-

The Fed Is to React to Inflation. How Will This Affect Oil?

January 26, 2022, 9:48 AMCrude oil prices rose slightly today before the release of weekly data on US commercial inventories. The market is still galvanized by tensions in Ukraine and the Middle East that threaten the supply of black gold.

Available to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Geopolitical Tensions Still Support High Oil Prices

January 24, 2022, 9:30 AMOil prices fell slightly on Friday, in the wake of a further dip in the stock market. However, the trend remains strong due to geopolitical tensions.

Available to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Crude Oil: A Surprising Increase in US Inventories

January 21, 2022, 8:18 AMRecently, oil prices hit their highest levels in 7 years. Despite this, we are witnessing a surprising increase in US inventories. Why is that?

Energy Market Updates

Crude oil retreated this morning in the pre-US trading session, after another volatile day on Thursday. It was followed by the weekly release of US inventory figures that surprised the market with an increase in stocks published by the Energy Information Administration (EIA). Meanwhile, market participants were expecting a drop close to 1 million barrels, which implies a slowdown in demand.

This imbalance has led to soaring prices for petroleum products and distillates, which will add pressure on households and businesses already struggling with higher levels of inflation. Also, as I mentioned in more detail on Wednesday, there are also geopolitical tensions in various regions carrying some uncertainty, which is an additional turbine to propel oil prices.

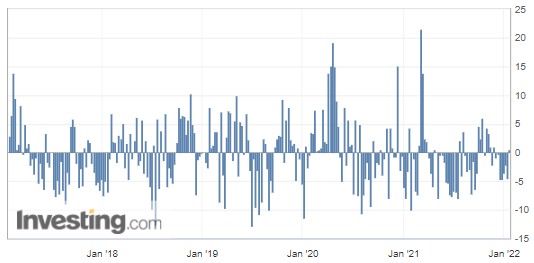

(Source: Investing.com)

RBOB Gasoline (RBH22) Futures (March contract, daily chart)

WTI Crude Oil (CLH22) Futures (March contract, daily chart)

Do you think that black gold will be worth three figures ($100) anytime soon? In the first quarter of 2022, maybe? Let us know in the comments.

That’s all folks for today. Have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Oil Markets More Animated by Geopolitics, Supply, and Demand

January 19, 2022, 9:39 AMCrude oil prices closed yesterday near their 7-year highs. What do you think are the main price drivers prevailing for this surge on crude oil prices?

Geopolitical Situation

Crude oil prices closed yesterday near their 7-year highs, as an attack on an oil site in Abu Dhabi further strained an already tense market. The concern about the deterioration of the situation between Ukraine and Russia, which has been occurring for several days, has been overtaken by the attack on the infrastructures of the United Arab Emirates. On Monday, an attack probably committed by drones blew up three tank trucks near the Abu Dhabi National Oil Company (ADNOC)’s reservoirs.

This strike, claimed by the Houthi rebels in Yemen, killed three people and injured six others, without damaging the emirate's oil installations. Therefore, this attack increases the likelihood of seeing production losses at a time when supply is already very tight. On the other hand, the spread of the civil war in Yemen could signal that a new Iranian nuclear deal is out of the question anytime soon, thus depriving the market of Iranian crude oil barrels since the Houthi rebels are indeed close to Iran.

Still, in the Middle Eastern region, yesterday an explosion damaged an oil pipeline linking Iraq to Turkey through which some 450,000 barrels of crude transit per day, thus cutting off flow from Iraq. This news has boosted prices, making them reach new records. It appears now that this Iraq-Turkey pipeline was back in operation earlier this morning, according to the Turkish public company Botas.

Supply/Demand Dynamics

As the market worries about supply, OPEC+ on Tuesday maintained its forecast for a rise in global demand for black gold in 2022, which would reach 100 million barrels per day.

Even the IEA has raised its forecast for oil demand this year and warned that the market could experience another year of volatility if supply disappoints. According to the agency, total demand should thus reach a level close to 100 million barrels per day this year.

WTI Crude Oil (CLH22) Futures (March contract, daily chart)

WTI Crude Oil (CLH22) Futures (March contract, daily chart)As you can see, there is currently a lot going on in the energy markets to maintain a high level of volatility. In particular, some fundamental drivers and news of supply disruptions and geopolitical tensions often push prices significantly higher. However, it is also interesting to note that they do not seem to be falling back to their previous level once the issues are resolved or when the tensions de-escalate.

PS: Don’t forget to switch to the March 2022 contract (CLH22) for WTI Crude Oil.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

New Profitable Call on Natural Gas: The Yoyo-Trade Is Back!

January 14, 2022, 9:52 AMGas prices surged in stride and then the market plunged back down like a yoyo thrown from a balcony. What caused such a reaction?

At the beginning of the week, Henry Hub natural gas futures closed above the $4 psychological mark on the NYMEX for the first time this new year as a result of robust US LNG exports and weather-driven demand. Overall, the prices on the February contract were still trading on a longer-term downtrend, which is why I was especially looking for the best spot to initiate a short-selling trade rather than jumping on a galloping horse.

Meanwhile, some of our subscribers – always free to scalp the market (or to take more aggressive counter-trend trades towards our suggested entries) – were just getting ready to go short around the $4.876.5.079 resistance zone (highlighted by a yellow band), with a stop placed just above the higher $5.400 level (represented by a red dotted line) and targets at $4.568 and $4.213 (also marked by two green dotted lines), according to my last projections.

As a result, gas prices indeed surged in stride (performing a high-speed rally up to the 4.879 that got almost immediately stopped by the yellow band – thus triggering our entry). It was just before the market plunged back down like a yoyo thrown from the third floor and wheeling on the first-floor balcony, considering our targets to be located on both the second and first floors.

This sudden reversal move was certainly triggered on the one hand, technically by aggressive traders taking profits, but also , more fundamentally, by a slowdown in gas demand as the purchases for colder weeks were already anticipated by the commercials (large MNCs hedging their risk, oil and gas majors, utility companies, etc.); the latter having undoubtedly more impact and weight than we, or larger speculators, on those markets. Thus, I would say the key is trying to think like them to get some understanding of trading energies.

Trading Charts

Chart – Henry Hub Natural Gas (NGG22) Futures (February contract, daily chart)Now, let’s zoom into the 4H chart to observe the recent price action all around the above mentioned levels of our trade plan:

Chart – Henry Hub Natural Gas (NGG22) Futures (February contract, 4H chart)In summary, my trading approach has led me to suggest some short trades around potential key resistances since this sudden surge in natural gas offered a great opportunity for the bears to enter short whilst aiming towards specific projected targets. Some of you – more aggressive traders – may also enjoy jumping on galloping horses. However, for such trades, the timeframe would be much shorter and difficult to make everyone take advantage of them, due to the volatility in the markets and the fact that I always try to provide trades with optimal entry levels meeting a profitable risk-to-reward ratio.

You are always free – at your own risk and time schedule – to scalp the markets in a more aggressive way (counter-trend trading) towards a projected entry area if you feel comfortable doing so. However, sometimes, the “FOMO” (Fear-Of-Missing-Out) voices might tell you to trade when you shouldn’t, so just be aware that over-trading could also lead you to take more risky positions – refraining from trading all the time is also part of trading – a mind game that you will have to rapidly master!

If you don’t want to miss any future trading alerts, make sure to look at our Premium section.

Stay tuned – have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM