-

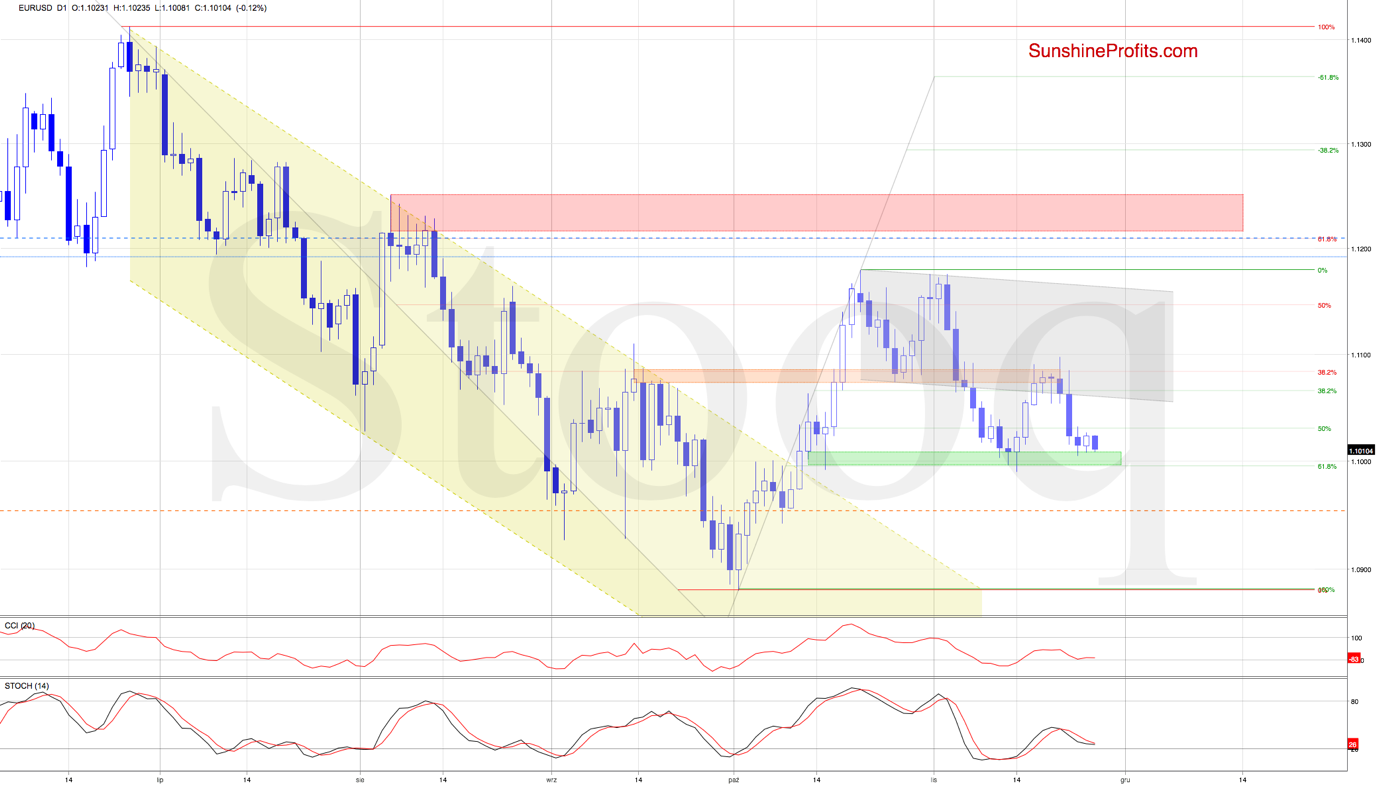

Don't Get Lulled to Sleep by the Tiny EUR/USD Moves

November 27, 2019, 6:42 AMEUR/USD

EUR/USD keeps testing the green support zone, yet the bears can't muster enough strength to break through. What are their chances of breaking below before Thanksgiving, or is another rebound more likely actually?

Although EUR/USD moved down a bit earlier today, the green support zone coupled with the 61.8% Fibonacci retracement continues to hold declines in check. Let's recall our yesterday's comments as they're also valid today:

(...) EUR/USD has indeed tested the above-mentioned downside targets, triggering the interest and involvement of the bulls. As a result, the exchange rate has bounced, suggesting that a similar rebound to what we saw in mid-November could likely be ahead of us.

If that's the case, the bulls could push the exchange rate to the lower border of the grey declining trend channel once again in the coming days.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in USD/JPY and AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

-

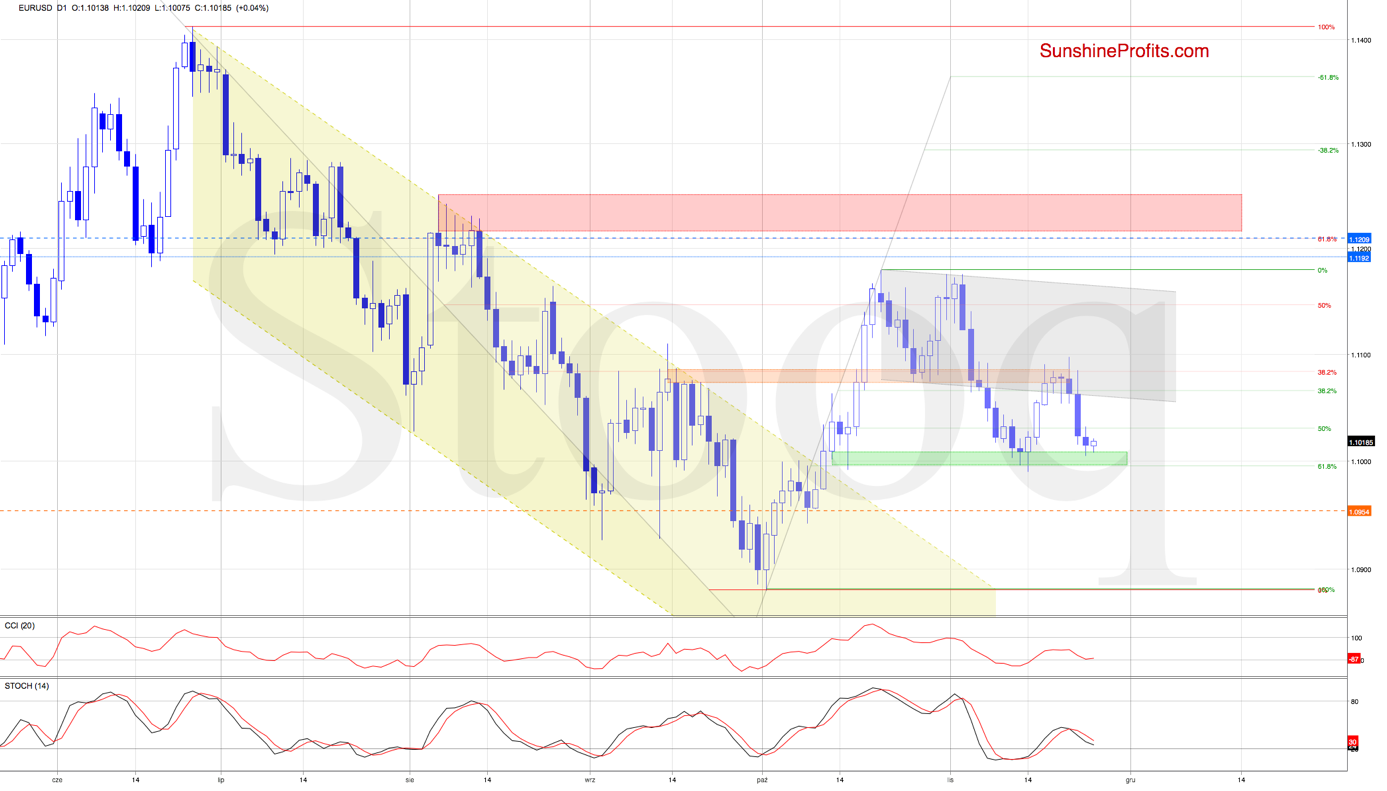

Euro Bulls Stage a Rebound: How Far Can It Run?

November 26, 2019, 10:02 AMEUR/USD

Okay, the green support zone has been reached, and the bulls tried to move higher earlier today - yet the pair trades close to unchanged now. What are the prospects of the upswing - just when can it materialize? And what about its upside target?

These were our yesterday's observations:

(...) Earlier today, follow-through selling came, and with it the increased likelihood of testing the green support area, the 61.8% Fibonacci retracement and the recent lows in the very near future.

EUR/USD has indeed tested the above-mentioned downside targets, triggering the interest and involvement of the bulls. As a result, the exchange rate has bounced, suggesting that a similar rebound to what we saw in mid-November could likely be ahead of us.

If that's the case, the bulls could push the exchange rate to the lower border of the grey declining trend channel once again in the coming days.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in GBP/USD and USD/CAD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

-

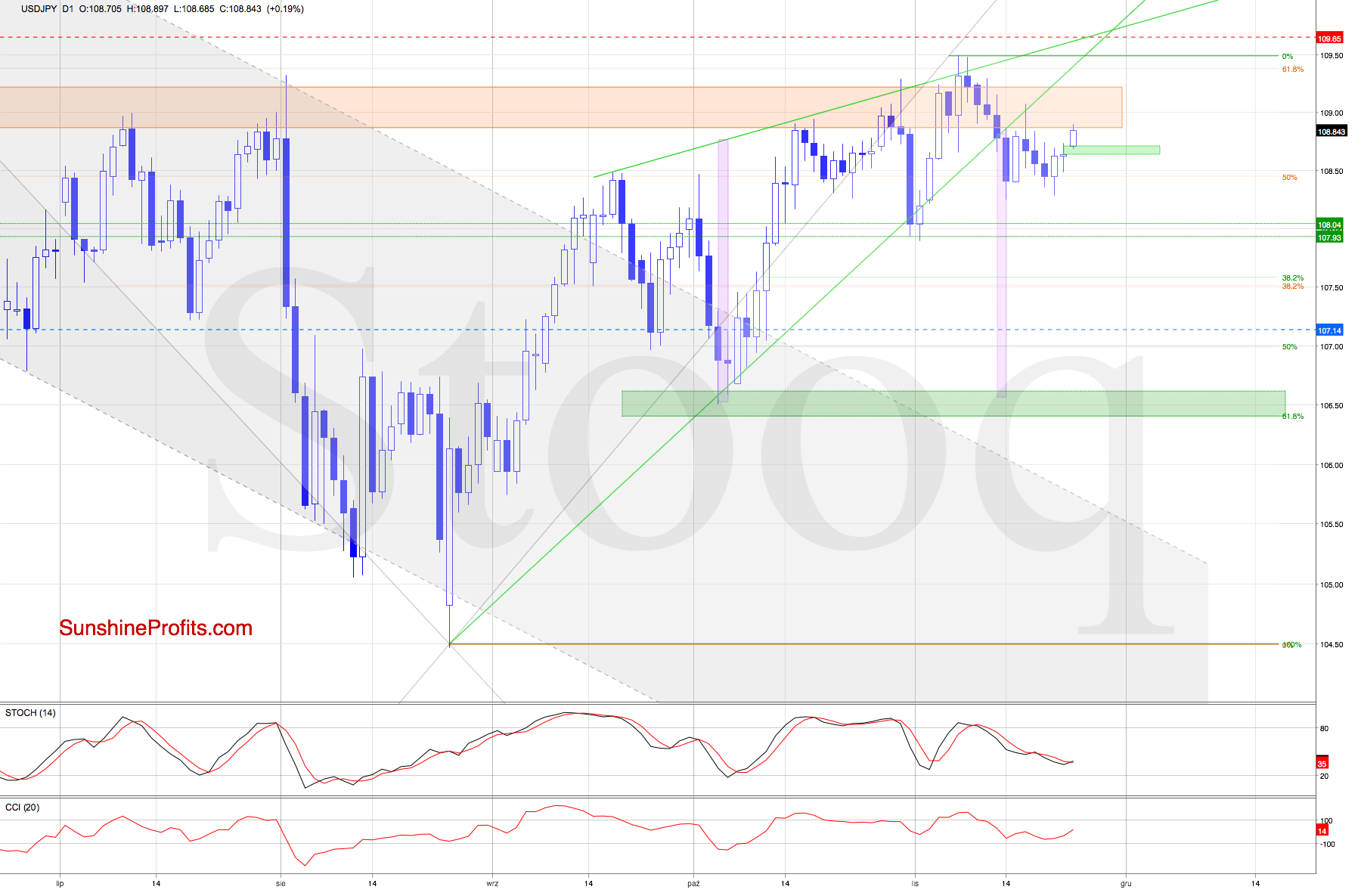

The Calm Before the Next Japanese Yen Move

November 25, 2019, 9:30 AMUSD/JPY

After breaking below the green wedge, the pair has kept trading below another important resistance, the orange zone. How likely is it that the bulls will muster enough strength and break higher?

USD/JPY opened today's session bullishly with a green gap, and went on to extend gains in the following hours. Despite the upswing, the exchange rate is still trading below both the orange resistance zone and the previously broken lower border of the rising green wedge. It means that as long as there is no breakout above these key resistances, another downward reversal remains likely.

Should we see such price action and USD/JPY indeed moves lower in the coming days, the first downside target for the bears will be around 107.93-108.04. This is where the nearest support area (created by the lows at the turn of Oct and Nov) is.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD, USD/CHF and AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

-

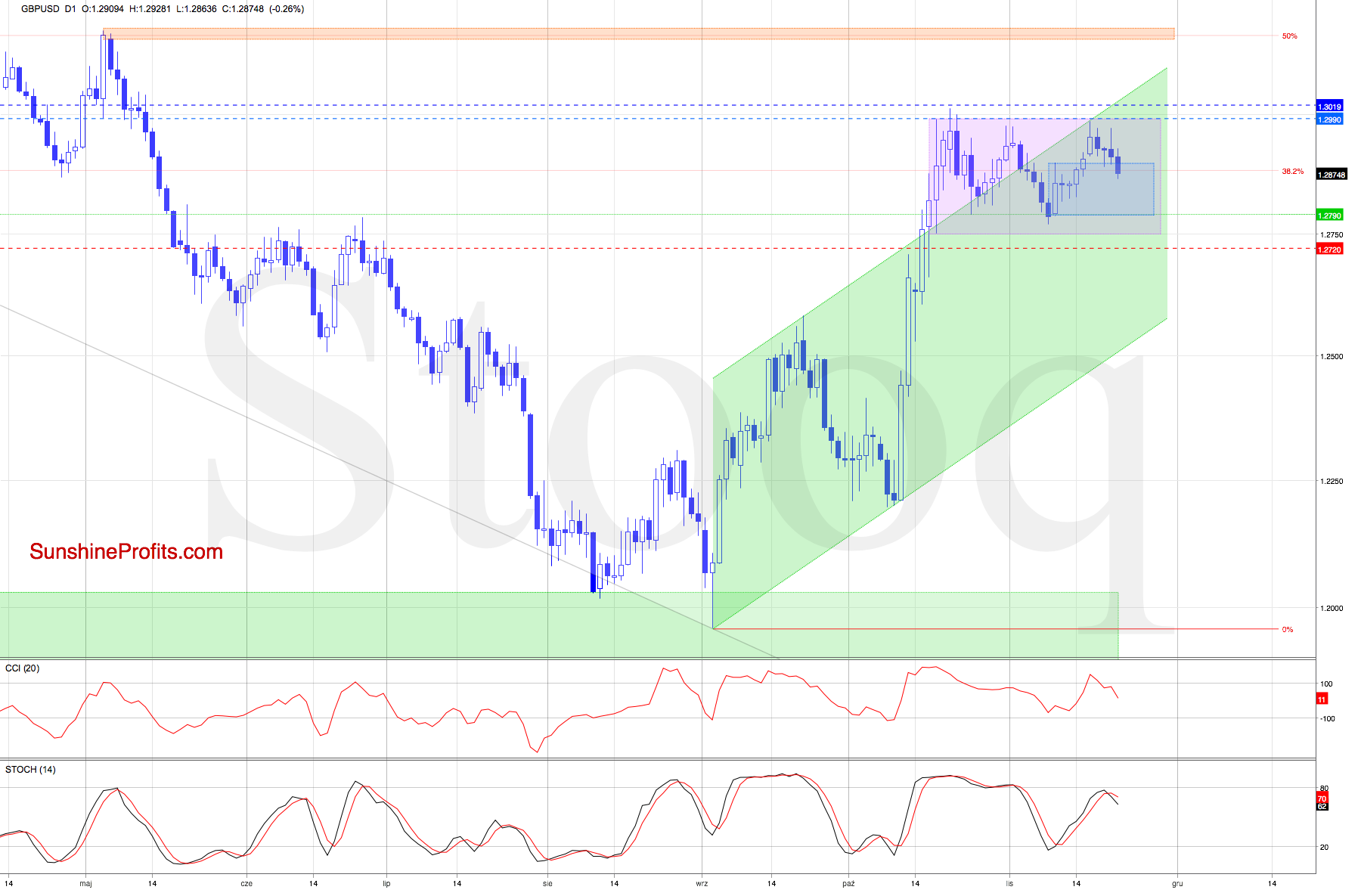

The British Pound Is Consolidating, or Probing Lower Values?

November 22, 2019, 9:08 AMGBP/USD

GBP/USD has been wandering up and down in recent weeks, stuck in a wide consolidation. The bears seem to be having the upper hand now, but can their gainful series continue? Let's examine the chart's standing this very moment (charts courtesy of www.stooq.com )

GBP/USD has extended losses for the third session running, hinting at the bulls' strength. Or rather, the lack thereof as the recent highs coupled with the upper border of the purple consolidation and the upper border of the green rising trend channel may be too strong for them.

Today's downswing took the pair below the bullish gap created at the beginning of the week. Should we see the gap closed, and a breakout above the upper border of the blue consolidation invalidated, we'll consider closing our long positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/CAD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

-

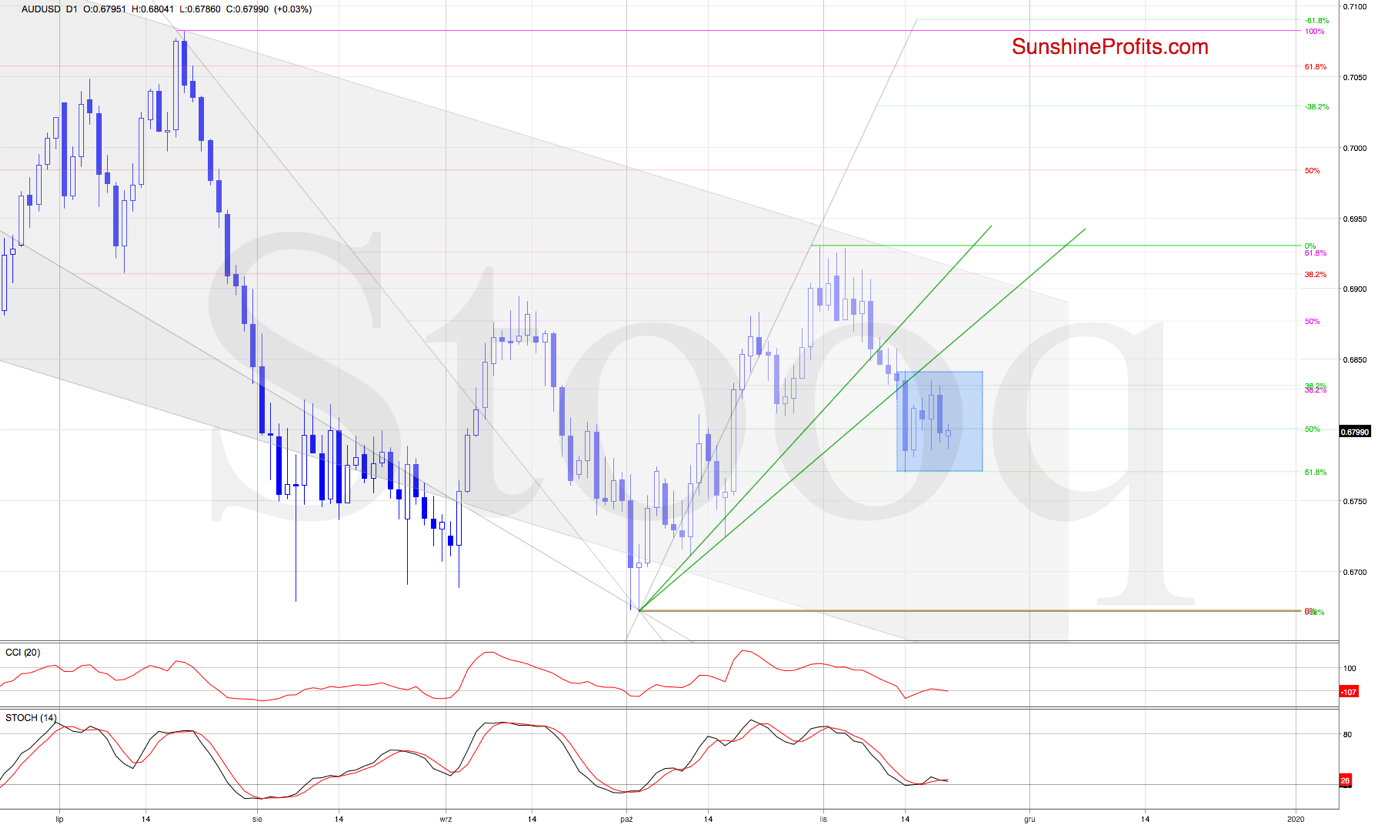

The Australian Dollar Isn't Just Treading Water

November 21, 2019, 7:10 AMAUD/USD

The Australian dollar has recently broken below two important supports, and went on to tread water in a not-so-tight trading range. Is it rather the bulls or the bears who has the upper hand here?

Lacking clear direction, AUD/USD remains trading inside the blue consolidation. This means that as long as we do not see either a breakout above the upper border of the formation or a breakdown below its lower border, another bigger move is not likely to be seen. Short lived moves in both directions should not surprise us in the following days.

The examination of the daily indicators reveals though that the bulls will try to push the pair higher in the coming week. Should we see such price action, the first upside target would be the previously broken lower green line based on the previous lows.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/JPY. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold &

Forex Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM