tools spotlight

-

What Did the Dollar Have to Do With Gold’s Nov. 7 Rally?

November 8, 2022, 5:39 AMGold, silver and mining stocks’ prices soared on Friday. Let’s see if the dollar may have had something to do with this movement.

Very little happened in the precious metals market yesterday, and what I wrote and said yesterday remains up-to-date.

I got a request to comment on the USD Index (and its link with gold), and I’ll be happy to deliver.

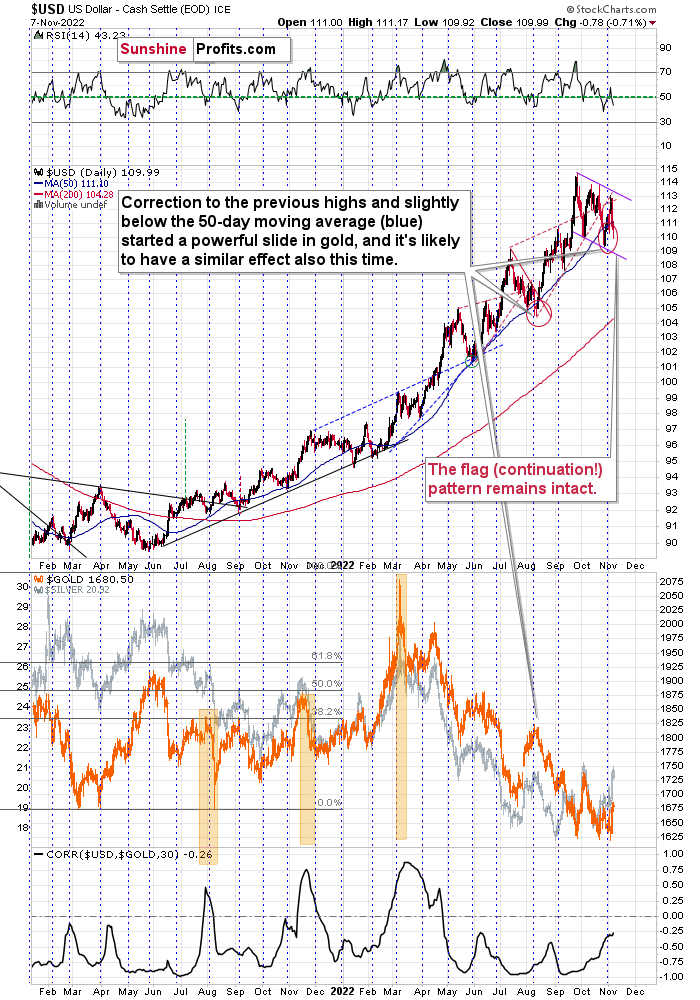

The Flag Pattern

In short, the USD Index remains in its flag pattern that started in September. A flag pattern is a continuation pattern where the price trades sideways (but slightly against the trend) and it continues… until it doesn’t. Quite often, the pattern ends after two or three bottoms. We already had two, and it seems that the third one is about to be formed or it has already formed.

The RSI is slightly below 50 and the USDX itself is a bit below its 50-day moving average (blue line). In the previous months, this combination of factors meant that another sizable rally was just around the corner. As history tends to rhyme, the implications are bullish.

Since March, gold has been moving in the opposite direction to the USD Index, so the implications of the above are bearish for gold and the rest of the precious metals sector.

Why wasn’t gold moving against the USD Index in February? Because of the fear and uncertainty related to the Russian invasion of Ukraine. Please note that the war in Ukraine is still in place, and yet, gold is hundreds of dollars below its 2022 high. This serves as a strong confirmation of gold’s current weakness.

Looking at gold’s short-term picture, we see that its short-term top might already be in.

The last two times it broke slightly above its declining medium-term resistance line, it then stayed above it for a couple of days, and then it started $100+ declines.

Given today’s pre-market decline, and given the overall self-similarity to how gold performed in 2013, it seems that not only the short-term top is in, but it’s likely the case that another huge decline is about to be seen.

A Word About Silver

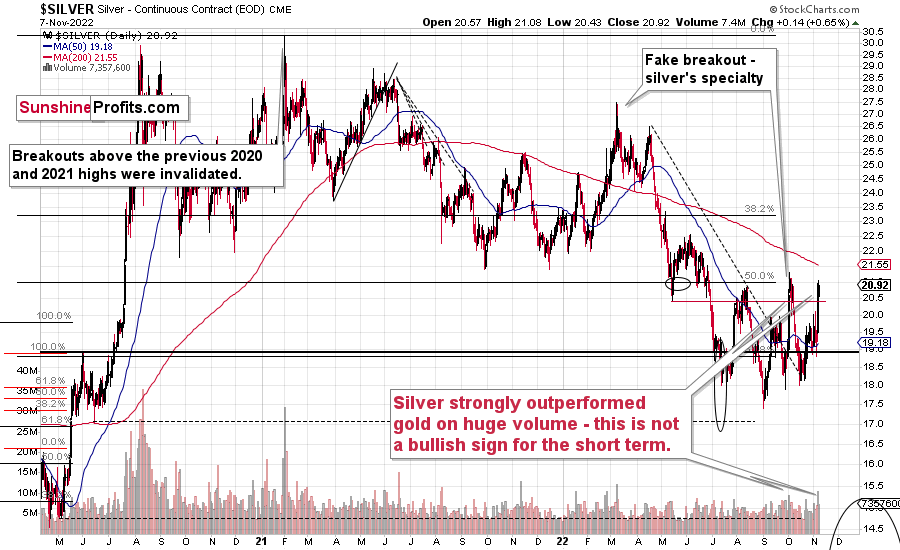

Moreover, let’s keep in mind the silver price signal.

As I explained in my yesterday’s video, silver’s short-term outperformance is an important sell signal.

We saw this indication many times before, and it’s been one of the most reliable indications that the next big move lower is at hand. Remember the spike at the 2021 top, when silver soared relative to gold? Many people thought that silver was taking off and heading straight to the moon, but I warned that this was likely a fake move. And indeed, that was the top.

There were times to be long this year (for example, I went long miners on May 12 and on July 11 – very close to local bottoms). However, in my opinion, right now is not a good time to do so. Instead, it seems to me that profits from short positions are likely to grow substantially in the following weeks.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

This Is Why Friday’s Rally Was Nothing to Worry About

November 7, 2022, 8:16 AMThe prices of gold, silver, and mining stocks moved higher on Friday, which might have seemed a big deal, but in reality, it wasn’t. Nothing happened that hasn’t already happened before, and the outlook is just as bearish as it’s been previously.

Of course, we would all prefer to see our profits increase on a daily basis, but sometimes the market really “likes” to test our patience. Fortunately, the current short position in the GDXJ is still profitable, as we entered it on July 28, 2022, when the GDXJ was trading at about $33.50, and all previous trades this year were profitable (just as this one currently is), so the waiting shouldn’t be that difficult.

In the video you’ll find below, I’ll discuss the current technical picture, and will also talk about the supposedly bullish nature of the recent increase in the official (governments / monetary authorities) sector’s purchases (it’s not bullish).

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Unlike Rhodes Colossus, Giant USDX Rally Won’t Fall Quickly

November 4, 2022, 10:20 AMAvailable to premium subscribers only.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

GDXJ Plummeted. Has the Time Come a Cascade Reaction?

November 3, 2022, 9:17 AMSo, the Fed has spoken, and yesterday’s move lower on the markets was as unsurprising as it gets. Why? Because it was all in the charts well before the interest rate hike and the following conference. You will find details in my yesterday’s analysis. Here’s a quick quote:

Instead of moving back above $1,700, gold verified its breakdown below this level, and we saw a fresh sell signal from the stochastic indicator. Yes, it’s a bearish combination of factors.

If it wasn’t enough, we just saw a major sell indication from the silver market.

(…)

The signal comes from silver’s very short-term outperformance of gold. Whenever something like that happens (especially on strong volume) after a rally, it’s an indication that the rally is either over or about to be over. And yes, yesterday’s rally (and intraday reversal) took place on relatively strong volume.

Remember the fake early-October rally? That was yet another example of this technique in action.

(…)

Junior miners moved a bit higher yesterday, but our short positions in them remain profitable nonetheless (and we keep the 100% profitability in the 2022 trades, at least as long as one uses the GDXJ).

Interestingly, the most recent short-term upswing materialized practically right at the vertex of the triangle, based on the two black, dashed support/resistance lines. The vertexes tend to mark reversals, and the most recent move was to the upside, which means that the implications are bearish here.

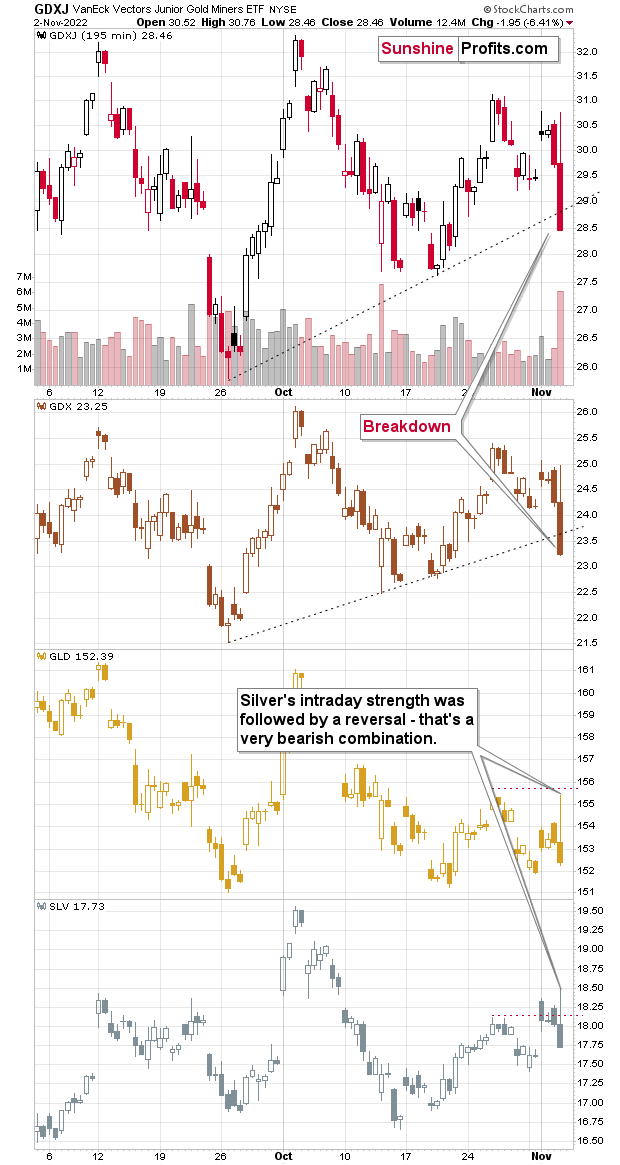

Now, let’s take a look at what happened during yesterday’s session. On the chart below, each candlestick represents half of a daily session.

In the upper part of the chart (GDXJ and GDX, proxies for junior miners and senior miners, respectively), we see that mining stocks declined heavily, and they broke below their rising, short-term support lines on strong volume.

This tells us that the counter-trend rally and the recent consolidation are likely over.

What we see on the bottom part of the charts confirms it.

Namely, silver once again outperformed gold on a very short-term basis, but then it failed to hold onto its gains and declined sharply.

As you can see, silver visibly moved above its late-October highs, while gold didn’t – thus, we can speak of silver’s intraday outperformance. That’s a sell sign.

The profits on our short position in junior miners have just increased once again, and given today’s pre-market decline in gold, it seems that those profits will increase (as mining stocks decline) once again today. And then, since gold is now testing its previous 2022 lows, it seems that we’ll see a breakdown to new lows in gold, and then – finally – a breakdown to new lows in mining stocks.

Then, as stocks continue to decline (why wouldn’t they? The hopes for a dovish U-turn have just been crushed once again…), junior miners are likely to drop significantly, thus growing our profits even further. Of course, I can’t promise any kind of performance, but the above is what appears very likely in my view.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The GDXJ Has a Choice: Rise With the S&P 500 or Fall With Gold?

November 2, 2022, 10:00 AMThe S&P 500 is blooming, while gold cannot hide its weakness. Both have an impact on junior miners, but which lead will gold stocks follow?

It’s Fed decision day! Will the rally in stocks continue? Will miners follow stocks higher or gold lower? Charts provide hints.

Let’s start with something that usually happens at this time of the month.

The USD Index tends to reverse its direction.

It seems that’s exactly what we saw recently. The USDX dipped below its 50-day moving average, and each time that happened since mid-2021, it meant that a bottom was in or just around the corner.

At the same time, the USDX moved to the lower border of the flag pattern and approximately to the previous (July) high.

This is all bullish, not just per se, but also because we saw something very similar in early August, earlier this year. What happened next? Well, not only did the USD Index rally, but gold fell like a stone in water.

The main difference this time is that gold (the lower part of the above chart) is not after a rally that’s as big as the July rally was. In other words, gold is now weaker, and the situation is now more bearish for gold than it was in early August.

During its most recent run-up, gold wasn’t even able to get back above the $1,700 level. It’s weak, and it’s all really, really bearish.

Instead of moving back above $1,700, gold verified its breakdown below this level, and we saw a fresh sell signal from the stochastic indicator. Yes, it’s a bearish combination of factors.

If it wasn’t enough, we just saw a major sell indication from the silver market.

The signal comes from silver’s very short-term outperformance of gold. Whenever something like that happens (especially on strong volume) after a rally, it’s an indication that the rally is either over or about to be over. And yes, yesterday’s rally (and intraday reversal) took place on relatively strong volume.

Remember the fake early-October rally? That was yet another example of this technique in action.

Junior miners moved a bit higher yesterday, but our short positions in them remain profitable nonetheless (and we keep the 100% profitability in the 2022 trades, at least as long as one uses the GDXJ).

Interestingly, the most recent short-term upswing materialized practically right at the vertex of the triangle, based on the two black, dashed support/resistance lines. The vertexes tend to mark reversals, and the most recent move was to the upside, which means that the implications are bearish here.

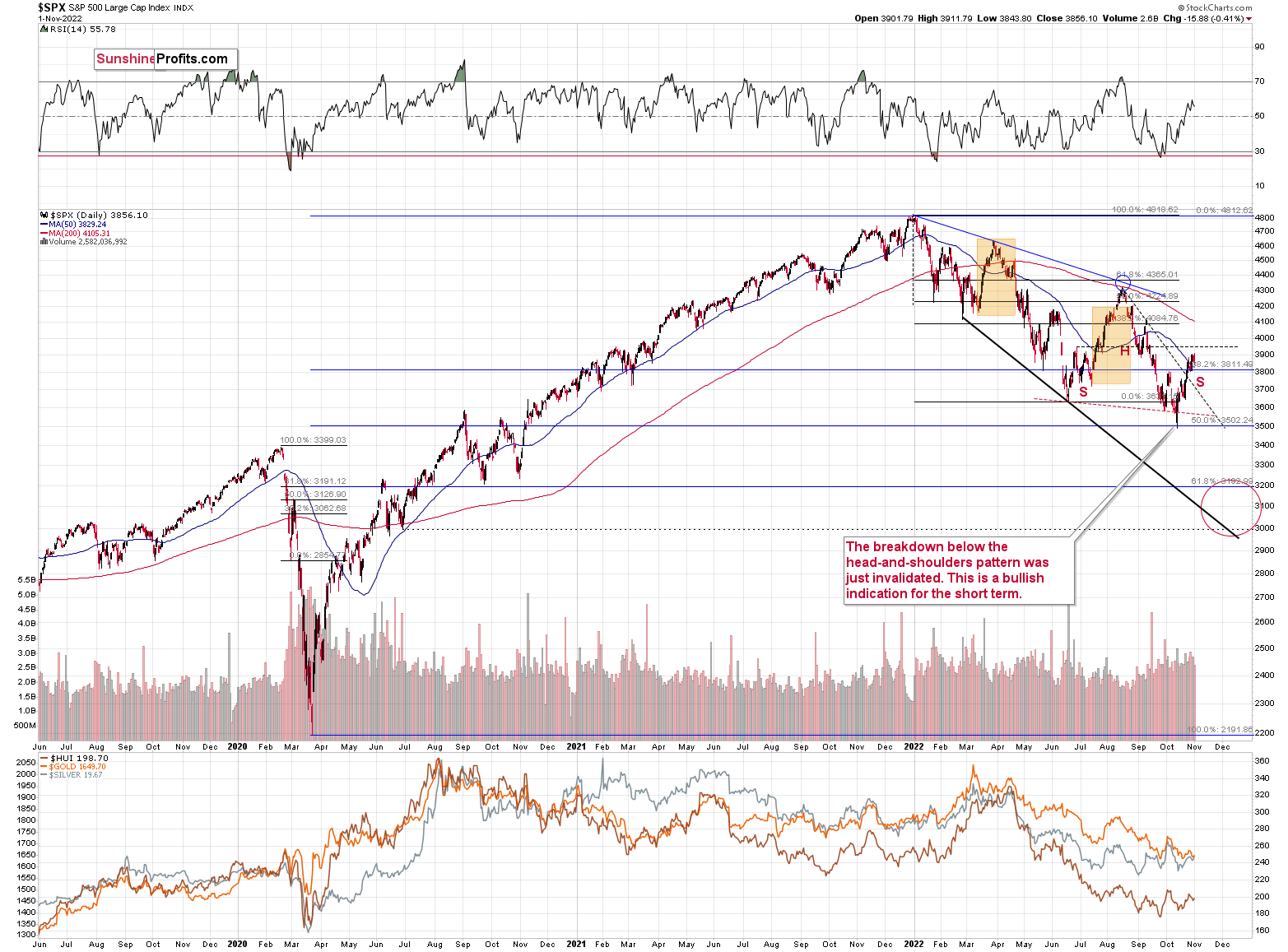

And now for the part that I get most questions about – the stock market.

The S&P 500 recently rallied to new monthly highs, which caught investors’ eyes. However, as the index didn’t move above its June 2022 high, the head and shoulders formation could still be completed.

In the case of the S&P 500 index, there is a visible breakout above the declining dashed resistance line based on the August and September 2022 highs.

However, once we zoom in and focus on S&P 500 index futures, it becomes clear that the situation is much more bearish than it seems at first glance.

The index futures have longer trading hours than the index, so the above chart includes a broader data range. In many cases, the U.S. session would be key and overnight trading wouldn’t be that important, but in the case of the S&P 500 index futures, those trades are important as this extremely popular index/futures is being traded all over the world, and the sizes of those transactions are not minor.

In other words, paying attention to the S&P 500 index futures is a good idea.

The above chart shows that we just saw a failed attempt to break above the declining resistance line, the October highs, and the 50% Fibonacci retracement based on the August-October decline. This is a powerfully bearish combination.

On top of that, yesterday’s session took the form of a daily reversal.

And yes, this is all bearish news for the stock market.

This, in turn, means that the positive impact that the stock market had on the prices of mining stocks is likely to be reversed. This, plus the bearish implications of gold and silver charts, tells us that the very bearish outlook for mining stocks (especially junior mining stocks) remains up-to-date – at least for the next few weeks-months. In my view, they are likely to rally in the very long run, but not without a bigger decline first.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM