-

Japanese Yen Is Bumping Against Resistance Again. Breakout Imminent?

November 5, 2019, 6:42 AMUSD/JPY

In our Thursday's analysis, we noted the reversal at the upper border of the green rising wedge. The pair ended sharply lower that day but has been rising since. What is going on?

Thursday's decline reached the lower border of the green rising wedge. This has stopped the sellers, and a rebound followed. At the moment of writing these words, the exchange rate is back at the orange resistance zone, which has been strong enough to stop the buyers a few times in the recent past.

Additionally, the pair remains below the upper border of the green wedge that serves as an additional resistance. All in all, it means that as long as there is no breakout above these resistances, another reversal may be just around the corner.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/CAD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

What's Up, Euro Bulls? Taking a Breather Prior to Powering to New Highs?

November 4, 2019, 11:34 AMEUR/USD

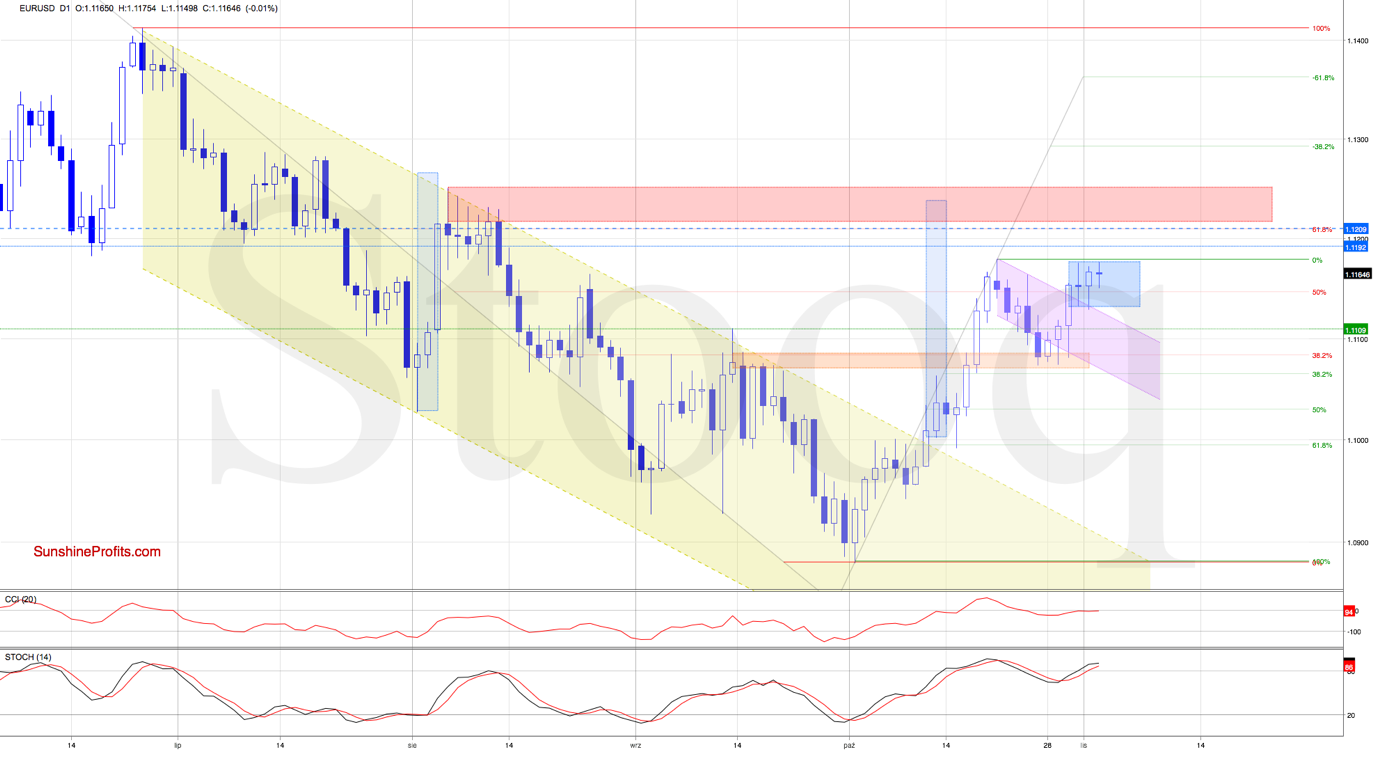

Our Thursday's commentary notes the bulls' gains and the open path to the recent peaks. At the same time, we've raised the question how high can the pair go, providing several handy answers.

What happened in the market since our Forex Trading Alert was posted? Let's see the chart below to find out.

For now, EUR/USD remains stuck in the blue consolidation, which leaves the very short-term picture unchanged. Let's quote our Thursday's observations:

(...) considering the breakout above the upper border of the declining yellow trend channel, EUR/USD could hit a fresh monthly high in the following day(s).

How high could the pair go?

In our opinion, the first upside target could be the 61.8% Fibonacci retracement or even the red resistance area created by the August peaks. This is where the size of the upward move will correspond to the height of the mentioned yellow channel (as marked with blue rectangle).

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in USD/CHF and AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Two New Positions As the British Pound's Rise Delights Us

October 31, 2019, 9:37 AMIn our last commentary on GBP/USD, we noticed that the sellers had problems breaking below the upper border of the short-term rising green trend channel. Their visible difficulties encouraged us to open long positions.

What happened after our Alert was posted?

The daily chart show that despite several attempts to go south, the buyers didn't just give up - they pushed the pair higher and higher from session to session, making our long positions profitable.

As a result, GBP/USD approached the previous peaks and the upper border of the purple consolidation earlier today, highlighting the key question: will we see further improvement?

Taking into account the invalidation of the sell signal generated by the Stochastic Oscillator and the sellers' weakness in recent days, we think that a fresh peak is just around the corner.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD, USD/JPY and USD/CAD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

About to Break Higher from the Current Euro Consolidation?

October 30, 2019, 10:03 AMEUR/USD

Our yesterday's commentary on this currency pair mentions the bears' problems with breaking below the orange support zone. It also notes the potential implications of this situation.

What happened after our Forex Trading Alert was posted? Let's focus on the chart below to find out.

We see that EUR/USD closed Tuesday above the green horizontal line based on the mid-September peak. Earlier today, the bears attempted another downswing, but the bulls successfully stepped in, pushing the exchange rate above yesterday's high. This has made our open long positions profitable.

Taking all the above into account, we continue to think that higher values of EUR/USD could be just around the corner - especially if the exchange rate closes today's session above the peak of Friday's candlestick. This candlestick we be considered as the upper border of the very short-term consolidation.

What could happen if the bulls show more strength?

Let's quote from our yesterday's Alert:

(...) In our opinion, EUR/USD will likely test the upper border of the declining purple trend channel or even the recent peaks.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in USD/JPY and USD/CAD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Two New Positions Just Opened As Australian Dollar Bulls Catch Second Breath

October 29, 2019, 12:49 PMAUD/USD

The most important event that we noticed in our last commentary on this pair, was the breakdown below the lower border of the very short-term purple consolidation. How did the fate of AUD/USD unfold in the days following this bearish development?

Let's examine the daily chart to find out.

From today's point of view, we see that although the sellers were strong enough to push the pair below the above-mentioned consolidation, they didn't succeed in taking the exchange rate to the 38.2% Fibonacci retracement in the following days.

This is certainly a sign of their weakness. Combined with the black horizontal line based on the mid-October peak, it encouraged the buyers to take over. AUD/USD reversed and moved quite sharply higher earlier today, invalidating the earlier breakdown below the above-mentioned consolidation. Additionally, the Stochastic Oscillator invalidated its sell signal, giving the bulls another reason to act.

What does it mean for AUD/USD?

The bulls will likely test not only the previous peaks and the upper line of the formation, but also the mid-September highs or even the 38.2% Fibonacci retracement based on the entire 2019 decline in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. Nevertheless, should we see the reliable signs of the buyers' weakness around the above-mentioned resistances, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and GBP/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold &

Forex Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM