-

WTI Crude Oil: New Contract – Updated Trading Projections

November 17, 2021, 7:38 AMAvailable to premium subscribers only.

In today’s edition, since it’s time to switch to new front month’s (Jan’22) futures contract on WTI crude oil (CLF22), I will update my market projections for WTI Crude Oil futures.

-

Commodity Currencies Explained (Part I)

November 15, 2021, 9:59 AMEver think of commodities when trading currencies? Or vice-versa? What do Brazilian reals have to do with soybeans, or Indian rupees with diamonds?

Let’s start by defining what could be called a commodity currency.

Generally, a commodity currency represents a currency from a country or geographical zone that produces specific commodities which will account for most of its exports.

Some examples of currencies which could be considered as commodity currencies are presented in the following table:

Currencies

Top Material Exports

Argentine peso (ARS)

Soybean meal ($8.81B), corn ($6.19B), delivery trucks ($3.83B), soybeans ($3.47B), soybean oil ($3.38B), bran ($292M), other vegetable residues and waste ($232M), and ground nut oil ($131M)

Australian dollar (AUD)

Iron ore ($67.5B), coal briquettes ($51.5B), petroleum gas ($34.1B), gold ($25.4B), aluminium oxide ($5.6B), sheep and goat meat ($3.07B), and wool ($2.26B)

Brazilian real (BRL)

Soybeans ($26.1B), crude petroleum ($24.3B), iron ore ($23B), corn ($7.39B), sulfate chemical wood pulp ($7.35B), poultry meat ($6.55B), frozen bovine meat ($5.67B) and raw sugar ($5.33B)

Canadian dollar (CAD)

Crude petroleum ($67.8B), cars ($40.9B), gold ($14.6B), refined Petroleum ($12.3B), vehicle parts ($10.8B), sawn wood ($6.35B), raw aluminium ($5.45B), potassic fertilizers ($5.27B), rapeseed ($3.23B), and rapeseed oil ($2.6B)

Indian rupee (INR)

Refined petroleum ($39.2B), diamonds ($22.5B), packaged medicaments ($15.8B), jewellery ($14.1B), cars ($7.15B), Rice ($6.9B), Crustaceans ($4.67B), and Non-Retail Pure Cotton Yarn ($2.86B)

Indonesian rupiah (IDR)

Coal briquettes ($20.3B), palm oil ($15.3B), petroleum gas ($8.32B), cars ($4.52B), gold ($4.01B), lignite ($2.91B), stearic acid ($2.76B), uncoated paper ($2.37B), and coconut oil ($1.9B)

Malaysian ringgit (MYR)

Integrated circuits ($63B), refined petroleum ($17.8B), petroleum gas ($11.5B), semiconductor devices ($9.65B), palm oil ($8.91B), rubber apparel ($4.37B), other vegetable oils ($1B), copper powder ($873M), asphalt mixtures ($417M), and platinum clad metals ($127M)

Mexican peso (MXN)

Cars ($53.1B), computers ($32.4B), vehicle parts ($31.2B), delivery trucks ($26.9B), crude petroleum ($26.6B), tractors ($10.7B), beer ($5.07B), tropical fruits ($3.6B), and railway freight cars ($3.57B)

New Zealand dollar (NZD)

Concentrated milk ($5.73B), sheep and goat meat ($2.62B), rough wood ($2.31B), butter ($2.29B), frozen bovine meat ($2.09B), casein ($613M), and honey ($237M)

Nigerian naira (NGN)

Crude Petroleum ($46B), petroleum gas ($7.78B), scrap vessels ($2.26B), flexible metal tubing ($2.1B), and cocoa beans ($715M)

Peruvian nuevo sol (PEN)

Copper ore ($12.2B), gold ($6.76B), refined petroleum ($2.21B), zinc ore ($1.65B), and refined copper ($1.62B), animal meal and pellets ($1.54B), lead ore ($1.01B), fish oil ($434M), and buckwheat ($139M)

Russian ruble (RUB)

Crude petroleum ($123B), refined petroleum ($66.2B), petroleum gas ($26.3B), coal briquettes ($17.6B), wheat ($8.14B), semi-finished iron ($6.99B), coal tar oil ($4.49B), raw nickel ($4.03B), and nitrogenous fertilizers ($3.05B)

South African rand (ZAR)

Gold ($16.8B), platinum ($9.62B), cars ($7.61B), iron ore ($6.73B), and coal briquettes ($5.05B), manganese ore ($3.16B), chromium ore ($1.92B), titanium ore ($583M), and niobium, tantalum, vanadium, and zirconium ore ($480M)

Swiss franc (CHF)

Gold ($59B), packaged medicaments ($46.2B), blood, antisera, vaccines, toxins, and cultures ($32.9B), base metal watches ($13.6B), jewellery ($10.9B), precious metal watches ($7.32B), and hydrazine or hydroxylamine derivatives ($501M)

US dollar (USD)

Refined petroleum ($84.9B), crude petroleum ($61.9B), cars ($56.9B), integrated circuits ($41.4B), vehicle parts ($41.2B), medical instruments ($29.5B), gas turbines ($28.1B), aircraft parts ($16.3B), and orthopedic appliances ($12.1B)

Vietnamese dong (VND)

Broadcasting equipment ($42.3B), telephones ($18.2B), integrated circuits ($15.5B), textile footwear ($10.6B), and leather footwear ($6.43B), coconuts, Brazil nuts, and cashews ($3.16B), fuel wood ($2.05B), cement ($1.39B), metal-clad products ($1.37B), and cinnamon ($175M)

West African CFA franc (XOF)

Gold ($11.66B), cocoa beans ($3.84B), refined petroleum ($2.64B), rubber ($1.08B), raw cotton ($1.04B), and crude petroleum ($941M), cocoa paste ($795M), other oily seeds ($407M), Phosphoric Acid ($346M), coconuts, Brazil nuts, and cashews ($280M), ground nuts ($192M), zinc ore ($173M), raw zinc ($155M), electricity ($141M), cocoa shells ($115M), calcium phosphates ($95.7M), radioactive chemicals ($59.6M), rough wood ($59.5M), raw copper ($49.4M), Petroleum Gas ($42.5M), non-fillet frozen fish ($356.1M), other vegetable residues ($25.4M), and aluminium ore ($3.17M)

Data: The Observatory of Economic Complexity (OEC)

(Bold: products which the country/economic area was the world’s biggest exporter in 2019)

For active trading purposes, the ones underlined would be characterised as freely floating and more liquid currencies. Thus, they would also be more accessible and less costly (with lower fees) to trade.

For hedging purposes, the others would present some advantages to the commercialisation of their associated natural resources, even though they would rather be considered more exotic currencies.

Charts:

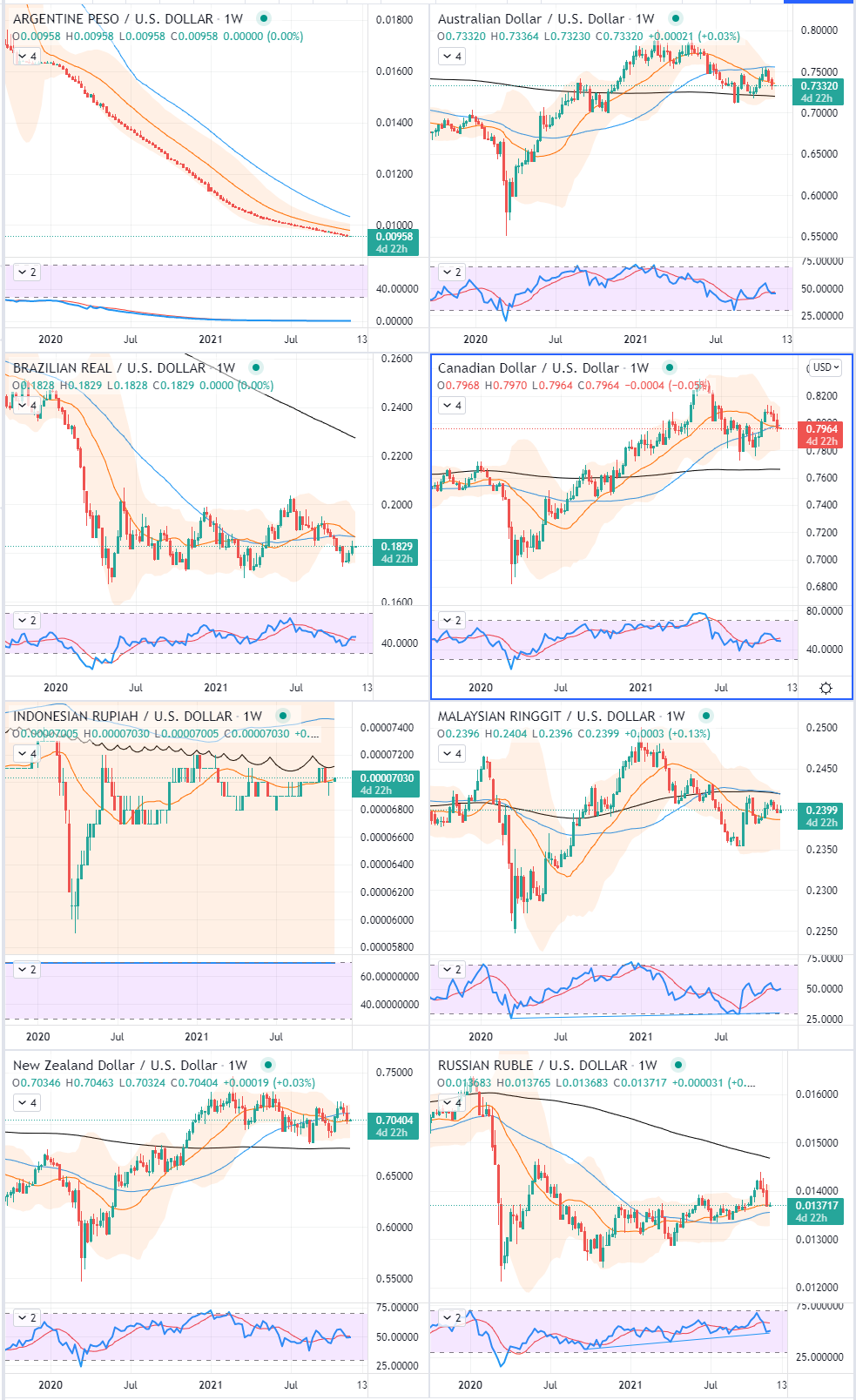

Here is a representation of some key commodity currencies presented in the above table on a weekly timeframe against the US dollar (reference currency):

Each chart was represented within 2-standard deviation Bollinger Bands based on a 20-period simple moving average (in orange), a 50-period simple moving average (blue curve), a 200-period simple moving average (the black curve) and in the pane below is a 14-period relative strength index (in blue) to which was applied a 9-period simple moving average (red curve).

All those charts are displayed over a 2-year historical period.

In the next article I’ll focus on highlighting some correlations which may exist between key natural resources and the currencies in which they are usually traded.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

WTI Crude Oil: New Trading Projections!

November 12, 2021, 8:10 AMAvailable to premium subscribers only.

In today’s edition, I will share with you my new projections for WTI Crude Oil futures…

-

Crude Oil Eyeing EIA Figures – “Yoyo-Trade” Exited After Hitting All Projected Targets!

November 10, 2021, 9:31 AMIs crude really set to break its highs again?

Fundamental Analysis

Crude oil prices reached their last highs on Wednesday before pulling back, initially supported by US crude stocks falling as shown by API figures, and afterwards cooled by contrary prospects from the U.S. Energy Information Administration (EIA).

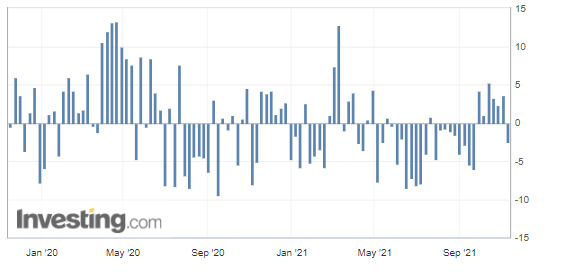

Meanwhile, our subscribers were exiting their last oil trade, after the black gold hit the second projected target at $83.40 (see technical chart).

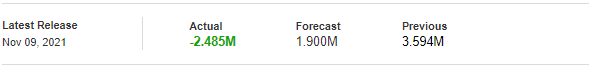

U.S. API Weekly Crude Oil Stock:

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via InvestingRegarding the API figures published Tuesday, the decline in crude inventories (with 2.485 million barrels versus 1.900 million barrels expected) implies greater demand and is normally bullish for crude prices (at least in theory). This was indeed the case yesterday, as those figures have supported crude prices in the first place.

In the perspective of the figures to be published later today by the U.S. Energy Information Administration (EIA), and according to the median of analysts surveyed by Bloomberg, the market would expect an increase of 1.6 million barrels, so let’s see whether this figure will be confirmed.

Chart – WTI Crude Oil (CLZ21) Futures (December contract, daily chart)In summary, with an oil market progressing (with some rallying limitations set by threats of the US administration to release some of its strategic crude reserves – to relieve the market by artificially increasing the supply) – there is currently no trade position justified from a risk-to-reward point of view.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

A New Profitable Call on Crude Oil: “The Yoyo-Trade”

November 8, 2021, 10:15 AMWas the adage "buy the rumor, sell the news" also verified with that new trading position?

It was Thursday (Nov. 4) that the following rumor had flourished: a possible coordinated action which was supposed to consist of drawing on the strategic reserves of several countries, including the United States, which were leading the dance.

Meanwhile, our subscribers were just getting ready to go long around the $76.57-79.65 support zone (yellow band), with a stop placed on lower $76.48 level (red dotted line) and targets at $81.80 and $83.40 (green dotted lines).

As a result, oil prices had contracted in stride (trading just into our entry area), just before the rumor effect faded shortly on Friday (Nov. 5), to push them back up.

In fact, with oil prices picking up momentum on Friday, once again settling firmly above $80 per barrel, and with a market still showing doubts on the possible use of strategic crude reserves, the proposed trade entry on the black gold, triggered on Thursday – following my last post – was thus profitable since it already turned into a partial profit-taking at the end of the week.

Then, on Saturday, Joe Biden said that his administration had the means to cope with the rise in energy prices, in particular after the OPEC+'s decision not to raise their production to more than 400,000 barrels per day. in a context of global imbalance between supply and demand.

In addition, Joe Biden also insinuated that the organization (and its allies) might actually not do its best to pump enough volume of crude oil.

Trading Charts

Chart – WTI Crude Oil (CLZ21) Futures (December contract, daily chart)Now, let’s zoom into the 4H chart to observe the recent price action all around the above-mentioned levels of our trade plan:

Chart – WTI Crude Oil (CLZ21) Futures (December contract, 4H chart)In summary, my trading approach has led me to suggest some long trades around potential key supports, as this dip on crude oil offered a great opportunity for the bulls to enter long whilst aiming towards specific projected targets. If you don’t want to miss any future trading alerts, make sure to look at here. . Moreover, for those interested in Forex trading, please note that I am currently preparing some new series about the co-existing links and relationships between commodities and currencies.

Stay tuned – happy trading!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM