-

The Euro Upswing Paints an Upcoming Opportunity

December 30, 2019, 9:30 AMEUR/USD

Like a phoenix from the ashes, the euro has risen recently - and quite sharply so. Does it portend more strength ahead, or what exactly can we expect ahead? The answer features our game plan for the scenario ahead...

Let's recall our Friday's analysis:

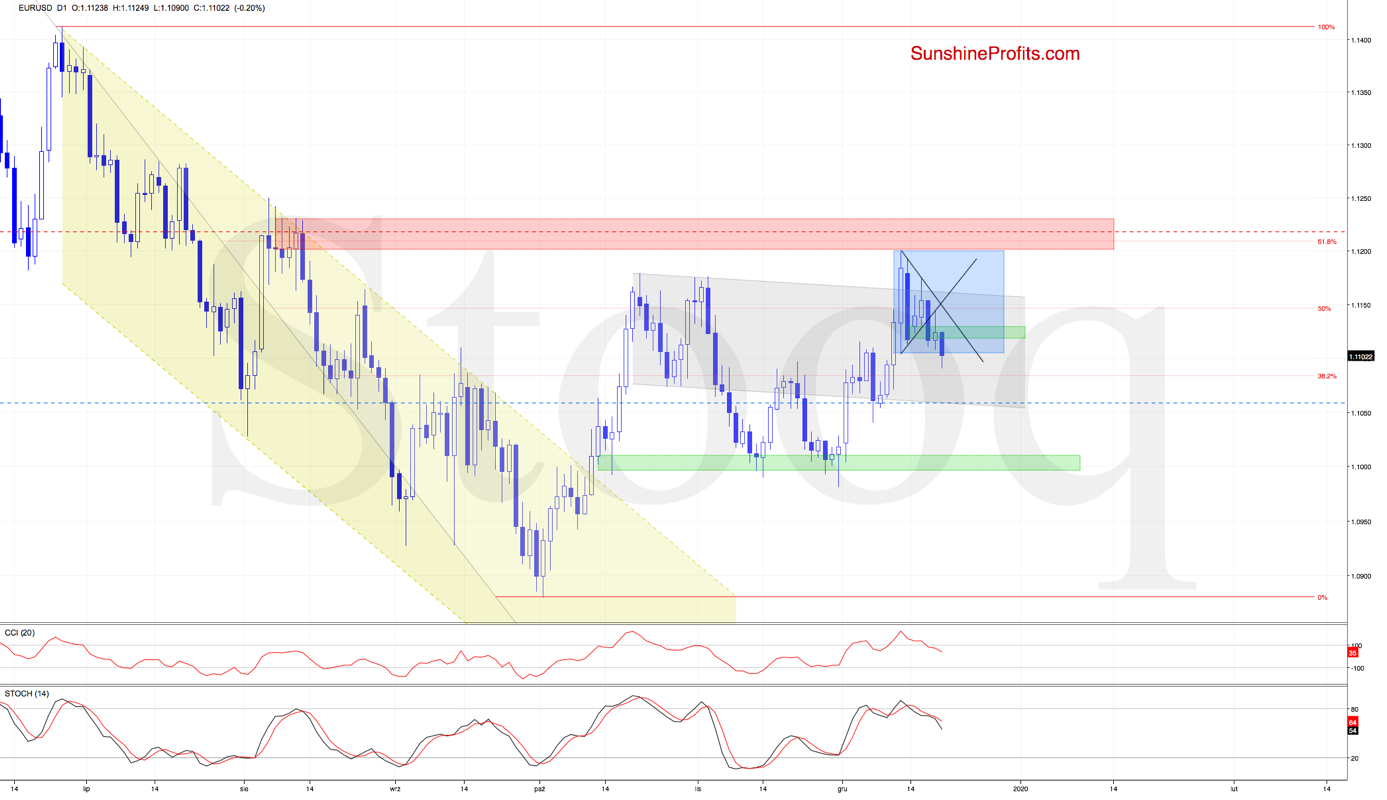

(...) EUR/USD moved sharply higher earlier today, breaking out above the declining black resistance line that is based on its previous peaks. This move also brought us invalidation of the earlier breakdown below the lower border of the blue consolidation, while the Stochastic Oscillator generated its buy signal.

Taking the above developments into account, it seems probable that we'll see further improvement and a test of the lower arm of the black triangle, of the upper border of the declining grey trend channel or even of the recent peaks at the upper border of the blue consolidation.

The situation developed in tune with the above, and EUR/USD reached both resistances on Friday and earlier today. The move also took the pair to both the red resistance zone and the 61.8% Fibonacci retracement, suggesting that we could see a downward reversal in the very near future.

But what about the daily indicators? The Stochastic Oscillator has generated its buy signal, and there is still some upside potential in it. The best course of action would be to observe the exchange rate and in case we would see reliable signs of the bulls' weakness, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in GBP/USD, USD/JPY, USD/CAD, USD/CHF and AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Swiss Franc - Is There Any Stopping It?

December 27, 2019, 9:48 AMUSD/CHF

The Swiss franc has been trading around the green support zone recently, until it broke down earlier today. Is it a one-day event where the dollar bulls can be expected to step in shortly? Or is there some dollar-selling still ahead?

Earlier today, USD/CHF broke below the green support zone and the 61.8% Fibonacci retracement, triggering further deterioration and a breakdown below the recent lows.

This move opens the way to the next support area based on the 76.4% and 78.6% Fibonacci retracements, as the bears have the initiative.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/JPY. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Just How Much Downside Is Left in the USD/CAD?

December 23, 2019, 9:12 AMUSD/CAD

The Canadian dollar has been growing in strength recently, yet the greenback bulls staged a rebound recently. Just a pause in the previous trend, or a change in gears looms?

Although USD/CAD moved below the black support line based on the previous lows that also forms the neck line of the potential head-and-shoulders formation, the deterioration proved only temporary. The exchange rate rebounded on Friday, invalidating not only the earlier breakdown below the black line, but also below the previously broken green support zone that is based on the early-November lows.

Additionally, the CCI joined the Stochastic Oscillator in generating its buy signal, suggesting that higher values of USD/CAD may be just around the corner.

Such price action will be more likely and reliable though only if the pair succeeds in breaking above the upper border of the blue consolidation.

Should the bulls be strong enough to close today or one of the following days above this resistance, we'll consider opening long positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

EUR/USD Has Made Up Its Mind

December 20, 2019, 9:54 AMEUR/USD

The euro was stuck in some back-and-forth trading recently, yet some downward bias was palpable. The breakdown from an important pattern has been verified, and a logical question then follows - what is the right thing to do from the risk-reward perspective now?

EUR/USD moved lower on Wednesday, breaking below the lower border of the black triangle. This bearish development resulted also in the green gap getting closed.

The euro bulls pushed the pair higher yesterday, but upon reaching the previously-broken lower line of the triangle, the exchange rate pulled back.

Thanks to this price action, the exchange rate verified the earlier breakdown from the triangle, which increases the probability of further deterioration in the coming days. This is especially so when we factor in the sell signals generated by the daily indicators and also the breakdown below the lower border of the blue consolidation.

Should it be the case and the pair extends losses from here, the initial downside target for the sellers will be the lower border of the declining grey trend channel.

Taking all the above into account, opening short positions is justified from the risk/reward perspective. All details below.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in GBP/USD and USD/JPY. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold &

Forex Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM