-

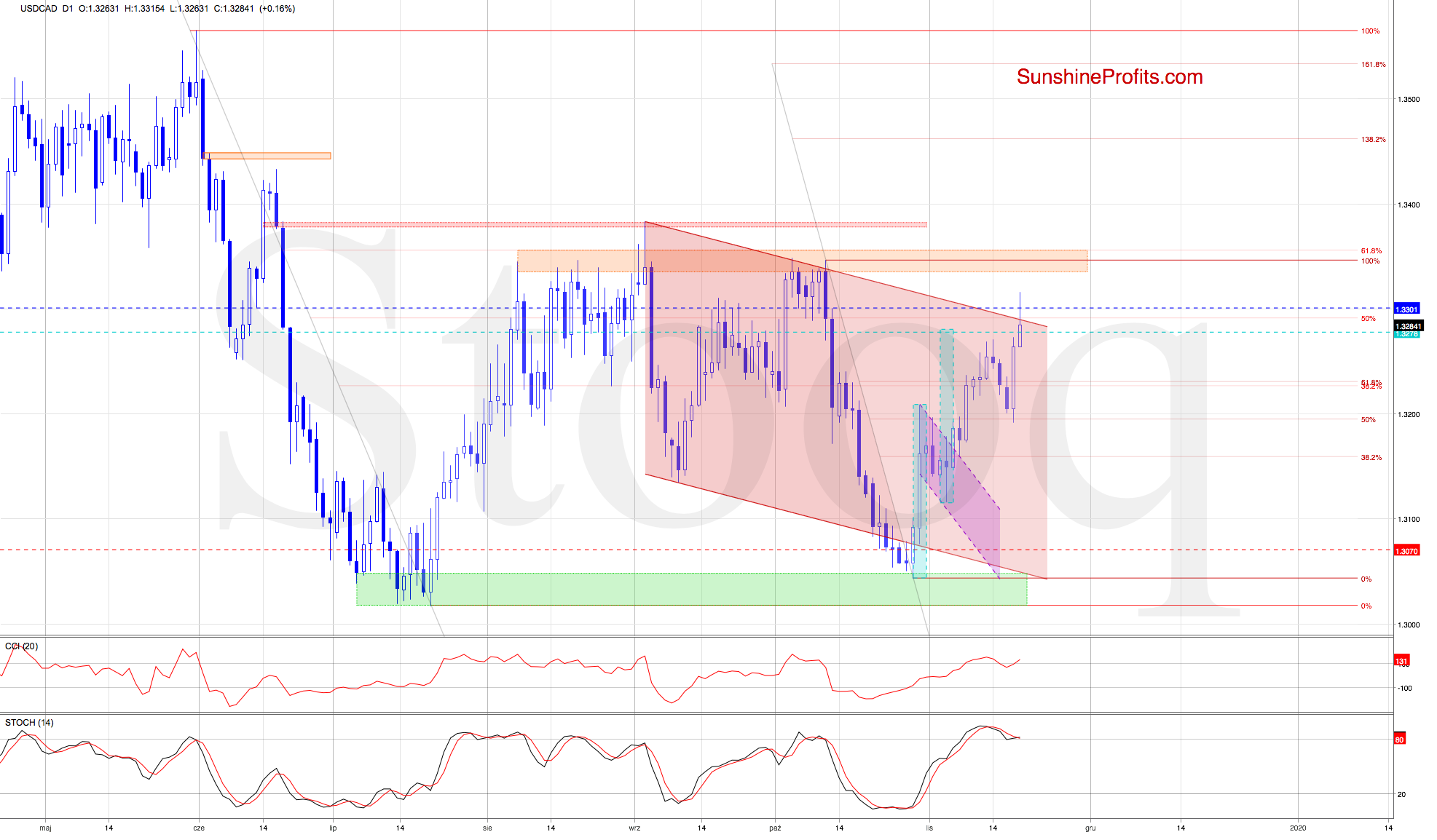

At First Sight, USD/CAD Just Keeps Rolling...

November 20, 2019, 10:31 AMUSD/CAD

USD/CAD just shot higher, and the bulls are attempting to add to yesterday's strong gains. Yet it seems they're having trouble keeping today's momentum. Is it merely an intraday consolidation, or will the bears show up shortly?

In our last commentary on this currency pair, we wrote:

(...) When October gave way to November, USD/CAD moved sharply higher, up to the 50% Fibonacci retracement. Then, it pulled back, sliding inside the declining purple trend channel, reversing and continuing even higher. This is what a flag pattern looks like: it's a consolidation within the pre-existing trend. In a flag, prices are reluctant to move much lower, and the correction tends to wear you off rather in time. And patience was exactly what we needed back then in USD/CAD.

Should it be the case and we're again looking at a flag, we'll likely see further improvement and a fresh November peak hit in the coming week.

Take a look slightly above the recent highs. The size of the upward move would correspond there to the height of the mentioned formation (marked with the turquoise rectangles for your convenience).

Connecting the dots, we lowered our upside target a little, and changed it to the exit target to make sure that our long position will be closed with a satisfactory profit without the risk of a sudden reversal when other bulls start cashing their profits.

The cautious approach is also supported by overextended levels of daily indicators. The Stochastic Oscillator even generated its sales signal, which underscores the risk of reversal in the very near future.

The situation developed in tune with the above, and USD/CAD not only reached our exit target to close our long positions with profit, but also managed to break above the upper border of the declining red trend channel.

The bulls however didn't manage to hold gained ground, and the pair pulled back earlier today. Coupling this fact with the current position of the daily indicators, a reversal may be just around the corner. It'll be more likely and reliable only if the pair closes today or one of the following sessions below the upper border of the red channel, invalidating the earlier breakout in terms of daily closing prices.

Should we see such price action, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and GBP/USD The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

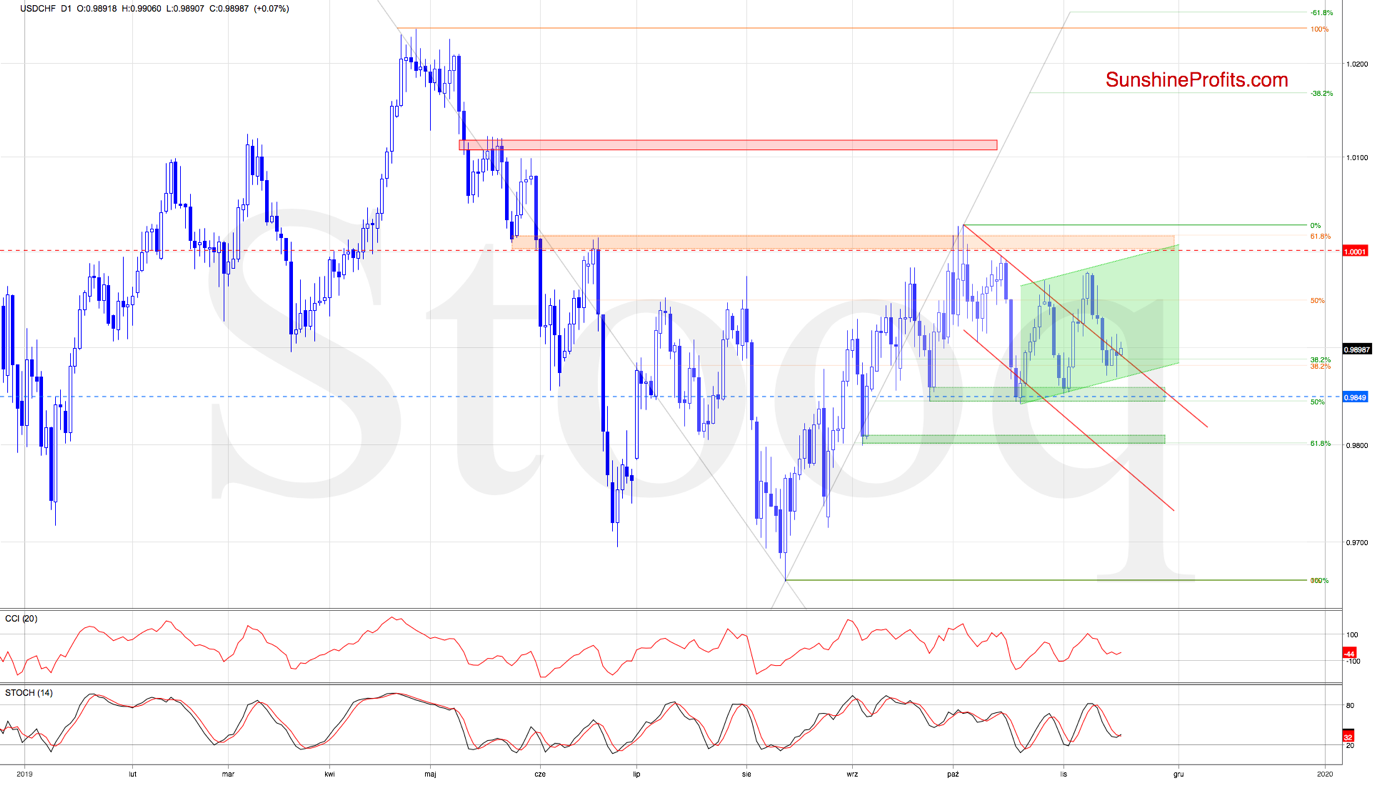

The Swiss Franc Isn't Looking For Direction. It's Bidding Its Time

November 19, 2019, 9:27 AMUSD/CHF

USD/CHF has been trading without much in terms of a clear direction recently. But employing the powerful tools of technical analysis lets us see the odds of the upcoming move. Let's dive into the analysis and see how it influences our open position.

Since our Thursday's commentary on the currency pair, USD/CHF has extended losses and approached the lower border of the rising green trend channel. This has encouraged the bulls to act.

The pair rebounded and climbed above the previously broken upper border of the declining red trend channel yesterday. The bulls couldn't however keep gained ground, and the exchange rate pulled back to close the day below the red line.

Earlier today, we've seen another hesitant move to the upside but taking into account the shape of yesterday's candle and overall situation in the USD Index (described below), another move to the downside is likely just around the corner.

Should it be the case, the way to at least the green support zone based on the previous lows would be open.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD, USD/JPY, and the USD Index. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

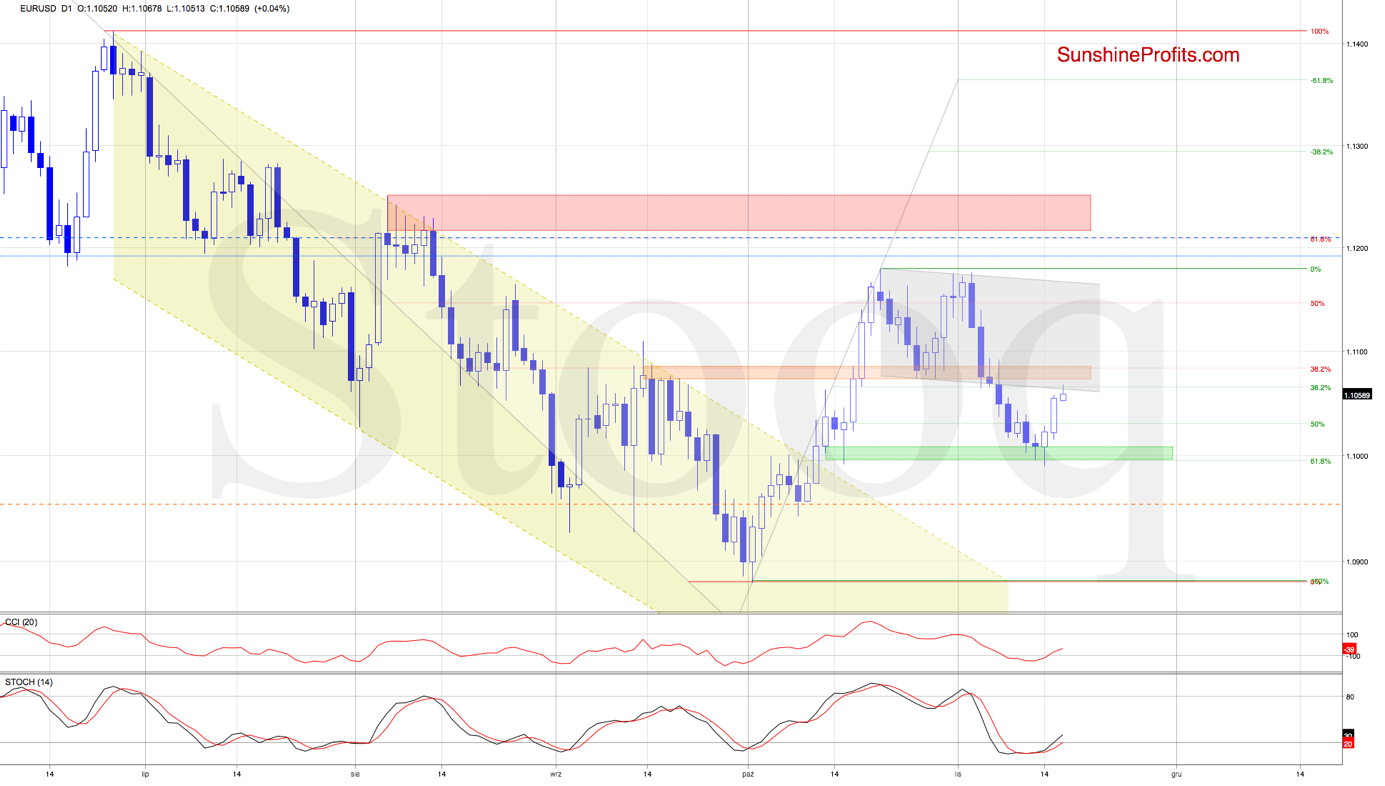

The Euro Bulls Are Back: Targets to Eye

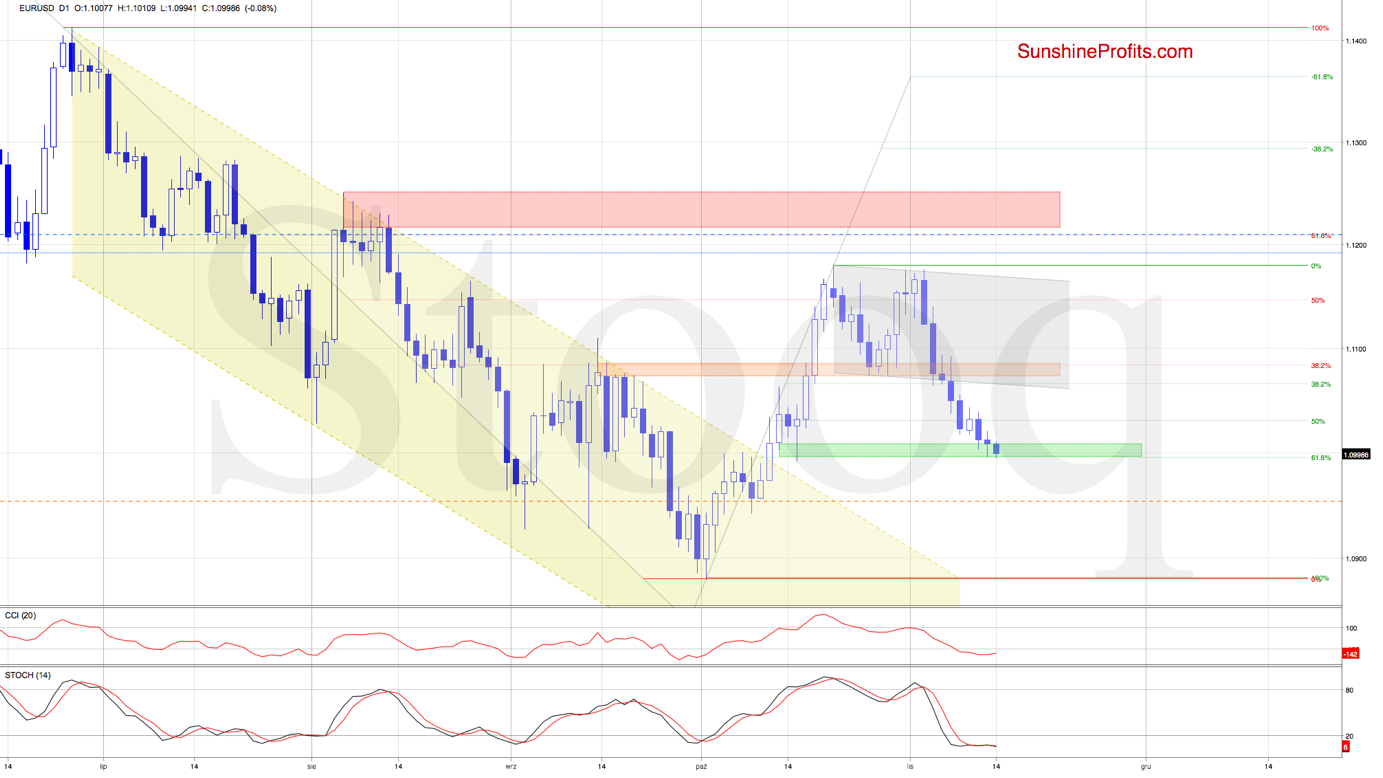

November 18, 2019, 10:33 AMEUR/USD

The euro has recently rebounded, and the pair is approaching resistance after swift Friday's action. Will the bulls be strong enough to overcome it - and if so, where exactly can their efforts take them?

These were our Friday's observations:

(...) The EUR/USD bears were stopped at the combination of the green support zone based on mid-Oct lows and the 61.8% Fibonacci retracement yesterday. A rebound followed, resulting in the exchange rate invalidating the earlier tiny breakdown below these supports.

This suggests further improvement, especially when we factor in the buy signals generated by the daily indicators.

Should it be the case and the pair extends gains from here, we'll see at least an increase to the previously broken lower border of the declining grey trend channel in the coming week.

The situation indeed developed in line with the above, and EUR/USD has reached the first above-mentioned upside target.

Then, both the CCI and the Stochastic Oscillator generated their buy signals, increasing the likelihood of further improvement in the very near future - even if we see a small pullback from current levels first.

Nevertheless, if the bulls prove strong enough to break higher, the way to the upper border of the grey channel (or even recent peaks) may be open.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in GBP/USD and AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

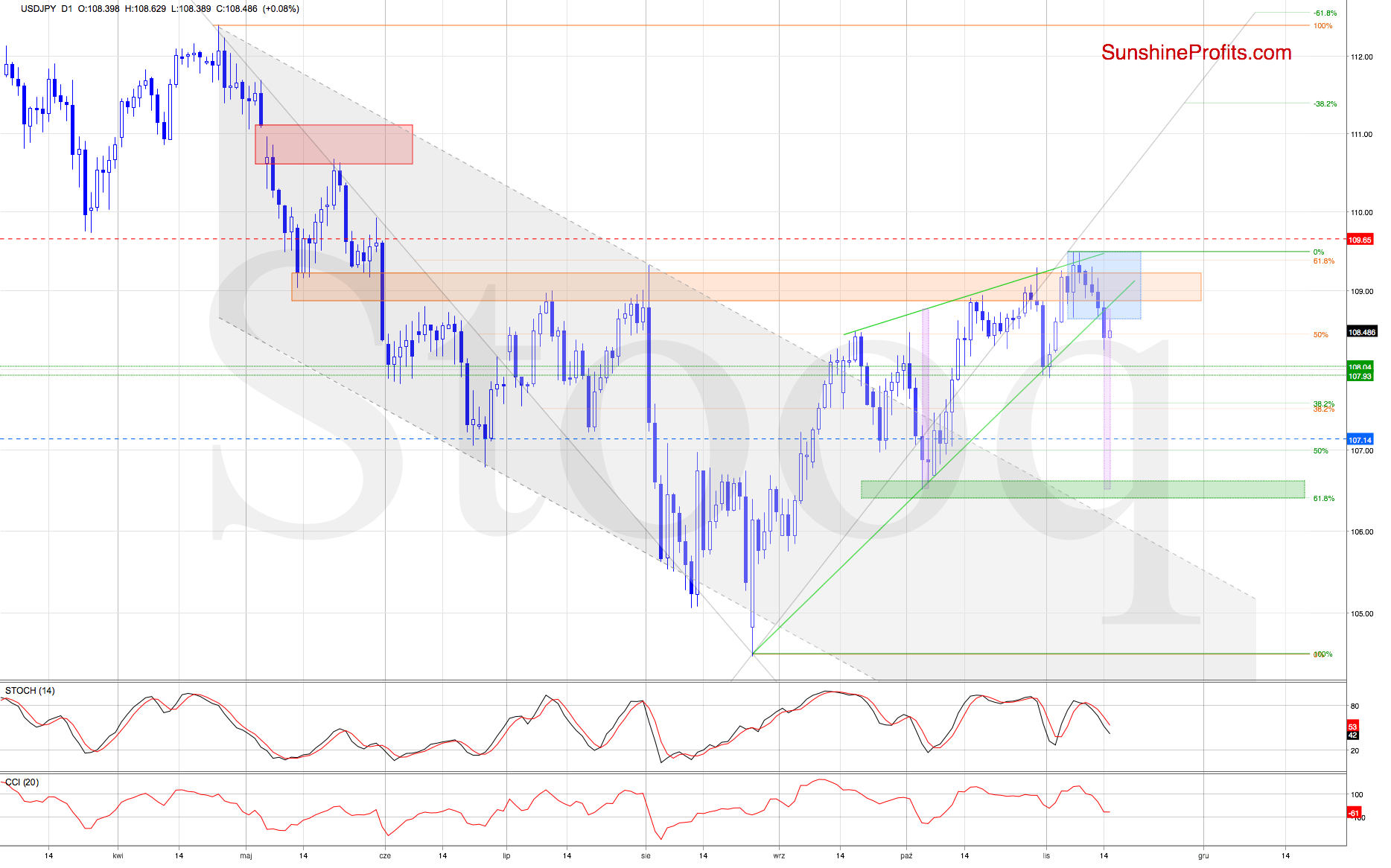

Finally, USD/JPY Hesitantly Rises Today. A Bit Too Cautiously?

November 15, 2019, 8:22 AMUSD/JPY

USD/JPY has been steadily decreasing in recent days, as the bulls had trouble overcoming the orange resistance zone. The pair has ended its losing streak with today's rise, however. Does it mark the end of its decline, or is there more to come?

Let's recall our Wednesday's commentary on this currency pair:

(...) USD/JPY recently attempted breakout above both the upper border of the rising green wedge, and the upper border of the orange resistance zone. It has been invalidated, though. The fact is that invalidation of a breakout is a bearish development.

Additionally, both the CCI and the Stochastic Oscillator have generated their sell signals, which increases the probability of upcoming deterioration.

The exchange rate is however still trading inside the blue consolidation and the rising green wedge. A bigger move to the downside will be more likely and reliable only if the bears push USD/JPY below the lower borders of both formations.

Should we see such price action, the way to the early-Nov lows will be open.

The situation has indeed developed in tune with the above, and the pair's move lower has made our short positions more profitable.

Yesterday brought us a breakdown below the lower border of the rising green wedge, which is a bearish development. This is especially the case when we factor in the sell signals generated by the daily indicators and yesterday's breakdown below the lower border of the blue consolidation.

Then, there is also today's tiny move to the upside, which looks like a verification of yesterday's breakdown below the consolidation. All in all, the short positions are justified from the risk/reward perspective, and it seems we won't have to wait long for the bearish scenario to be realized.

Indeed, yesterday's breakdown below the green wedge has opened the way to even lower levels. Should USD/JPY break below the support area created by the recent lows (marked with two horizontal lines on the above chart) the way to the green support zone created by the early-Oct lows and the 61.8% Fibonacci retracement would be then up for grabs.

Interestingly, this is where the size of the downward move would correspond to the height of the rising wedge, which raises the likelihood of the bears cashing profits in this area. In other words, should we see reliable signs of the bulls' weakness there, we could move our current profit target lower. It'll be interesting, so stay tuned.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/CAD The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The Euro Bulls Better Show Up and Soon

November 14, 2019, 7:24 AMEUR/USD

The euro has been having a hard time catching a bid recently. Yet the pace of its decline has slowed day-by-day. The say that when everyone piles up in one direction, the market tends to surprise in the other. Does it mean that the bears are to face stiff headwinds soon?

While EUR/USD moved lower once again earlier today, the combination of the green support zone based on mid-Oct lows and the 61.8% Fibonacci retracement continues to keep declines in check. That's still true at the moment of writing these words, as the pair keeps above 1.0990.

It means that our yesterday's observations are up to date also today:

(...) Let's examine the daily indicators. While they're in their oversold areas, the Stochastic Oscillator is on the verge of flashing its buy signal.

Connecting the dots, there is a high probability of a reversal being just around the corner.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in GBP/USD and USD/CHF. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold &

Forex Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM