tools spotlight

-

Gold Rallied Immediately After the Invasion – But What’s Next?

February 24, 2022, 5:26 AMAvailable to premium subscribers only.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Miners for Breakfast, Gold for Dessert: Bearish Fundamentals Will Hurt

February 23, 2022, 9:32 AMTo the disappointment of gold bulls, the yellow metal’s upward trend will not last long. Fundamentals have already taken their toll on gold miners.

While gold remains uplifted due to the Russia-Ukraine drama, the GDXJ ETF declined for the second-straight day on Feb. 22. Moreover, I warned on numerous occasions that the junior miners are more correlated with the general stock market than their precious metals peers. As a result, when the S&P 500 slides, the GDXJ ETF often follows suit.

To that point, with shades of 2018 unfolding beneath the surface, the Russia-Ukraine headlines have covered up the implications of the current correction. However, the similarities should gain more traction in the coming weeks. For context, I wrote on Feb. 22:

When the Fed’s rate hike cycle roiled the NASDAQ 100 in 2017-2018, the GDXJ ETF suffered too. Thus, while the Russia-Ukraine drama has provided a distraction, the fundamentals that impacted both asset classes back then are present now.

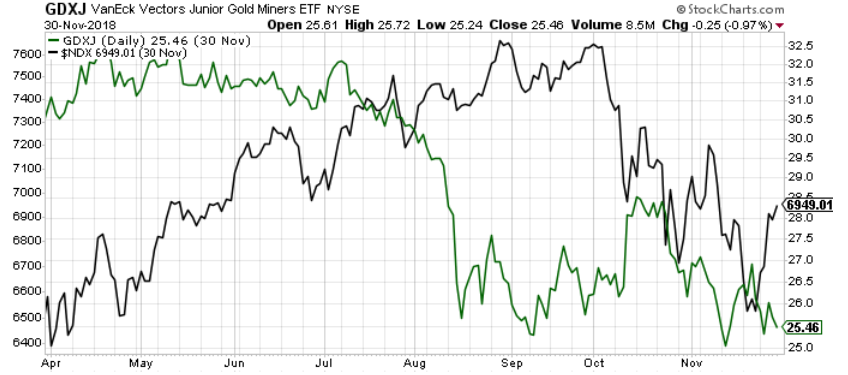

Please see below:

To explain, the green line above tracks the GDXJ ETF in 2018, while the black line above tracks the NASDAQ 100. If you analyze the performance, you can see that the Fed’s rate hike cycle initially rattled the former and the latter rolled over soon after. However, the negativity persisted until Fed Chairman Jerome Powell performed a dovish pivot and both assets rallied. As a result, with the Fed Chair unlikely to perform a dovish pivot this time around, the junior miners have some catching up to do.

Furthermore, while the S&P 500 also reacts to the geopolitical risks, the Fed’s looming rate hike cycle is a much bigger story. With the U.S. equity benchmark also following its price path from 2018, a drawdown to new 2022 lows should help sink the GDXJ ETF.

Please see below:

To explain, the yellow line above tracks the S&P 500 from March 2018 until February 2019, while the blue line above tracks the index's current movement. If you analyze the performance, it's a near-splitting image.

Moreover, while Morgan Stanley Chief Equity Strategist Michael Wilson thinks a relief rally to ~4,600 is plausible, he told clients that "this correction looks incomplete." "Rarely have we witnessed such weak breadth and havoc under the surface when the S&P 500 is down less than 10%. In our experience, when such a divergence like this happens, it typically ends with the primary index catching down to the average stock," he added.

As a result, while a short-term bounce off of oversold conditions may materialize, the S&P 500's downtrend should resume with accelerated fervor. In the process, the GDXJ ETF should suffer materially as the medium-term drama unfolds.

To that point, the Fed released the minutes from its discount rate meetings on Jan. 18 and Jan. 26. While the committee left interest rates unchanged, the report revealed:

“Given ongoing inflation pressures and strong labor market conditions, a number of directors noted that it might soon become appropriate to begin a process of removing policy accommodation. The directors of three Reserve Banks favored increasing the primary credit rate to 0.50 percent, in response to elevated inflation or to help manage economic and financial stability risks over the longer term.”

For context, the hawkish pleas came from the Cleveland, St. Louis, and Kansas City Feds. Moreover, the last time Fed officials couldn’t reach a unanimous decision was October 2019. As a result, the lack of agreement highlights the monetary policy uncertainty that should help upend financial assets in the coming months.

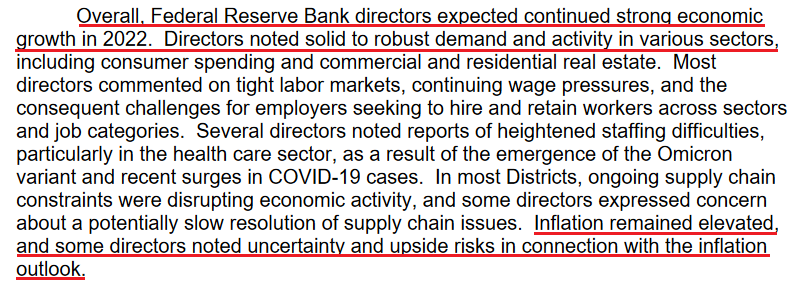

As evidence, the report also revealed:

Thus, while I’ve highlighted on numerous occasions that a bullish U.S. economy is bearish for the PMs, the Russia-Ukraine drama has been a short-term distraction. However, with Fed officials highlighting that growth and inflation meet their thresholds for tightening monetary policy, higher real interest rates and a stronger USD Index will have much more influence over the medium term.

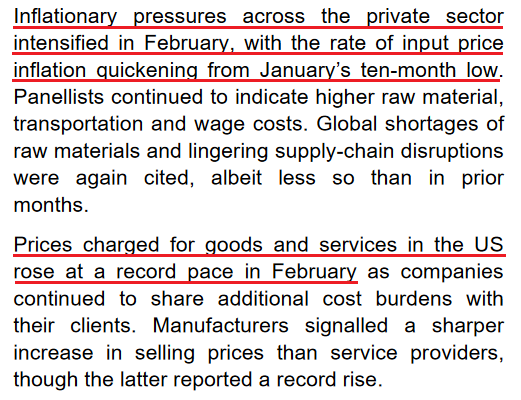

To that point, IHS Markit released its U.S. Composite PMI on Feb. 22. With the headline index increasing from 51.1 in January to 56.0 in February, an excerpt from the report read:

“February data highlighted a sharp and accelerated increase in new business among private sector companies that was the fastest in seven months. Firms mentioned that sales were boosted by the retreat of the pandemic, improved underlying demand, expanded client bases, aggressive marketing campaigns and new partnerships. Customers reportedly made additional purchases to avoid future price hikes. Quicker increases in sales (trades) were evident among both manufacturers and service providers.”

More importantly, though:

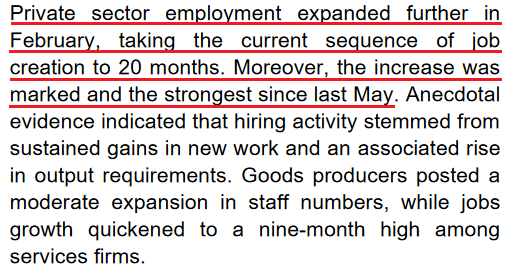

In addition, since the Fed’s dual mandate includes inflation and employment, the report revealed:

Likewise, Chris Williamson, Chief Business Economist at IHS Markit, added:

“With demand rebounding and firms seeing a relatively modest impact on order books from the Omicron wave, future output expectations improved to the highest for 15 months, and jobs growth accelerated to the highest since last May, adding to the upbeat picture.”

If that wasn't enough, the Richmond Fed released its Fifth District Survey of Manufacturing Activity on Feb. 22. While the headline index wasn't so optimistic, the report revealed that "the third component in the composite index, employment, increased to 20 from 4 in January" and that "firms continued to report increasing wages."

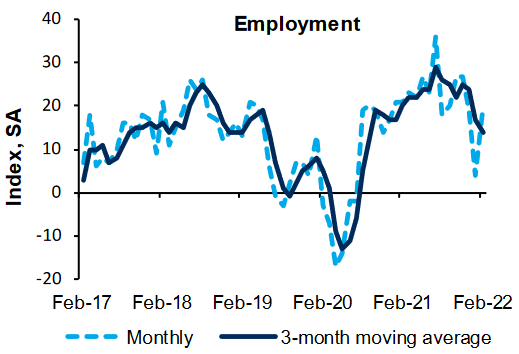

For context, the dashed light blue line below tracks the month-over-month (MoM) change, while the dark blue line below tracks the three-month moving average. If you analyze the former's material increase, it's another data point supporting the Fed's hawkish crusade.

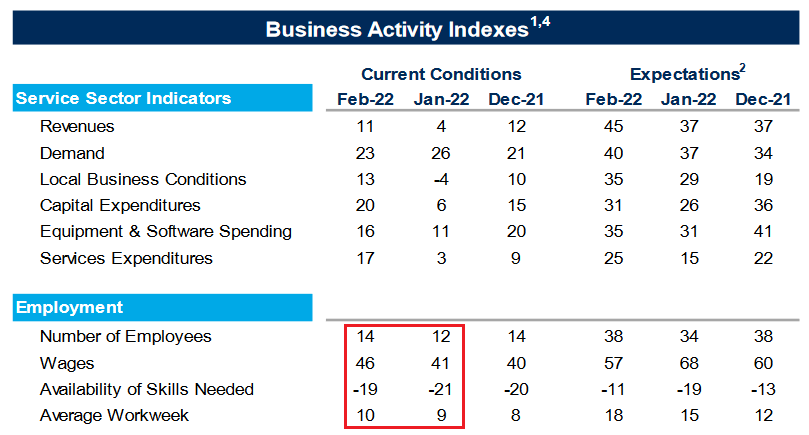

Finally, the Richmond Fed also released its Fifth District Survey of Service Sector Activity on Feb. 22. For context, the U.S. service sector suffers the brunt of COVID-19 waves. However, the recent decline in cases has increased consumers’ appetite for in-person activities. The report revealed:

“Fifth District service sector activity showed improvement in February, according to the most recent survey by the Federal Reserve Bank of Richmond. The revenues index increased from 4 in January to 11 in February. The demand index remained in expansionary territory at 23. Firms also reported increases in spending, as the index for capital expenditures, services expenditures, and equipment and software spending all increased.”

Furthermore, with the employment index increasing from 12 to 14, the wages index increasing from 41 to 46, and the average workweek index increasing from 9 to 10, the labor market strengthened in February. Likewise, the index that tracks businesses’ ability to find skilled workers increased from -21 to -19. As a result, inflation, employment and economic growth create the perfect cocktail for the Fed to materially tighten monetary policy in the coming months.

The bottom line? While the Russia-Ukraine saga may dominate the headlines for some time, the bearish fundamentals that hurt gold and silver in 2021 remain intact: the U.S. economy is on solid footing, and demand is still fueling inflation. Moreover, with information technology and communication services’ stocks – which account for roughly 39% of the S&P 500 – highly allergic to higher interest rates, the volatility should continue to weigh on the GDXJ ETF. As such, while gold may have extended its shelf life, mining stocks may not be so lucky.

In conclusion, the PMs were mixed on Feb. 22, as the news cycle continues to swing financial assets in either direction. However, while headlines may have a short-term impact, technicals and fundamentals often reign supreme over the medium term. As a result, lower lows should confront gold, silver, and mining stocks in the coming months.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Despite Russian-Ukrainian Drama, Gold Will Divorce Bullish Prospects

February 22, 2022, 7:57 AMAfter Russian President Vladimir Putin ordered troops to enter Ukraine to “maintain peace,” the conflict escalated on Feb. 21. However, while the Russia-Ukraine saga will likely dominate the headlines in the short term and may uplift the PMs in the process, the outlook is much different over the medium term.

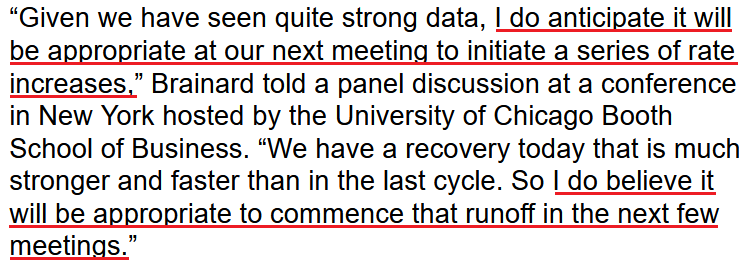

To explain, with inflation still elevated, Fed officials continue to sound the hawkish alarm; and with a March rate hike likely a done deal, the liquidity drain that hurt the PMs in 2021 should accelerate in 2022.

For example, Fed Governor Lael Brainard said on Feb. 18 that officials will use rate hikes and quantitative tightening (QT) to “bring down inflation over time”. “The market is aligned with that. We’ve already seen the kind of tightening facing households and businesses that is consistent with the economy’s outlook,” she added.

As a result, she expects a “series of rate increases” in the coming months.

Please see below:

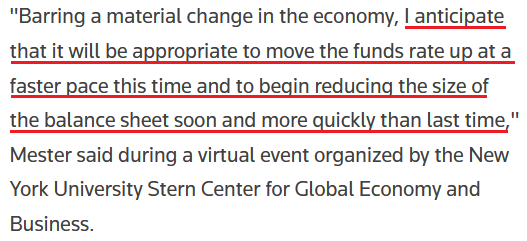

Echoing that sentiment, Cleveland Fed President Loretta Mester said on Feb. 17 that sticky inflation may force the Fed to shift away from explicit forward guidance and instead convey an “overall trajectory of policy and give the rationale for our policy decisions.”

In a nutshell: she means that surging inflation may prevent the Fed from providing investors with “advance notice.” If the Consumer Price Index (CPI) keeps running hot, the Fed will have to react in real-time instead of telegraphing its next move.

Please see below:

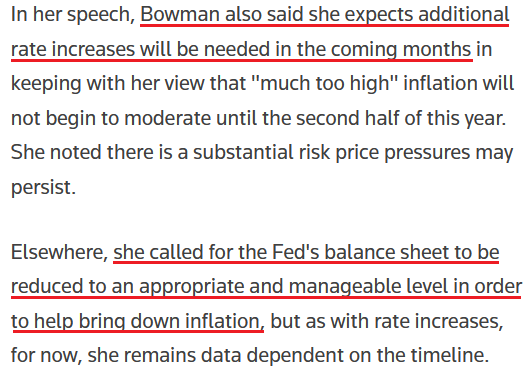

On top of that, Fed Governor Michelle Bowman said on Feb. 21 that she is undecided about a 50 basis point rate hike in March:

"I, as all of my colleagues will as well, will be watching the data closely to judge the appropriate size of an increase at the March meeting.” However, she added: "I intend to support prompt and decisive action to lower inflation."

As a result:

If that wasn’t enough, New York Fed President John Williams (a major dove) conceded on Feb. 18: “I think we can steadily move up interest rates and reassess.” As a result, even the doves expect a 25 basis point rate hike in March.

Furthermore, while I warned throughout 2021 that surging inflation would elicit a hawkish shift from the Fed, officials’ overconfidence is coming back to bite them. Moreover, with Fed officials materially shifting their stance, institutional investors are also showcasing heightened anxiety.

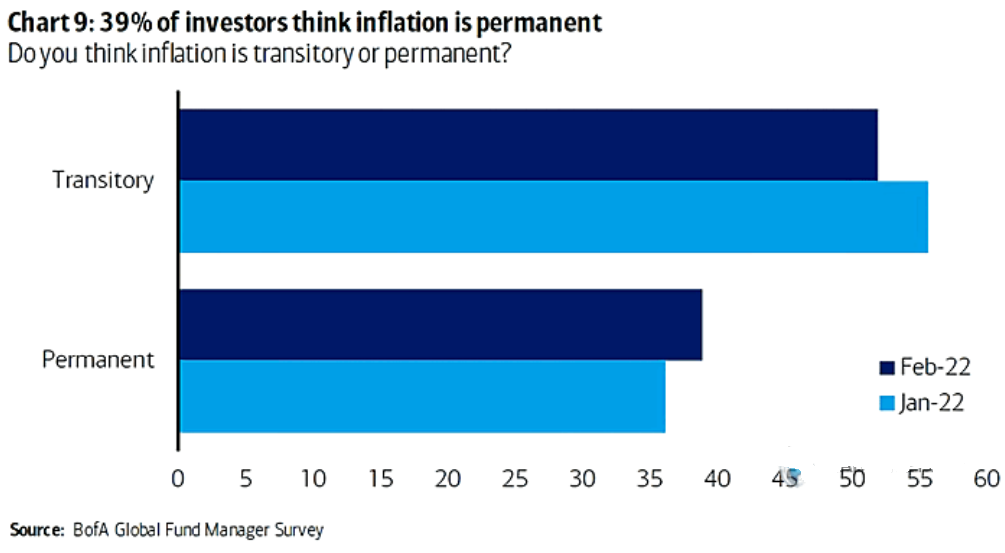

For example, Bank of America’s latest Global Fund Survey shows that 39% of institutional investors believe inflation is permanent, while slightly more than 50% believe it’s transitory. However, in September 2021, 28% of respondents thought that inflation was permanent, and 69% thought it was transitory. As a result, institutional investors are also grappling with the change in sentiment.

Please see below:

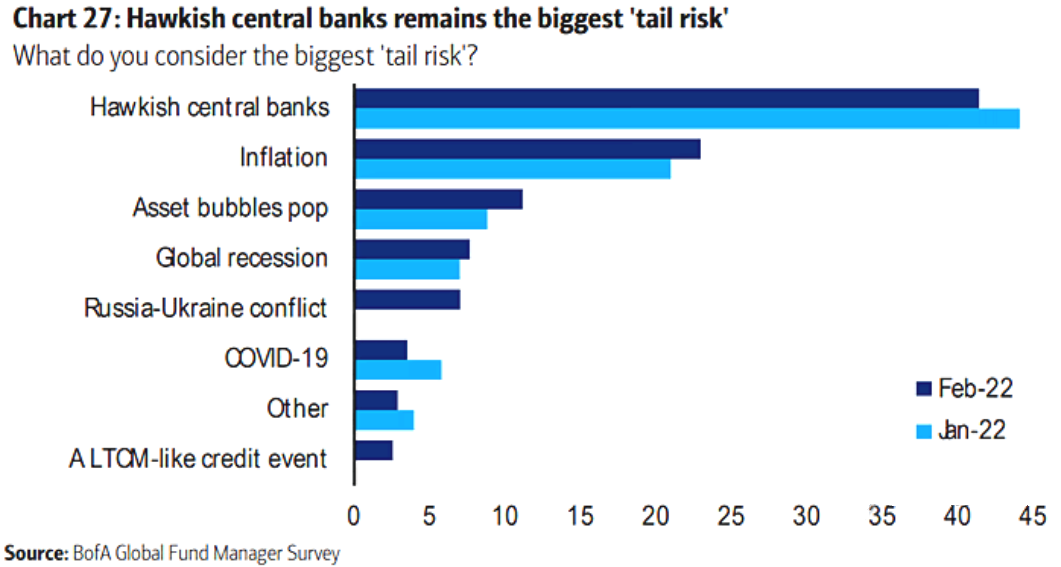

To that point, inflation and central banks have become the most significant tail risks confronting the financial markets.

Please see below:

To explain, a “tail risk” is a low probability, high-risk event that could impair financial assets. If you analyze the chart above, you can see that inflation fears increased in February, while the risk of hawkish central banks remains in the top spot.

Furthermore, if you analyze the row labeled “Russia-Ukraine conflict,” you can see that institutional investors aren’t apprehensive about the medium-term impact on their portfolios. As a result, while the conflict has uplifted the PMs in the short term, it’s prudent to look beyond the current headlines and focus on the coming months.

For context, I wrote on Feb. 14:

With another dire warning from the White House uplifting gold and mining stocks on Feb. 11, Russia and Ukraine's 'will they or won't they' saga has shifted sentiment. However, it's important to remember that geopolitical risk rallies often have a short shelf life and dissipate over the medium term.

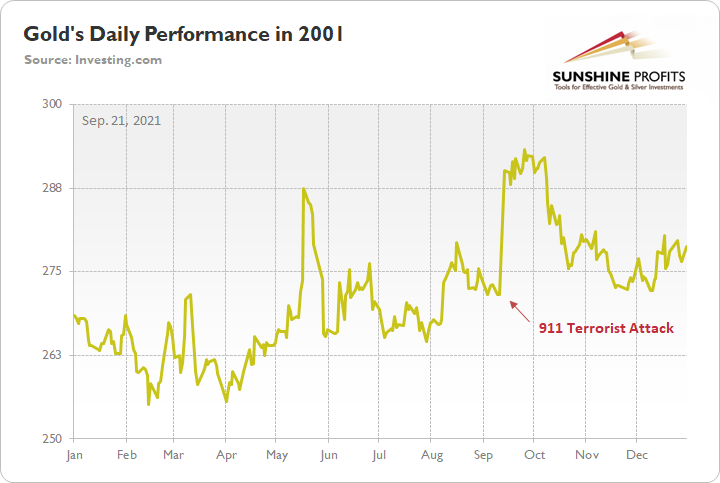

To explain, I wrote on Sep. 21:

When terrorists attacked the World Trade Center roughly 20 years ago, gold spiked on Sep. 11, 2001. However, it wasn’t long before the momentum fizzled and the yellow metal nearly retraced all of the gains by early December. Thus, when it comes to forecasting higher gold prices, Black Swan events are often more semblance than substance.

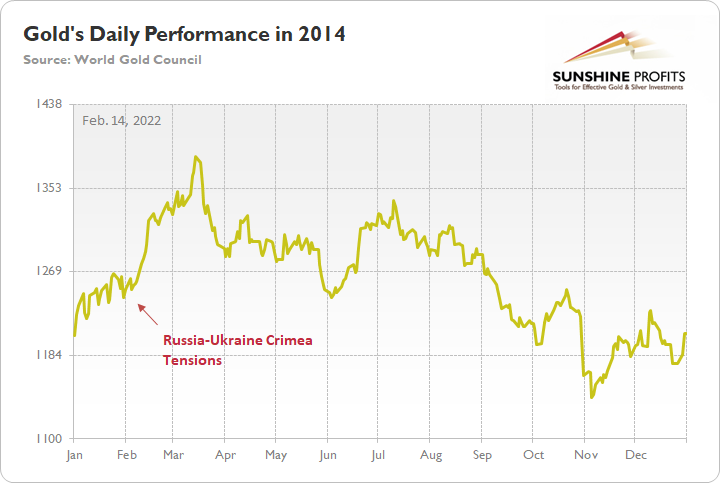

As further evidence, when Russia annexed Crimea from Ukraine in 2014, similar price action unfolded. For example, when rumors swirled of a possible invasion, gold rallied on the news. Then, when Russia officially invaded, the yellow metal continued its ascent. However, after the short-term sugar high wore off, bearish medium-term realities confronted gold once again. And in time, the yellow metal gave back all of the gains and sunk to a new yearly low.

Please see below:

Thus, while conflicting reports paint a conflicting portrait, the algorithms don’t care whether Russia invades Ukraine or not. With the rumor enough to pique investors’ interest, quantitative traders see it as an opportunity to capitalize on the momentum. However, once that momentum fizzles, history shows that the quants rush for the exits. As a result, is this time really different?

To that point, while the general stock market continues to suffer, the Russia-Ukraine saga has propped up the PMs. In the absence of that, gold, silver, and mining stocks would likely confront some of the pressures plaguing the NASDAQ Composite. For context, the PMs and Big Tech benefit from low real interest rates. However, the fundamental dynamic often hurts both asset classes when the outlook shifts.

Please see below:

To explain, the light blue line above tracks the NASDAQ 100, while the dark blue line above tracks the equity risk premium. If you analyze the relationship, you can see that spikes in the latter often result in drops in the former. With the Fed’s fears helping to uplift the equity risk premium in recent months, the NASDAQ 100 finally cracked.

More importantly, though, when the Fed’s rate hike cycle roiled the NASDAQ 100 in 2017-2018, the GDXJ ETF suffered too. Thus, while the Russia-Ukraine drama has provided a distraction, the fundamentals that impacted both asset classes back then are present now.

Please see below:

To explain, the green line above tracks the GDXJ ETF in 2018, while the black line above tracks the NASDAQ 100. If you analyze the performance, you can see that the Fed’s rate hike cycle initially rattled the former and the latter rolled over soon after. However, the negativity persisted until Fed Chairman Jerome Powell performed a dovish pivot and both assets rallied. As a result, with the Fed Chair unlikely to perform a dovish pivot this time around, the junior miners have some catching up to do.

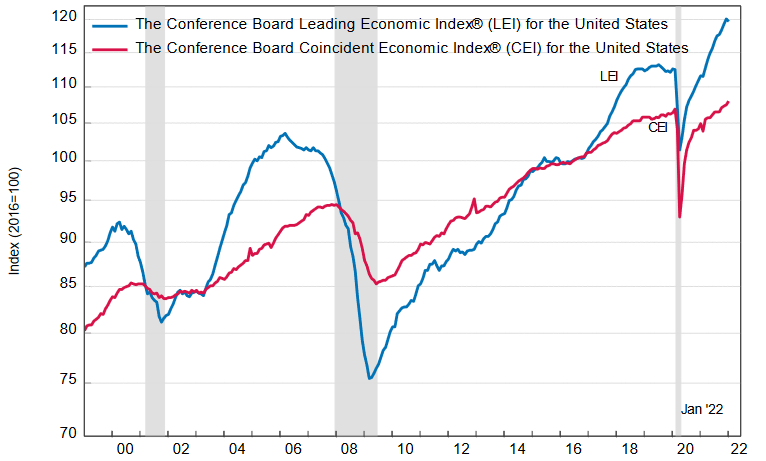

Finally, while a strong U.S. economy keeps the pressure on the Fed, The Confidence Board released its Leading Economic Index (LEI) on Feb. 18. While “the U.S. LEI posted a small decline in January, as the Omicron wave, rising prices, and supply chain disruptions took their toll,” Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board, said that the bullish medium-term outlook remains intact:

“Despite this month’s decline and a deceleration in the LEI’s six-month growth rate, widespread strengths among the leading indicators still point to continued, albeit slower, economic growth into the spring. However, labor shortages, inflation, and the potential of new COVID-19 variants pose risks to growth in the near term.

“The Conference Board forecasts GDP growth for Q1 to slow somewhat from the very rapid pace of Q4 2021. Still, the US economy is projected to expand by a robust 3.5 percent year-over-year in 2022 – well above the pre-pandemic growth rate, which averaged around 2 percent.”

Please see below:

The bottom line? While the Russia-Ukraine saga may continue to drive the short-term narrative, history shows that bullish sentiment doesn't last over the medium term. Moreover, with the Fed even more hawkish than in 2021, geopolitical factors have distracted the PMs from the more important fundamental development. As a result, the 'big picture' signals that their medium-term prospects are profoundly bearish.

In conclusion, the PMs were mixed on Feb. 18, as positive and negative developments in the Russia-Ukraine conflict continue to shape sentiment. However, while the short term is difficult to predict in geopolitics, the medium-term implications for the precious metals market remain intact: the Fed is hawked up, and tighter monetary policy supports a stronger USD Index and higher U.S. real yields. With the PMs often moving inversely to their main fundamental adversaries, this time shouldn't be any different. Also, this week’s weak reaction to what’s happening in Ukraine suggests that the precious metals sector is not far from its top.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The USD Keeps Cool Amidst Chaos. Is It Sure of Upcoming Highs?

February 18, 2022, 9:57 AMGold and the USDX reacted vigorously to the worrisome news concerning Eastern Europe. However, only the latter can be calm about its medium-term future.

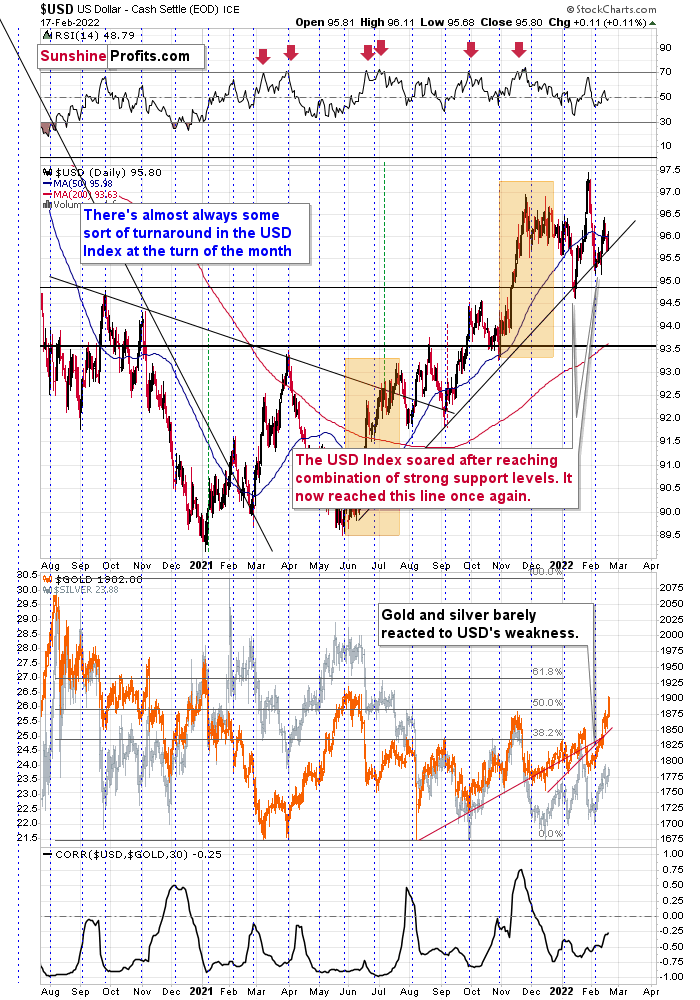

As geopolitical tensions uplift gold, silver, and mining stocks, they’re in rally mode each time a doom-and-gloom headline surfaces. However, while the ‘will they or won’t they’ saga commands investors’ attention, the USD Index continues to behave rationally. For example, while volatility has increased recently, the dollar basket has held firm.

To explain, I wrote on Feb. 17:

The USD Index is at its medium-term support line. All previous moves to / slightly below it were then followed by rallies, sometimes really big rallies, so we’re likely to see something like that once again.

Such a rally would be the prefect trigger for the triangle-vertex-based reversal in gold and the following slide.

Please see below:

Furthermore, the USD Index’s recent pullback was far from a surprise. For example, I highlighted on numerous occasions that the greenback is nearing its weekly rising resistance line, and the price action has unfolded as I expected.

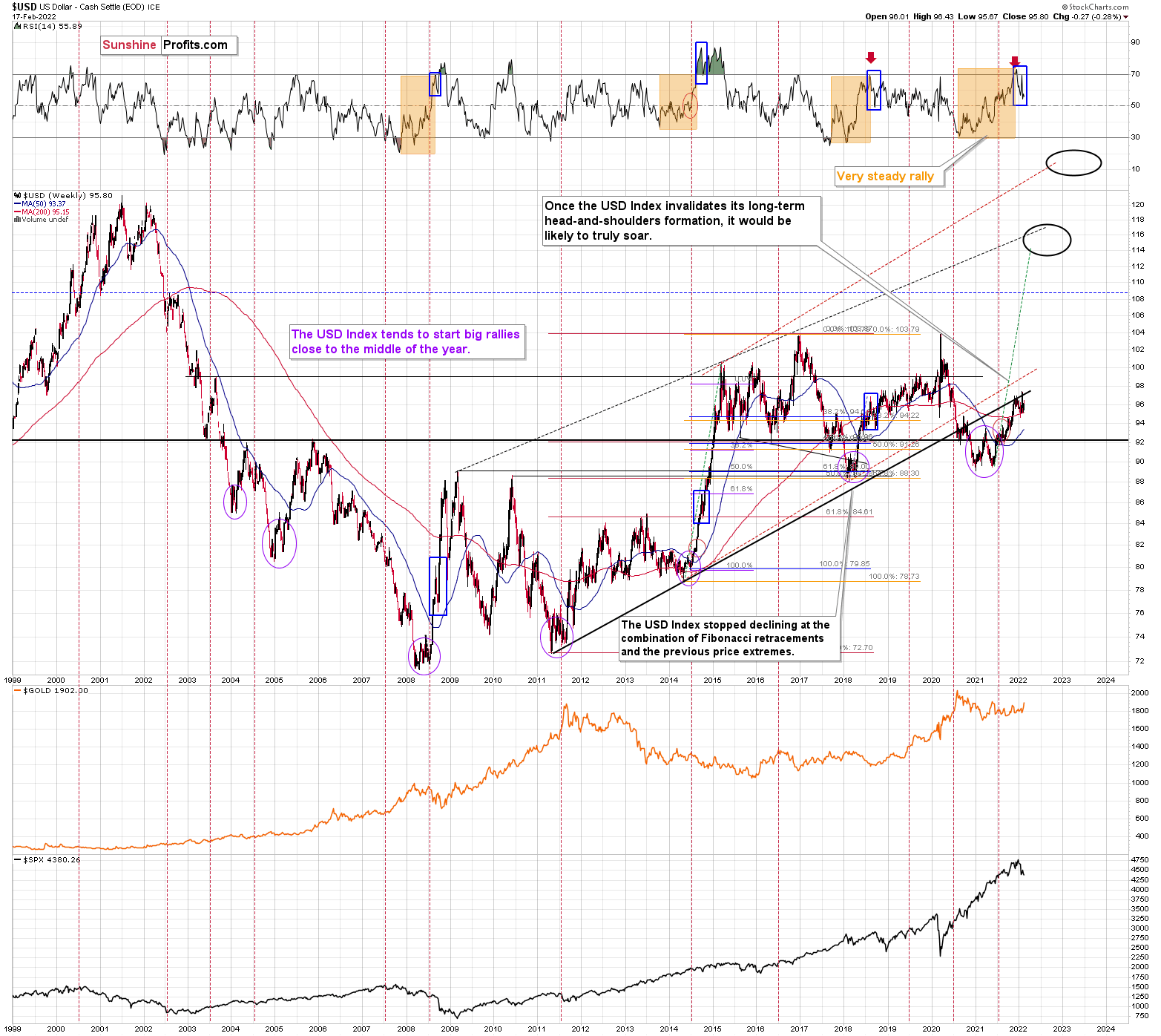

Moreover, while overbought conditions resulted in a short-term breather, history shows that the USD Index eventually catches its second wind. To explain, I previously wrote:

I marked additional situations on the chart below with orange rectangles – these were the recent cases when the RSI based on the USD Index moved from very low levels to or above 70. In all three previous cases, there was some corrective downswing after the initial part of the decline, but once it was over – and the RSI declined somewhat – the big rally returned and the USD Index moved to new highs.

As a result, with the USD Index showcasing a reliable history of profound comebacks, higher highs should materialize over the medium term.

Please see below:

Just as the USD Index took a breather before its massive rally in 2014, it seems that we saw the same recently. This means that predicting higher gold prices (or those of silver) here is likely not a good idea.

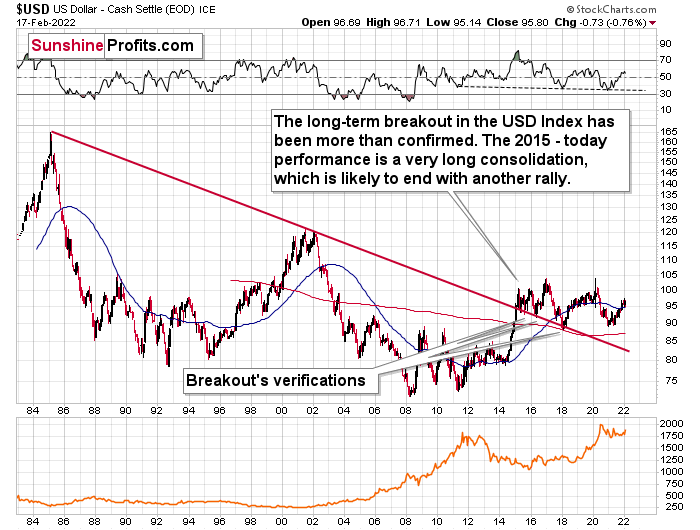

Continuing the theme, the eye in the sky doesn’t lie, and with the USDX’s long-term breakout clearly visible, the wind remains at the dollar’s back. Furthermore, dollar bears often miss the forest through the trees: with the USD Index’s long-term breakout gaining steam, the implications of the chart below are profound. While very few analysts cite the material impact (when was the last time you saw the USDX chart starting in 1985 anywhere else?), the USD Index has been sending bullish signals for years.

Please see below:

The bottom line?

With my initial 2021 target of 94.5 already hit, the ~98-101 target is likely to be reached over the medium term (and perhaps quite soon). Mind, though: we’re not bullish on the greenback because of the U.S.’s absolute outperformance. It’s because the region is fundamentally outperforming the Eurozone. The EUR/USD accounts for nearly 58% of the movement of the USD Index, and the relative performance is what really matters.

In conclusion, the financial markets remain on Russia-Ukraine watch. While gold, silver, mining stocks, and the USD Index whipsaw on the news, the technical and fundamental backdrops support higher prices for the latter, not the former. Thus, while geopolitical tensions are always short-term bullish for the precious metals, the rush is often short-lived. As a result, the trios’ downtrends that began in late 2020 will likely resurface once the headline-driven market returns to normal.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM