-

Quick Oil Position Update – 12 Jan. 2021

January 12, 2022, 10:09 AMAvailable to premium subscribers only.

-

Energies: New Trading Projections on Oil, Gasoline and Gas

January 11, 2022, 9:27 AMCrude oil prices edged higher in the European session by maintaining most of their recent gains. How are gas and gasoline doing?

Both the North Sea Brent barrel and the West Texas Intermediate (WTI) barrel resumed their forward march after the stabilisation of the situation in Kazakhstan and an increase in Libyan production. Black gold is thus on the rise again today, after two sessions down, stimulated by investor confidence in sustained demand.

Trading projections available to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Geopolitics: Current Situation in Kazakhstan and Libya

January 7, 2022, 11:08 AMAvailable to premium subscribers only.

In today’s edition, I will provide some updates on the geopolitical situation in both regions.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Big Man Winter Will Stimulate Gas and Heating Oil Demand

January 5, 2022, 10:28 AMHappy new year, everyone! We hope that 2022 will be a prosperous one for all our readers. However, will it be successful for oil?

Energy Market Updates

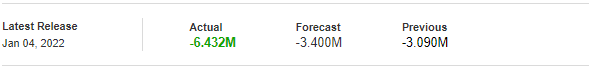

Yesterday, crude oil prices ended higher, after a volatile session as US inventories fell by 6.4 million barrels – more than twice the previous week – which is another positive sign for demand.

US inventories levels of crude oil, gasoline, and distillates stocks are again forecasted to fall by about 3 million more than expected last week. That would be another significant decline on the back of greater demand, according to estimated figures released by the American Petroleum Institute (API) yesterday.

(Source: Investing.com)

Crude oil prices stabilized near their 6-week highs following the OPEC+ group meeting, which maintained a limited increase in production of 400k barrels/day (no surprise). It is therefore a matter of maintaining an increase in production for the seventh consecutive month.

This also shows that the organization was confident and believed in the resistance of global oil demand despite the recent restrictions implemented by several governments scared by Omicron, even though those travel restrictions may likely delay the resumption of aviation demand.

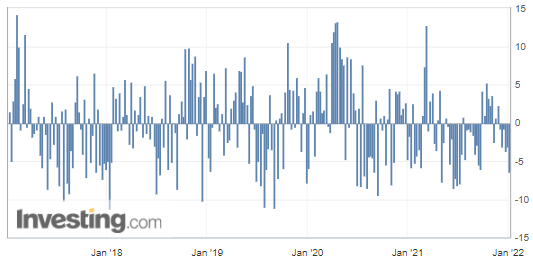

RBOB Gasoline (RBG22) Futures (February contract, daily chart)

WTI Crude Oil (CLG22) Futures (February contract, daily chart)

Regarding natural gas, the Henry Hub (US benchmark) is slowly climbing as temperatures are dropping in many regions, while the European benchmark, the Dutch Title Transfer Facility (TTF), rallied 3.5% as European gas prices remain extremely volatile due to reduced exports from Russia (notably via the Yamal pipeline) but also via Ukraine.

The upward momentum is also linked to weather forecasts, such as colder temperatures and frost encountering the European continent in the coming days and weeks, which may obviously have a stimulating effect on gas demand.

Henry Hub Natural Gas (NGG22) Futures (February contract, daily chart)

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM