-

Crude Oil & Natural Gas: A New Position and Updated Levels

October 28, 2021, 7:48 AMAvailable to premium subscribers only.

In today’s trading alert, we draw a new projection on WTI Crude Oil and update the one on Henry Hub Natural Gas…

-

Shrinking US Crude Reserves Might Confirm the Trend Now!

October 27, 2021, 5:42 AMOil prices rose again on Tuesday, approaching multi-year highs amid concerns over steadily shrinking US crude reserves.

Fundamental Analysis

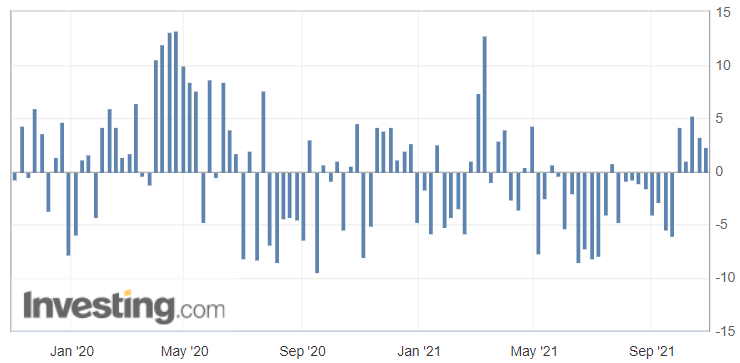

U.S. API Weekly Crude Oil Stock:

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via InvestingRegarding the API figures published Tuesday, the increase in crude inventories (with 2.318 million barrels versus 1.650 million barrels expected) implies weaker demand and is normally bearish for crude prices. However, we have a strongly bullish context, where the supply is still voluntarily – or not – narrowed by the OPEC+ and the global demand increases. What has to be synthesized from this report are the consecutively decreasing figures week-on-week, which are lifting prices higher.

Today, we have to see whether or not these figures will be confirmed by the weekly Energy Information Administration's (EIA) report… But there is very little doubt that they won’t be, given the current environment in which black gold is progressing.

Geopolitical Context

On the international scene, a meeting between Iran and the European Union is likely to happen fairly quickly since the Iranian deputy minister in charge of the nuclear issue, Ali Bagheri, will meet with an European negotiator Enrique Mora this week in Brussels to discuss a resumption of negotiations in Vienna. There is no need to specify that if the negotiations are successful, the easing of sanctions will lead to the return of a large-volume market of black gold, which is currently under embargo.

Chart

WTI Crude Oil (CLZ21) Futures (December contract, daily chart)To sum up, we now have some context on how the oil market might develop in the forthcoming days, with some events and news to monitor, as they could have a moderated to strong impact on the ongoing lack of supply…

In our daily alerts, we also analyze other markets and assets (ETFs, Futures, MLPs, stocks, etc.) of the oil and gas sector in order to get some exposure to the energy industry. Regarding natural gas, yesterday we provided a new trade plan to our members, following the last trading position, which successfully hit all the projected targets.

Stay tuned to receive our next projections!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Natural Gas: New Trading Position!

October 26, 2021, 9:15 AMAvailable to premium subscribers only.

In today’s edition, following the successful completion of our previous trade plan that hit our second target on Friday, we draw a new projection on Henry Hub Natural Gas futures…

By the way, it’s now time to switch to a new front month contract: December 2021, NGZ21!

-

Oil Breaks Records, But Don’t Expect Increases in Supply

October 25, 2021, 10:59 AMFundamental Analysis

Oil prices broke new multi-year records on Monday (Oct. 25) because of statements by the Saudi Energy Minister over the weekend, leaving little room for an upcoming increase in supply from OPEC and its allies. The latter, interviewed on Saturday (Oct. 23) by Bloomberg on the side-lines of the "Saudi Green Initiative" forum, also added that the crisis was somehow contained but not over yet, and particularly in some regions like Russia, where Moscow is in fact preparing for an eleven-day shutdown of all its non-essential services (restaurants, beauty salons, clothing or furniture stores, gyms, etc.) from this upcoming Thursday, in the hope of stemming the serious outbreak of the Covid-19 epidemic that is hitting the country. On the other hand, Minister of State for Petroleum Resources of Nigeria Timipre Sylva, also interviewed by Bloomberg during the same forum, estimated that the market was still too fragile.

WTI Crude Oil (CLZ21) Futures (December contract, daily chart)In summary, we should not expect a further increase in supply beyond the expected level from OPEC+ in the near future, despite a strong recovery in demand, as estimated by Goldman Sachs in a note on Sunday, saying that it could soon reach its pre-Covid-19 level, i.e., 100 million barrels per day!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Natural Gas Trading: Yet Another Profitable Call!

October 22, 2021, 11:25 AMWe entered a natural gas trade on Tuesday, which turned out to be profitable… just like the previous ones! Let’s have a look at how we can continue.

If you are one of Sunshine Profits’ subscribers, you should have come across our recent gas trade plan recommendation, published in our Tuesday’s “Oil & Gas Trading Alerts” edition.

Trade Plan

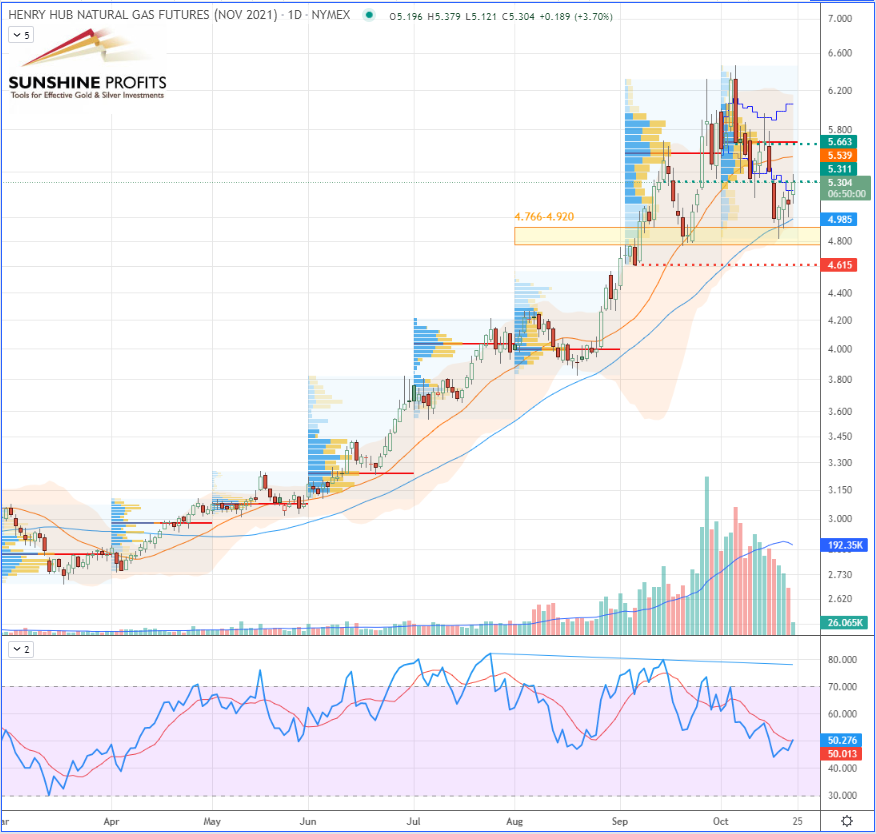

Our initial trade plan was to go long on Natural Gas [NGX21] (November 2021 contract) around $4.766-4.920 support (yellow rectangle) – with stop below $4.615 (red dotted line) and targets at $5.311 and $5.604 (green dotted lines) – See Fig. 1.

The entry got triggered in the early hours of Tuesday; as you can see, the market made a rebound where the bulls took over. Our first target at $5.311 has just been hit — for those who exit partially, we suggest lifting the second target to the $5.663 level, while your stop should be lifted just below the new/recent swing low ($4.825) or at breakeven.

Figure 1 – Henry Hub Natural Gas (NGX21) Futures (November contract, daily chart, logarithmic scale)

That’s pretty much it. If you want to take the next trade with us, remember to sign up for our premium Oil Trading Alerts! Happy trading…

…and have a great weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM