tools spotlight

-

Another Rally in the Gold Market Turned Out to Be Fake?

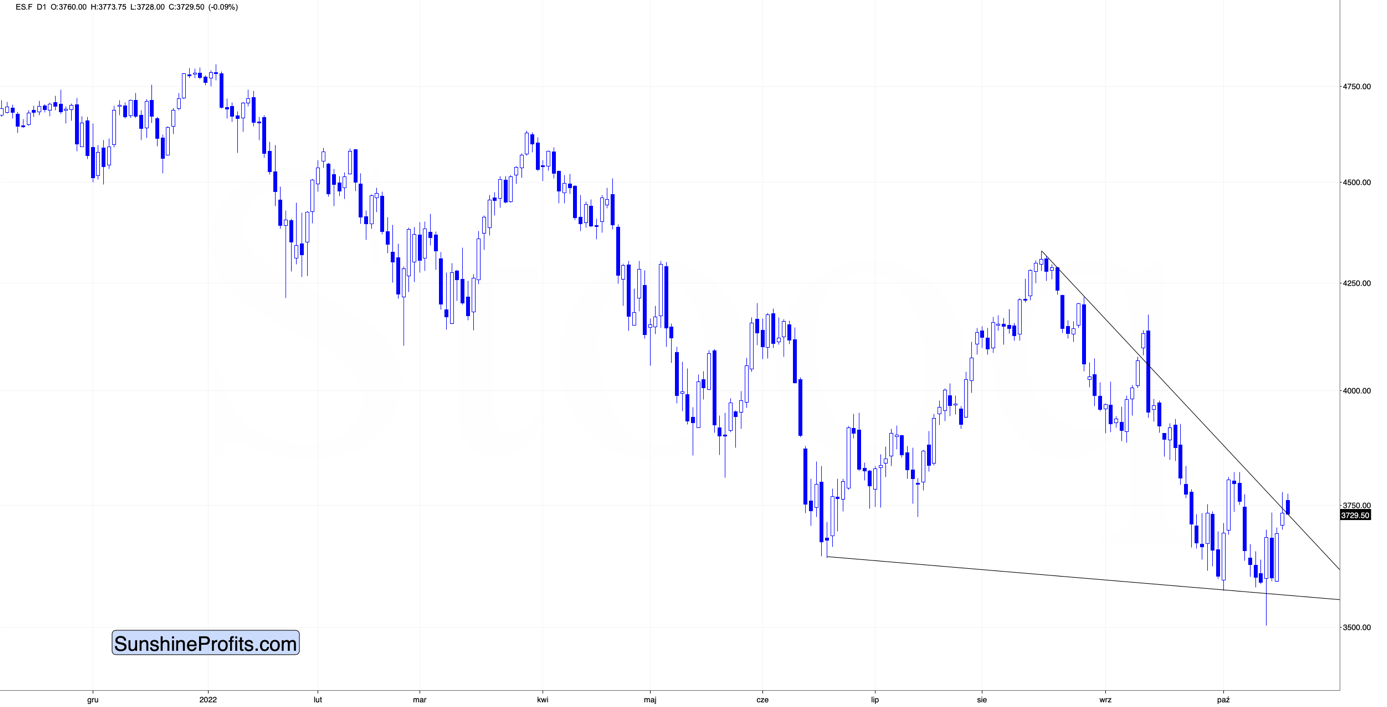

October 24, 2022, 9:15 AMOnce again, belief in the Fed's dovish pivot triggered rallies in gold and junior miners. Does this have any impact on their medium-term situation, though?

Gold bounced from the previous low, and part of this daily rally was already erased.

Is there anything special about a rebound from the previous lows? No. That’s a normal thing for any market to do. When it encounters support, a rebound is quite possible and normal. Unless you’re a daytrader, it’s not really important if that rebound happens or not, as long as the previous trend remains intact.

A rebound, two rebounds, or even a few rebounds are relatively unimportant as long as the trend remains in place, because the support is still likely to be broken eventually. That’s what the “trend remains intact” part implies.

Did anything change fundamentally based on Friday’s events?

No.

Did anything change technically based on Friday’s events?

No.

Gold didn’t even rally above its declining resistance line, breaking above which triggered reversals in August and October.

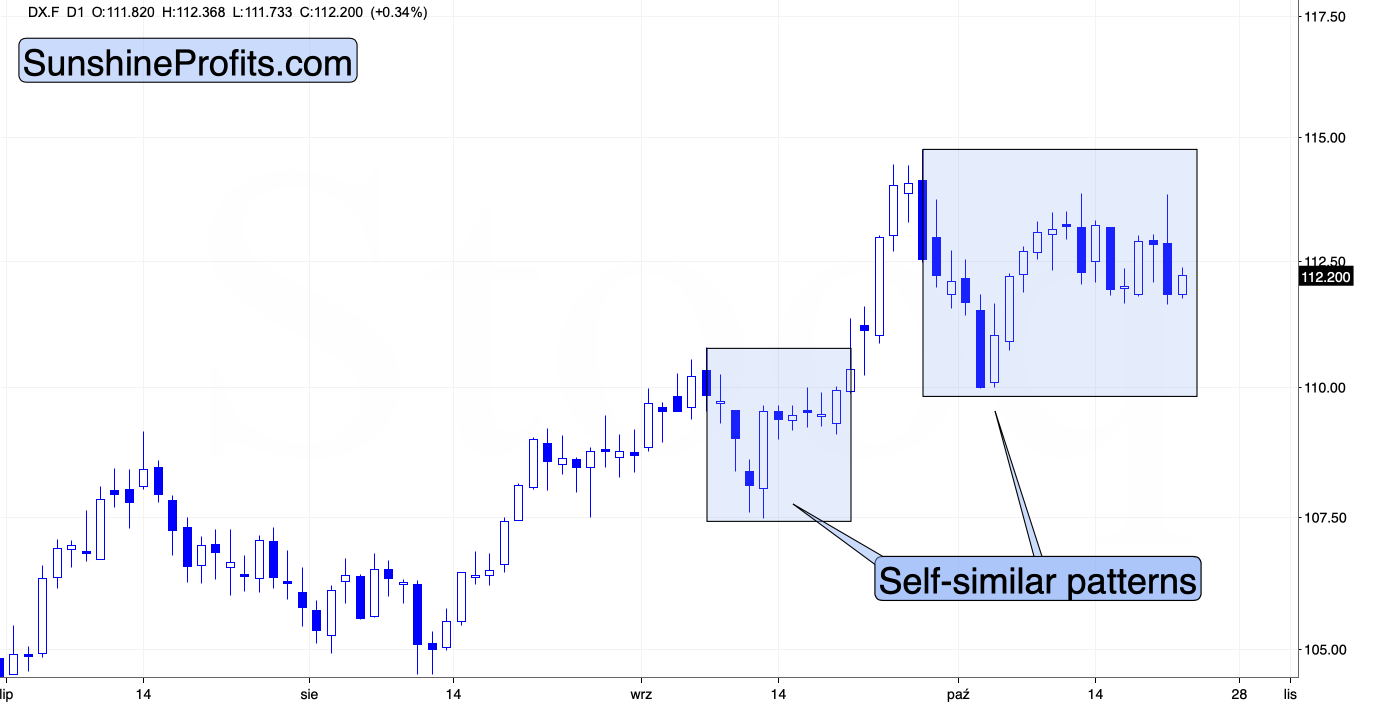

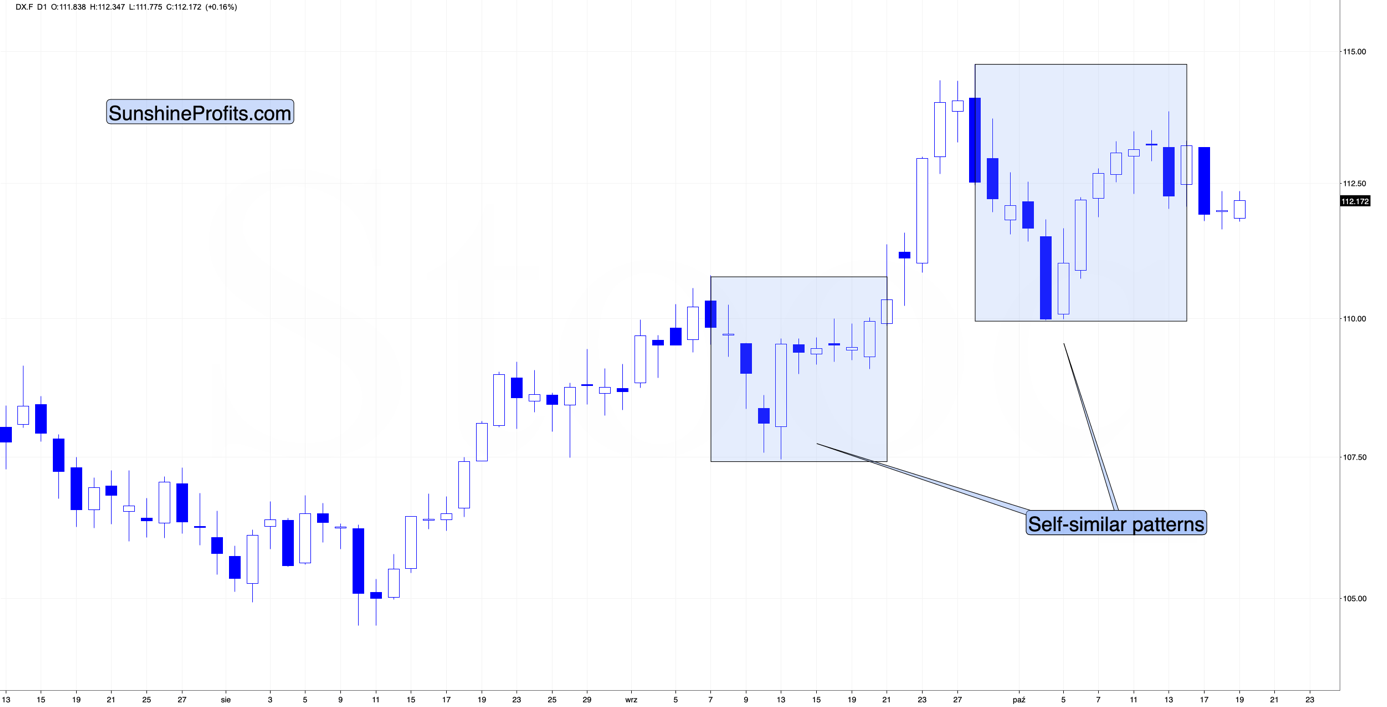

We see more of the same on the USD Index chart.

Namely, nothing really changed. The USD Index continues to trade sideways, just like what we saw in mid-September.

Back then, a similar pattern preceded a sharp upswing, and it seems quite likely that we’ll see something similar again in the near future. How “near” is this future likely to be? It’s impossible to tell with certainty, but I would say that days are more likely than weeks in the case of this question.

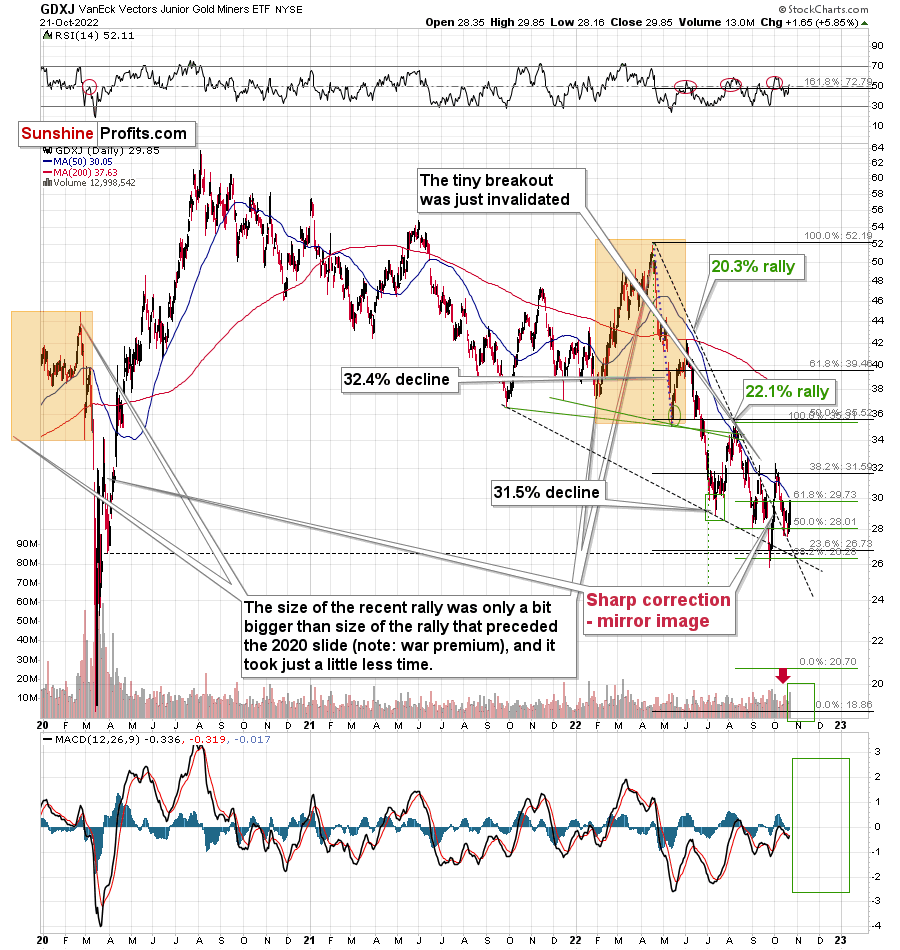

The GDXJ ETF moved higher on Friday, but – just like in the case of gold – it didn’t change the downtrend, and it didn’t cause our profitable short position to become unprofitable. As a reminder, we opened it (right after taking profits from the long position) on August 3, when the GDXJ was well above $30.

The downtrend has continued since that time, but in a rather back-and-forth manner. The markets are still susceptible to dovish rumors, but at some point, the “hope” for a dovish U-turn is likely to turn into despair as people realize that higher rates and hawkish operations overall are the “new normal”.

This will remain the case as long as inflation is the main concern of the voters. That’s unlikely to change anytime soon.

Therefore, the support levels in gold and mining stocks are likely to be broken, and they are likely to fall. That’s simply how those markets react to higher real interest rates.

Given the technical position in which the precious metals market is, and the 2013 analogy that remains fully intact, it seems that we won’t have to wait for the breakdown much longer.

Any potential (!) rally in the main stock indices is unlikely to have a lasting impact on the precious metals sector – if it happens at all.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Will Gold Stocks Manage to Ignore the S&P 500’s Volatility?

October 21, 2022, 9:23 AMGold, silver, and mining stocks rallied, but with higher interest rates triggering volatility, the outlook for the precious metals market remains bearish.

Introduction

Despite the S&P 500’s 0.80% decline on Oct. 20, gold rallied by 0.16%, silver by 1.80%, the GDX ETF by 1.27% and the GDXJ ETF by 1.48%. Moreover, the USD Index traded 0.05% lower, while the U.S. 10-Year real yield ended the day flat. Thus, while volatility remains uplifted amid the rise in interest rates, the PMs’ bearish medium-term technical and fundamental outlooks are unchanged.

Rising Rates

While the S&P 500 suffered a sharp intraday reversal on Oct. 20, gold, silver and mining stocks ended the day in the green. However, with rising interest rates poised to inflict more pain on risk assets, their relative strength should fade in the weeks and months ahead.

Please see below:

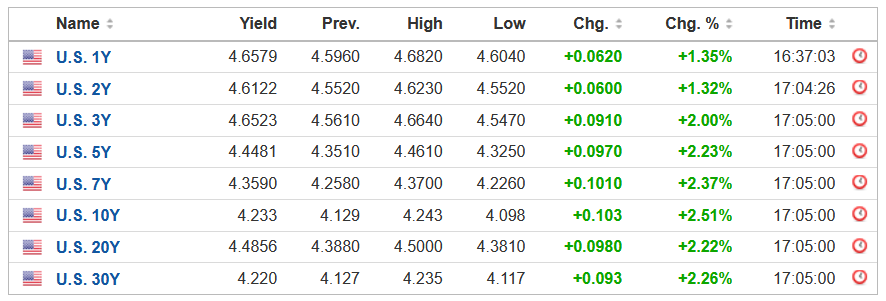

To explain, yields jumped once again, and the U.S. 10-Year Treasury yield closed at another 2022 high. But with the USD Index and the U.S. 10-Year real yield remaining roughly flat, the ramifications were largely neutral for the PMs. Yet, with the real yield benchmark still at a decade-plus high, the USD Index and the U.S. 10-Year real yield should seek higher ground in the months ahead.

Please see below:

In addition, while the consensus assumed that a ~3% U.S. federal funds rate (FFR) would be enough to curb the highest inflation in 40+ years, I warned throughout 2021 and 2022 that the prospect was extremely unrealistic. Furthermore, with expectations shifting substantially in only a few months, the reality check should pressure the PMs over the medium term. To explain, I wrote on Aug. 1:

While the consensus assumes the Fed is near the end of its rate hike cycle, the Consumer Price Index (CPI) is on the fast track to 2% and a 3% FFR will be enough to capsize inflation, market participants are living in fantasy land.

For example, I’ve warned on numerous occasions that demand is much stronger than the consensus realizes. With Americans’ checking account balances at unprecedented all-time highs and the Atlanta Fed’s wage growth tracker hitting an all-time high in June, the FFR needs to go meaningfully above 3%. To explain, I wrote on Jul. 25:

With more earnings calls showcasing how the situation continues to worsen, market participants don’t realize that the U.S. federal funds rate needs to hit ~4.5% or more for the Fed to materially reduce inflation. For context, the consensus expects a figure in the 2.5% to 3.5% range.

However, a major milestone materialized on Oct. 20, as the dovish pivot crowd suffered a painful death.

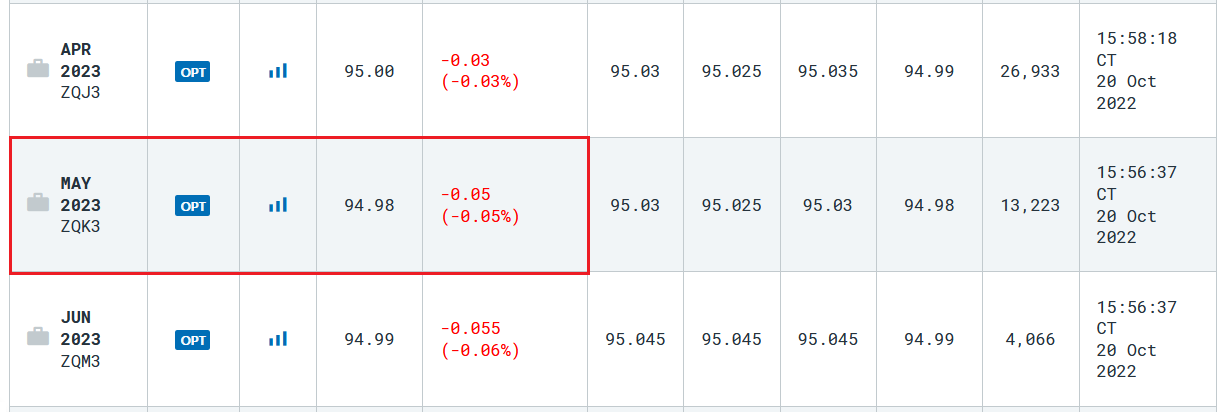

Please see below:

To explain, the table above tracks the peak FFR implied by the futures market, and the rate is calculated by subtracting the last price from 100. If you analyze the red rectangle, you can see that futures traders expect a peak FFR of 5.02%. Moreover, it’s the first time in 2022 that rate hike expectations have hit 5% or more, and the crowd is now firmly aligned with our estimate of 4.5% to 5.5% in 2023.

As a result, the fundamentals continue to unfold as expected, and the liquidity drain is profoundly bearish for gold, silver, mining stocks and the S&P 500.

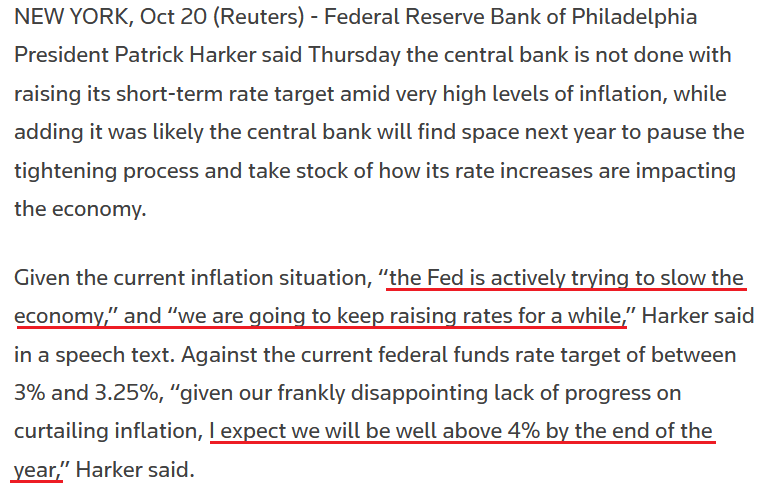

To that point, while stocks were up for most of the morning, Fed officials’ hawkish rhetoric poured cold water on the celebration. For example, Philadelphia Fed President Patrick Harker said on Oct. 20:

“Sometime next year, we are going to stop hiking rates. At that point, I think we should hold at a restrictive rate for a while to let monetary policy do its work. It will take a while for the higher cost of capital to work its way through the economy. After that, if we have to, we can tighten further, based on the data.”

Thus, with “sometime” still well into the future, the Fed has plenty of room to lift the FFR.

Please see below:

Similarly, Fed Governor Lisa Cook said on Oct. 20:

“Inflation is too high; it must come down and we will keep at it until the job is done. This likely will require ongoing rate hikes and then keeping policy restrictive for some time (…). Policy must be based on whether we see inflation actually falling in the data, rather than just in forecasts. Policy should remain focused on restoring price stability, which will also set the foundation for a sustainably strong labor market.”

So with Fed officials reiterating their commitment to normalizing inflation, I warned on Apr. 6 that the bulls were fighting a losing battle. I wrote:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. As that occurs, investors should suffer a severe crisis of confidence.

Furthermore, with Harker making the point for me when he said, “the Fed is actively trying to slow the economy,” there is no more confusion; and while the S&P 500 and the PMs have declined substantially since Apr. 6, their medium-term lows are likely still on the horizon.

To explain, I wrote on Oct. 7:

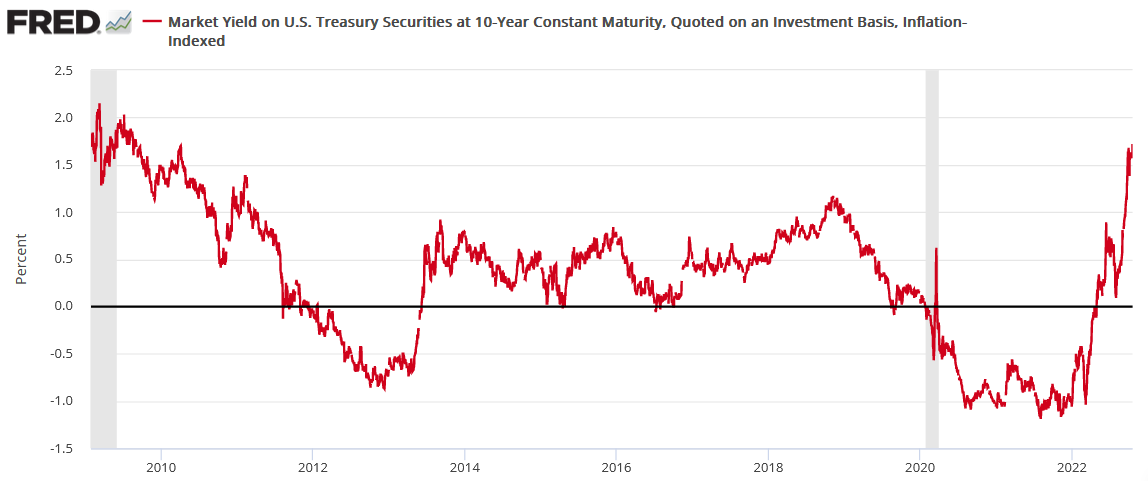

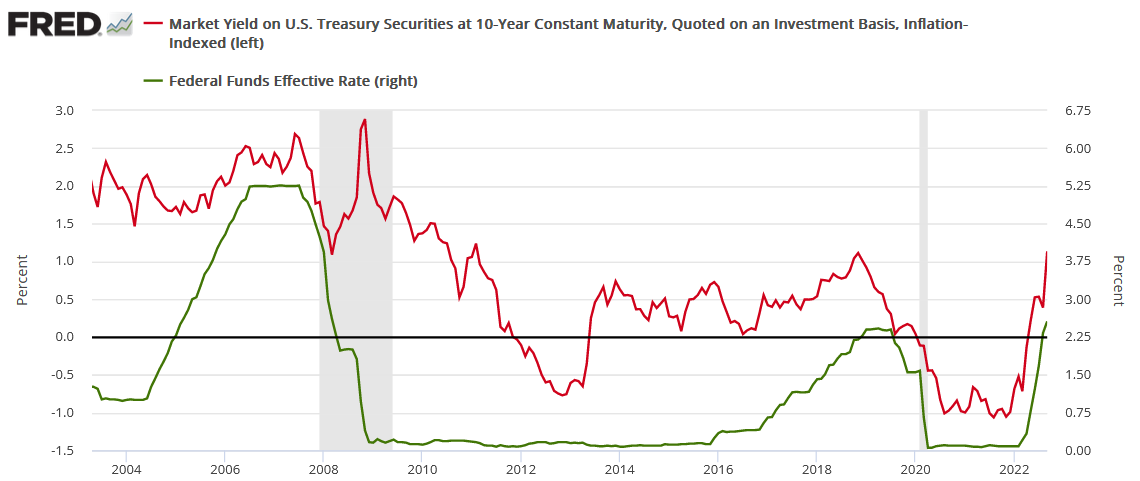

The U.S. 10-Year real yield often peaks alongside the FFR (or near it). As a result, with the Fed poised to raise the FFR by at least another 1.25% (to reach 4.5%), the U.S. 10-Year real yield should have more room to run, which is bullish for the USD Index.

Please see below:

To explain, the red line above tracks the U.S. 10-Year real yield, while the green line above tracks the FFR. As you can see, a higher FFR supports higher real interest rates. Also, when the FFR hit ~4.5% in February 2006, the U.S. 10-Year real yield reached a monthly high of 2.14%, and it occurred with a YoY CPI at roughly half the current rate.

So with the latter ending the Oct. 6 session at 1.54%, there is still plenty of potential upside over the medium term. As such, the outlook is bullish for the U.S. 10-Year real yield and the USD Index, and the PMs should suffer as interest rates normalize to more appropriate levels.

To that point, the U.S. 10-Year real yield ended the Oct. 20 session at 1.74%, and there is still room to run; and if the FFR exceeds the February 2006 reading of ~4.5% (remember, 5.02% is now priced in), the U.S. 10-Year real yield could surpass its February 2006 high of 2.14%.

Thus, risk assets remain in a precarious position, and the PMs shouldn’t bottom until the medium-term technicals turn bullish, the Fed turns dovish, and the USD Index and the U.S. 10-Year real yield show weakness.

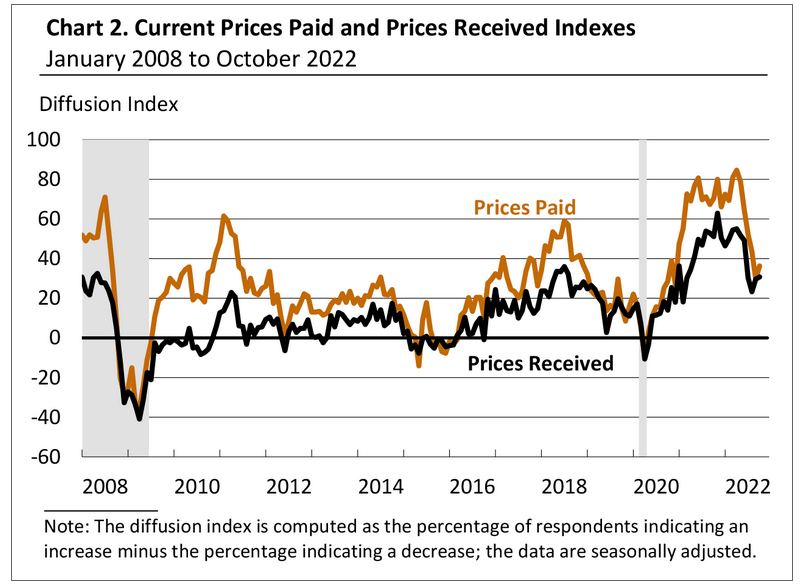

Hawkish PMIs

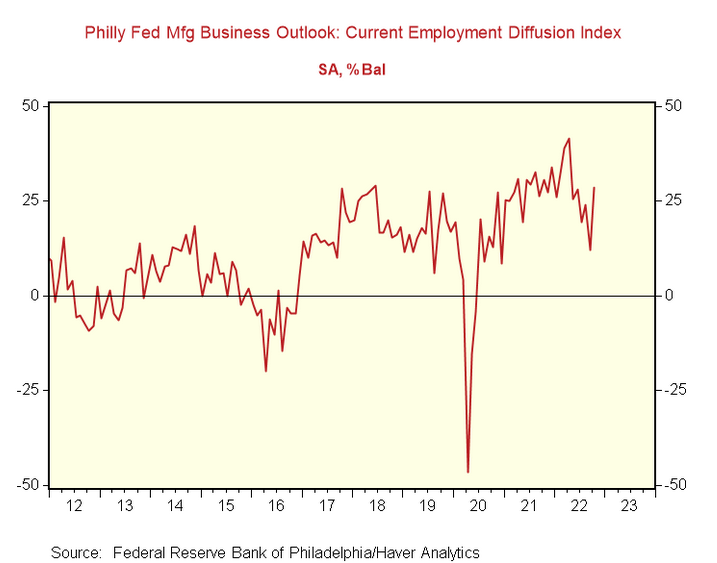

The Philadelphia Fed released its Manufacturing Business Outlook Survey on Oct. 20; and while the headline index increased from -9.7 to -8.7, it remains relatively weak. However, the report stated:

“The indicators for prices paid and prices received rose modestly this month following steady declines through the summer. The prices paid index – which had fallen 55 points between April and September of this year – rose 7 points to 36.3. The current prices received index edged up 1 point to 30.8.”

Therefore, while some progress is present, the price indexes increased again in October.

Please see below:

More importantly, I’ve noted recently how the U.S. labor market has become the most important fundamental variable. In a nutshell: even if inflation has peaked, it’s too high for the Fed to relax. As a result, unless employment collapses, the Fed should keep its foot on the hawkish accelerator.

Likewise, with the Philadelphia Fed’s report highlighting further job gains, the Fed has the green light to hammer inflation. An excerpt read:

“Firms continued to report increases in employment on balance. The employment index rose from 12.0 to 28.5 this month, more than offsetting its decline from last month. The average workweek index returned to positive territory, rising 14 points to 10.4.”

Please see below:

To explain, the red line above tracks the Philadelphia Fed’s employment index. If you analyze the right side of the chart, you can see that the metric is nowhere near crisis levels, and a higher FFR should materialize as the U.S. labor market remains on solid footing.

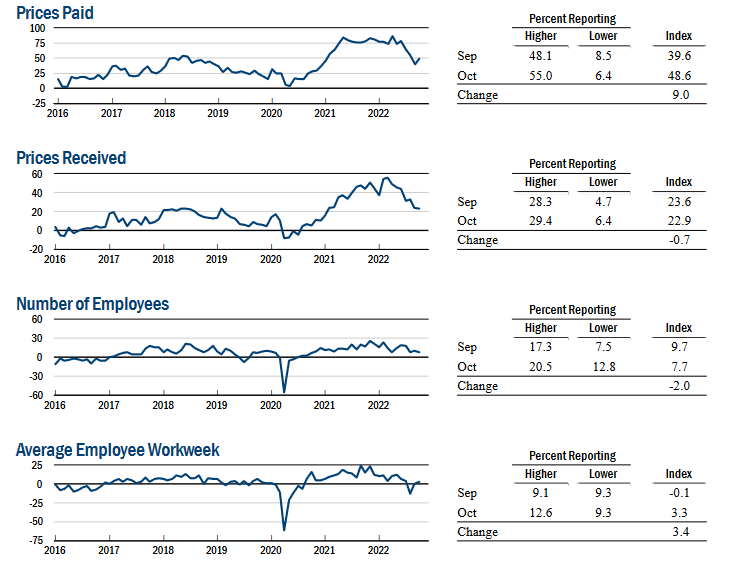

Finally, the New York Fed released its Empire State Manufacturing Survey on Oct. 17. The headline index declined from -1.1 to -9.1. However, the report revealed:

“After falling significantly over the prior three months, the prices paid index rose nine points to 48.6. The prices received index held steady at 22.9.”

In addition:

“The index for number of employees was little changed at 7.7, pointing to a modest increase in employment levels, and the average workweek index climbed to 3.3, signaling a slight increase in hours worked.”

Thus, with inflation and employment still moving in hawkish directions, a higher FFR, higher real yields, and a stronger USD Index are profoundly bearish for the PMs.

The Bottom Line

With higher interest rates stifling the S&P 500, even bullish seasonality coupled with contrarian positioning and sentiment metrics couldn’t help the index hold its daily gain. Therefore, while its performance is more of a wild card in the weeks ahead, the GDXJ ETF should remain a relative underperformer as the months progress.

In conclusion, the PMs rallied on Oct. 20, as they sidestepped the S&P 500’s volatility. However, while their daily optimism was aided by a flat USD Index and U.S. 10-Year real yield, both should hit new highs over the medium term. As such, the PMs will likely confront more downside before long-term buying opportunities emerge.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold and Silver Wiped Out Their Rallies in ‘2013 Style’

October 20, 2022, 8:40 AMAvailable to premium subscribers only.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Didn’t Need Any Special Boost to Reach the New Low

October 19, 2022, 8:57 AMAlthough gold had the conditions to rest for a while and fall only a little, it chose a more radical path and hit new monthly lows. Can it move lower?

In yesterday’s video analysis, I emphasized that gold, silver, and mining stocks are moving lower, and that they can do that regardless of the possible rally in the stock market. Let’s start today’s analysis with a look at how perfectly the markets confirmed what I said yesterday.

Stocks ended yesterday’s session higher, and in today’s overnight trading, they are moving sideways.

So, theoretically, gold, silver, and mining stocks had a good reason to rally yesterday and do nothing today.

The influence coming from the USD Index is somewhat similar.

Nothing really happened yesterday, and the USDX is up just slightly in today’s overnight trading. Thus, gold had a good reason not to do anything yesterday, and decline just a little today.

Instead, gold just moved to new monthly lows.

This is not really supported by the moves in either the stock market or the USD Index. It seems that gold simply wants to decline here.

Since it recently broke below a very strong support area (that it then verified as resistance), it seems that gold could fall significantly soon.

While gold is weak, maybe the junior miners are strong?

While they didn’t move to a new monthly low just yet, it’s clear that their short-term downtrend continues, and the theoretically positive impact of the general stock market doesn’t affect them in the way it “should”. Consequently – that’s right, you guessed it – it seems that junior miners really want to slide once again.

Given the analogy to 2013, it seems that they can now slide really profoundly.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Despite the Rally, Is the Future of Gold Only Bearish?

October 18, 2022, 9:13 AMSentiment-driven gold and silver rose, and the dollar index lost ground. However, does this change anything in the medium term?

The precious metals sector moved higher yesterday, but overall it was most likely just a blip on the radar screen and it didn’t change anything – the downtrend remains intact.

For more details, I invite you to watch today’s analysis below – today, it took a video format.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM