In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the exit target at 1.3019)

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 1.0001; the initial downside target at 0.9849)

- AUD/USD: none

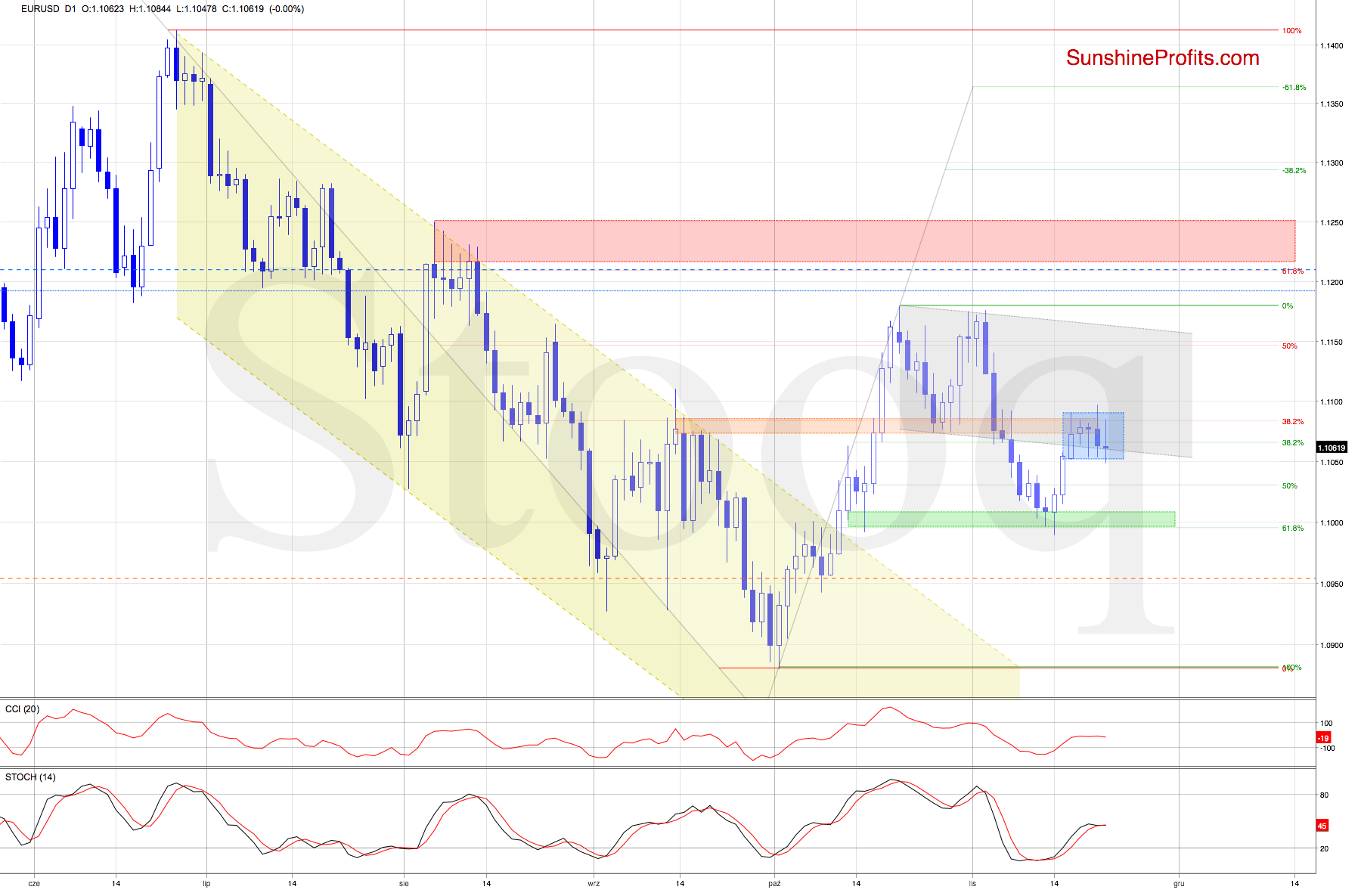

EUR/USD

The short-term situation hasn't really changed since yesterday. EUR/USD is still trading inside the blue consolidation, which means that our yesterday's observations are up-to-date also today:

(...) The daily indicators' buy signals remain on the cards, and they support further improvement in the very near future.

Should the bulls move higher from current levels and break above the Nov 6 and Nov 7 peaks, the way to the upper border of the grey trend channel (or even the recent peaks) may be open.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

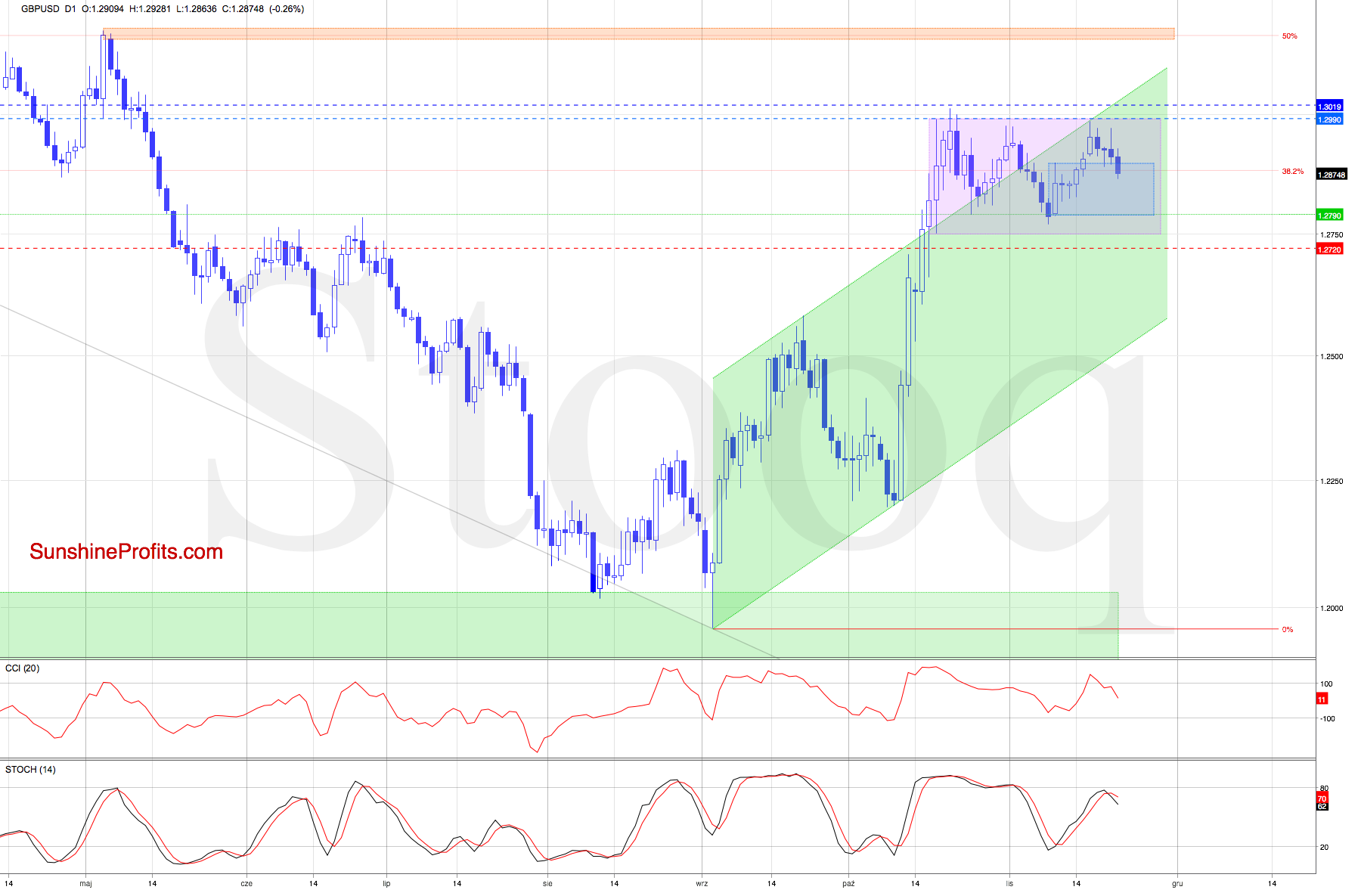

GBP/USD

GBP/USD has been wandering up and down in recent weeks, stuck in a wide consolidation. The bears seem to be having the upper hand now, but can their gainful series continue? Let's examine the chart's standing this very moment (charts courtesy of www.stooq.com )

GBP/USD has extended losses for the third session running, hinting at the bulls' strength. Or rather, the lack thereof as the recent highs coupled with the upper border of the purple consolidation and the upper border of the green rising trend channel may be too strong for them.

Today's downswing took the pair below the bullish gap created at the beginning of the week. Should we see the gap closed, and a breakout above the upper border of the blue consolidation invalidated, we'll consider closing our long positions.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.2720 and the exit target at 1.3019 are justified from the risk/reward perspective.

USD/CAD

USD/CAD pulled back yesterday, finishing below the previously broken upper border of the declining red trend channel. This is certainly a bearish development.

Earlier today, the pair rebounded slightly, and moved again to the upper border of the trend channel. There was however no breakout above it, which suggest that this move could be nothing more than verification of yesterday's decline back into the channel.

Should it be the case, we could witness another reversal and lower values of the exchange rate. Such price action will be more likely and reliable though only if the pair closes today's session inside the channel.

If we see such price action, we'll consider opening short positions.

But if the bulls push the pair back above the trend channel on a closing basis, the way to the recent peaks of even the orange resistance zone and the 61.8% Fibonacci retracement would be open.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist