-

RBOB Gasoline – Short-Term Projections

December 17, 2021, 10:02 AMAvailable to premium subscribers only.

In today’s edition, I will provide a trade projection for RBOB Gasoline futures (RBF22).

-

WTI & Brent Crude Oil – How Will Inflation Impact Prices?

December 15, 2021, 10:05 AMOnce inflation is set free, it never returns to the previous state. The fight requires fast thinking, but major banks still sit on the fence.

On the global economic scene, major central banks still don’t really know which pedal to use - either the one to fight inflation (tapering) or the other one to keep taking their shoot of quantitative easing (money-printing) policies. Inflation, however, is like toothpaste: once you got it out, you can’t get it back in again. So, instead of squeezing the tube too strongly, both the Federal Reserve (Fed) and the European Central Bank (ECB) are likely to maintain an accommodating tone this week, which could eventually benefit the price of black gold.

Crude oil prices were looking for a direction to take on Tuesday, after mixed reports emerged, one rather pessimistic on global demand (published by EIA) and the other, more optimistic over sustained demand, from the OPEC group. Indeed, the first report came from the International Energy Agency (IEA) on Tuesday morning. It slightly lowered its forecast of world oil demand for 2021 and 2022, by 100,000 barrels per day on average, mainly to consider the lower use of air fuels due to new restrictions on international travel.

The second one, from OPEC, stated on Monday in a more optimistic bias that the cartel has indeed maintained its forecasts for global oil demand in 2021 and 2022. It estimated that the impact of Omicron should be moderate and short-term since the world is becoming better equipped to face new variants and difficulties they may cause.

Therefore, while the prospect of possible travel restrictions and new lockdowns worries investors, the American Petroleum Institute (API) reported on Tuesday a drop in commercial crude reserves of 800,000 barrels last week.

On the geopolitical scene, growing tensions between Russia and the West over the conflict in Ukraine are contributing to escalating gas prices, given that a third of European gas comes from Russia.

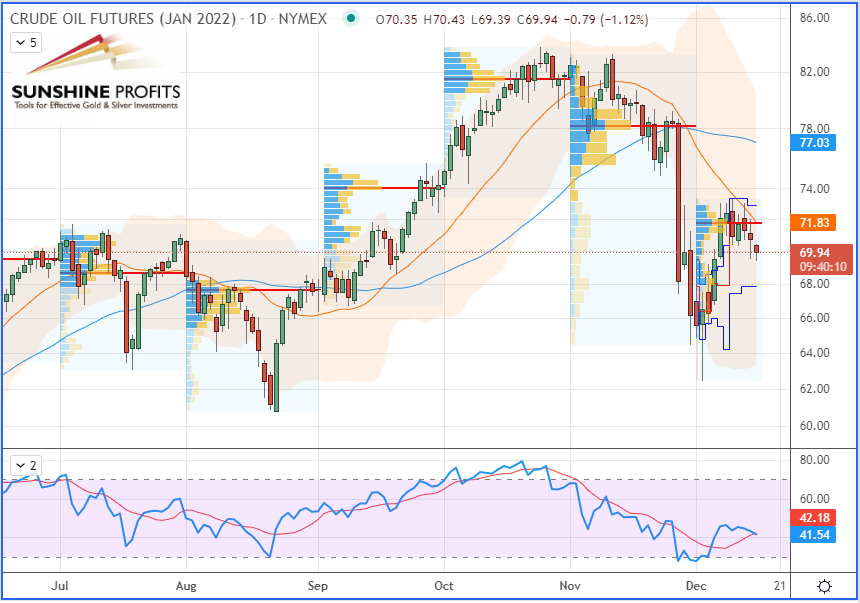

WTI Crude Oil (CLF22) Futures (January contract, daily chart, logarithmic scale)

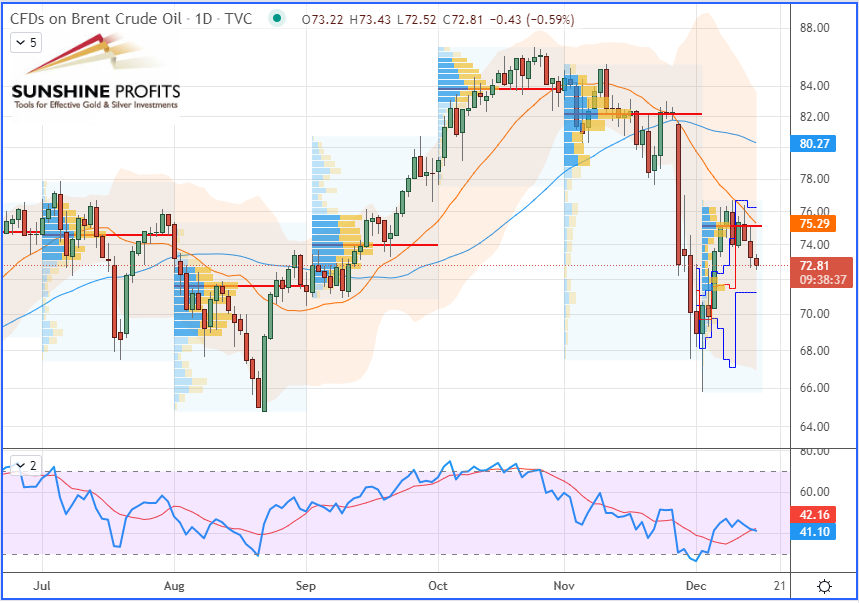

Brent Crude Oil (UKOIL) CFD (daily chart, logarithmic scale)

Henry Hub Natural Gas (NGF22) Futures (January contract, daily chart, logarithmic scale)

In summary, we can witness more volatile markets than usual for the month of December. Even though this could be accentuated by the end-of-year adjustment operations among traders, some uncertainties with central banks’ monetary policies remain and are certainly weighing on the financial markets, especially in the inflationary context. Thus, the week ahead could be an interesting one for both the black gold and the greenback.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Natural Gas: Our First Price Target Hit! Ready For the Next One?

December 13, 2021, 10:50 AMIn today’s edition, I will provide some updates on recent market developments for Natural Gas futures (NGF22) following my last article published Friday, Dec-10.

Alternatively, you can find my initial trade plan (with projections) in last Monday’s Oil & Gas Trading Alert.

The Trading Plan

(Source: tenor.com)

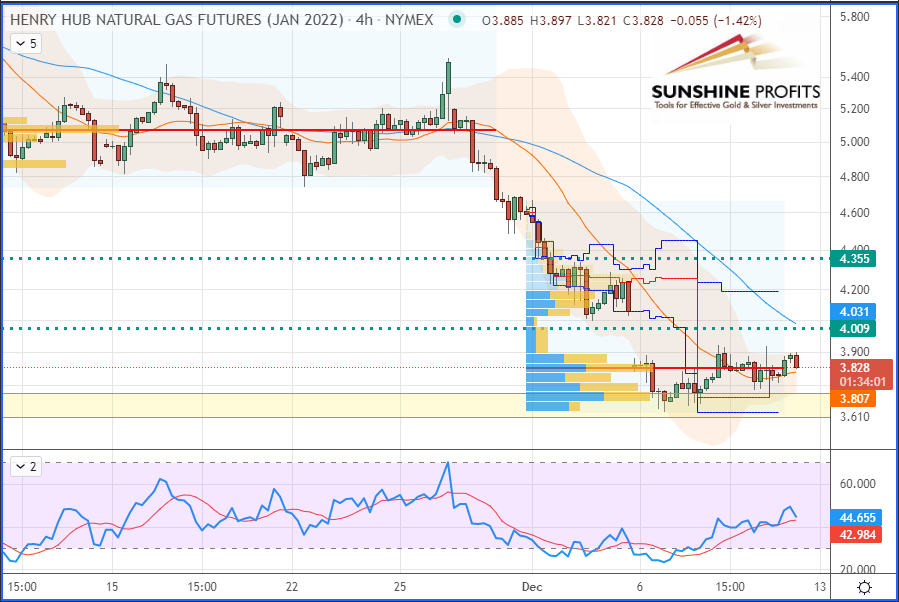

We all love it when a trade plan comes together! Since the market has to cope with stronger demand due to lower temperatures, you can see that the rebounding floor (support) provided was ideal for the Henry Hub. It has been supported by unyielding global demand for US Liquefied Natural Gas (LNG), and that also fueled its momentum. The recommended objective at $4,009 was thus hit this morning (during the European session) and the $4.355 level is now the next target.

As I explained in more detail in my last risk-management-related article to secure profits, my recommended stop, which was located just below the $ 3.424 level (below half-yearly swing low), was now lifted up around the $3.800 level, which corresponds to the 50% distance between the initial entry and target 1. By doing so, that trade turns out to be risk-free. Alternatively, you could also eventually use an Average True Range (ATR) multiple to determine a different level (above breakeven) that may better suit your trading style.

Henry Hub Natural Gas (NGF22) Futures (January contract, daily chart)

Now, let’s zoom into the 4H chart to observe the recent price action all around the abovementioned levels of our trade plan:

Chart – Henry Hub Natural Gas (NGF22) Futures (January contract, 4H chart, logarithmic scale)That’s all for today, folks. Happy trading!

As always, we’ll keep you, our subscribers well informed.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

New Profitable Call on Natural Gas: “The Yoyo-Trade” Is Back

December 10, 2021, 9:11 AMWhat will next week bring us? Hopefully, another profitable trade! The entry has been triggered, and we are on track to reaching our first target.

The fundamental question is: are we witnessing a resumption of bullish factors on natural gas?

The price of gas hit its highest level since February 2014 in early October. Tight supplies and concerns about a rougher than expected winter in the northern hemisphere were the main propellants for natural gas. However, quite suddenly, a dip took place over the past week. Since exiting the key $ 5.00 per Million British thermal units (MBtu) support zone a week ago, it has fallen by more than 25% – more than 40% drop from its highest level in October.

Meanwhile, at the pre-open last Monday, I told our subscribers to get ready to go long around the $3.604-3.716 support zone (yellow band), with a stop placed just below the $3.424 level (red dotted line) and targets at $4.009 and $4.355 (green dotted lines).

As a result, gas prices contracted in stride while trading just into the provided entry area before the bull crowd woke up to push them back up in the following days.

In fact, with gas prices picking up momentum from Wednesday, the proposed trade entry on the Henry Hub futures is turning profitable (and getting closer to target #1).

Trading Charts

Chart – Henry Hub Natural Gas (NGF22) Futures (January contract, daily chart, logarithmic scale)Now, let’s zoom into the 4H chart to observe the recent price action all around the abovementioned levels of our trade plan:

Chart – Henry Hub Natural Gas (NGF22) Futures (January contract, 4H chart, logarithmic scale)In summary, my trading approach has led me to suggest some long trades around potential key supports, as this dip on natural gas offered a great opportunity for the bulls to enter long whilst aiming towards specific projected targets. If you don’t want to miss any future trading alerts, make sure to look at our Premium section.

By the way, for those of you who are interested in trading biofuels, please note that I recently wrote an article on this topic to diversify your portfolio. Alternatively, you can have a closer look at my selection of stocks and MLPs through our public dynamic stock watchlist.

Stay tuned – and happy trading!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

WTI Crude Oil – Update on Fundamentals

December 9, 2021, 9:38 AMAvailable to premium subscribers only.

In today’s edition, I will provide some updates on fundamentals for WTI Crude Oil futures (CLF22).

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM