-

Impending USD Bottom Means Gold’s Plummet is Close at Hand

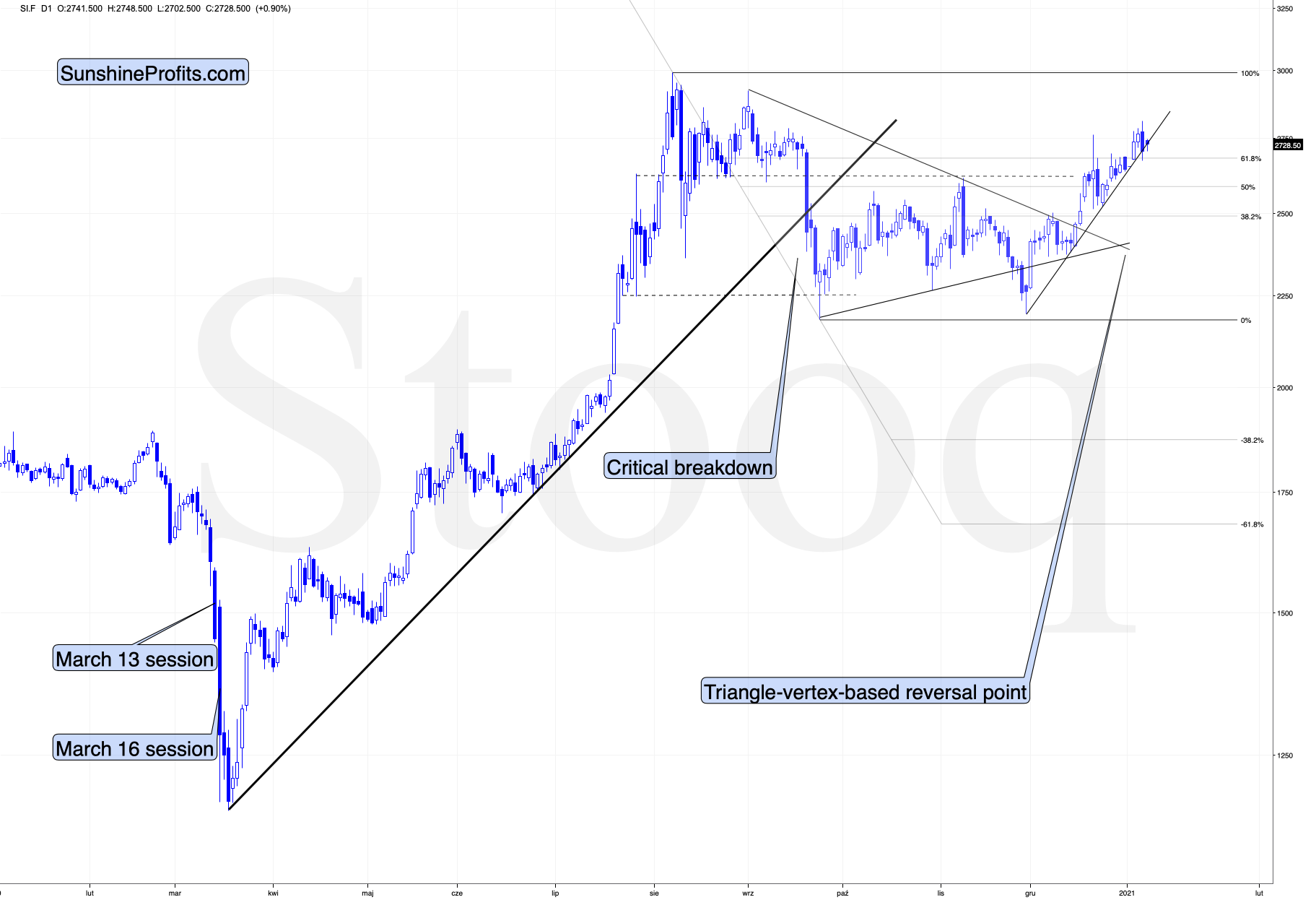

January 7, 2021, 8:32 AMGold prices eased on Thursday (Jan. 7), the first time they did so after experiencing a strong start to the year, and the dollar remains firm for the moment. In the first days of January 2021, gold was likely to top at its triangle-vertex-based reversal, similarly to what it did in November, and that’s exactly what happened.

Figure 1 - COMEX Gold Futures

The daily slide was not as big as the one we saw in early November, but the rally in the USD Index was also not as big as the one in early November.

Figure 2 - USD Index

In fact, the USD Index closed yesterday’s (Jan. 6) session just slightly higher in terms of the futures prices, and it actually closed slightly lower in ETF terms (UUP ETF in this case).

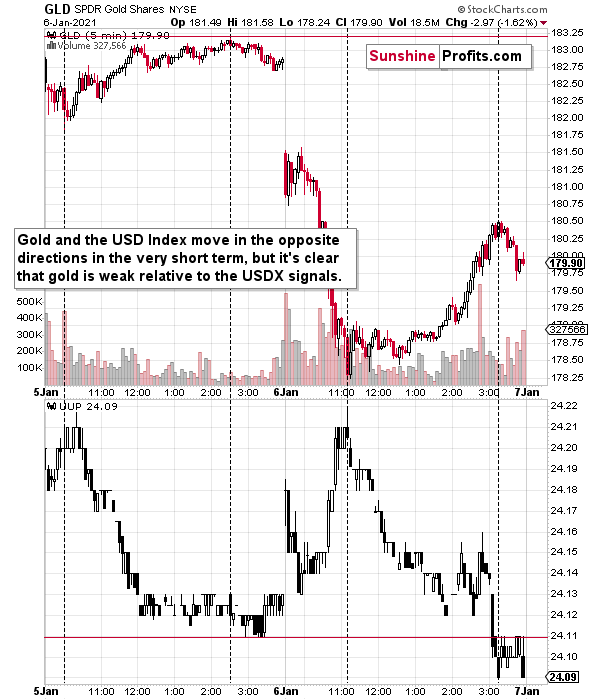

Figure 3 - SPDR Gold Shares (GLD) and Invesco DB US Dollar Index Bullish Fund (UUP)

Comparing both ETFs with identical opening and closing hours, we see how closely gold was reacting to moves in the U.S. currency, but at the same time how it was magnifying the USD’s rallies (by declining more) and how it was mostly ignoring the USD’s declines (by rallying less).

Ultimately, the UUP ETF ended yesterday’s session slightly below the Jan. 5 closing price, and the GLD ETF didn’t end above its Jan. 5 closing price. Conversely, it didn’t even manage to erase half of the intraday decline before the closing bell.

The above tells us that if the USD Index rallies more visibly here and breaks above the declining resistance line in a decisive manner, gold would be likely to truly plunge.

And that’s exactly what’s likely to happen! The USD Index is extremely oversold and just a little strength here will allow it to break above the steep resistance line.

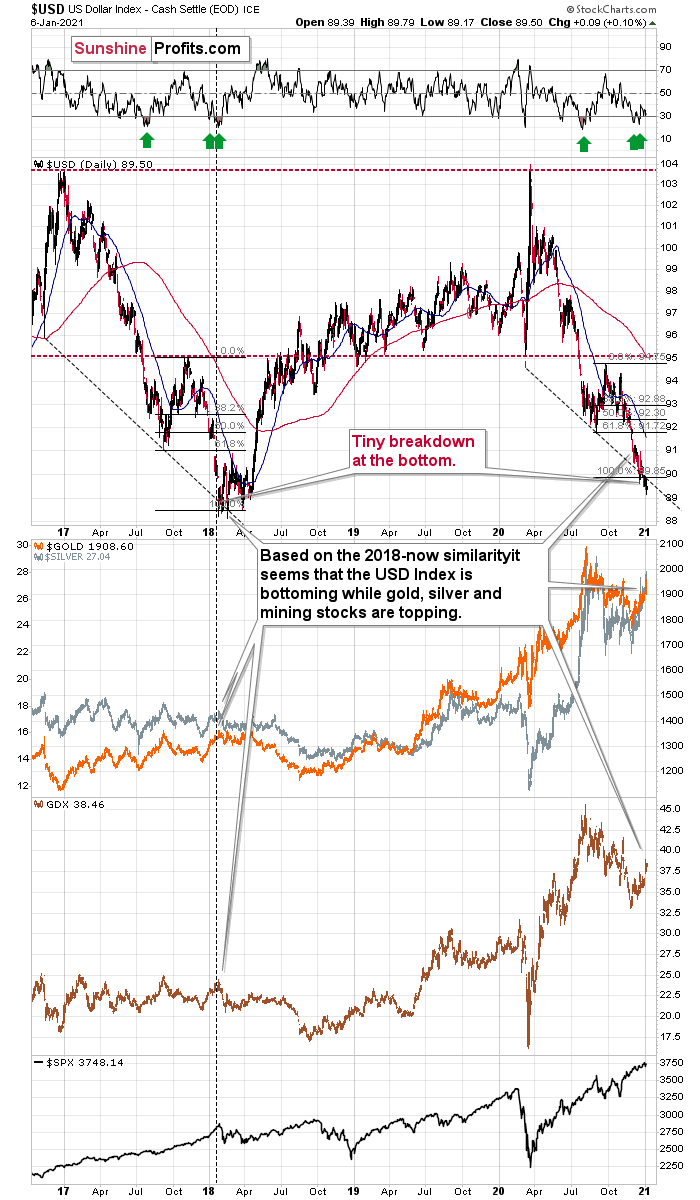

Figure 4 -USD Index (ICE), USD, GOLD, GDX, and SPX Comparison

With the situation looking just like it did in early 2018, it seems that the USD index is bottoming, and the precious metals sector is topping.

The USD Index is slightly below the Fibonacci-extension-based target based on the size of the most recent corrective upswing and the declining dashed resistance line. The same situation in 2018 (also please note that cryptocurrencies are in a price bubble now just like they were in early 2018) meant that the final bottom was already in. The situation in the RSI indicator is similar as well.

Let’s get back to gold.

Figure 5 - COMEX Gold Futures

Please note that after topping at its triangle-vertex-based reversal, gold then declined but stopped at its rising support line.

Figure 6 - COMEX Silver Futures

Silver did pretty much the same thing.

They both stopped where they were likely to stop, which is quite normal. The USD Index didn’t rally yet in a particularly visible way and the UUP ETF even declined somewhat yesterday. But the day when the PMs are going to get a significant push lower is coming. It’s likely very, very close. And then, once gold and silver break below their rising support lines, we’ll see significantly lower prices.

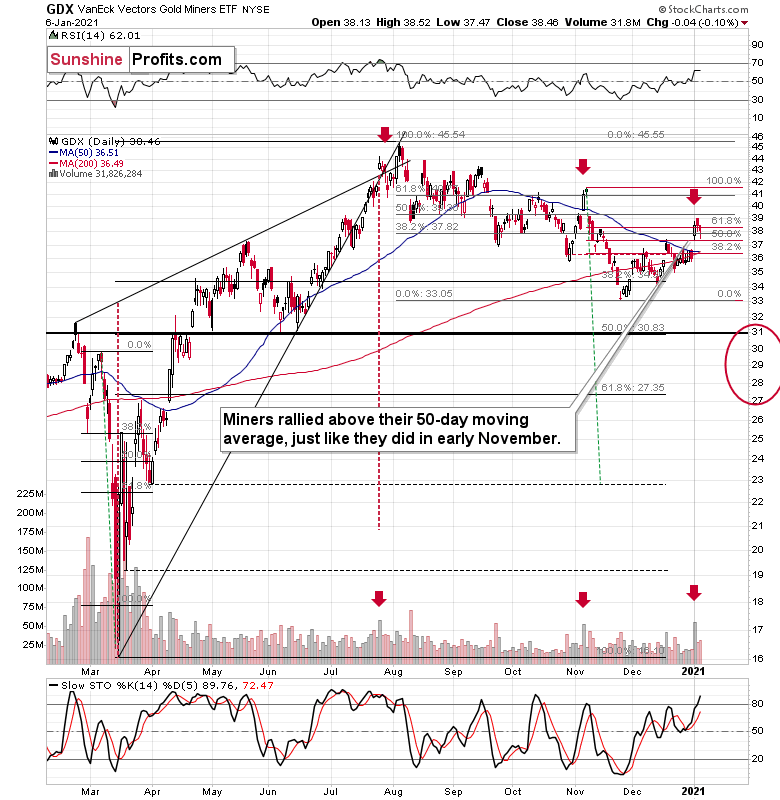

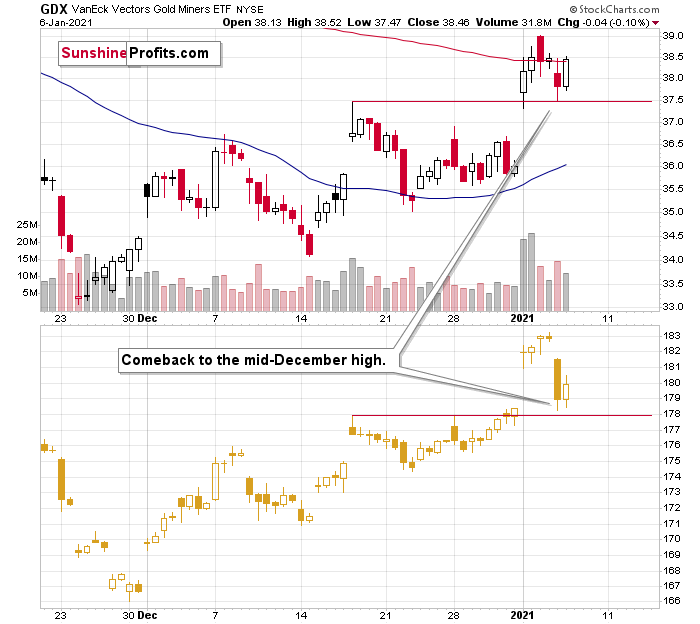

Figure 7 - VanEck Vectors Gold Miners ETF (GDX) and Slow Stochastic Oscillator (Slow STO) comparison

Mining stocks moved somewhat lower yesterday, but the decline was relatively small at first sight. Are miners showing strength here?

Let’s take one more look at the GDX while comparing it with the GLD ETF so that they both have the same opening and closing hours.

Figure 8 - GDX and GLD ETFs comparison

As you can see, both ETFs have actually moved to their mid-December highs and then moved back up yesterday. The GDX corrected a bit more of the daily decline, but nothing more.

What seems like a show of strength is more of an intraday price noise. If this persists and miners hold up well despite gold’s declines, it might be a bullish indication, but it’s way too early to draw bullish conclusions from miners’ performance.

The spike in volume in the GDX ETF that we saw recently continues to emphasize the similarity between the recent top, the November top, and the late-July top. The implications remain bearish.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Taking EUR/USD Profits Off the Table

January 10, 2020, 9:53 AMEUR/USD

After a string of recent losses, the pace of decline in the common currency has moderated. Is a cautious approach the call of the day now?

Earlier today, EUR/USD extended losses and slipped to 1.1085, almost touching our downside target. This has made our short positions even more profitable. In the following hours, the exchange rate rebounded slightly, which could translate into a bigger move to the upside in the coming week.

Therefore, so as not to compromise on cashing our open profits, we decided to close our short positions and take money off the table. Should we see more reliable signs confirming the upper hand of either the bulls or the bears, we'll consider opening new positions. Standing aside is the most reasonable course of action from the risk-reward perspective now. As always, we'll keep you informed.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and GBP/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

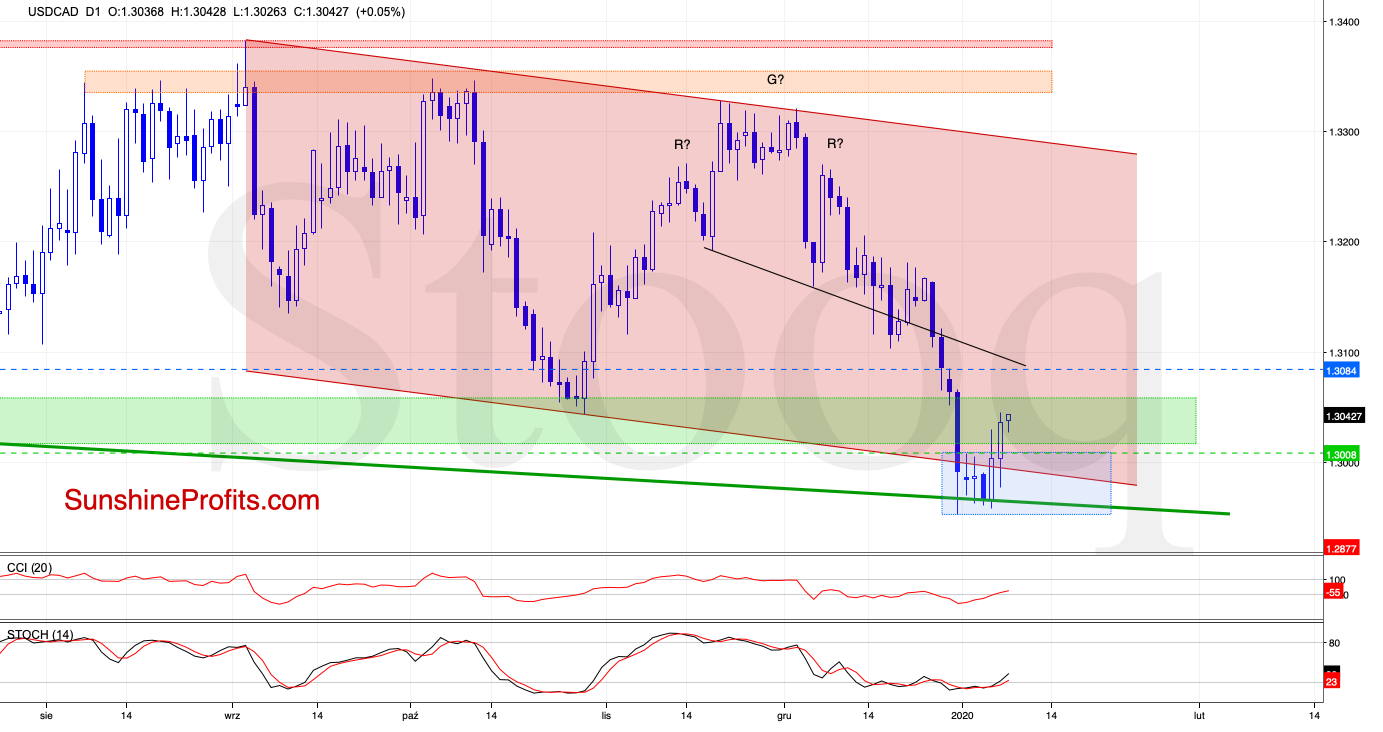

The Prospects of USD/CAD Rebound Continuation

January 9, 2020, 8:21 AMUSD/CAD

The technicals indicated high likelihood of an upswing, and the pair obliged by moving higher recently. Great, but with quite a move behind us already, let's assess further appreciation potential as it stands right now.

Quoting our last commentary on this currency pair:

(...) we noticed another move to the upside, which not only invalidated yesterday's drop below the green line, but also the earlier breakdown below the lower border of the declining red trend channel. Both of these invalidations are bullish signs.

Additionally, the current position of the daily indicators suggests that further improvement is just around the corner.

The situation developed in line with the above scenario and USD/CAD managed to break above the upper border of the blue consolidation during yesterday's session. Earlier today, the pair extended gains, making our long positions even more profitable.

As the buy signals continue to support the buyers, this observation of yesterday keeps being still valid:

(...) Should this be the case and USD/CAD extends gains from here, the initial upside target will be the previously broken black line - that is the neck line of the head and shoulders formation.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/CHF. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

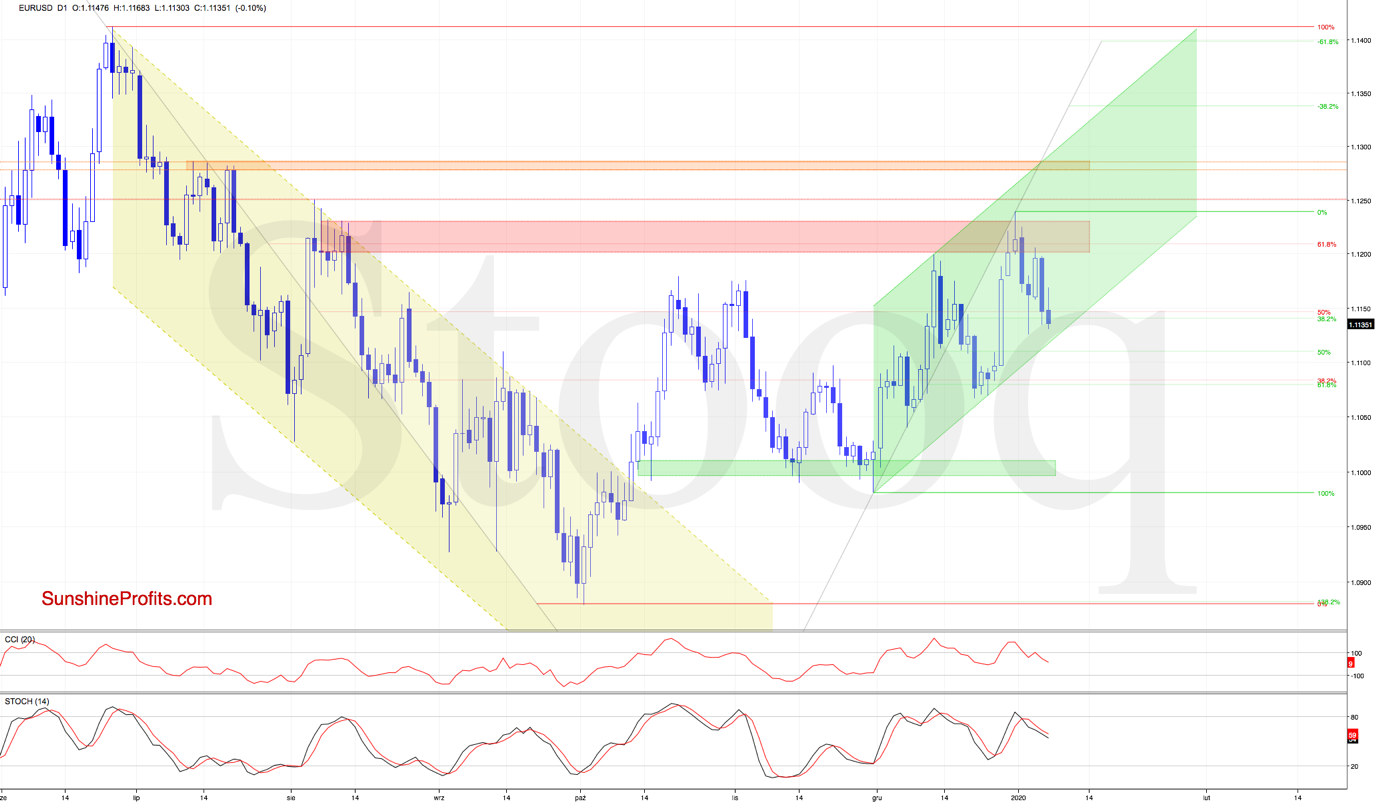

Assessing the Scope of Further EUR/USD Downside

January 8, 2020, 8:05 AMEUR/USD

After a string of recent losses, many wonder whether and how far can the euro still drop. Driven by the flight-to-safety amid current geopolitical turmoil or not, let's assess the technical outlook cold-bloodedly.

As EUR/USD extended losses earlier today, it's time to recall our yesterday's observations as they're still up-to-date also today:

(...) the CCI and the Stochastic Oscillator generated their sell signals, increasing the probability of further deterioration in the following days.

(...) Nevertheless, a bigger move to the downside will be more likely and reliable only if EUR/USD drops below the lower border of the rising green trend channel.

Should we see such price action, the way to the late-December lows would be open.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in GBP/USD and AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold &

Forex Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM