-

Can the Euro Bulls Overcome the Array of Bearish Signs?

October 28, 2019, 9:28 AMEUR/USD

In our Friday's EUR/USD commentary, we highlighted the bulls' problems with breaking the 50% Fibonacci retracement. What happened with EUR/USD in the hours following the Alert's publication? Let's check the chart below.

On Friday, we also wrote that even if the exchange rate manages to move lower from current levels, the bears would have to overcome two supports: the lower border of the potential purple trend channel and the previously-broken orange area that serves as support now.

Today's chart reveals that the sellers pushed the exchange rate below the green horizontal support line during Friday's session. This is certainly a bearish development. It triggered further deterioration, translating into the breakdown below the lower line of the declining purple trend channel.

Additionally, the pair closed the day below both supports, and both the CCI and Stochastic Oscillator generated their sell signals. EUR/USD slipped to the orange support zone, which encouraged the bulls to fight for higher values earlier today.

The pair rebounded and came back into the purple channel, which suggests that we could see an invalidation of Friday's breakdown in the following hours. If it happens, we could also see an attempt to move above the green line or even higher.

Regardless of the many bearish omens, it is therefore not justified from the risk/reward perspective to open short positions at the moment of writing these words.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, we will carefully observe the actions of both, bulls and bears, in the areas discussed today, waiting for more clear clues as to the direction of the next bigger move.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in USD/JPY and USD/CAD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Will the British Pound Bulls Prove Their Mettle?

October 25, 2019, 12:04 PMGBP/USD

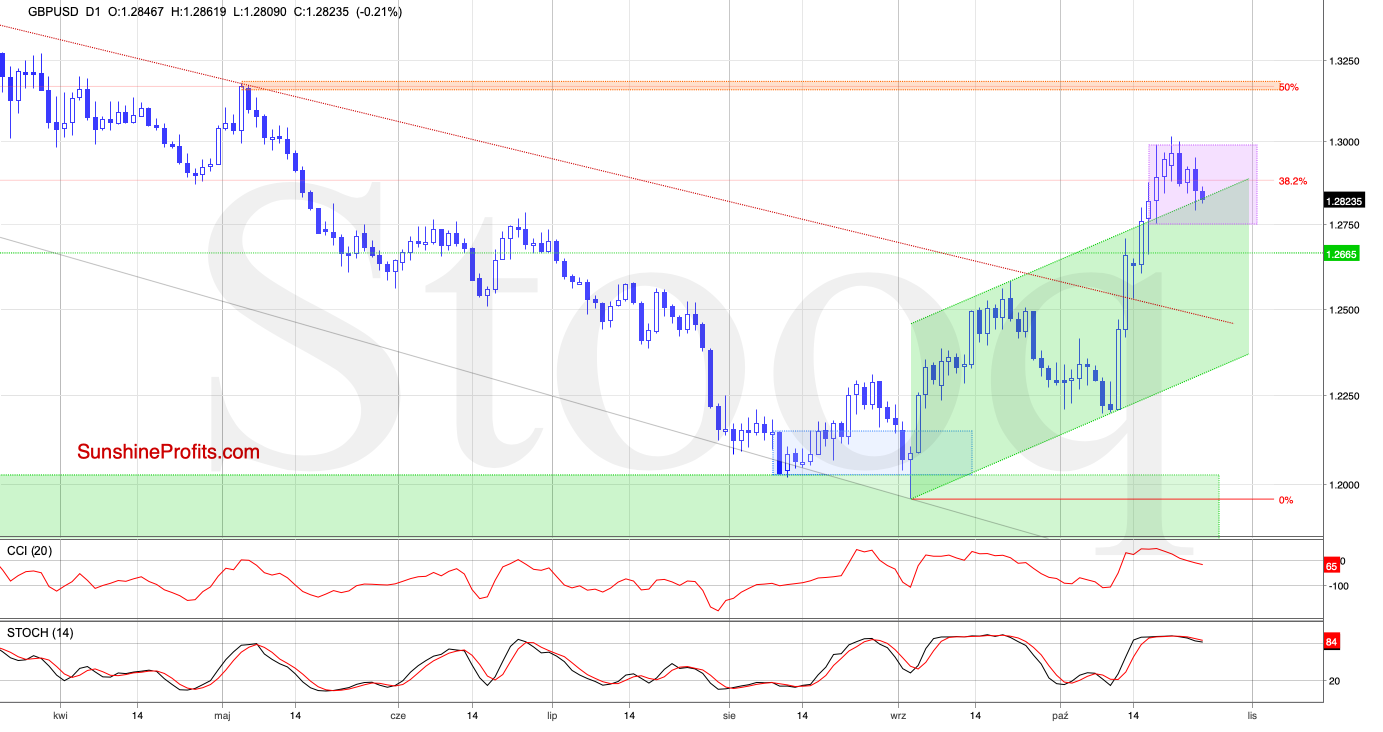

In yesterday's alert we also discussed recent developments in this currency pair. We focused on the breakout above the upper border of the green rising trend channel and its implications, as well as the bulls' struggles with the psychological barrier of 1.300.

How did the buyers deal with this resistance? Let's take a look at the chart below.

We see that the bulls failed and didn't manage to break above the mentioned psychologically important level. This caused a downside move during recent sessions.

Thanks to yesterday's drop, the pair tested the previously-broken upper border of the rising green trend channel. The pair rebounded and closed the day still above the channel.

Despite this positive event, the bears moved once again earlier today, and GBP/USD slipped to the upper border of the channel for the second time in a row. Additionally, the CCI and the Stochastic Oscillator generated sell signals increasing the probability of further deterioration.

But will we see such price action? In our opinion, as long as there is no daily close back inside the channel (in other words, as long as the pair doesn't invalidate last week's breakout above the channel), another rebound from here can't be ruled out and opening short positions is not yet justified from the risk/reward point of view.

Should we see an invalidation of the breakout above this important support, we'll consider going short.

What could happen if the bulls do not manage to hold these levels? Comeback into the channel could translate into a drop to around 1.2500 or even lower, where the previously-broken red declining line currently is, serving as an additional support.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Thank you.

-

Green Shoots of Canadian Dollar Turnaround?

October 24, 2019, 11:09 AMUSD/CAD

The first thing catching our eyes on Tuesday's USD/CAD chart, was the invalidation of the earlier breakdown below the lower border of the short-term trend channel. Additionally, the exchange rate came back above the green horizontal line based on the late-July low that day, which gave the bulls another reason to act.

While these are positive developments for the bulls, and the daily indicators show oversold readings, we decided to focus on the buyers' behavior around the mentioned green line instead of opening positions based on unconfirmed signals.

Was that a good decision? Let's take a closer look at the chart below to find out.

While the buyers overcame two previously-broken lines, they didn't manage to close recently above the green line, which caused a pullback on Tuesday.

On the following day, the bulls tried to go north once again, but they failed for the second time in a row, and their weakness encouraged the bears to act.

As a result, USD/CAD slipped below the declining red trend channel, invalidating the prior positive developments. Earlier today, we noticed one more attempt to move higher, but the bulls disappointed just as previously, and the pair remains trading below the lower border of the formation.

What does it mean for the exchange rate?

If the buyers do not manage to come back into the channel later in the day, we should treat today's upswing as nothing more than verification of yesterday's breakdown. If the situation develops in line with the above, we'll likely see further deterioration and a test of the green support area created by the July lows in the very near future.

Finishing today's USD/CAD commentary, we would like to add that the CCI and the Stochastic Oscillator are very close to generating their buy signals, increasing the probability of reversal in the coming day(s).

Should we see reliable signs of the bulls' strength, we'll consider opening long positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/JPY. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

About Those Keenly Watched Opportunities

October 23, 2019, 9:33 AMEUR/USD

In our yesterday's commentary on this currency pair, we wrote that EUR/USD climbed slightly above the late August peak and the 50% Fibonacci retracement, but then the bulls lost strength. This translated into a pullback at the beginning of this week.

Additionally, we assumed that if the bears take over the market, the exchange rate could test the previously-broken green horizontal line based on the last month's peak.

What happened after our Alert was posted? Let's check.

From today's point of view, we see that the pair extended losses and reached our first downside target. The sell signal generated by the Stochastic Oscillator remains on the cards, giving support to the bears.

Nevertheless, we think that as long as there is no daily close below the above-mentioned line, a reversal from here and a test of the 50% Fibonacci retracement or even the recent high can't be ruled out. Therefore, we decided to keep our cool and refrain from opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, we will carefully observe the actions of both the bulls and bears, in the areas discussed today, waiting for more clear clues as to the direction of the next bigger move.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. In the full version we discuss also the current situation in GBP/USD and USD/CHF. The full Alert includes more details about levels to watch before deciding to open next positions. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold &

Forex Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM