tools spotlight

-

On the Race to the Bottom, Miners Beat Gold

September 15, 2021, 10:06 AMThe medium-term outlook for precious metals is a bearish one, and as gold moves lower, the miners will move lower faster. Small price jumps don’t count.

Let’s get this straight, we’re not day traders, and getting excited about an occasional bounce is much ado about nothing.

Remember when I told you yesterday that the “strength” of gold stocks was likely more or less random and not a true sign of strength? Yesterday’s lack thereof confirmed it. Gold moved higher, but gold stocks almost didn’t. Implications? That was just a tiny, inconsequential, counter-trend upswing within a bigger decline.

Let’s take a look at what senior miners and junior mining stocks did yesterday.

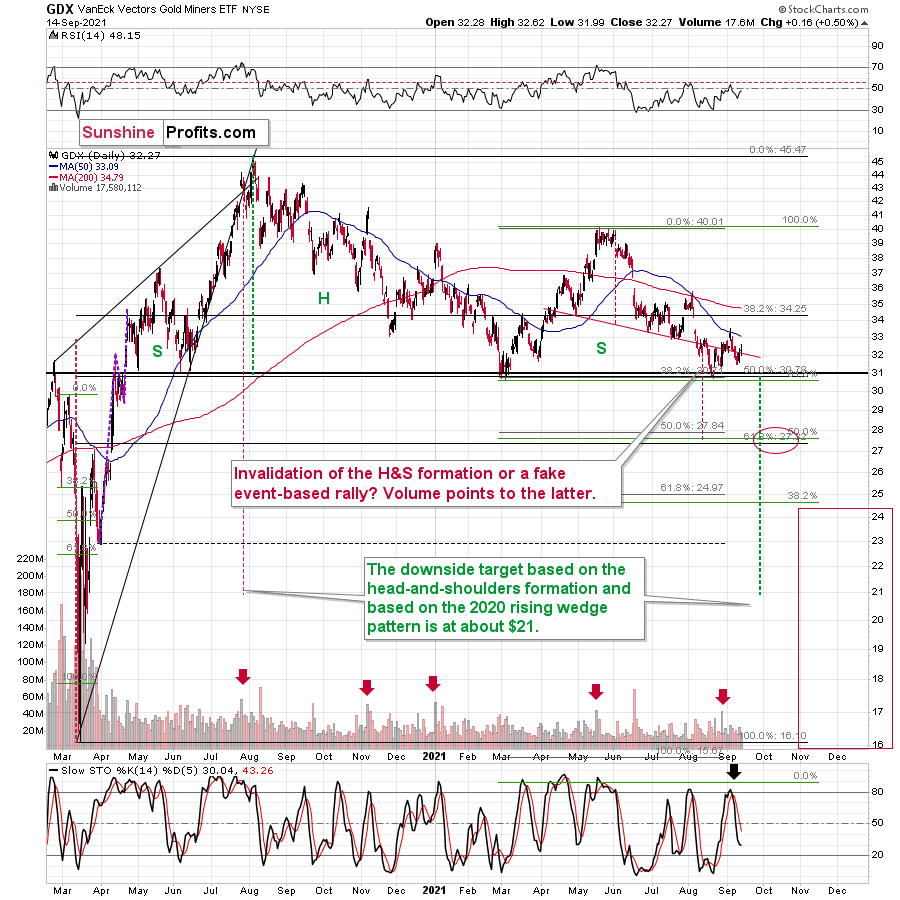

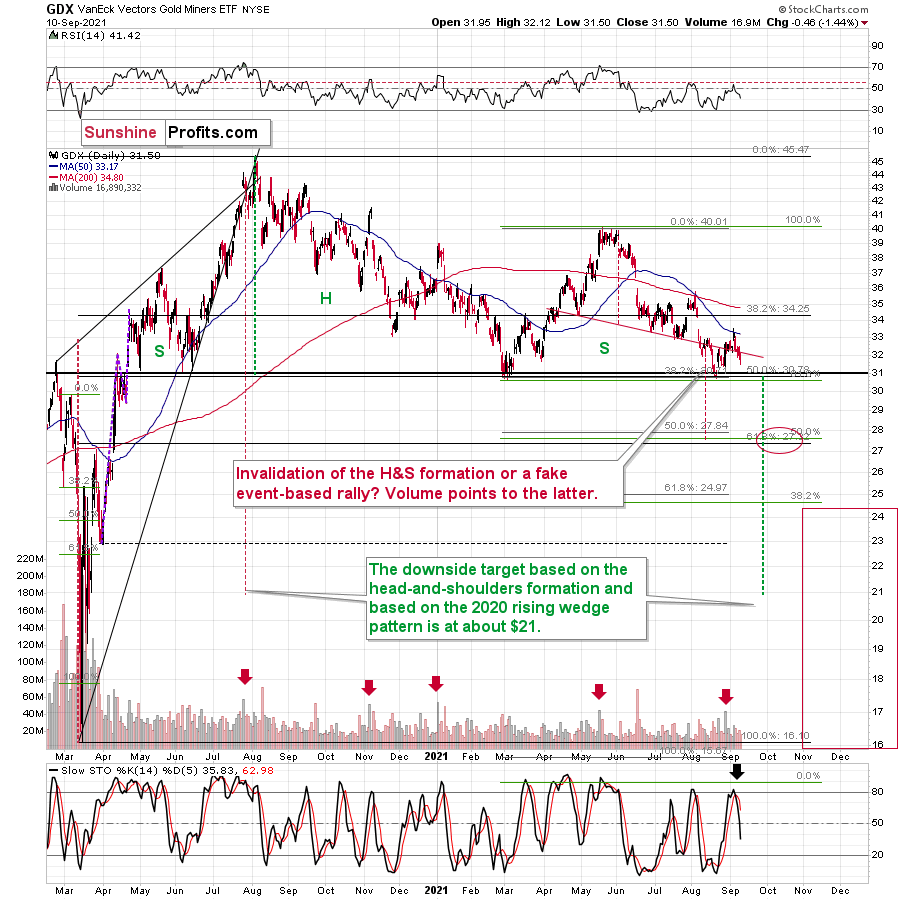

The GDX ETF was up by a mere $0.16 and it closed the day very close to where it had closed on Aug. 23 – just a day after it rallied from its recent lows. In other words, the current GDX ETF price is practically just a single-day rally above the yearly lows. At the same time, gold is trading over $130 above its yearly lows. Are senior gold stocks really showing strength? Absolutely not.

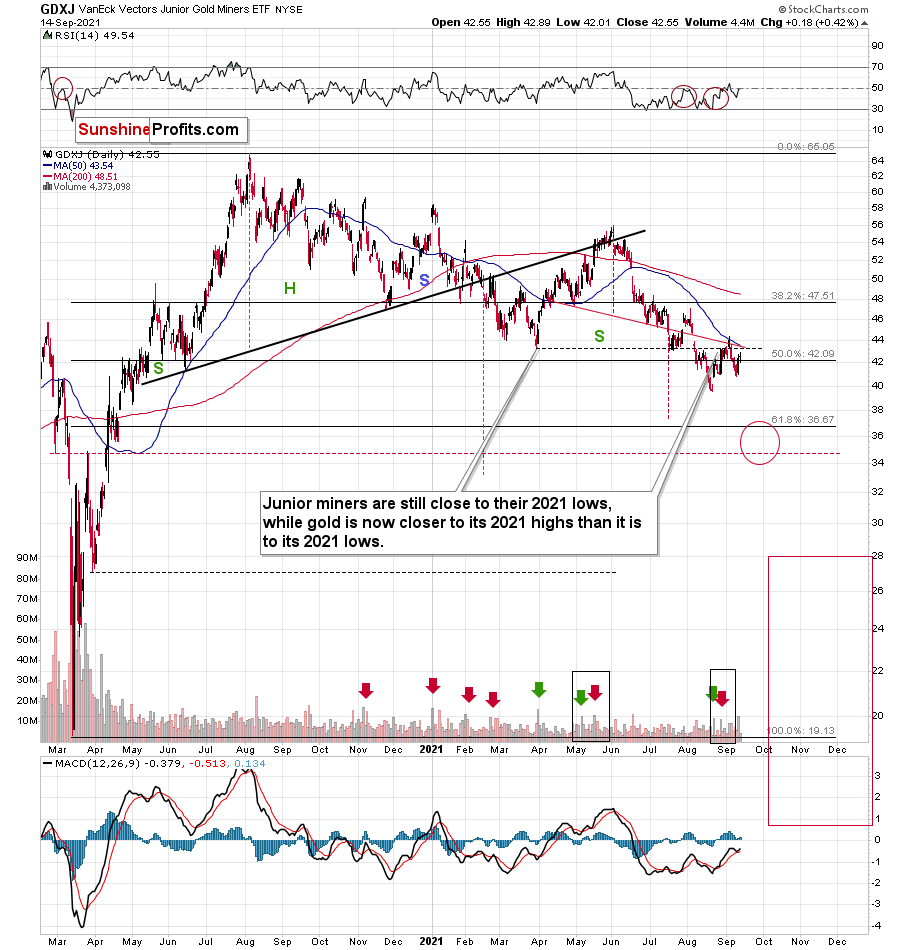

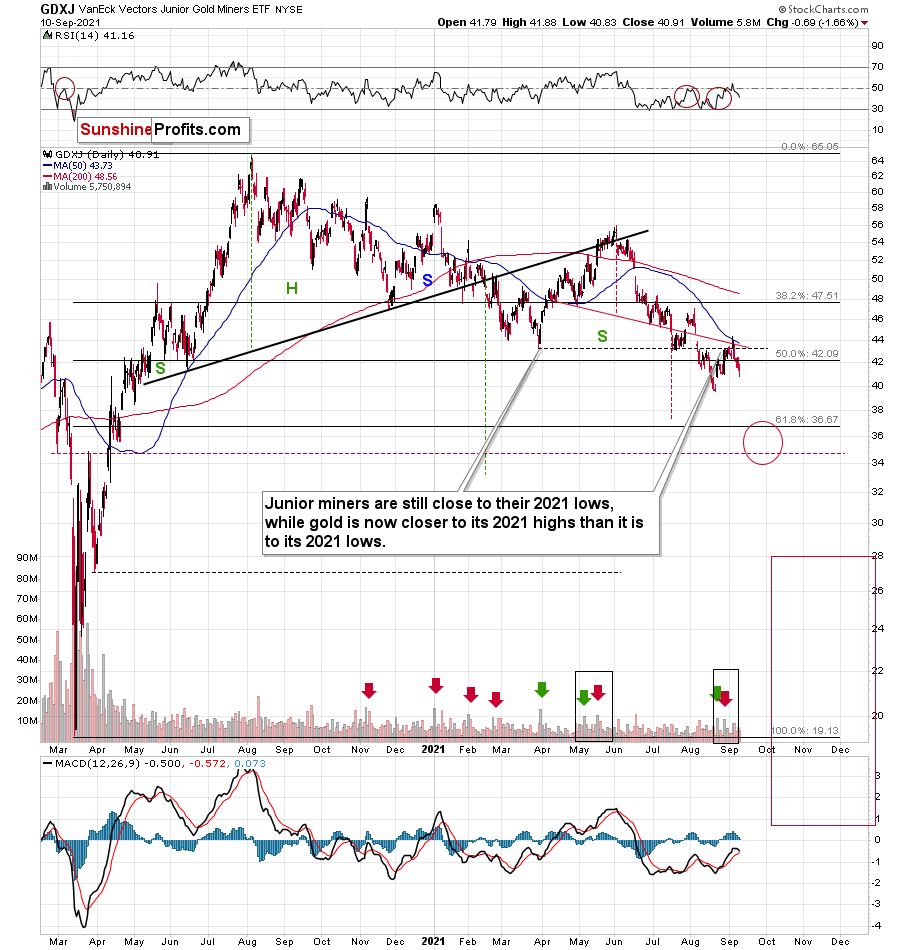

As far as junior miners are concerned, the situation is similar, but even more bearish. In GDXJ, we have another sell signal coming from volume. It spiked, and the last time we saw the volume this high, was in mid-May. And what happened in mid-May? It was not the exact top, but it was very close to it, and shortly before a $15+ decline started. It was a perfect time to enter a short position in the junior miners, or one could use this indication as reassurance that this position is justified from the risk to reward point of view. (Of course, there are many more factors that point to this direction, not just the volume spike in the GDXJ ETF.)

Overall, juniors are verifying their previous breakdown to new yearly lows, and they are successful in this verification. This opens the door to huge declines wide open.

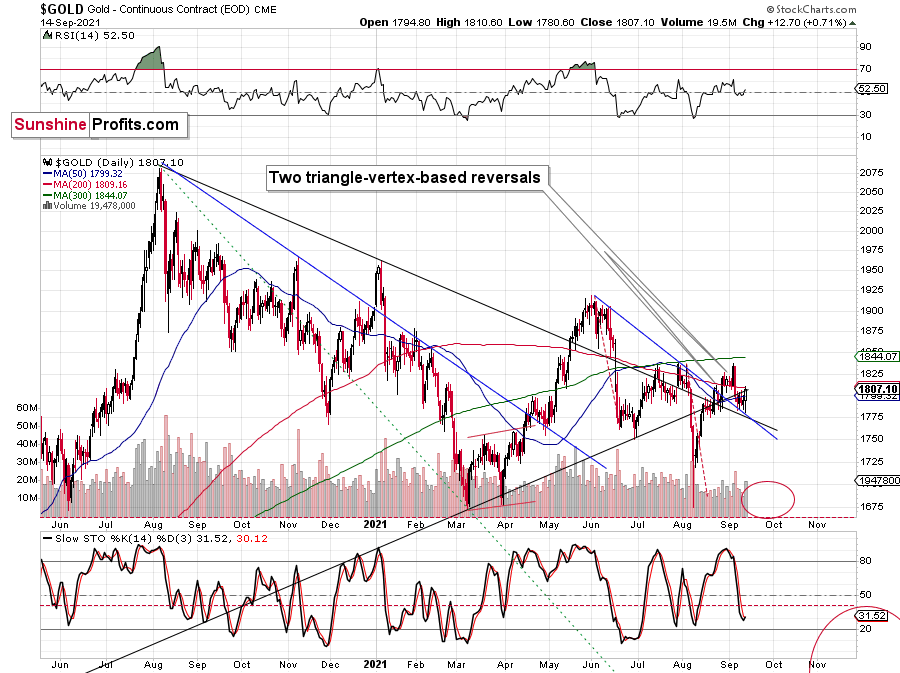

Just like I wrote earlier today, gold moved higher yesterday (it’s down in today’s pre-market trading, though), but it didn’t break any important resistance level, so this move was rather inconsequential. The outlook for gold and gold stocks remains bearish.

By the way, do you recall when I wrote that gold was likely to reverse in the second half of September or in the middle thereof, but that we’ll know more when we get closer to this date? Well, it’s the middle of the month today, and it’s obvious that we didn’t see a major decline in the recent days, just a relatively small one.

Consequently, it seems that the reversal that I mentioned previously will not be an important bottom, but an important top. This makes sense in light of the upcoming FOMC (in one week), which is likely to trigger some short-term volatility. Will the PMs and miners rally until the Fed speaks? It’s unclear, and not that likely. They could decline beforehand, or they could do nothing. The very near term is unclear, but that doesn’t matter that much, as the medium-term is very clear – the gold, silver, and mining stocks are going down.

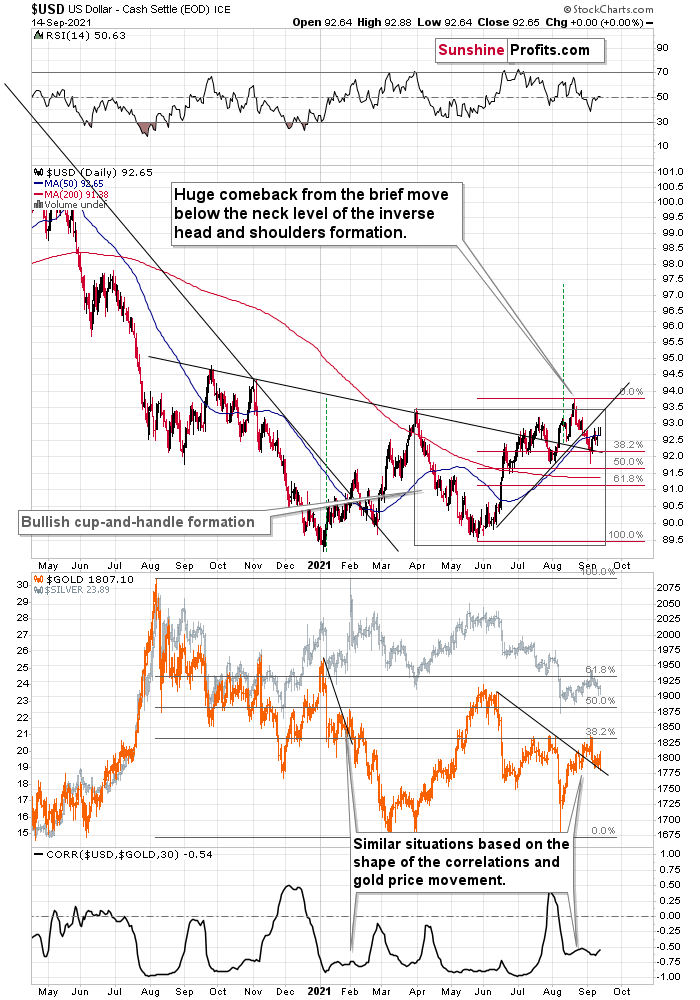

One of the reasons is the more-than-confirmed breakout above the neck level in the USD Index’s inverse head and shoulders pattern.

It took about a year for this bullish pattern to form, so it’s likely that its consequences will also be of medium-term nature. So far, the USDX has been moving back and forth, but when it finally moves, it’s likely to rally above 97, as the targets based on this formation are based on the size of its “head” (marked with green, dashed lines).

As the USD Index rallies, gold is likely to move lower. And as gold moves lower, gold stocks are likely to move lower faster, as they’ve been underperforming gold for months. And as senior gold miners move lower faster, junior miners are likely to move lower even faster.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

US Economic Outlook: Cooling Down During the Fall

September 14, 2021, 7:34 AMTwo Sides of the Same Coin

With the Delta variant decelerating U.S. economic momentum, the chorus proclaiming ‘peak growth’ is growing louder by the day. And as the colder months approach and outdoor activities fail to stimulate consumer spending, economists have sounded the alarm on the U.S. economic Renaissance.

Case in point: Goldman Sachs has reduced its third-quarter GDP growth estimate three times, and the investment bank expects Q4 and full-year 2022 to come in weaker than expected.

Please see below:

To explain, the blue bars above track Goldman Sachs’ GDP growth estimates, while the red bars above track economists’ consensus estimates. If you analyze the columns labeled “Q4” and “Full Year 2022,” you can see that Goldman Sachs expects a sharper-than-expected slowdown in the autumn months, and the weakness should persist into 2022.

Alongside, economists’ consensus estimates for the third and fourth quarters have also come down.

Please see below:

Source: Bloomberg/Liz Ann Sonders

Source: Bloomberg/Liz Ann SondersTo explain, the blue and orange lines above track economists’ consensus GDP growth estimates for the third and fourth quarters. If you analyze the right side of the chart, you can see that the blue line has fallen sharply and that the orange line is slowly following suit.

And upping the bearish ante, the Atlanta Fed’s GDPNow estimate for the third quarter has sunk well below Goldman Sachs and Bloomberg’s consensus estimates, with the metric nearly halving in the last month alone.

Please see below:

To explain, the blue line above tracks the Blue Chip consensus GDP growth estimate for the third quarter, and the shaded blue area represents the range of economists’ estimates. If you analyze the depth, you can see that economists expect a print in the ~5% to ~8% range. In stark contrast, the green line above tracks the Atlanta Fed’s GDPNow estimate – which implies 3.7% GDP growth in the third quarter.

More importantly, though, if growth falls off a cliff and the U.S. recovery is derailed, the doom and gloom could actually uplift the gold prices.

Well, while a major slowdown in U.S. growth could reduce U.S. Treasury yields and increase gold’s attractiveness as a bond proxy, the U.S. dollar’s uprising will likely outweigh any bullish potential. For example, when GDP growth decelerates and investors flock to safe-haven assets, the U.S. dollar is a primary beneficiary. And with gold, silver and mining stocks exhibiting strong negative correlations with the U.S. dollar, the PMs often suffer in the process.

Please see below:

To explain, the green line above tracks the annualized percentage change in U.S. real GDP, while the red line above tracks the EUR/USD. For context, the EUR/USD accounts for nearly 58% of the movement of the USD Index. If you analyze the relationship, you can see that troughs in U.S. GDP growth often coincide with troughs in the EUR/USD. For example, when the U.S. entered recession in 2001, 2008 and 2020, the EUR/USD declined precipitously and helped fuel the USD Index’s uprising. Thus, with the PMs often moving inversely of the U.S. dollar, they’re unlikely to celebrate a decline in U.S. GDP growth.

Delta Variant Fades, Inflation… Not So Much

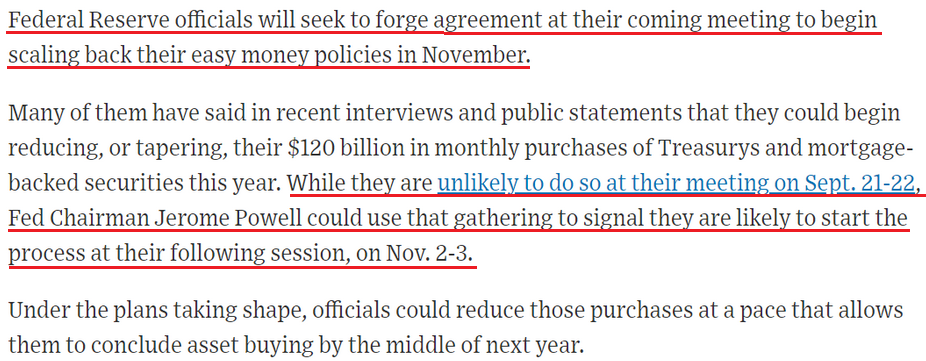

Furthermore, while the U.S. economy will likely regain its momentum once the Delta variant dissipates, the weakness in U.S. GDP growth could prove transient. In stark contrast, however, inflationary pressures remain robust, and the surge could elicit hawkish rhetoric from the Fed during its September 21/22 monetary policy meeting. To explain, the Wall Street Journal (WSJ) published a rather cryptic article on Sep. 10 titled: “Fed Officials Prepare for November Reduction in Bond Buying.” And with Chairman Jerome Powell promising “advance notice” before a formal announcement commences, the September meeting could be used to brace investors for what’s to come.

Please see below:

Furthermore, since the WSJ is considered the unofficial mouthpiece of the Fed, Goldman Sachs chief economist Jan Hatzius told clients on Sep. 11 that the article has moved the taper needle. He wrote:

“Earlier today, the Wall Street Journal published an article titled “Fed Officials Prepare for November Reduction in Bond Buying.” The article went on to state that officials “will seek to forge agreement” on November as the beginning of “scaling back” accommodation, and it subsequently cited several public remarks about tapering from Chairman Powell and other members of the leadership. Reflecting this, we are increasing our subjective odds of a November taper announcement. We now see 70% odds of a November announcement (vs. 45% previously) and 10% odds of a December announcement (vs. 35% previously); we continue to see a 20% chance that growth risks related to the Delta variant delay the tapering announcement into 2022.”

Thus, if a formal announcement is scheduled for November, hawkish hints will likely emerge at the Fed’s upcoming meeting.

In the meantime, though, surging inflation should be keeping Powell up at night. For example, Apollo Global Management CEO Marc Rowan – whose firm has $472 billion in assets under management as of June 30 – said on Sep. 13 that inflation is “everywhere.”

“There’s not a place [where we are not seeing it]. Everything that we once did now costs more,” he told CNBC’s Leslie Picker as part of “Delivering Alpha.” “Lead times, pressure on inventory, pressure on supplies, pressure on employment. Our experience in our portfolio is really no different than the broader economy.”

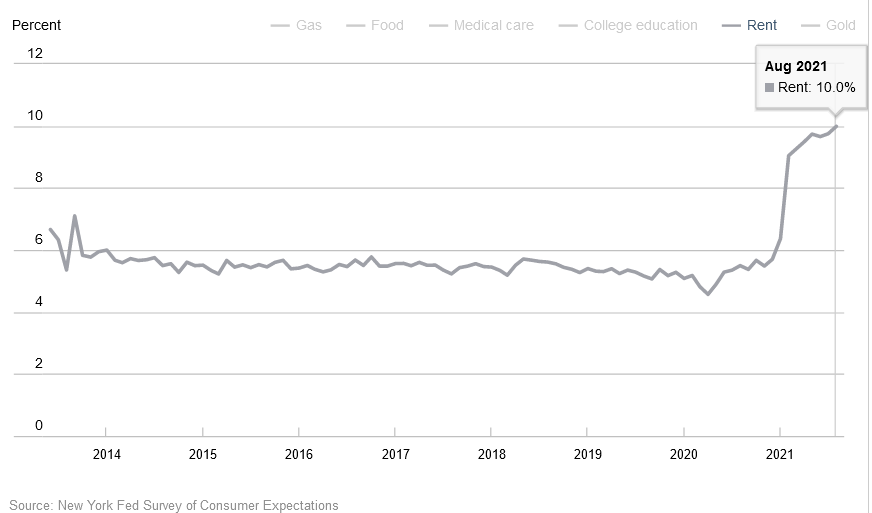

What’s more, the New York Fed also released its August Survey of Consumer Expectations on Sep. 13. And surprise, surprise, the report revealed:

“Median one-year-ahead inflation expectations increased by 0.3 percentage point to 5.2% in August, the tenth consecutive monthly increase and a new series high. Median inflation expectations at the three-year horizon also increased by 0.3 percentage point to a new series high of 4.0%.”

Please see below:

In addition, while I’ve warned on several occasions that the Shelter Consumer Price Index (CPI) could accelerate the inflationary momentum during the autumn months, U.S. consumers are already bracing for a surge in rent inflation.

Please see below:

Base Effects Are Long Gone

Finally, with the U.S. headline CPI likely to sizzle today and weak comparable periods no longer relevant, notice how deflationists no longer cite “base effects” anymore?

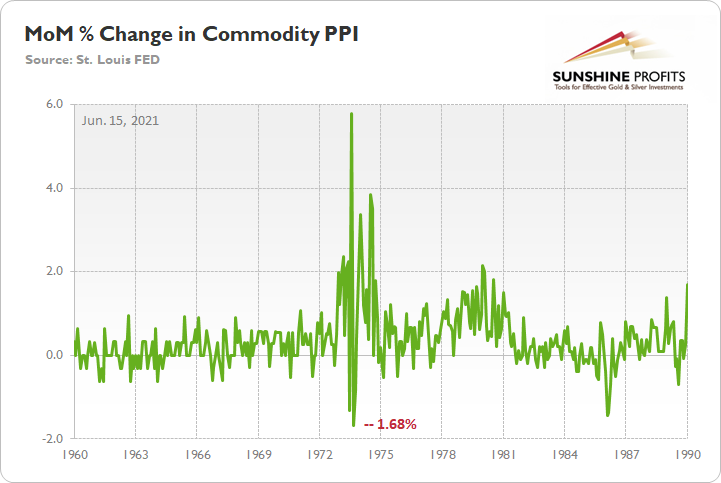

To explain, I wrote on Jun. 15 and updated on Aug. 17:

The commodity Producer Price Index (PPI) often leads the headline CPI and that’s why tracking its movement is so important. If we analyze the performance of the pair during the inflationary surges of the 1970s and the early 1980s, it’s clear that the relationship has stood the test of time.

Please see below:

To explain, the green line above tracks the year-over-year (YoY) percentage change in the commodity PPI, while the red line above tracks the YoY percentage change in the headline CPI. If you analyze the relationship, you can see that the pair have a close connection.

More importantly, though, during the historical inflationary downpour, the month-over-month (MoM) percentage change in the commodity PPI never declined by more than 1.68%.

Please see below:

To explain, the green line above tracks the MoM percentage change in the commodity PPI. And if you compare the two MoM spikes in the commodity PPI to the two YoY spikes in the first chart above (focus your attention on the highs between 1972-1975 and 1978-1981), you can see that MoM resiliency helped sustain the YoY surges. In addition, during the roughly nine-year bout of inflation, the commodity PPI dipped in-and-out of negative territory but never fell off a cliff.

Back to the present, with the commodity PPI rising by 1.2% MoM and 19.8% YoY (highest since 1974) on Aug. 12, the inflationary pressures remain abundant. Moreover, with the commodity PPI rising MoM in March, April, May, June and July 2021, the YoY percentage increase in July was actually higher than it was during the lockdown periods (“base effects”) of March, April and May 2020. Thus, input inflation is still accelerating even though “base effects” are no longer relevant. And with the merry-go-round still turning, the commodity PPI implies a headline CPI print of roughly 5.25% to 5.75% when the data is released on Sep. 14.

Please see below:

The bottom line? With another 5%+ headline CPI print likely to hit the wire today, inflation is more than 2.5x the Fed’s annual target. And with “base effects” long gone and several Fed officials lobbying for an immediate taper, pressure on Powell should accelerate in the coming weeks.

In conclusion, while gold and the gold miners rallied on Sep. 13, their medium-term outlooks remain extremely treacherous. And with the Fed’s taper timeline shortening by the day, a hawkish surprise on Sep. 21/22 could lead to another sell-off. Moreover, with the USD Index holding firm and decelerating economic growth poised to add to the greenback’s momentum during the autumn months, the PMs’ performance will likely cool alongside the fall temperature.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Miners: Last of the Summer Wine

September 13, 2021, 9:22 AMAutumn is just around the corner, and while the precious metals tasted some success most recently, the medium-term is still set for a downtrend.

With Fed Chairman Jerome Powell sticking to his dovish guns and U.S. nonfarm payrolls elongating the central bank’s perceived taper timeline, gold, silver, and mining stocks were extremely happy campers. However, with event-driven rallies much more semblance than substance, I warned on Sep. 7 that the rollercoaster of emotions would likely end in tears.

I wrote:

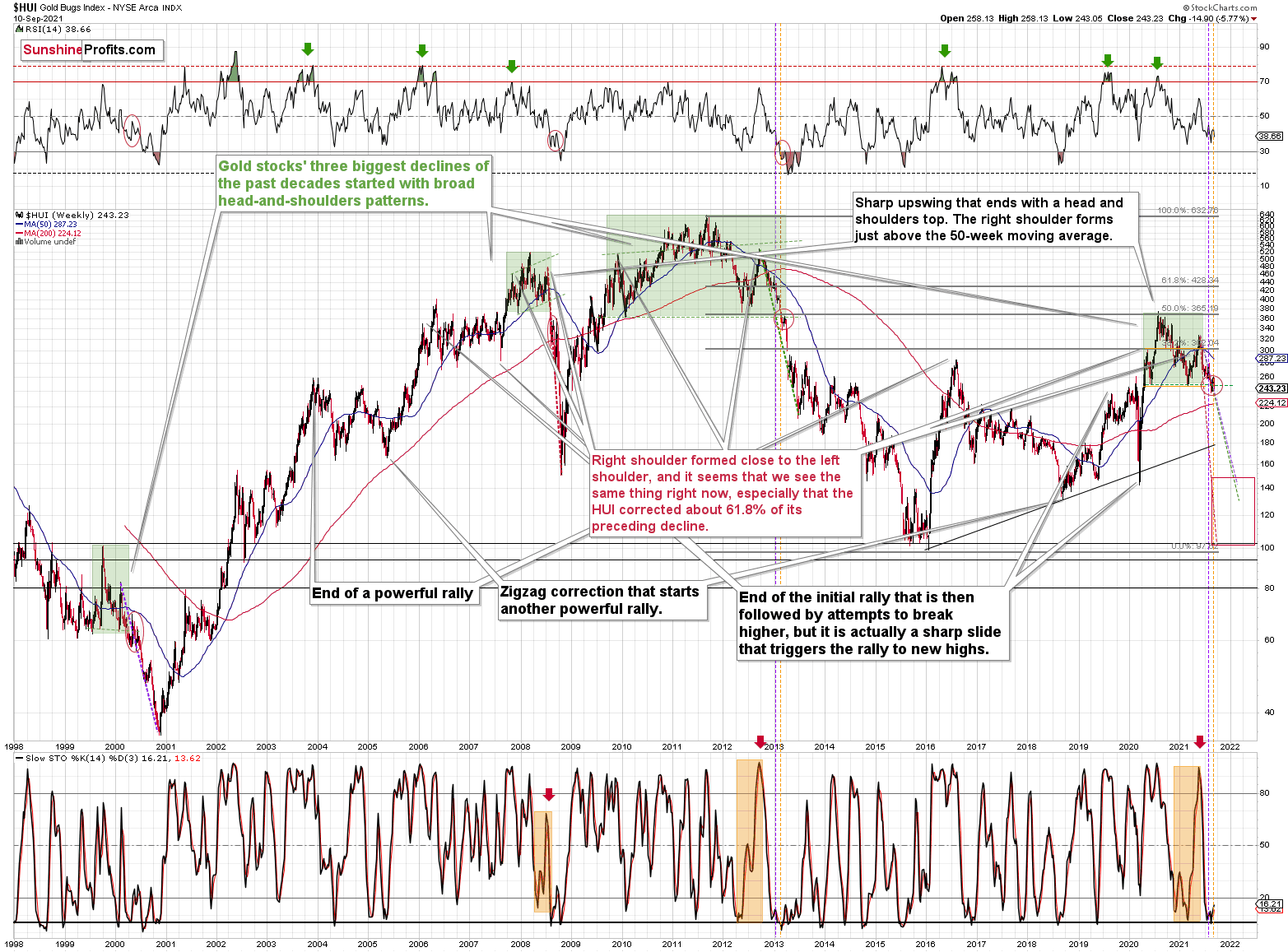

With the 2013 analogue leading the gold miners down an ominous path, the HUI Index and the GDX ETF have rallied by roughly 8% off their recent lows. However, identical developments occurred in 2013, and neither bout of optimism invalided their bearish medium-term outlooks.

And after the GDX ETF and the GDXJ ETF (our profitable short position) plunged by 5.35% and 6.98% respectively last week, summertime sadness confronted the precious metals. Likewise, with more melancholy moves likely to materialize over the medium term, gold, silver, and mining stocks should hit lower lows during the autumn months.

To explain, the HUI Index also plunged by nearly 6% last week, and the reversal of the previous corrective upswing mirrors its behavior from 2013. In addition, with its stochastic oscillator and its RSI (Relative Strength Index) also a spitting image, an ominous re-enactment of 2013 implies significantly lower prices over the medium term.

Please see below:

What’s more, the vertical, dashed lines above demonstrate how the HUI Index is following its 2012-2013 playbook. For example, after a slight buy signal from the stochastic indicator in 2012, the short-term pause was followed by another sharp drawdown. For context, after the HUI Index recorded a short-term buy signal in late 2012 – when the index’s stochastic indicator was already below the 20 level (around 10) and the index was in the process of forming the right shoulder of a huge, medium-term head-and-shoulders pattern – the index moved slightly higher, consolidated, and then fell off a cliff. Thus, the HUI Index is quite likely to decline to its 200-week moving average (or so) before pausing and recording a corrective upswing. That’s close to the 220 level. Thereafter, the index will likely continue its bearish journey and record a final medium-term low some time in December.

Furthermore, I warned previously that the miners’ drastic underperformance of gold was an extremely bearish sign. There were several weeks when gold rallied visibly and the HUI Index actually declined modestly. And now, gold stocks are trading close to their previous 2021 lows, while gold is almost right in the middle between its yearly high and its yearly low.

And why is this so important? Well, because the bearish implications of gold stocks’ extreme underperformance still remain intact.

Let’s keep in mind that the drastic underperformance of the HUI Index also preceded the bloodbath in 2008 as well as in 2012 and 2013. To explain, right before the huge slide in late September and early October 2008, gold was still moving to new intraday highs; the HUI Index was ignoring that, and then it declined despite gold’s rally. However, it was also the case that the general stock market suffered materially. If stocks didn’t decline so profoundly back then, gold stocks’ underperformance relative to gold would have likely been present but more moderate.

Nonetheless, broad head & shoulders patterns have often been precursors to monumental collapses. For example, when the HUI Index retraced a bit more than 61.8% of its downswing in 2008 and in between 50% and 61.8% of its downswing in 2012 before eventually rolling over, in both (2008 and 2012) cases, the final top – the right shoulder – formed close to the price where the left shoulder topped. And in early 2020, the left shoulder topped at 303.02. Thus, three of the biggest declines in the gold mining stocks (I’m using the HUI Index as a proxy here) all started with broad, multi-month head-and-shoulders patterns. And in all three cases, the size of the declines exceeded the size of the head of the pattern. As a reminder, the HUI Index recently completed the same formation.

Yes, the HUI Index moved back below the previous lows and the neck level of the formation, which – at face value – means that the formation was invalidated, but we saw a similar “invalidation” in 2000 and in 2013. And then, the decline followed anyway. Consequently, I don’t think that taking the recent move higher at its face value is appropriate. It seems to me that the analogies to the very similar situation from the past are more important.

As a result, we’re confronted with two bearish scenarios:

- If things develop as they did in 2000 and 2012-2013, gold stocks are likely to bottom close to their early-2020 low.

- If things develop like in 2008 (which might be the case, given the extremely high participation of the investment public in the stock market and other markets), gold stocks could re-test (or break slightly below) their 2016 low.

In both cases, the forecast for silver, gold, and mining stocks is extremely bearish for the next several months.

For even more confirmation, let’s compare the behavior of the GDX ETF and the GDXJ ETF. Regarding the former, investors rejected the senior miners (GDX) attempt to recapture their 50-day moving average and the failure was perfectly in tune with what I wrote on Sep. 7:

Large spikes in daily volume are often bearish, not bullish. To explain, three of the last four volume outliers preceded an immediate top (or near) for the GDX ETF, while the one that preceded the late July rally was soon followed by the GDX ETF’s 2020 peak. Thus, when investors go ‘all in,’ material declines often follow. And with that, spike-high volume during the GDX ETF’s upswings often presents us with great shorting opportunities.

Please see below:

Even more bearish, not only did last week’s plunge usher the GDX ETF back below the neckline of its bearish head & shoulders pattern (the horizontal red line on the right side of the chart above), but the sell signal from the stochastic oscillator remains firmly intact. As a result, ominous clouds continue to form.

And with the GDXJ ETF stuck in a similar rut, I wrote on Sep. 7 that overzealous investors would likely end the week disappointed:

With the current move quite similar to the corrective upswing recorded in mid-May, the springtime bounce was also followed by a sharp drawdown. As a result, the GDXJ ETF could be near its precipice, as its 50-day moving average is right ahead. And with the key level now acting as resistance, investors’ rejection on Sep. 3 could indicate that the top is already here.

Moreover, while the junior miners followed the roadmap to perfection, the GDXJ ETF still remains ripe for lower lows over the medium term.

Please see below:

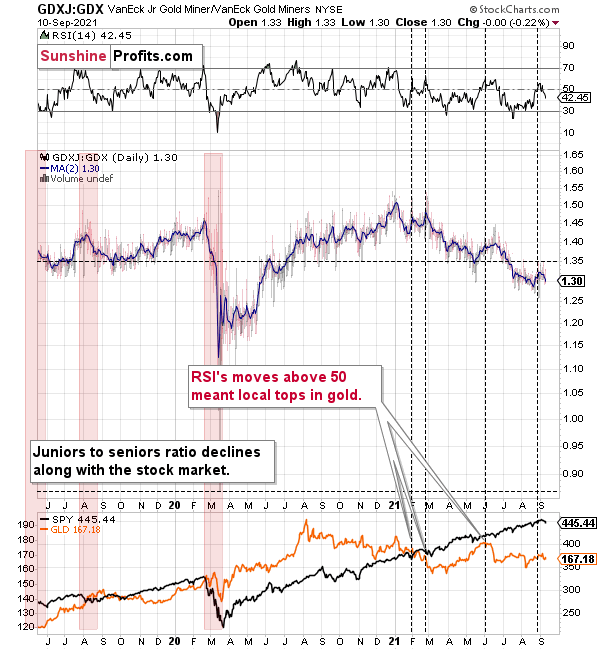

Finally, while I’ve been warning for months that the GDXJ/GDX ratio was destined for devaluation, after another sharp move lower last week, the downtrend remains intact. For example, when the ratio’s RSI jumped above 50 three times in 2021, it coincided with short-term peaks in gold. Second, the trend in the ratio this year has been clearly down, and there’s no sign of a reversal, especially when you consider that the ratio broke below its 2019 support (which served as resistance in mid-2020). When the same thing happened in 2020, the ratio then spiked even below 1.

More importantly, though, with the relative weakness likely to persist, the profits from our short position in the GDXJ ETF should accelerate during the autumn months.

The bottom line?

If the ratio is likely to continue its decline, then on a short-term basis we can expect it to decline to 1.27 or so. If the general stock market plunges, the ratio could move even lower, but let’s assume that stocks decline moderately (just as they did in the last couple of days) or that they do nothing or rally slightly. They’ve done all the above recently, so it’s natural to expect that this will be the case. Consequently, the trend in the GDXJ to GDX ratio would also be likely to continue, and thus expecting a move to about 1.26 - 1.27 seems rational.

If the GDX is about to decline to approximately $28 before correcting, then we might expect the GDXJ to decline to about $28 x 1.27 = $35.56 or $28 x 1.26 = $35.28. In other words, $28 in the GDX is likely to correspond to about $35 in the GDXJ.

Is there any technical support around $35 that would be likely to stop the decline? Yes. It’s provided by the late-Feb. 2020 low ($34.70) and the late-March high ($34.84). There’s also the late-April low at $35.63. Conservatively, I’m going to place the profit-take level just above the latter.

Consequently, it seems that expecting the GDXJ to decline to about $35 is justified from the technical point of view as well.

In conclusion, gold, silver, and mining stocks went from delighted to despondent, as the technical downpour continues to rain on their parade. And while a major buying opportunity may present itself in December, the next few months will likely elicit more tears than cheers. As a result, while we eagerly await the opportunity to go long the precious metals and participate in their secular uptrends, bearish breakdowns, stock market struggles, and the Fed’s taper timeline will likely dampen their moods over the medium term.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Early (Video) Heads-up before Tomorrow’s Session

September 12, 2021, 4:35 PMAvailable to premium subscribers only.

-

Gold 2013 Analogy: The One to Rule Them All

September 10, 2021, 9:36 AMIt’s almost 9/11 – 20 years ago everything changed for so many people. The world was never the same since the day of the tragedy. So many unnecessary deaths, and so much suffering that resulted from them…

Gold – being the safe-haven asset – soared in the immediate aftermath, but it was not the immediate rally that really mattered. It was the shift in the global sentiment that was the real change. The world suddenly became a much more violent and uncertain place in the eyes of many investors. Therefore, the need for getting protection – in the form of gold – started to emerge on investors’ radars.

Twenty years later we have gold priced over 6 times higher than the price it reached immediately after the 9/11 disaster. Moreover, with the monetary authorities printing massive amounts of money in the aftermath of yet another tragedy – the recent pandemic – gold seems poised to soar to the moon.

But.

Just because something is likely to move much higher, it doesn’t mean that it can’t become overvalued on a temporary basis.

Just because something is likely to move much higher, it doesn’t mean that it’s likely to go higher now.

And finally, just because something is likely to move much higher, it doesn’t mean that it’s likely to go higher without declining first.

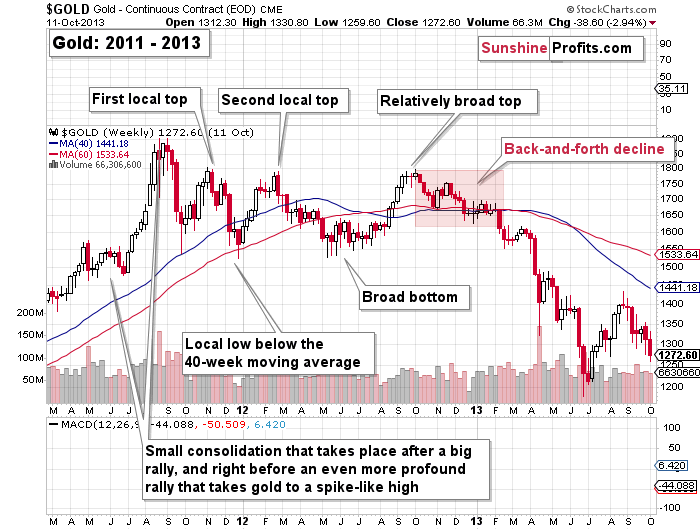

And the gold price – as bullish as it might get in the long run – is very likely repeating its pattern from 2013, when it declined profoundly. There are multiple confirmations present in other markets (like gold stocks) and ratios (like gold to bonds ratio, and gold stocks to gold ratio that shows the extreme weakness of the entire precious metals market), but in today’s analysis, I would like to focus on gold’s price itself.

It’s Not a Rhyme Anymore. It’s Repetition!

The history repeats itself to a considerable degree, and you will soon see that the fact that gold was unable to hold its breakout above its 2011 highs was not accidental. It’s not a coincidence that gold is now about $300 lower than it was when it reached its August 2020 high, even though the USD Index is trading approximately at the same levels as it was trading in August 2020. Let’s jump right into gold’s long-term chart.

Even without zooming in, you can clearly see that both areas marked in yellow are similar (please note that you can click on the chart to enlarge it).

Before discussing gold’s price moves, please note that the positions of the indicators (the RSI in the upper part of the chart, and the MACD in the lower part of the chart) are almost identical now and during the 2012-2013 decline. The areas marked with red and blue correspond to each other.

To make the analogy clearer, I’ll zoom in on them separately, using two charts below.

Both yellow areas start with a small consolidation that takes place after a big rally and right before an even more profound rally, which takes gold to a spike-like high.

Then gold declines. After the first drop and a quick rebound (in both cases), we get the first local top, where gold shows that it’s unable to reach the previous high, let alone break above it. We saw that in November 2011 and in early November 2020.

Then we see another decline in gold’s price. This time, it takes gold below its 40-week moving average (marked with red). Both bottoms form quickly, and the comeback is swift. That happened in December 2011 and in late November 2020.

Then we see another move higher – right to the most recent local high. That happened in February 2012 and in early January 2021.

And then we see another slide lower. In this case, gold bottoms close to the small consolidation that preceded the final (2011, 2020) top. The bottoms were broad and took place between May 2012 and July 2012, as well as between March and April 2021.

Then we get yet another rally that takes gold relatively close to the previous local tops (October 2012 and May 2021). In both cases, the shape of the top is broader than it was in the case of the previous two tops.

After that top, a huge decline in the price of gold begins, but it’s not clear at first, and many people still think it’s just a consolidation that will be followed by more rallies.

During this time (October 2012 – early 2013, and May 2021 – now) gold moves back and forth with lower lows and lower highs. Gold stocks underperform gold in a clear manner in both periods.

So far, the moves have been extremely similar, and if the history simply continues to be similar, we can estimate what’s ahead by extrapolating what we already saw in 2013. Based on this analogy, it seems that we’re about to see one final correction when gold once again moves to its previous (2021) lows, but this correction won’t be significant. It will be the final good-bye to the current trading range before gold truly slides – just as it did between April and June 2013.

Now, this is what the situation looks like right now, and the above outlook is based on much more than just the above (extraordinary, but still) single analogy. The remarkable self-similarity is present also in the HUI Index, and what’s likely to take place in the case of gold’s arch-nemesis – the USD Index – fully corresponds to the above-featured scenario. Silver’s performance confirms it as well. (By the way, have you noticed the fact that even though gold temporarily moved above its 2011 high, neither gold stocks nor silver managed to do the same thing? They were not even close. This should make even the most bullish precious metals investors concerned.)

I’m looking at the markets each day, I’m going through many charts and news announcements (hint: most of them matter very little) on a daily basis, and I will accordingly report to you – my subscribers – as soon as I notice any meaningful change in the above analogies so that you are able to adjust your outlooks (and investment/trading positions) in advance. If the change is not urgent, I’ll let you know through the regular daily analyses, and if it is urgent, I’ll notify you via a quick email message. As always, I’ll keep you informed.

Thank you for reading our free analysis today. If you enjoyed it, I have great news for you! As soon as you sign up for our free mailing list (mostly about gold, but with extra analyses of stocks and crude oil), you'll get 7 days of completely free (no-obligation). Sign up today.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM