Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Natural Gas [NGF22] Long around $ 3.604-3.716 support (yellow band) with targets at $ 4.009 & 4.355 and stop just below $ 3.424 – See my previous analysis.

- WTI Crude Oil [CLF22] No position currently justified on a risk-to-reward point of view.

Are we witnessing a resumption of bullish factors on natural gas?

The price of gas hit its highest level since February 2014 in early October. Tight supplies and concerns about a rougher than expected winter in the northern hemisphere were the main propellants for natural gas. However, quite suddenly, a dip took place over the past week. Since exiting the key $ 5.00 per Million British thermal units (MBtu) support zone a week ago, it has fallen by more than 25% – more than 40% drop from its highest level in October.

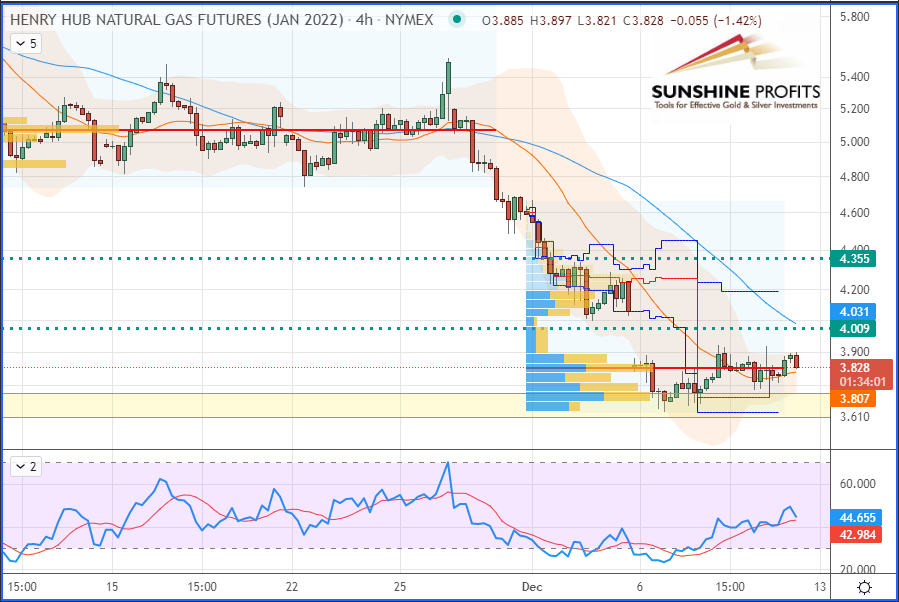

Meanwhile, at the pre-open last Monday, I told our subscribers to get ready to go long around the $3.604-3.716 support zone (yellow band), with a stop placed just below the $3.424 level (red dotted line) and targets at $4.009 and $4.355 (green dotted lines).

As a result, gas prices contracted in stride while trading just into the provided entry area before the bull crowd woke up to push them back up in the following days.

In fact, with gas prices picking up momentum from Wednesday, the proposed trade entry on the Henry Hub futures is turning profitable (and getting closer to target #1).

Trading Charts

Chart – Henry Hub Natural Gas (NGF22) Futures (January contract, daily chart, logarithmic scale)

Now, let’s zoom into the 4H chart to observe the recent price action all around the abovementioned levels of our trade plan:

Chart – Henry Hub Natural Gas (NGF22) Futures (January contract, 4H chart, logarithmic scale)

In summary, my trading approach has led me to suggest some long trades around potential key supports, as this dip on natural gas offered a great opportunity for the bulls to enter long whilst aiming towards specific projected targets. If you don’t want to miss any future trading alerts, make sure to look at our Premium section.

By the way, for those of you who are interested in trading biofuels, please note that I recently wrote an article on this topic to diversify your portfolio. Alternatively, you can have a closer look at my selection of stocks and MLPs through our public dynamic stock watchlist.

Stay tuned – and have a nice weekend!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist