tools spotlight

-

No Worries, Gold Is Already Below Its Recent Correction

December 28, 2022, 8:37 AMToday’s short-term analysis will once again be in video format. However, to make a long story short, the precious metals sector declined yesterday, and what we wrote previously remains up-to-date.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief -

Despite the War in Europe, Gold Remains Below Its 2011 High

December 27, 2022, 6:56 AMCan gold's recent short-term rally be considered bullish, or can we expect a decline like in 2008?

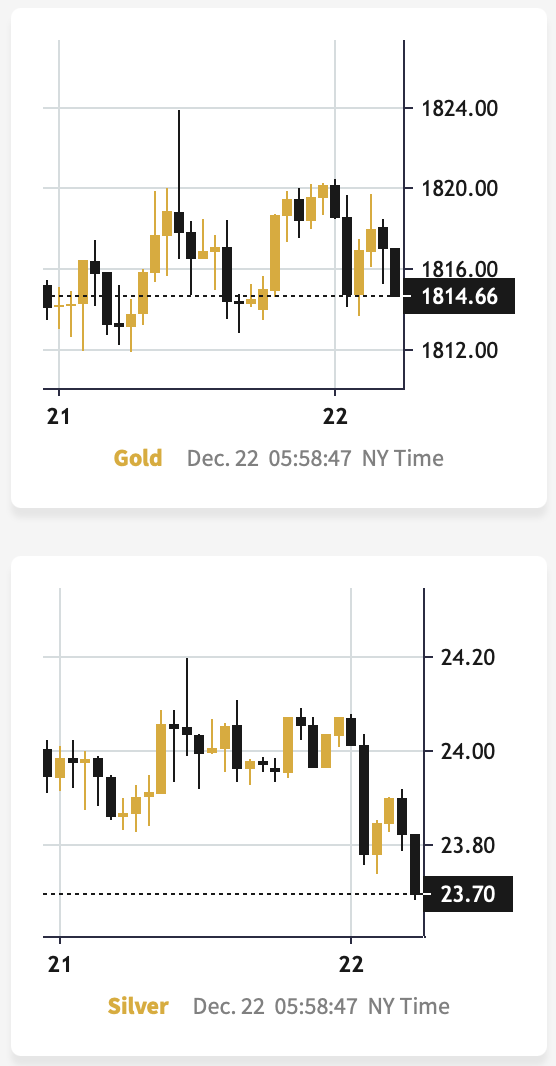

Gold and silver are moving higher today, but nothing really changed despite that. Silver moved to its previous highs, while gold didn’t (chart courtesy of https://GoldPriceForecast.com).

Yes, the silver price is once again outperforming on a very short-term basis, and it makes the previous bearish indications stronger.

As a reminder, silver is much more popular with the investment public than gold is (relatively to how they are both popular with institutional buyers, that is), quite likely due to multiple theories surrounding its mispricing and also quite likely due to the fact that the silver market is much smaller than the gold market and big buyers can’t easily enter the silver market without moving its price too much.

Since the investment public tends to buy close to the tops (and sell close to the bottoms), silver’s outperformance relative to gold is what we often see as an indication that both precious metals are about to move lower.

Yes, there is some fundamental sense to PMs’ moving higher – China is ending its zero-COVID policy, which means some extra uncertainty for the markets, but overall, it’s unlikely to change that much.

Aside from the day-to-day price swings, the big picture for gold and the USD Index (one of gold’s price key drivers) should make it clear that whatever we have seen in the recent months was not bullish, but rather a regular correction within a medium-term downtrend.

The size of the recent short-term upswing may seem significant, but only until one zooms out and notices that the correction that we saw in 2008 was even bigger. It was then followed by a huge decline. I marked both rallies – the 2008 one and the current one – with green rectangles.

The 2008 correction ended with gold above its 40- and 60-week moving averages. That’s where gold has moved recently as well.

Why would the current situation be similar? In both cases, there is major trouble ahead for the stock market due to tighter financial conditions. Back in 2008, it was the subprime crisis that started it all, and while the circumstances were different this time, interest rates (nominal and real) are now on the rise (globally!), which is likely to contribute to people's rapidly decreasing motivation to hold anything that doesn't provide interest or a decent yield. Also, speaking of the big picture, did you notice that gold is NOT above its 2011 high despite so many dollars, euros, yen, and other currencies being printed since that time? Gold is not above its 2011 high even thiugh there’s now a war in Europe!

Silver is not even trading at half of the value that it had at its 2011 top…

And gold stocks… The HUI Index is trading below its 2003 (yes!) high.

All these are not signs of a strong market. Conversely, these are indications that the precious metals market wants to move lower in the following months, and (probably) weeks.

While the precious metals sector doesn’t need a specific trigger to decline, getting one would speed up the decline, and it seems that it’s about to get one from the USD Index.

The USDX moved to its 2016 and 2020 highs and is now trading slightly above them. It’s normal for any market to verify breakouts by moving back to the previously broken levels, before the main move continues. Consequently, it’s no wonder that the USD Index did exactly that.

It’s also normal that the recent corrective downswing was sharp – because that’s how the preceding rally was, too.

As very strong support was reached, the USD Index is now likely to rally once again. Since the USDX and the precious metals market tend to move in opposite directions, it implies lower precious metals values in the future, and it seems that we won’t have to wait too long, either.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold’s Plan for Christmas: Shine or Create a Shooting Star Pattern?

December 23, 2022, 8:35 AMGold’s rally was just stopped by the resistance provided by its previous high and its 60-week moving average. Will gold now reverse?

The above chart features gold price in terms of weekly candlesticks. As you can see, it just approached its August high.

And gold failed to move above it once again.

The resistance held.

What is even more bearish is the fact that gold is likely about to form another weekly shooting star (reversal) candlestick, the second in a row. “Likely,” because the week is not over yet.

This is a very powerful bearish indication, especially that it has now been repeated.

Given today’s pre-market moves in gold and silver (both are up just slightly, with gold trading below $1,800), it seems that the reversal candlestick will soon be a fact.

This – along with the failed attempt to move above the August high – has profoundly bearish implications for the following weeks.

Gold, just like many other markets (i.e., stock prices), recently corrected slightly more than 38.2% of its previous move. Then it invalidated this small breakout. It happened more than once, so this bearish indication was strengthened.

The same goes for gold’s attempt to move above its August high – the one that failed. It too strengthened the bearish case for the following weeks.

Please note that the above is taking place shortly after two sell signals from the RSI indicator, which further confirms the bearish nature of the recent price moves.

Gold’s breakdown below the rising, short-term, black support line makes the short-term outlook even more bearish.

And now, based on this week’s failed attempt to rally once again, gold is likely to form a head and shoulders top pattern. For now, this formation is just potential, as we’ll need to see a confirmed breakdown below the neck level (dashed, black line) first.

Given rising real interest rates and the USD Index that has likely formed its medium-term bottom, the foregoing is very likely.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The Breakout That’s REALLY Important for Gold

December 22, 2022, 8:55 AMSince the gold market now shows parallels to 2008 and 2013, what can we expect if the correction has just ended?

The changes that we saw on the charts yesterday were not enough to change anything that I described yesterday, so those comments remain up-to-date. Also, what I covered during yesterday’s live event (I combined the live market analysis with the presentation about the top 3 gold trading techniques – you can see the recording here) remains up-to-date at the moment of writing these words.

So far today, gold and silver have moved a bit lower, while the USD Index moved a bit higher (chart courtesy of https://goldpriceforecast.com).

After yesterday’s intraday reversal, both precious metals moved lower. The silver price once again failed to move above the $24 level.

And the USD Index?

At the moment of writing these words, it’s after an overnight reversal and after a confirmed breakout above its declining resistance line.

This means that it’s now likely to move higher.

Please keep in mind that both markets, the USDX and the precious metals market, have been very strongly negatively correlated recently (with the exception of the very recent yen-related turmoil). Consequently, analyzing the gold price, USDX, and their correlation implies very bearish implications for the PMs and miners.

From the long-term point of view, it’s clear that the long-term support remains intact. The relatively small move lower that we saw this week didn’t take the USDX to new short-term lows.

There was no breakdown below the 2016 and 2020 highs in terms of the closing prices, which means that the odds for a turnaround and a rally are very high.

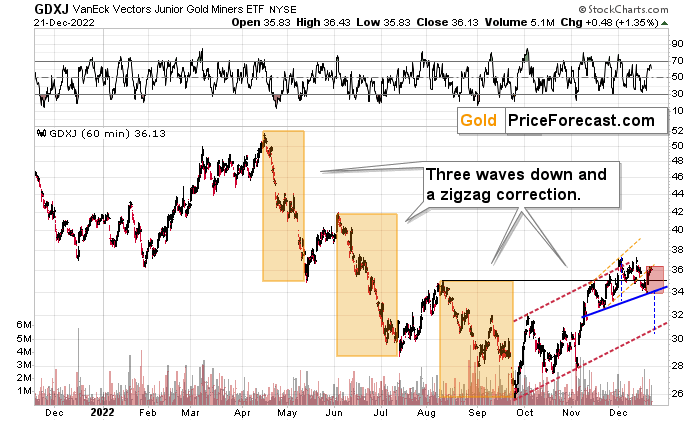

Meanwhile, junior gold and silver mining stocks moved a bit higher yesterday, but they haven’t moved above the lower border of the accelerated trend channel (marked with orange). This means that this week’s upswing was likely just a verification of the breakdown below it.

Interestingly, if we see a decline soon, which is likely, it could become the right shoulder of a potential head-and-shoulders pattern. I marked the theoretical right shoulder with a red rectangle and the neck level with a blue rectangle.

In short, when we see a confirmed breakdown below $34 in the GDXJ, we’re likely to see a move even lower – to $30.5 or so. Then, I’d expect to see something similar to what we saw in August, earlier this year – a small correction that is followed by another decline.

This time, however, I think that the medium-term decline will be much bigger than what we saw in the middle of the year. This is based not just on the bullish medium-term outlook for the USD Index but also on the analogies in gold price, silver price, and precious metals mining stocks: to 2013 and 2008. It seems that the history is rhyming, and the correction right before the biggest slide appears to be over or about to be over. I’ll discuss more details in tomorrow’s analysis.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

How Will the Hawkish Bank of Japan Affect the Gold Market?

December 21, 2022, 7:23 AMDear Subscribers, please click on the title for the premium version of the analysis.

Dear not-yet Subscribers, the free article based on the above is available at GoldPriceForecast.com.

The premium analyses include multiple timely details such as the interim targets for gold and mining stocks that could be reached in the next few weeks.We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM