In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the exit target at 1.3019)

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 1.0001; the initial downside target at 0.9849)

- AUD/USD: none

EUR/USD

While EUR/USD bounced off the lower border of the very short-term blue consolidation yesterday, the pairhasn't yet broken out of it. It means that the short-term outlook is little changed, and that our yesterday's observations remain valid also today:

(...) The daily indicators' buy signals remain on the cards, and they support further improvement in the very near future.

Should the bulls move higher from current levels and break above the Nov 6 and Nov 7 peaks, the way to the upper border of the grey trend channel (or even the recent peaks) may be open.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

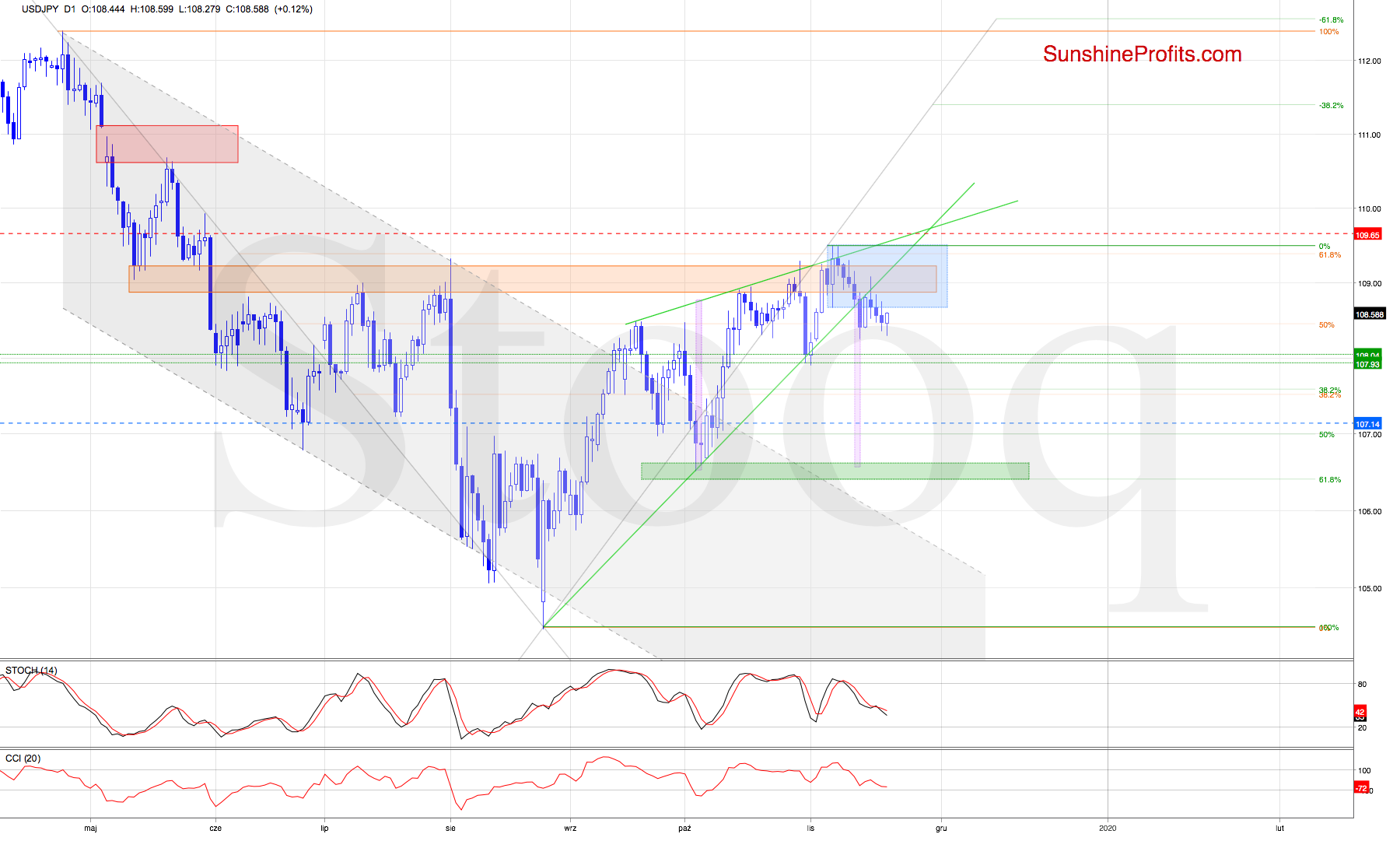

USD/JPY

Let's recall our Tuesday's commentary:

(...) While USD/JPY bounced higher in recent days, the bulls only reached the previously broken lower border of the rising green wedge. Such price action is likely nothing more than verification of the earlier breakdown.

We've indeed seen that the pair has declined recently, which points to the previous upswing being merely a verification of the earlier breakdown below the lower border of the rising green wedge.

Earlier today, the pair made another attempt to move higher, but keeps trading not only well below the previously-mentioned green wedge, but also below the lower border of the preceding blue consolidation.

All in all, today's upswing appears to be nothing more than verification of the breakdown below the said formation.

Should the bulls lack strength to close above the consolidation's lower border (thus invalidating the earlier breakdown below it), the bearish scenario described on Friday would likely come true:

(...) Should USD/JPY break below the support area created by the recent lows (marked with two horizontal lines on the above chart) the way to the green support zone created by the early-Oct lows and the 61.8% Fibonacci retracement would be then up for grabs.

Interestingly, this is where the size of the downward move would correspond to the height of the rising wedge, which raises the likelihood of the bears cashing profits in this area. In other words, should we see reliable signs of the bulls' weakness there, we could move our current profit target lower. It'll be interesting, so stay tuned.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.03 and the initial downside target at 107.14 are justified from the risk/reward perspective.

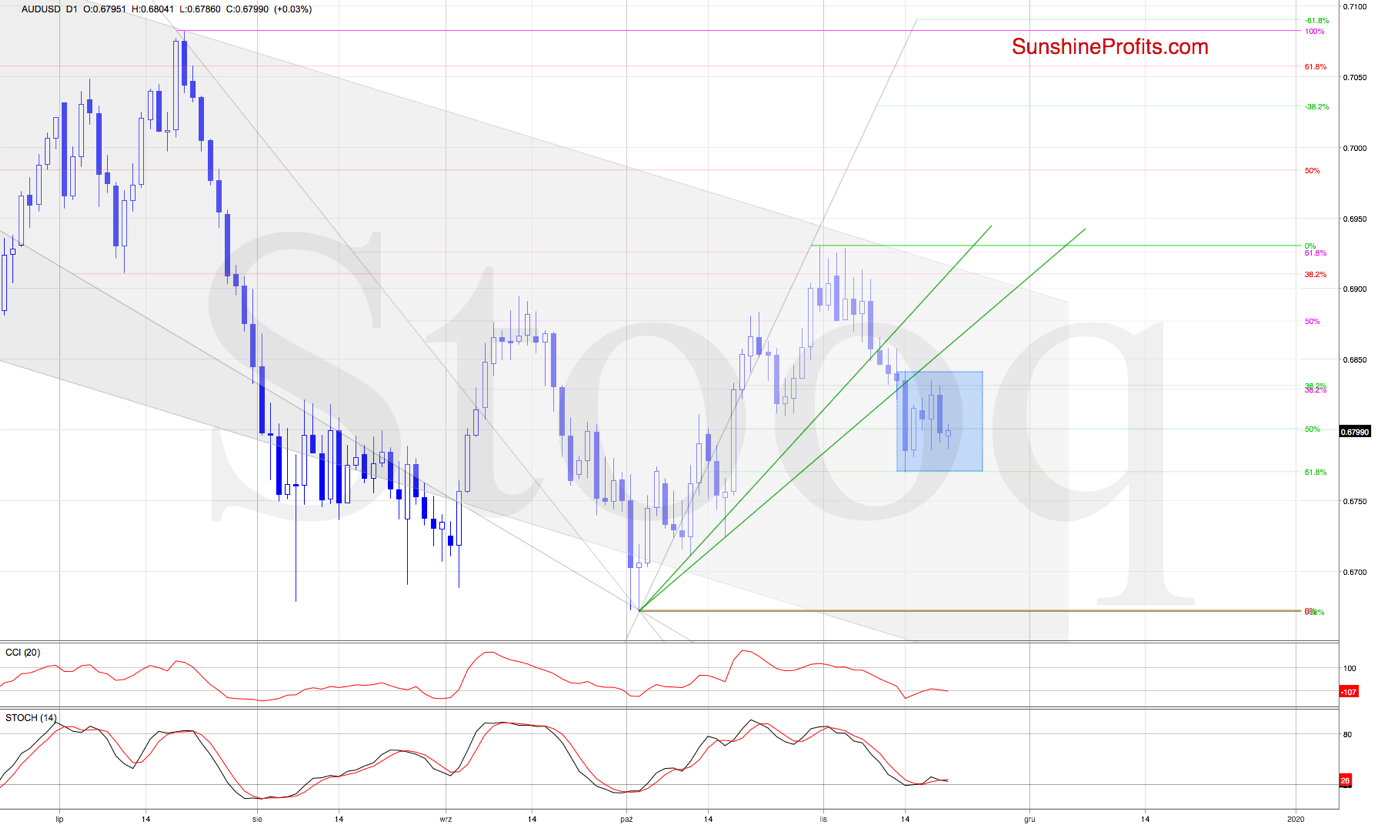

AUD/USD

The Australian dollar has recently broken below two important supports, and went on to tread water in a not-so-tight trading range. Is it rather the bulls or the bears who has the upper hand here?

Lacking clear direction, AUD/USD remains trading inside the blue consolidation. This means that as long as we do not see either a breakout above the upper border of the formation or a breakdown below its lower border, another bigger move is not likely to be seen. Short lived moves in both directions should not surprise us in the following days.

The examination of the daily indicators reveals though that the bulls will try to push the pair higher in the coming week. Should we see such price action, the first upside target would be the previously broken lower green line based on the previous lows.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist