-

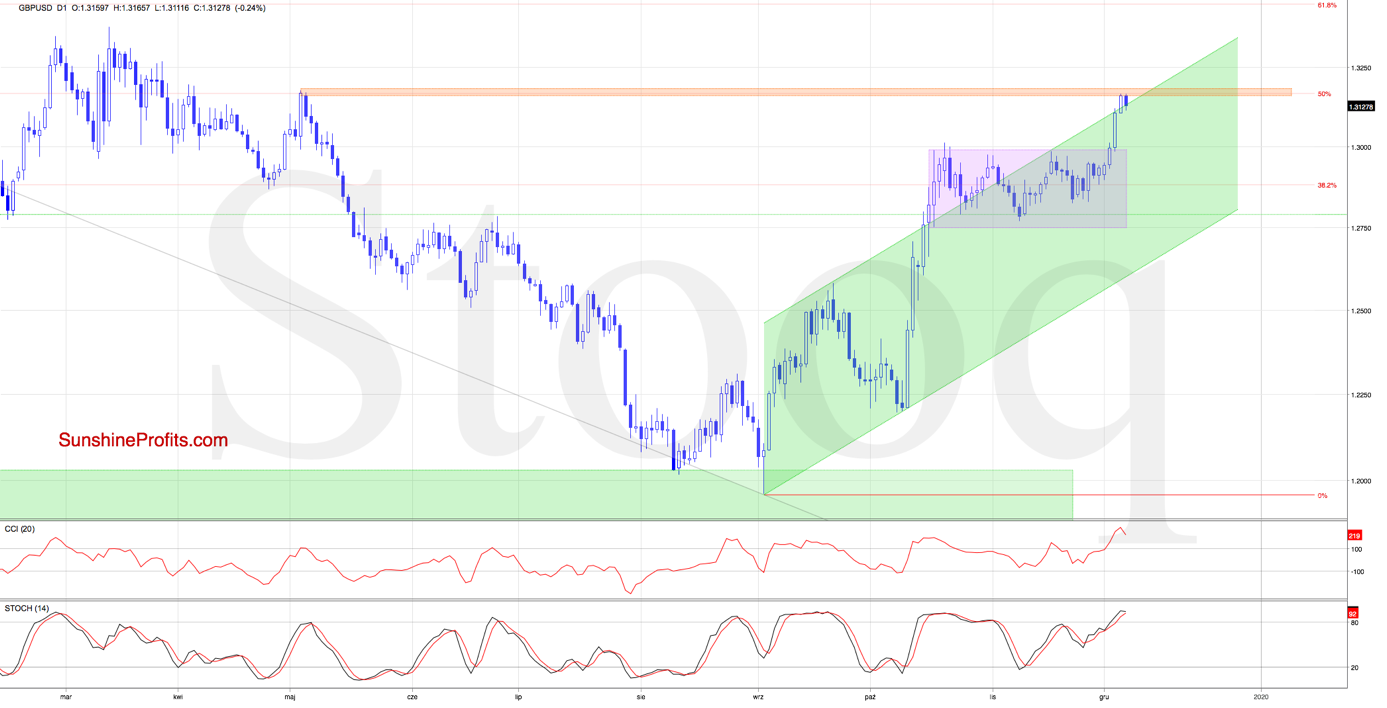

British Pound Struggling At New Resistance

December 6, 2019, 10:48 AMGBP/USD

For many weeks running, GBP/USD has been trading sideways in the pink consolidation. After moving higher recently, just what are the chances of the breakout sticking?

GBP/USD recently broke above the pink multi-week consolidation, and the bulls didn't really look back. The pair extended gains and reached the orange resistance area created by the May peaks, and the 50% Fibonacci retracement.

This move took the exchange rate also slightly above the upper border of the rising green trend channel. Before jumping to conclusions, let's take a look also at the position of the daily indicators. Both the CCI and the Stochastic Oscillator are very close to generating their sell signals.

Coupled with the above-mentioned resistance zone and the current position of the daily indicators, it seems that a reversal and lower values of GBP/USD may be just around the corner.

Should we see an invalidation of the breakout, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD, USD/JPY, USD/CAD, USD/CHF and also AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

This Is What a Serious USD/CHF Rebound Looks Like?

December 5, 2019, 6:59 AMUSD/CHF

After many a days' climb higher, USD/CHF bulls gave up all of their gains in two short sessions. They're making a recovery though, and it's worth asking what are its chances of sticking.

These were our Tuesday's observations regarding USD/CHF:

(...) The pair indeed reversed lower, and invalidated the earlier tiny breakout above both resistances. A sharp move to the downside followed yesterday, and we saw its continuation earlier today too.

Combined with the sell signals generated by the daily indicators, this increases the probability of not only seeing a test of the lower border of the rising green trend channel, but also of a re-test of the green support zone that is based on the late-September, October and early-November lows soon.

The pair went on to slip to our downside targets. The green support area encouraged the bulls to act though, and the exchange rate came back inside the green trend channel. This means invalidation of the earlier breakdown below it.

The sell signals of the daily indicators remain on the cards though, hinting at the high likelihood of another downswing ahead. This is especially so when we factor in the current situation in the USD Index.

Should the pair moves lower from here, we'll likely see a re-test of the green zone or even a move to the Oct 21 low in the very near future.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD, USD/JPY and the USD index. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The Australian Dollar Keeps Rising. A Fledgling Uptrend?

December 4, 2019, 9:34 AMAUD/USD

After a prolonged decline, the Australian dollar shot up recently. While swift and sizable, has the upswing been profound enough to turn the tide? Let's examine the technical outlook as it stands right now.

On one hand, AUD/USD broke above the upper border of the blue consolidation yesterday. On the other hand though, the 61.8% Fibonacci retracement stopped the buyers, and a pullback followed.

Earlier today, the pair extended losses and came back into the consolidation, which is a bearish development. Nevertheless, as long as there is no daily close inside the formation and the buy signals generated by the daily indicators remain on the cards, another attempt to move higher remains likely.

Should we see such price action, the bulls will likely test not only the 61.8% Fibonacci retracement, but also the medium-term declining grey resistance line in the coming days.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/CAD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. Subscribe today and stay informed.

-

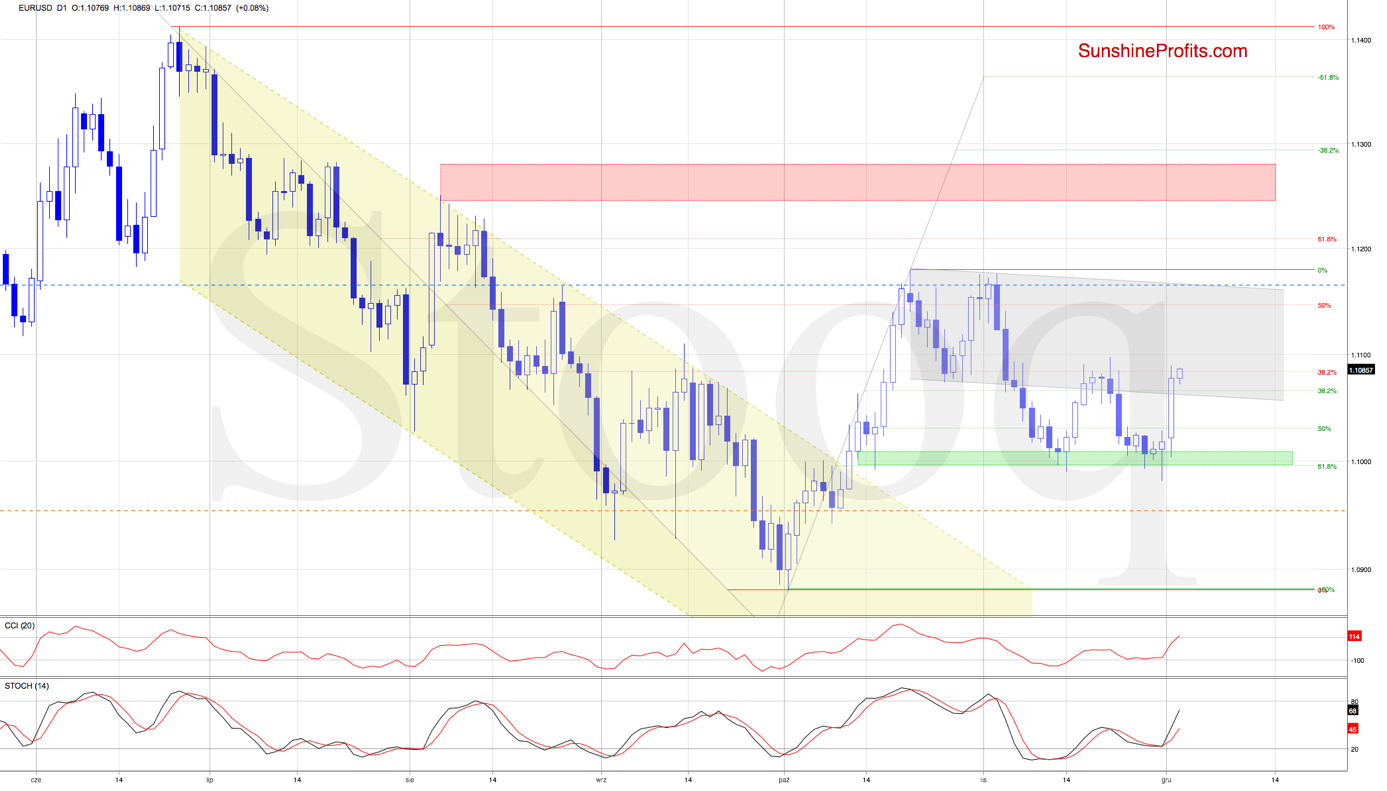

We Hope the Swift EUR/USD Recovery Didn't Leave You in the Dust

December 3, 2019, 10:08 AMEUR/USD

EUR/USD has been flirting with the green support zone recently, yet strongly rebounded yesterday. Was it a surprise? Not if you're reading our analysis. Enough tooting our horn, what's next in store for the pair?

These were our yesterday's observations:

(...) While EUR/USD slightly decline on Friday, the green support zone coupled with the 61.8% Fibonacci retracement stopped the sellers. A rebound followed, and the pair finished the day above the said support. This way, the tiny intraday breakdown below it has been invalidated.

In mid-November, we have seen similar price action, which suggests that reversal followed by higher values of the exchange rate may be just around the corner. This is especially so when we factor in the position of the daily indicators. Both the CCI and the Stochastic Oscillator have generated their buy signals just as they did in mid-November, which increases the likelihood of further improvement this week.

The situation developed in line with expectations, and the exchange rate moved sharply higher during yesterday's session. This upswing brought the pair back above the previously broken lower border of the declining grey trend channel, and the earlier breakdown was invalidated this way.

Additionally, both the CCI and the Stochastic Oscillator generated their buy signals, lending more support to the bulls.

Earlier today, we saw another attempt to move higher. It's our opinion that further rally will be more likely and reliable only if the exchange rate breaks above the late-November peaks.

Should the bulls prove strong enough and overcome that 1.1100 mark, the way to the upper border of the grey trend channel would be open.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in USD/JPY and USD/CHF. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

-

The Curious Case of Consolidating Canadian Dollar

December 2, 2019, 8:13 AMUSD/CAD

After the preceding upswing, USD/CAD has been trading in a tight range recently. With the declining trend channel's upper border at hand, and the orange resistance zone nearby, what are the chances of upswing continuation?

Similarly to GBP/USD, neither for USD/CAD has the short-term picture changed much. The pair is still trading inside the blue consolidation around the upper border of the declining red trend channel.

Unless there is no breakout above the upper border of the formation or breakdown below its lower border, another bigger move is not likely to be seen. Short-lived moves in both directions wouldn't surprise us in the least.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and GBP/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products. And besides, you can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. Subscribe today and stay informed at very preferred terms.

Free Gold &

Forex Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM