In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the exit target at 1.3019)

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 1.0035; the initial downside target at 0.9849)

- AUD/USD: none

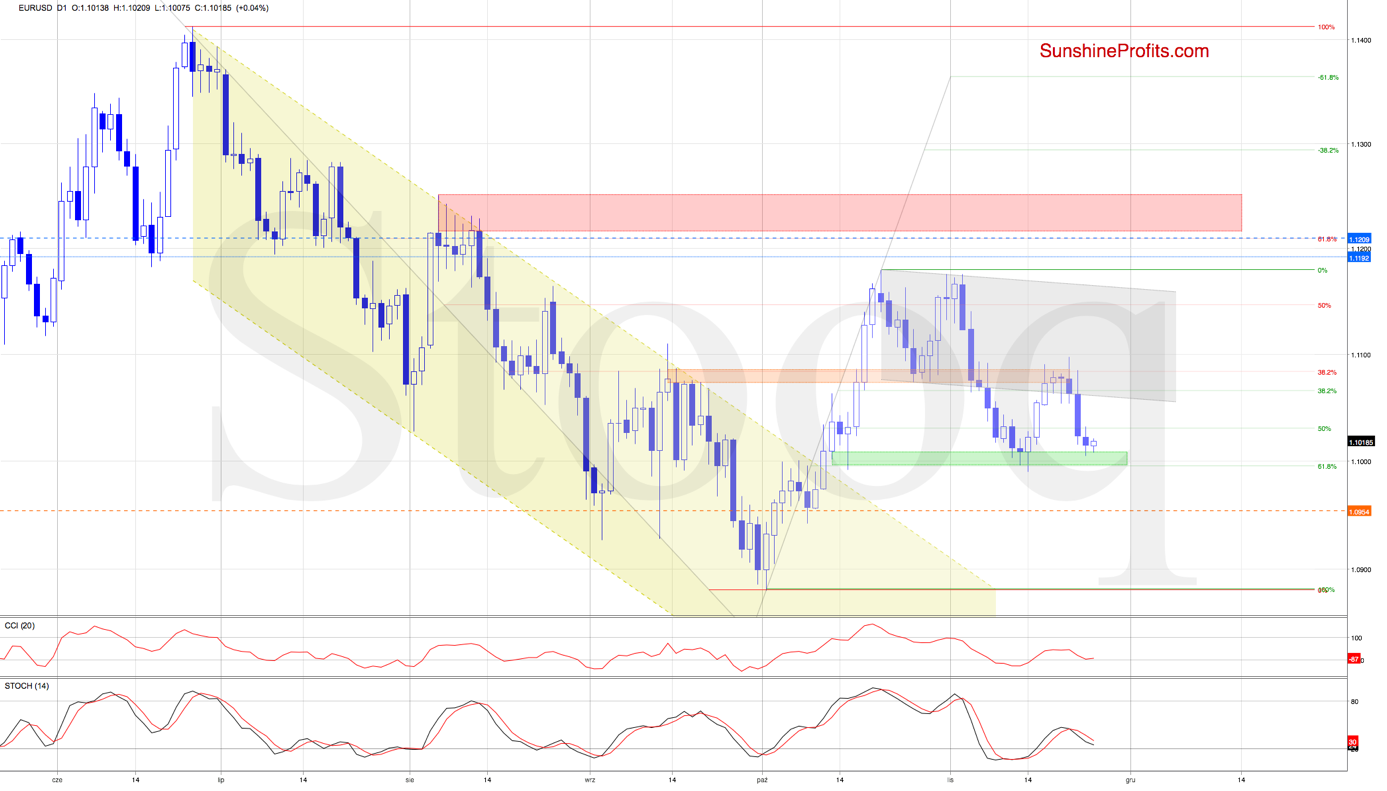

EUR/USD

Okay, the green support zone has been reached, and the bulls tried to move higher earlier today - yet the pair trades close to unchanged now. What are the prospects of the upswing - just when can it materialize? And what about its upside target?

These were our yesterday's observations:

(...) Earlier today, follow-through selling came, and with it the increased likelihood of testing the green support area, the 61.8% Fibonacci retracement and the recent lows in the very near future.

EUR/USD has indeed tested the above-mentioned downside targets, triggering the interest and involvement of the bulls. As a result, the exchange rate has bounced, suggesting that a similar rebound to what we saw in mid-November could likely be ahead of us.

If that's the case, the bulls could push the exchange rate to the lower border of the grey declining trend channel once again in the coming days.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

GBP/USD

GBP/USD declined sharply on Friday, and closed the Monday's gap in the process. While this is certainly a bearish development, the overall situation in the short-term remains almost unchanged as the pair is still trading inside several formations. These are the pink multi-week consolidation and the very short-term blue consolidation.

It means that as long as there is no breakdown below the lower border of the pink formation, a bigger move to the downside is not likely to be seen. Actually, a reversal in the coming days can't be ruled out, which would be similar to what we saw at the beginning of the month.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.2720 and the exit target at 1.3019are justified from the risk/reward perspective.

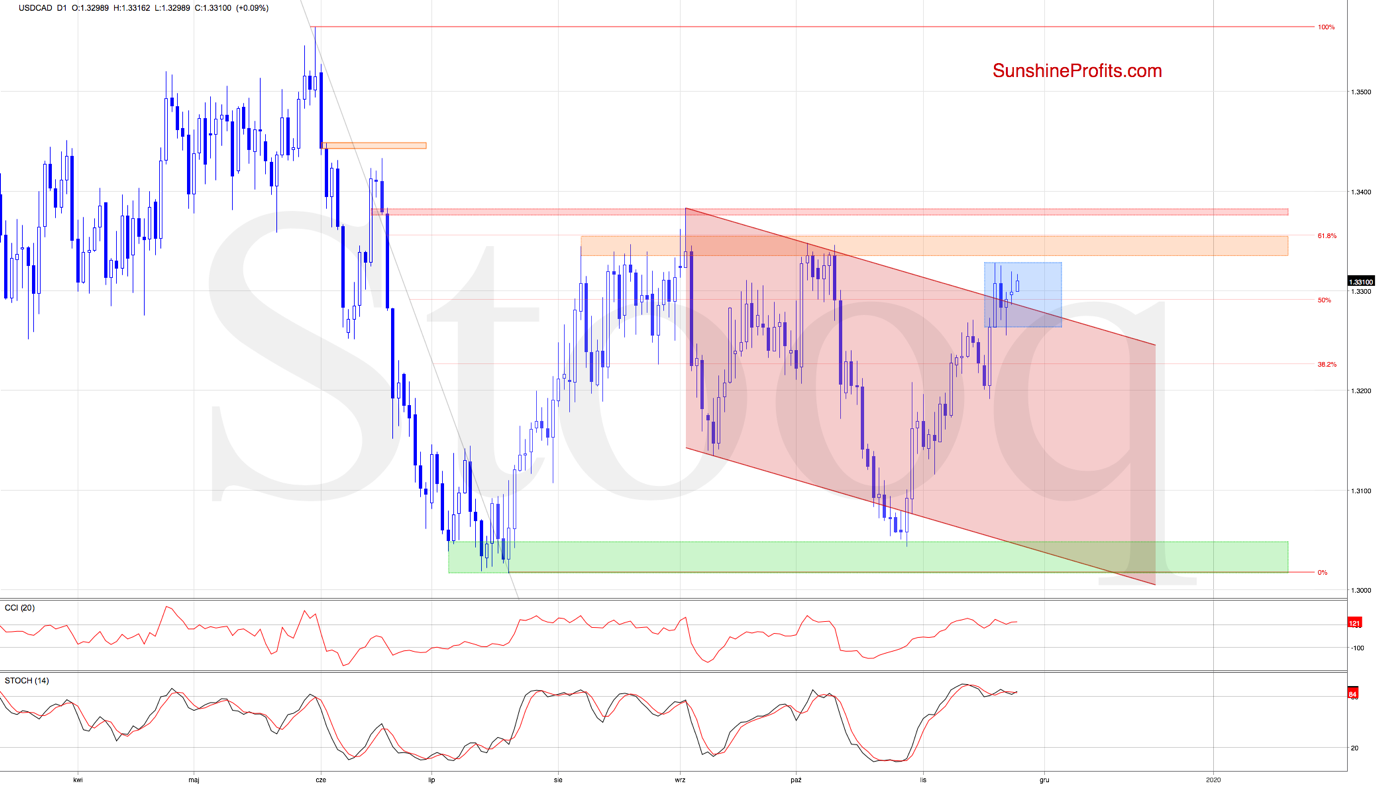

USD/CAD

On Friday, USD/CAD invalidated the earlier breakdown below the previously broken upper border of the declining red trend channel. This has triggered further improvement yesterday.

Taking the above into account, our Friday's observations are relevant also today:

(...) if the bulls push the pair back above the trend channel on a closing basis, the way to the recent peaks of even the orange resistance zone and the 61.8% Fibonacci retracement would be open.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist