Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Natural Gas [NGF22] Long around $3.604-3.716 support (yellow band) with targets at $4.009 (hit!) & 4.355 and stop just below $3.424 (lifted at $3.800, hit to secure profits) – Trade exited – See previous post.

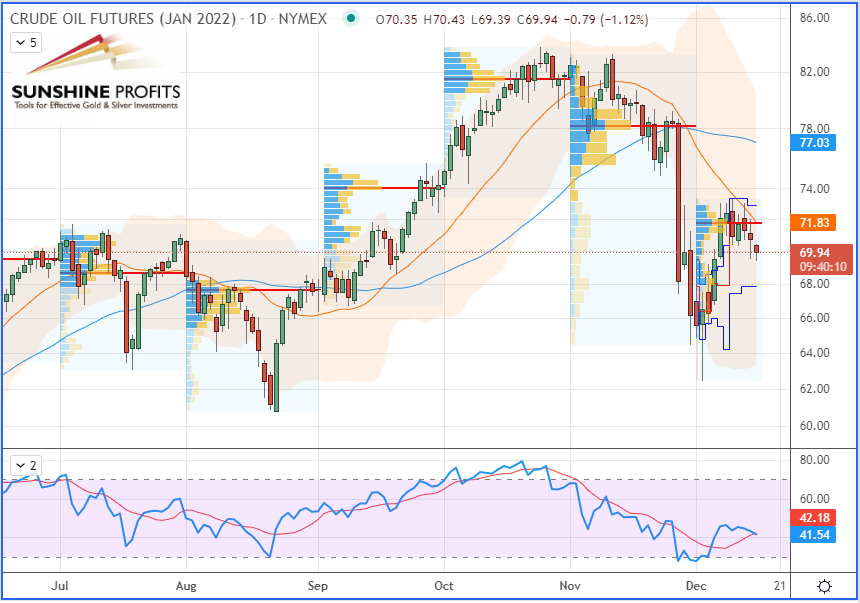

- WTI Crude Oil [CLF22] No new position currently justified on a risk-to-reward point of view.

Did you miss my last article about biofuels to diversify your portfolio? No problem, you can have a look at my selection through the dynamic stock watchlist.

On the global economic scene, major central banks still don’t really know which pedal to use - either the one to fight inflation (tapering) or the other one to keep taking their shoot of quantitative easing (money-printing) policies. Inflation, however, is like toothpaste: once you got it out, you can’t get it back in again. So, instead of squeezing the tube too strongly, both the Federal Reserve (Fed) and the European Central Bank (ECB) are likely to maintain an accommodating tone this week, which could eventually benefit the price of black gold.

Crude oil prices were looking for a direction to take on Tuesday, after mixed reports emerged, one rather pessimistic on global demand (published by EIA) and the other, more optimistic over sustained demand, from the OPEC group. Indeed, the first report came from the International Energy Agency (IEA) on Tuesday morning. It slightly lowered its forecast of world oil demand for 2021 and 2022, by 100,000 barrels per day on average, mainly to consider the lower use of air fuels due to new restrictions on international travel.

The second one, from OPEC, stated on Monday in a more optimistic bias that the cartel has indeed maintained its forecasts for global oil demand in 2021 and 2022. It estimated that the impact of Omicron should be moderate and short-term since the world is becoming better equipped to face new variants and difficulties they may cause.

Therefore, while the prospect of possible travel restrictions and new lockdowns worries investors, the American Petroleum Institute (API) reported on Tuesday a drop in commercial crude reserves of 800,000 barrels last week.

On the geopolitical scene, growing tensions between Russia and the West over the conflict in Ukraine are contributing to escalating gas prices, given that a third of European gas comes from Russia.

WTI Crude Oil (CLF22) Futures (January contract, daily chart, logarithmic scale)

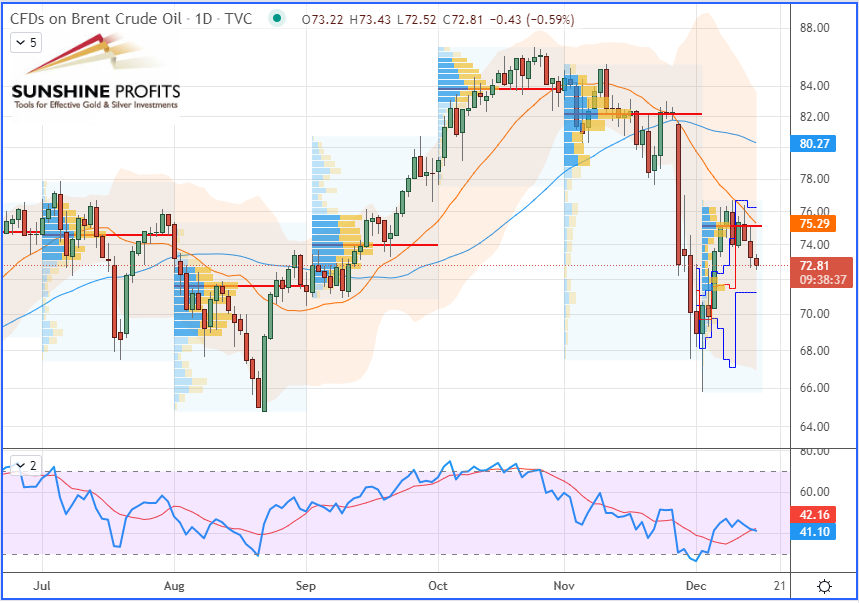

On a side note, I also want to take the opportunity to thank Alexander, one of our subscribers, who asked if I could provide trading opinions on Brent oil futures.

Here is my answer:

Regarding Brent, given its correlation with WTI, my analyses on WTI Crude Oil are very easily transposable to the Brent market since they really move in parallel. The next time that I will provide a position on WTI, I will remember to provide equivalent levels to enter the position on Brent.

The fundamentals will remain the same as well as the geopolitical aspects anyway. At the moment, both markets are rather unbalanced (still in a slightly bearish territory on the short-term so far), though I do feel it’s not a good idea to short them (given the volatility on those, their long-term overall bullish trend, and the fact that we don’t have sufficiently strong resistance above prices at the moment). Therefore, I prefer to wait for further demand indications before initiating a new long entry. So, we will see in a few days...

Brent Crude Oil (UKOIL) CFD (daily chart, logarithmic scale)

Henry Hub Natural Gas (NGF22) Futures (January contract, daily chart, logarithmic scale)

In summary, we can witness more volatile markets than usual for the month of December. Even though this could be accentuated by the end-of-year adjustment operations among traders, some uncertainties with central banks’ monetary policies remain and are certainly weighing on the financial markets, especially in the inflationary context. Thus, the week ahead could be an interesting one for both the black gold and the greenback.

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist