, with the Fed holding an emergency meeting on Oct. 3, speculation has arisen that the central bank may attempt to lower U.S. Treasury yields and weaken the USD Index. For example, Mark Cabana, Head of U.S. Rates Strategy at Bank of America, compared the BoE to the Fed on Oct. 3. He wrote:

Yet, with tales of Treasury market illiquidity resurfacing – which could force the Fed to intervene to avoid a crash in bond prices – it’s important not to assign credibility to individuals that constantly sound the same alarm. Remember, it’s like The Boy Who Cried Wolf. They recycle the same warning, while the wolf only arrives 1% of the time.

Please see below:

To explain, the screenshot above is from an article written on Nov. 17, 2021. Here is the link if you want to read it: https://www.axios.com/2021/11/17/treasury-market-stress-signs-regulators

As you can see, Cabana said the same thing nearly a year ago. Moreover, the U.S. 10-Year Treasury yield ended the Nov. 17, 2021 session at 1.59%, while the GDXJ ETF closed at $47.38. So, if you had positioned for Cabana's warning back then, you would have lost a lot of money buying the U.S. 10-Year Treasury Note and the junior miners' index.

As a result, more important than the information you're digesting is where the information comes from. Many 'analysts' lack objectivity and don't disclose how wrong they've been. Therefore, while Cabana awaits the Treasury market's implosion, his warning hasn't made his clients any money over the last ~11 months.

Conversely, all we (subscribers to Gold & Silver Trading Alerts) had this year were profitable transactions: both long and short.

Likewise, while we've had several GDXJ ETF short squeezes and pivot prognostications in 2022, the junior miners have continued to hit new lows. Thus, we view the current move as a countertrend rally within a medium-term downswing. In contrast, uninformed assessments of the fundamentals highlight why narratives seem so powerful in the short term.

Please see below:

To explain, extremely impressionable investors flock to narratives like a snowball rolling down a hill. The more ground it covers, the larger it becomes. However, if you bought the GDXJ ETF every time one of these false narratives emerged, your portfolio would have suffered substantial losses.

Remember, none of these supposed pivot-worthy issues solve inflation. In reality, the recent deceleration in month-over-month (MoM) inflation has occurred because the Fed maintained a hawkish stance. If that reverses, the small amount of realized progress will evaporate, and the Fed will confront the same problem again.

Follow the Data

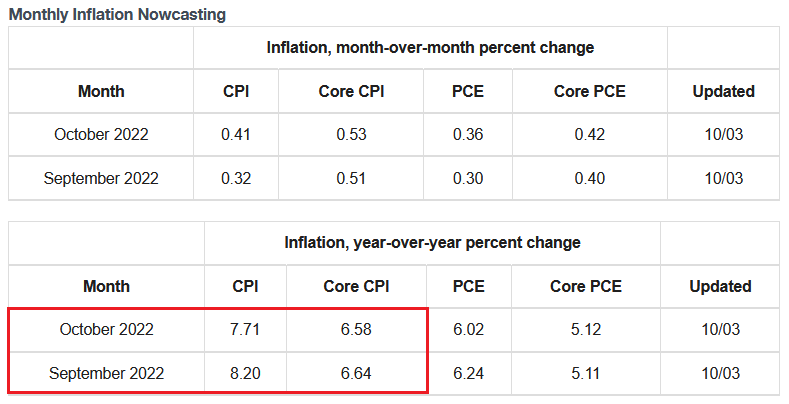

The Cleveland Fed projects that the headline and core Consumer Price Indexes (CPI) will hit 8.20% and 6.64% year-over-year (YoY) in September and 7.71% and 6.58% YoY in October; and while lower commodity prices help slow the headline CPI, resilient consumer demand should keep the core CPI uplifted.

Please see below:

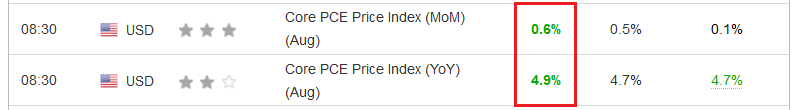

In addition, it was only one day ago that the core Personal Consumption Expenditures (PCE) Index re-accelerated YoY and outperformed expectations. For context, I wrote on Oct. 3:

With the core PCE Index – the Fed’s preferred inflation gauge – outperforming expectations on Sep. 30, inflation is nowhere near the levels that support a dovish pivot.

Please see below:

To explain, the core PCE Index came in at 4.9% year-over-year (YoY), which exceeded economists' consensus estimate of 4.7% YoY. Also, August's print exceeded the 4.7% YoY realized in July. As such, inflation remains highly problematic.

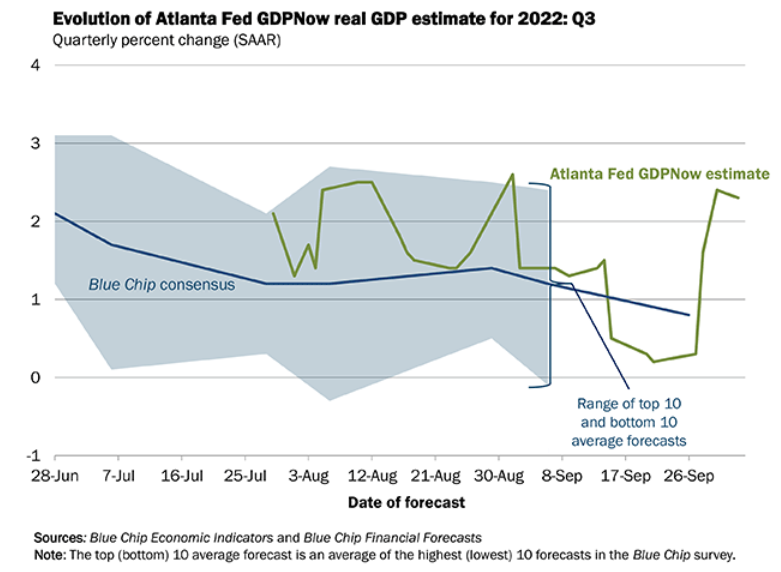

On top of that, the Atlanta Fed’s third-quarter real GDP estimate (updated on Oct. 3) stands at 2.3%, which is near the highs set in August.

Please see below:

To explain, the green line above tracks the Atlanta Fed’s Q3 real GDP estimate, while the blue line above tracks the Blue Chip consensus estimate (investment banks). If you analyze the sharp rise in the green line on the right side of the chart, you can see that expected economic growth is far from crisis levels. Therefore, the data does not support a dovish pivot.

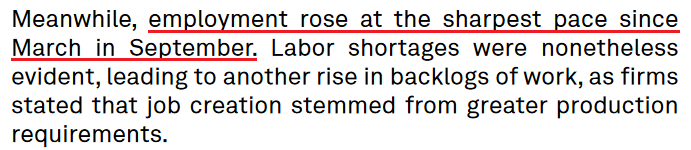

As further evidence, S&P Global released its U.S. Manufacturing PMI on Oct. 3. The headline index increased from 51.5 in August to 52.0 in September. The report revealed:

“On the price front, input costs rose at a slower pace in September. The rate of inflation was still historically elevated.”

In addition:

“Manufacturers registered a softer increase in selling prices compared to earlier in the year. That said, the pace of charge inflation ticked up from August as firms sought to pass through higher cost burdens to clients.”

So while inflation has slowed (which it should after 12 25 basis point rate hikes in 2022), U.S. manufacturers increased their selling prices at a faster pace in September versus August. As such, the pivot crowd is buying hope and selling reality.

More importantly:

With employment (one-half of the Fed’s dual mandate) going strong, the U.S. labor market remains on solid footing. Moreover, with increased hiring poised to uplift wages, the inflationary headwind will only be exacerbated if the Fed turns dovish.

Furthermore, with real GDP growth relatively strong (if the Atlanta Fed’s projection holds) and realized inflation still outperforming, the three metrics signal a higher, not lower, U.S. federal funds rate (FFR). Thus, the post-GFC crowd is repeating the same mistakes they made throughout 2021 and 2022.

Finally, Richmond Fed President Thomas Barkin said on Oct. 3 that inflation uncertainties “could make looking through short-term shocks more difficult. They could make gradual rate increase paths less effective. They could make market functioning interventions somewhat trickier.”

He added:

“Our efforts to stabilize inflation expectations could require periods where we tighten monetary policy more than has been our recent pattern.”

As a result, Barkin is the latest Fed official to reiterate that inflation is the top priority; and he understands that without “stable prices,” employment and growth are living on borrowed time.

The Bottom Line

While it’s hard to count how many times investors have predicted a dovish pivot in 2022, each iteration has been incorrect. Moreover, with realized inflation, projected real GDP growth, and the U.S. labor market still resilient, investors are in la-la land if they think these metrics support a dovish 180.

Likewise, the alarmists citing Treasury illiquidity, market functioning, and financial stability as reasons for a pivot tell the same stories over and over. Therefore, while the Fed will pivot at some point, timing matters, and their timing has been way off. As such, it’s important not to overthink short-term moves: assets become oversold, narratives create doubt, and short-covering sparks decent rallies. However, those gains are unlikely to hold since the medium-term technicals and fundamentals don’t support the moves.

What are the voters concerned about the most at this time?

Inflation.

Period.

In conclusion, the PMs rallied on Oct. 3, as hope uplifted risk assets. Also, the USD Index and U.S. real yields declined, which often occurs when risk-on sentiment dominates. Despite that, the optimism should evaporate in the months ahead, as all of the GDXJ ETFs 2022 rallies have failed, and this one should be no different.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM