In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the exit target at 1.3019)

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 1.0035; the initial downside target at 0.9849)

- AUD/USD: none

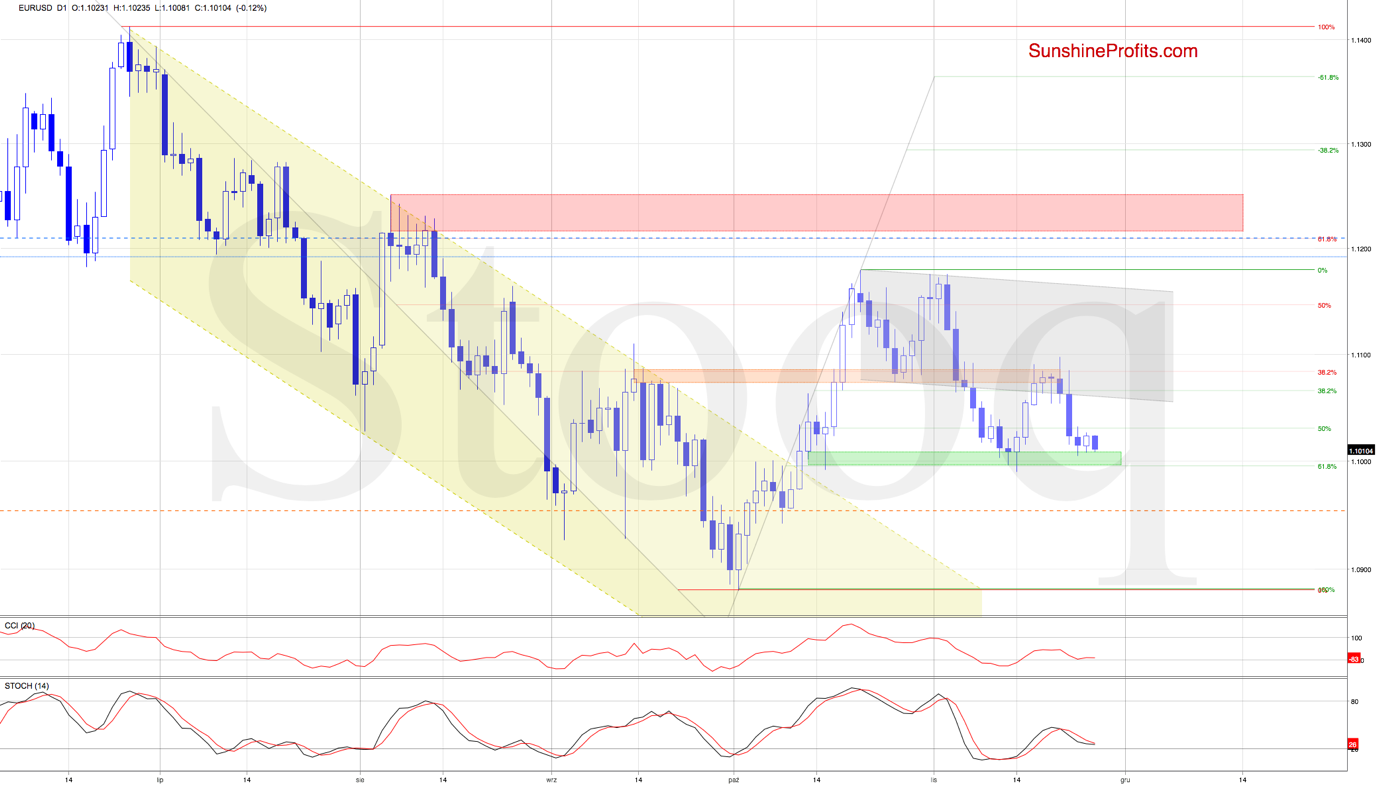

EUR/USD

EUR/USD keeps testing the green support zone, yet the bears can't muster enough strength to break through. What are their chances of breaking below before Thanksgiving, or is another rebound more likely actually?

Although EUR/USD moved down a bit earlier today, the green support zone coupled with the 61.8% Fibonacci retracement continues to hold declines in check. Let's recall our yesterday's comments as they're also valid today:

(...) EUR/USD has indeed tested the above-mentioned downside targets, triggering the interest and involvement of the bulls. As a result, the exchange rate has bounced, suggesting that a similar rebound to what we saw in mid-November could likely be ahead of us.

If that's the case, the bulls could push the exchange rate to the lower border of the grey declining trend channel once again in the coming days.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

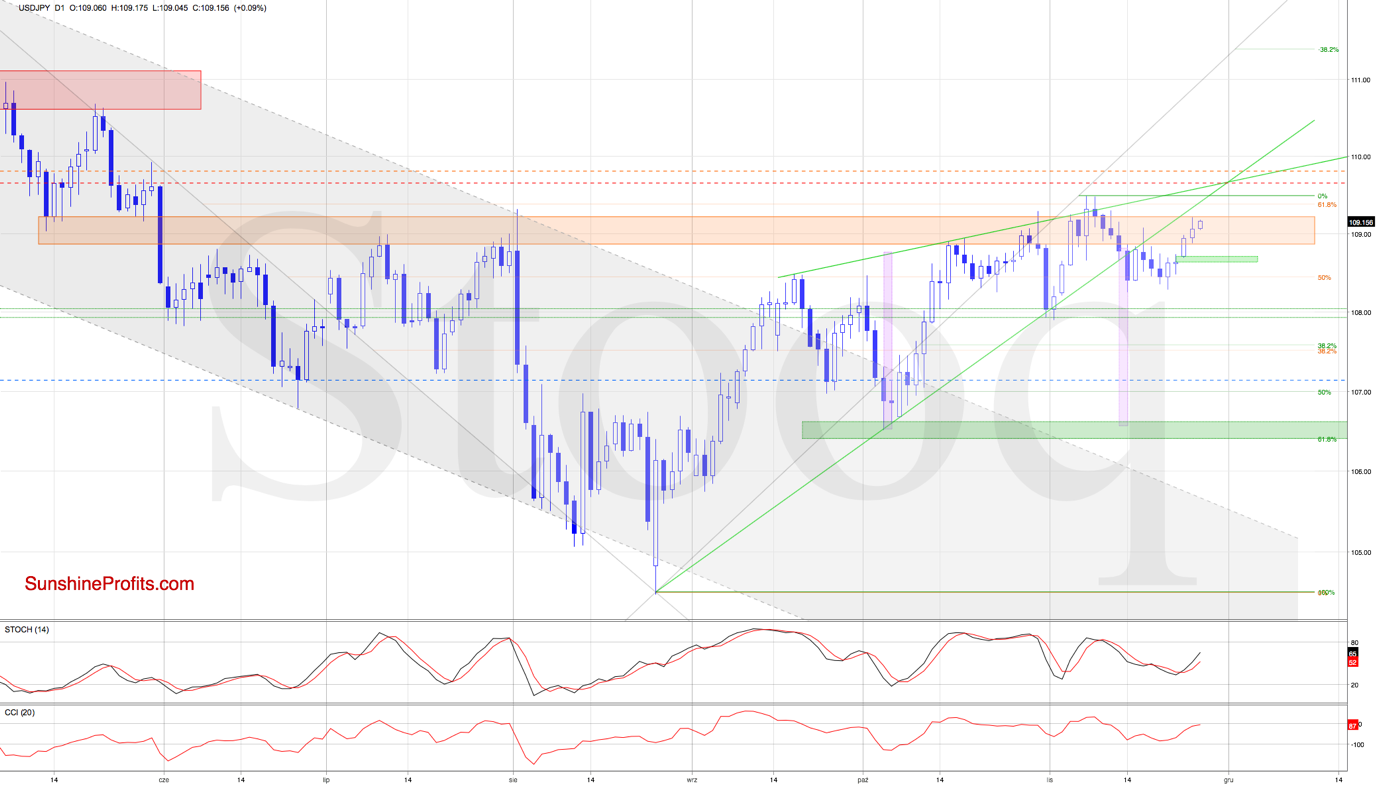

USD/JPY

USD/JPY moved a bit higher recently, but the pair still remains trading both inside the orange resistance zone and well below the previously broken lower border of the rising green wedge. It means that as long as there is no breakout above these key resistances, another downward reversal remains likely.

Should we see such price action and USD/JPY indeed moves lower in the coming days, the first downside target for the bears will be around 107.93-108.04. This is where the nearest support area (created by the lows at the turn of Oct and Nov) is.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.03 and the initial downside target at 107.14 are justified from the risk/reward perspective.

AUD/USD

AUD/USD is still trading inside the blue consolidation slightly above the 61.8% Fibonacci retracement. It means that our latest observations remain up-to-date also today:

(...) as long as we do not see either a breakout above the upper border of the formation or a breakdown below its lower border, another bigger move is not likely to be seen. Short lived moves in both directions should not surprise us in the following days.

The examination of the daily indicators reveals though that the bulls will try to push the pair higher in the coming week. Should we see such price action, the first upside target would be the previously broken lower green line based on the previous lows.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Please note that due to the upcoming U.S. holidays, there won't be any Alert tomorrow or the day after. The Service will resume on Monday. Happy Thanksgiving!

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist