In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the exit target at 1.3019)

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 1.0035; the initial downside target at 0.9849)

- AUD/USD: none

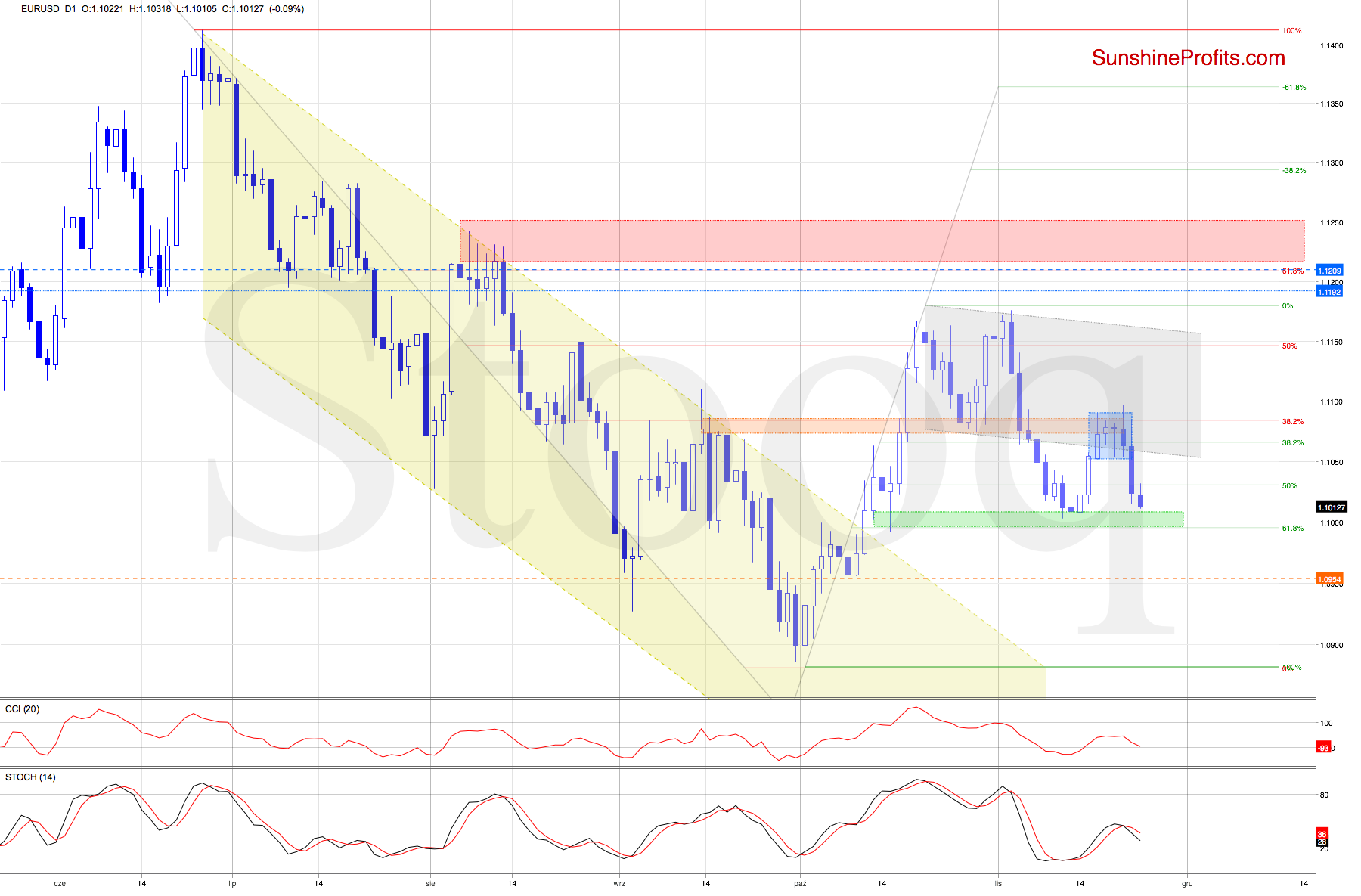

EUR/USD

On Friday, EUR/USD broke below the blue consolidation, and the move turned out to be a sharp one. The pair closed the week near the daily lows.

Earlier today, follow-through selling came, and with it the increased likelihood of testing the green support area, the 61.8% Fibonacci retracement and the recent lows in the very near future.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

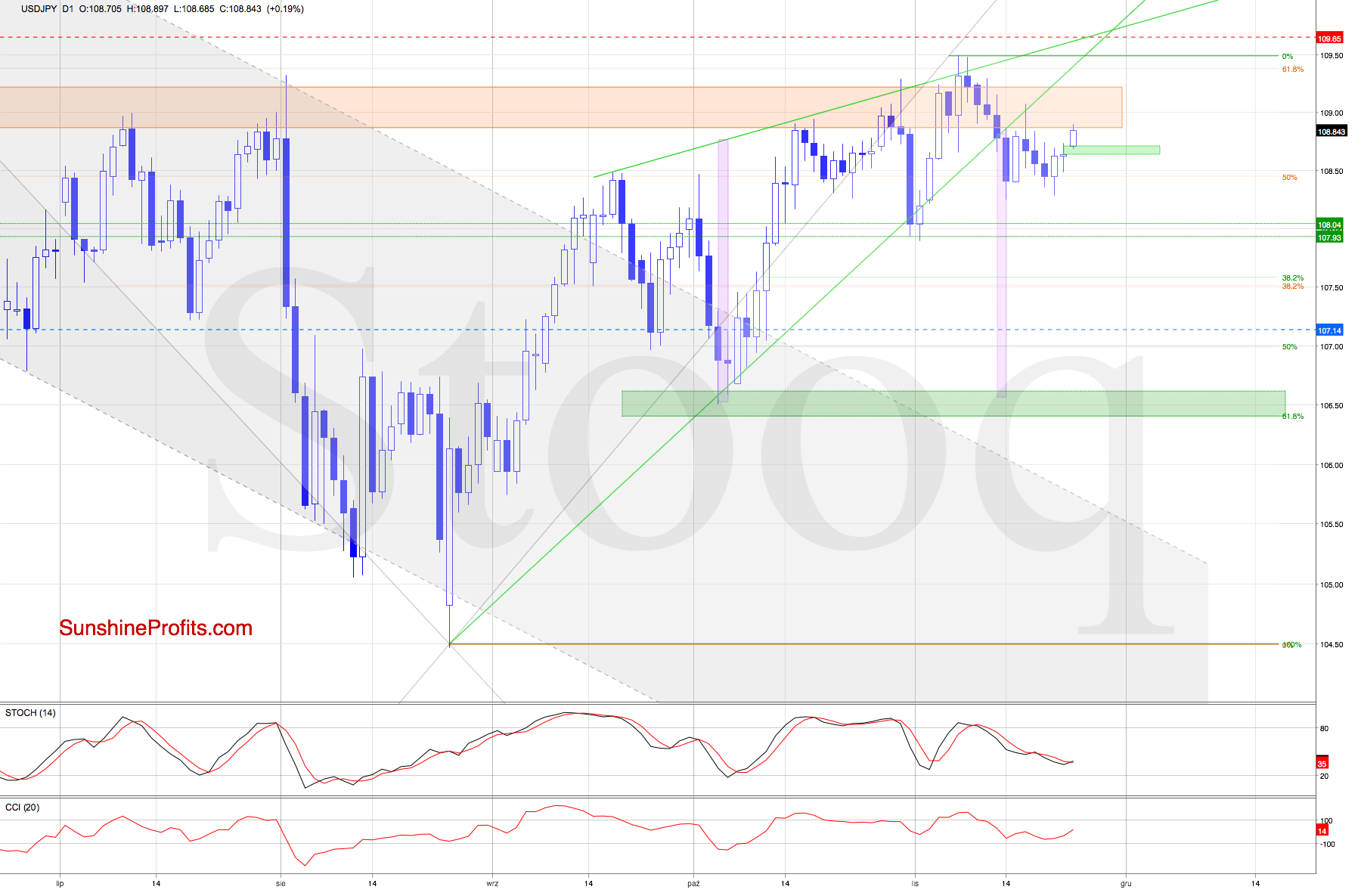

USD/JPY

After breaking below the green wedge, the pair has kept trading below another important resistance, the orange zone. How likely is it that the bulls will muster enough strength and break higher?

USD/JPY opened today's session bullishly with a green gap, and went on to extend gains in the following hours. Despite the upswing, the exchange rate is still trading below both the orange resistance zone and the previously broken lower border of the rising green wedge. It means that as long as there is no breakout above these key resistances, another downward reversal remains likely.

Should we see such price action and USD/JPY indeed moves lower in the coming days, the first downside target for the bears will be around 107.93-108.04. This is where the nearest support area (created by the lows at the turn of Oct and Nov) is.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.03 and the initial downside target at 107.14 are justified from the risk/reward perspective.

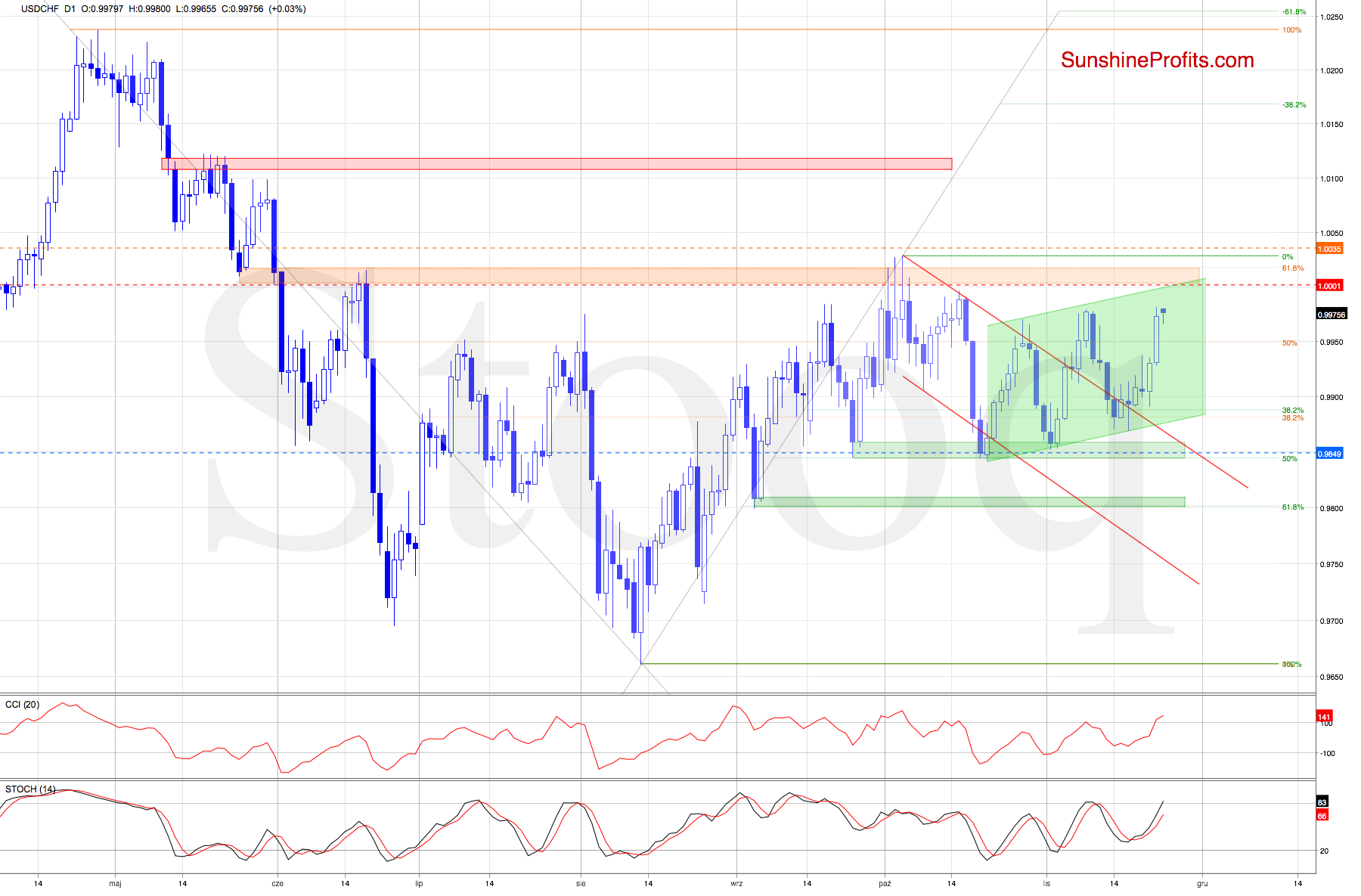

USD/CHF

USD/CHF extended its gains above the previously broken upper border of the declining red trend channel recently. The pair came near the resistance area created by the upper border of the rising green trend channel and the orange resistance zone. Together, they have been strong enough to stop the sellers several times in the past already.

Therefore, as long as there is no breakout above them, another bigger move to the upside is not likely to be seen and a reversal wouldn't surprise us in the least.

Trading position (short-term; our opinion): Short positions with a fresh stop-loss order at 1.0035 and the initial downside target at 0.9849 are justified from the risk/reward perspective.

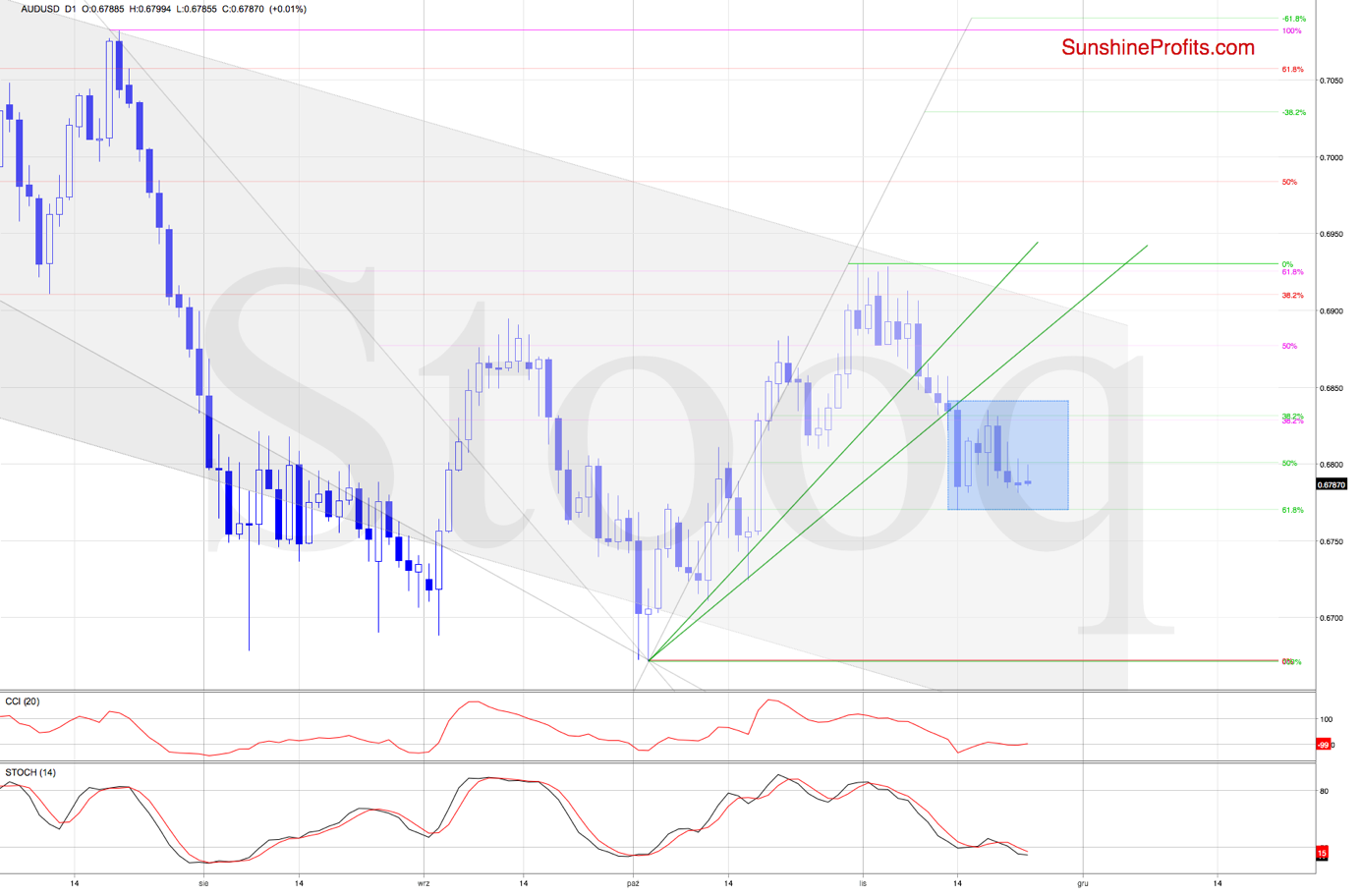

AUD/USD

AUD/USD keeps trading inside the blue consolidation, which means that our Thursday's commentary is up-to-date also today:

(...) as long as we do not see either a breakout above the upper border of the formation or a breakdown below its lower border, another bigger move is not likely to be seen. Short lived moves in both directions should not surprise us in the following days.

The examination of the daily indicators reveals though that the bulls will try to push the pair higher in the coming week. Should we see such price action, the first upside target would be the previously broken lower green line based on the previous lows.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist