tools spotlight

-

Since the Silver Market Soared, Has a Top Already Formed?

December 1, 2022, 6:31 AMSilver outperformed gold in quite an impressive way. However, can this really be considered bullish, or was it in fact just a correction?

Yesterday’s session was nothing particularly new except for silver’s performance, which is what I will focus on in my analysis of it today.

The silver market truly soared on an intraday basis, especially relative to gold. This is what we most often see at the tops or very close to them.

The Buying Frenzy

The reason is that the silver market is much smaller than the gold market is, and in addition to the above (and in relation to it), silver is much more popular with the investment public. The latter tends to buy close to the tops and sell close to the bottoms. Consequently, the particularly strong performance of the white metal indicates that the investment public is “buying like crazy,” and this, in turn, is a sign that a top is being formed. That’s what we saw yesterday.

Interestingly, silver’s rally yesterday was accompanied by yet another daily rally in the main stock indices. The S&P 500 moved above 4,000 once again, especially initially, and it was during this sharp rally that silver rallied the most. This tells us that perhaps similar buyers (the investment public) were buying stocks, and it serves as a small indication that stocks might have topped as well (or that they top in stocks could be just around the corner).

Technically, it was yet another move to the 50% Fibonacci retracement, so it didn’t change anything. The only new indication was gold’s outperformance, and it has bearish implications.

When looking at silver from a long-term point of view, it’s still obvious that the recent move higher was most likely just a corrective upswing.

Will There Be a 2022 Repeat?

What happens after corrections are over (as indicated by, i.e., silver’s outperformance)? The previous trend resumes. The previous trend was down, so that’s where silver is likely headed next.

Besides, the long-term turning point for silver is due in several months, and if silver repeats its previous 2022 decline, then it will bottom close to the turning point and also close to its 2020 low – in the first half of 2023.

It’s likely to repeat its previous 2022, because that’s what tends to happen after flag patterns, and what you see on silver’s short-term chart between September and yesterday appears to be a flag pattern.

Consequently, the current silver price forecast remains bearish, as does the outlook for the rest of the precious metals sector.

...And no. Today's pre-market rally in gold doesn't change that. It's the least rational thing that the gold market did in a long time, as lower jobless claims mean stronger U.S. economy and Fed that's more likely to keep raising interest rates. This is yet another indication that it is the investment public that is buying - and that happens right at the end of a given upswing.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Is Gold’s Outlook Bearish Given All the Factors Affecting It?

November 30, 2022, 10:07 AMThe GDXJ, the stock market, silver, and USDX are possible factors affecting the gold price. Is there anything new that can be read from the charts?

Today’s analysis will take a video format.

In the second part of the video, I’m providing a small teaser of the major improvement in the way in which I’m providing my services.

Oh, and if you’re wondering why I’m not more enthusiastic in the video while talking about it, it’s simply because I’m really tired, given how much work the entire team has been putting into this new platform and everything related to it. But I know – we know – that it’s well worth it.

In tomorrow’s notification email, you will receive two links. The first link will be an invitation link to join the new platform, and I highly recommend that you do it right away because, thanks to this, you can enjoy the new features right from the start.

The second link will be “plan B” – for some time (in days, maybe weeks, but not in months), we’ll be providing links to premium analyses posted in the old way in addition to links posted in the new way (on the new platform). The point is that I don’t want some temporary technical glitches to prevent you from accessing the analysis.

Please, please, please treat this as plan B – we all really want to see you and interact with you on the new platform :) When tomorrow’s notification email comes, please sign up for the new platform using the main link. Don’t worry, we’ll make it extremely clear where to find it.

Now, what I didn’t mention on the video was that the platform has an iOS app (and the Android app is likely to be available within a couple of months), which means that you’ll now be able to get notifications for your premium Gold & Silver Trading Alerts right on your iPhone (and in the not-too-distant future also for your Android device). Actually, you’ll be able to set up all sorts of notifications, and it will be up to you about what way you’ll be notified. Cool, huh?

On a final note, the name Gold & Silver Trading Alert will be shortened – to Gold Trading Alerts. However, the scope doesn’t change – I’m going to continue to cover gold, silver, and mining stocks. My current focus is on junior mining stocks, anyway.

Stay tuned!

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Stocks Get Into an Elevator With the S&P 500 – Up or Down?

November 29, 2022, 9:25 AMAs might have been deduced, the stock market invalidated its recent upswing. What's more, it dragged gold miners down. But is this really a a bearish story?

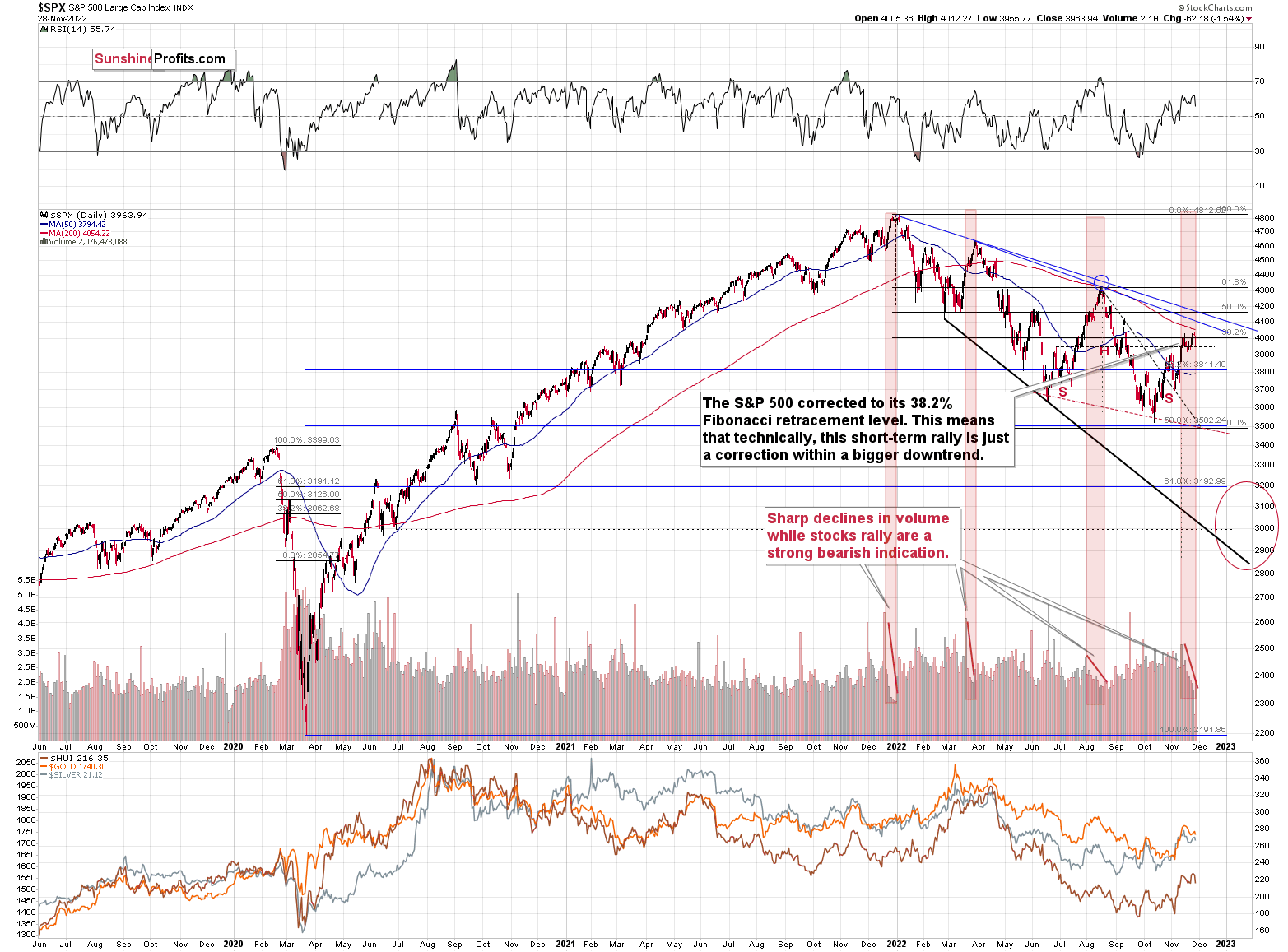

In yesterday’s analysis, I wrote that the stock market was likely to invalidate its recent upswing above its 38.2% Fibonacci retracement level, and that’s exactly what happened.

I wrote the following:

We just saw a small attempt to break above the 38.2% Fibonacci retracement, and I doubt that this breakout will be confirmed. The “why” behind it is currently the most interesting analogy that we see on this market.

Please take a look at the areas marked with red rectangles. In all those cases, the S&P 500 index rallied on big volume at first, and then the volume declined over the course of a few weeks. And as that happened, the price approached its top.

All three previous important tops that we saw this year were accompanied by this indication.

We also see it right now.

Even more interestingly, the volume levels that have just been seen are similar to the ones that accompanied previous tops.

Consequently, it seems that the end of the rally is near. This is likely to have very bearish implications for junior mining stocks.

Stocks declined and ended the day below the above-mentioned 38.2% Fibonacci retracement and the 4,000 level, which has profoundly bearish implications for the following weeks.

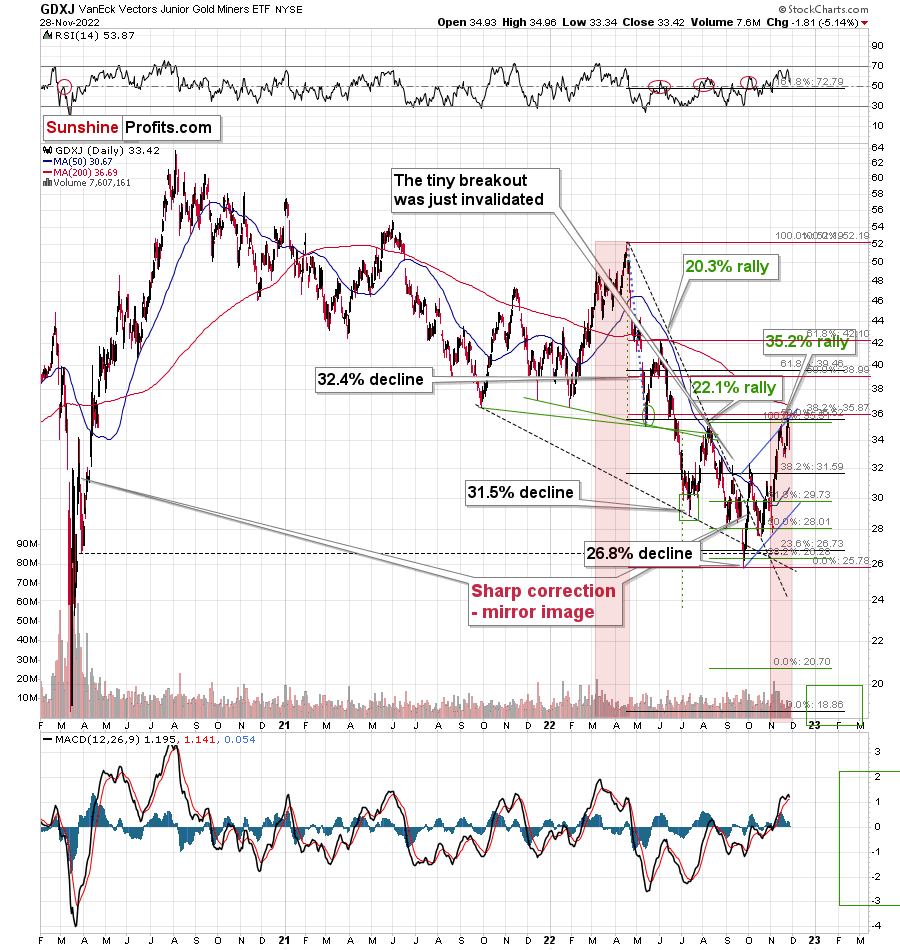

Indeed, junior miners’ prices fell substantially during yesterday’s trading.

When viewed broadly, a drop of more than 5% is not that significant, but it is, in my opinion, not so huge yet. Silver’s price was down more than gold’s (1.42% vs. 0.78%), but junior miners declined the most. Even more than senior miners – the GDX ETF was down by 4.01%.

No wonder – junior miners’ prices have the strongest link with the performance of the general stock market, and as the rallying stocks uplifted juniors in the previous weeks, now they are likely to drag juniors lower. Much lower.

I previously compared the current situation to the one from March and April 2022 in the following way:

The ETF moved higher on Wednesday and then lower on Friday. Most importantly, it moved in near-perfect tune with how it had moved earlier this year – in March and April.

I marked both situations with red rectangles. The initial rally was accompanied by huge volume, which then waned over the following days and weeks. That’s pretty much what we saw in November – and earlier this year.

Moreover, the GDXJ touched its upper border of the flag pattern once again. It also touched the resistance levels provided by the previous highs (moved slightly above them) and the 38.2% Fibonacci retracement level based on the entire 2022 decline.

This means that the top is likely in or at hand.

Juniors just moved back below their previous November high as well as back below their August high. This invalidation – similarly to the invalidation in stocks – suggests that lower values of mining stocks are likely just around the corner.

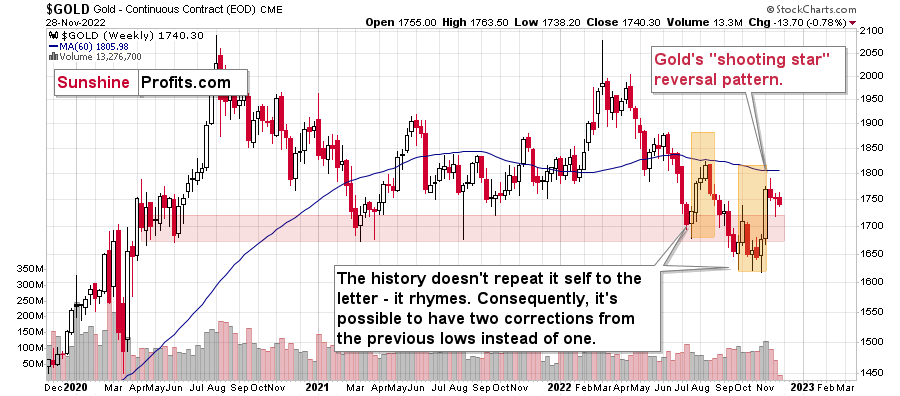

What about gold’s outlook?

Well, gold is behaving just like it was likely to after the powerful weekly reversal that we saw a bit over a week ago.

Last week it reversed to the upside, but the volume on which it did so was weak, so it wasn’t believable.

And indeed, this week gold is moving lower.

What’s next? As stocks are likely about to slide, and so is gold, the prices of mining stocks are likely to tumble – rather sooner than later.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM