-

Oil Trading Alert – Author Communique

November 29, 2021, 10:34 AMAvailable to premium subscribers only.

-

Crude Oil Didn’t Like Thanksgiving Turkey This Year

November 26, 2021, 9:17 AMIt appears that the US markets didn’t find the Thanksgiving turkey very tasty this year.

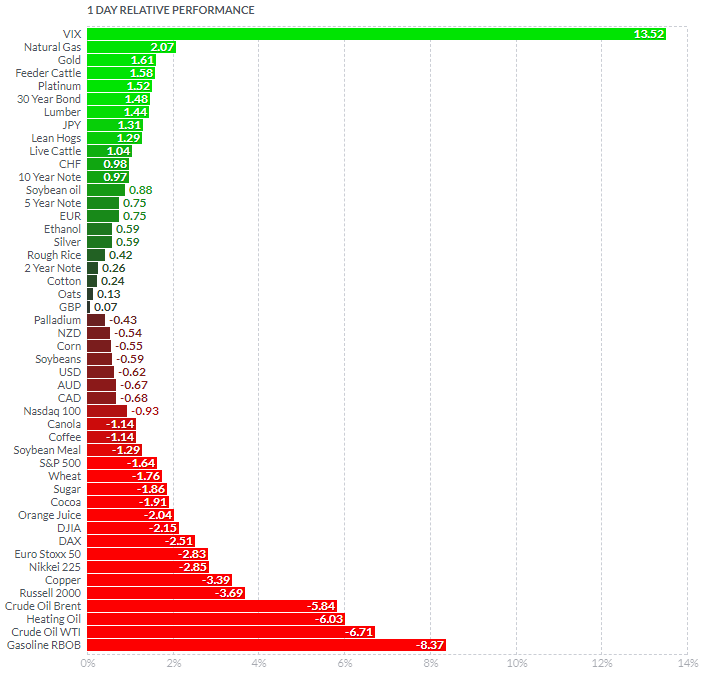

CBOE Volatility S&P 500 Index (VIX) Futures (daily chart)With the “indicator of fear” (also known as the VIX or Volatility Index) spiking over 13.5 % in the European session, propelling some precious metals (gold and platinum) and natural gas to the roof, while sending the crude and petroleum products to the lower ground, the volatility has just clearly reached a higher level.

(Source: FINVIZ)Most of our premium subscribers enjoyed a last ride on the long side for WTI crude oil this month while following our trade projections. For more details of the last oil trading position provided last week, I have just released that trade as it got very close to reach its projected target on Wednesday (Nov. 24).

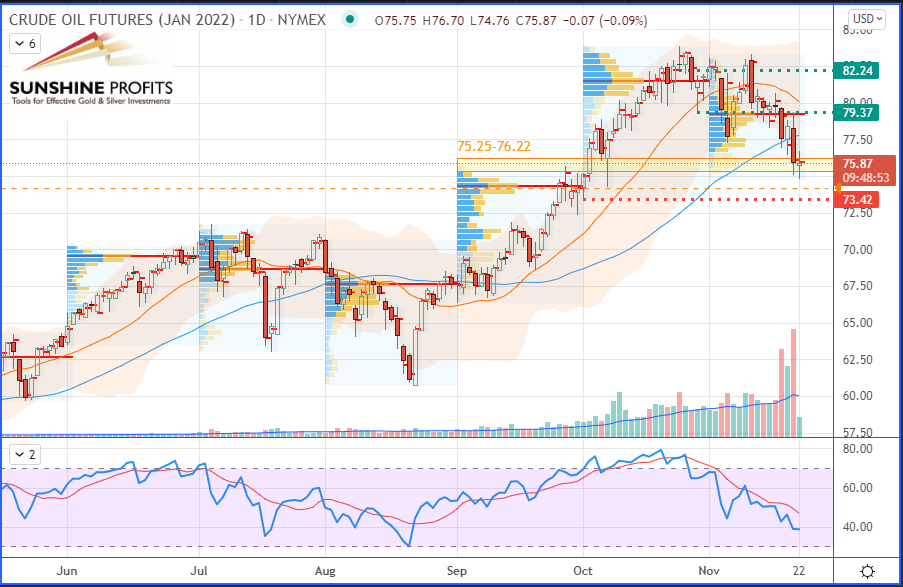

WTI Crude Oil (CLF22) Futures (January contract, daily chart)The main fears on the oil market come from the possibility of a demand slowdown starting from Q1 2022. Additionally, that timing happens when the United States, along with a larger group of countries (including China, India, Japan, Republic of Korea, and the UK) have made the decision to release some of their strategic oil reserves on the market, aiming at artificially increasing the supply, and thus lowering oil prices. Well, this may represent one driver of prices indeed, although a more general economic slowdown associated with a non-sustained demand as we are getting into the winter, may be the main concern now.

On the other hand, the winter – expected to be colder in certain regions – is also supporting the gas prices, hence the recent surge on the Henry Hub futures, along with sustained US exports of Liquefied Natural Gas (LNG) that are also supporting natural gas prices.

Henry Hub Natural Gas (NGF22) Futures (January contract, daily chart)In conclusion, we could be entering a new volatile period on the global markets, associated with various fears maintained through headlines by media (Covid variants, restrictions, etc.). For now, I would suggest staying away from the noisy headlines and just relax and enjoy some new pieces of turkey leftovers, or whatever else if you don’t eat meat. Ignore the noise and trade what you see (not what you think). Stay tuned and enjoy your weekend!

As always, we’ll keep you, our subscribers well informed.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Crude Oil: Anticipating Dips in the Near-Term

November 24, 2021, 10:05 AMThe market is struggling with further downward pressure, triggered by a stronger US dollar, and threats that the US and others will start using their strategic oil reserves.

Trade Plan Review

Indeed, Japanese Prime Minister Fumio Kishida said on Saturday (Nov 20th) that his government was considering drawing on oil reserves in response to rising crude prices. Since Japan sources most of its oil from the Middle East, the recent surge in prices and the decline of the yen have pushed up import cost for the Japanese archipelago.

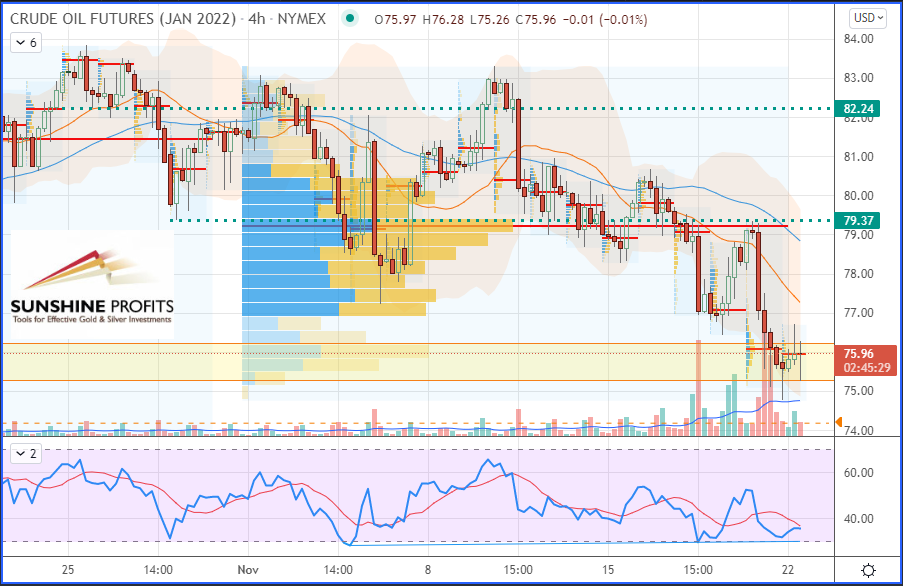

As a reminder, last week I anticipated a lower dip that would take place onto the $75.25-76.22 yellow band. The recommended objective would be the $79.37 and 82.24 levels. My suggested stop would be located on the $74.42 level (below both the previous swing low from 7-October and the previous high-volume node and volume point of control (VPOC) from September).

Alternatively, you could also eventually use an Average True Range (ATR) ratio to determine a different level that may suit you better. For now, that dip did happen Friday around that support area (likely to become a demand zone) where we might see some ongoing accumulation for the forthcoming hours. Now, we can observe a doji formation (candlestick figure), and more precisely a long-legged doji appearing on the daily chart, which is generally synonymous with indecision.

WTI Crude Oil (CLF22) Futures (January contract, daily chart)

To visualize how the price action is currently developing, let’s zoom into the 4H chart, which illustrates a much clearer downtrend:

WTI Crude Oil (CLF22) Futures (January contract, 4H chart)So, as you can see, even on that lower timeframe we have a doji pattern, where the bulls are trying to take over the bears to push the market towards higher levels. Will the current 4H downtrend extend lower, or will the longer-term (daily) uptrend resume its rally? Let’s see where this is going to end up.

Here is the latest chart from today (Nov 24th):

Figure 1 - WTI Crude Oil (CLF22) Futures (January contract, monthly chart)

By the way, my trade target for WTI Crude Oil positions has almost been reached. Please check out more details on my latest oil targets in Monday’s article.

That’s all for today, folks. Happy trading!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

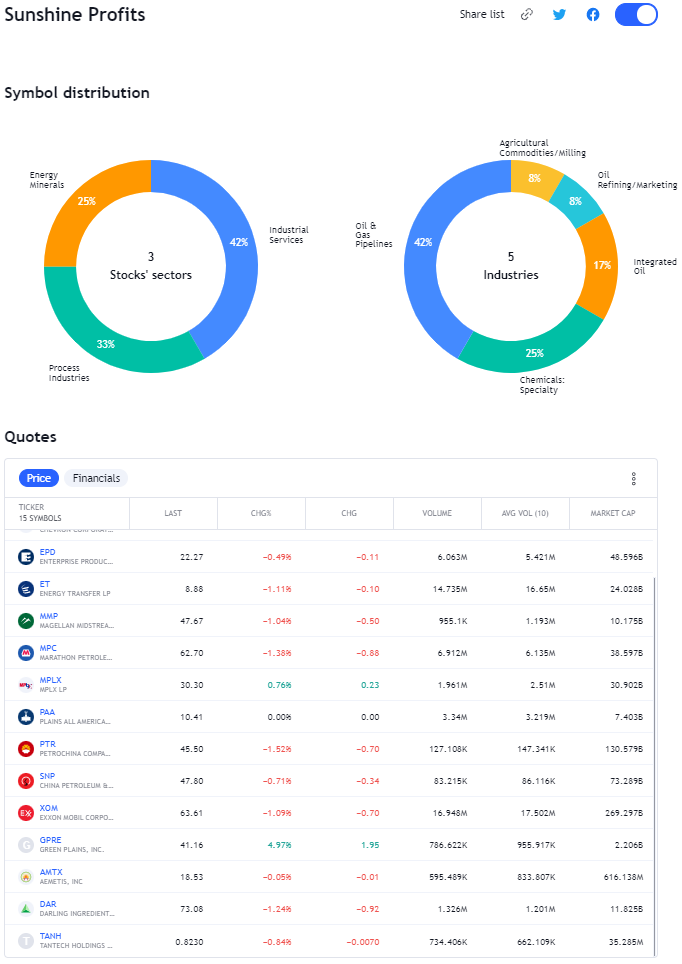

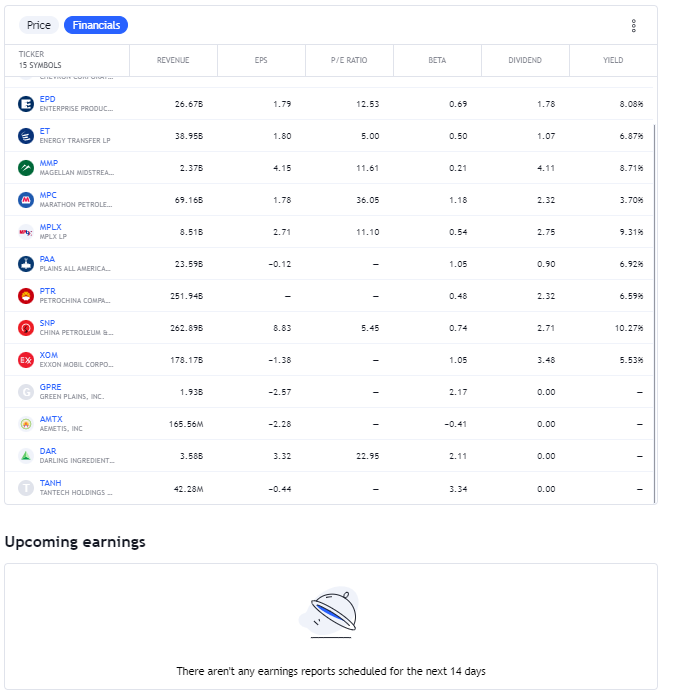

Ever Thought About Biofuels to Diversify Your Portfolio?

November 19, 2021, 10:21 AMHow do you feel about adding a broader range of stocks to our energy investment portfolio watchlist? Let’s see what we can do!

By the way, feel free to send us your questions or topics that you would like us to write about in the forthcoming editions, so we’ll try our best to answer them!

Trading positions are available to our premium subscribers.

First, let’s quickly define what biofuels are:

A biofuel is a liquid or gaseous fuel derived from the transformation of non-fossil organic matter from biomass, for example, plant materials produced by agriculture (beets, wheat, corn, rapeseed, sunflowers, potatoes, etc.). So, it is considered a source of renewable energy. The combustion of biofuels produces only carbon dioxide (CO2) and steam (H2O) and little or no nitrogen and sulfur oxides. Therefore, biofuels – as being at the crossroads between energy and agricultural commodities – respond to economic drivers (crops/supply, demand, dollar strength, reserves, etc.) and geopolitics of both industrial sectors. Furthermore, they allow their producing countries to reduce their energy dependence on fossil fuels.

Key reasons to invest in these alternative energy sources:

Given the recent surge of oil and gas prices, biofuels have become somehow more attractive, and consequently one could witness a slight shift in demand from fossil to non-fossil fuels. This was also a central topic of talks during the recent United Nations Conference of the Parties (COP26), which recently took place in Glasgow (Scotland), and where world leaders finally agreed to preliminary rules for trading carbon emissions credits. In addition, as we all know, the combustion of fossil fuels contributes to greenhouse gas (GHG) emissions. Regarding biofuels - the carbon emitted to the atmosphere during their combustion has been previously fixed by plants during photosynthesis. Thus, the carbon footprint seems to be a priori neutral.

Stock Watchlist (Continued)

In the first article, we started a watchlist with some major energy stocks. In the second article, we added some more spicy assets (MLPs). Today, let’s update it with some biofuel-based stocks!

As usual, our stock picks will be shared through that link to our dynamic watchlist which will be updated from time to time, as we progress through this portfolio construction process...

Below is an example of some indicative metrics:

Daily Technical Charts

Figure 1 – Green Plains, Inc. (GPRE) Stock (daily chart)

Figure 2 – Aemetis, Inc. (AMTX) Stock (daily chart)

Figure 3 – Tantech Holdings Ltd. (TANH) Stock (daily chart)Figure 4 – Darling Ingredients Inc. (DAR) Stock (daily chart)

In summary, those biofuel-related stocks may present some benefits to diversifying your energy portfolio while covering some alternative fuels as well.

As always, we’ll keep you, our subscribers well informed.

Today's Premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Subscribe to our Premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM