-

Position Update: Target Adjustment for Natural Gas

October 21, 2021, 10:39 AMAvailable to premium subscribers only.

In today’s edition, we update our trade plan by optimizing our targets on Henry Hub Natural Gas futures…

-

Is Crude Oil’s Rally Driven by Speculation Only?

October 20, 2021, 5:34 AMAfter the surge, the WTI Crude Oil still faces some global risk sentiment strong enough to make it fly higher. Will it pop like a helium balloon?

Fundamental Analysis

It appears that oil prices are being supported by speculators who have ignored signs of a slowing economy around the world. Nonetheless, the black gold may face a bearish supply forecast soon, which could potentially put it at risk of a pullback.

Furthermore, with a disappointing GDP in China in the third quarter and industrial production falling in September in the United States, the world's two largest economies have lost momentum, which could affect the level of energy demand.

Consequently, this context of state interventionism on energy prices is likely to reduce the transfer of demand from the coal market to petroleum products, depriving the crude of one of its wings that lifted it for a number of weeks.

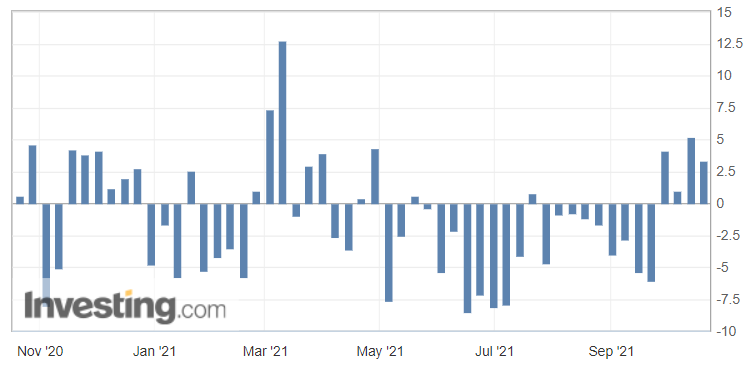

U.S. API Weekly Crude Oil Stock

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via InvestingRegarding the API figures published Tuesday, the increase in crude inventories (with 3.294 million barrels versus 2.233 million barrels expected) implies weaker demand and is normally bearish for crude prices.

However, we have to see whether or not these figures will be confirmed by the weekly Energy Information Administration's (EIA) report.

If that scenario is confirmed by the EIA’s figures later today, then the black gold may be set for a corrective wave, possibly back to previous support levels.

WTI Crude Oil (CLZ21) Futures (December contract, daily chart)In conclusion, anything can happen in this market in the forthcoming days… Therefore, no position in the WTI Crude is justified from the risk-reward perspective at the moment. However, things change quickly, and when they do, you don’t want to miss it! Subscribe to our premium Oil Trading Alerts to be the first to know about our trading outlooks, which are published as soon as opportunities arise.

Happy Trading!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Natural Gas Position Update: Quick Moves Required!

October 19, 2021, 7:39 AMAvailable to premium subscribers only.

In today’s edition, we update our trade plan on Henry Hub Natural Gas futures…

-

Crude Oil Is in the Fast Lane, But Where Is It Going?

October 18, 2021, 10:23 AMWhat’s the price level exit for the black gold?

The new front month contract (as we switched now to Dec’21) for WTI Crude Oil futures closed the week at $82 per barrel on Friday (Oct. 15th).

Fundamentally, nothing seems to be able to stop, in the short term, the surge in crude oil prices which continued to rise on Friday amid concerns over supply, since the WTI hit a new high in almost seven years.

In addition, the slight decline of the US dollar may signify a more marked optimism of the markets in the perspectives of a gradual recovery of the global economy.

OPEC+ remains stuck in its timetable for the gradual increase in production, thus tightening a market which suffers from insufficient supply.

If a return in global demand appears to be faster than that of supply (as we are getting close to the winter season and its cooler temperatures), more shipping and other requirements are needed.

WTI Crude Oil (CLZ21) Futures (December contract, daily chart)In summary, in times of uncertainty, we are wondering where the oil market is going to drive us with such directional moves. So far, it’s in the fast lane on the highway. However, the question now is: which exit is it going to take? $82? Or is it driving with a sufficiently full fuel tank in order to reach the psychological $100 exit? For now, let’s just enjoy the road and let us know what you think!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

We Love When a Plan Comes Together — Natural Gas Position Review

October 15, 2021, 11:03 AMIn our previous edition published last week, we projected that if the market (Henry Hub Natural Gas (NGX21) Futures) broke below $5.480-5.568 support, we would then readjust our long position to lower levels above $5.073-5.147 support.

So, this is exactly what the market did (after rebounding a few times on the same level), and thus an opportunity arose on Tuesday to enter just above this new projected support (just look how prices got rejected back up after almost touching it…).

We suggested that an appropriate stop would be placed just below $4.766 in order for a target to be $5.663-5.790, and the market hit that target yesterday by topping at the $ 5.964 level on the futures contract! – See Fig. 1

Trading Chart

Figure 1 – Henry Hub Natural Gas (NGX21) Futures (November contract, daily chart)

Our trading approach has led us to suggest some long trades around key supports, as natural gas recently offered a few opportunities to take advantage of dips onto those projected levels. If you don’t want to miss any future position calls, be sure to look at our premium Oil Trading Alerts.

Have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM