tools spotlight

-

What May Boost Gold Prices in the Future? Digital Money and War

March 9, 2022, 9:25 AMMany people wonder what the future of gold is in the face of military conflicts and central bank decisions. Here is an example of possible scenarios.

Q: Many thanks for your great service. Here are a couple of points I would like to offer to you for your thoughts:

1. There is talk of the US government (and this would lead other governments to follow) moving to a Central Bank Digital Currency (CBDC). This would potentially be the end of cryptos in the private sector. Crypto would be transferable at a given price and time for the CBDC. Like what FDR did with gold in 1933. After the conversion, cryptos would be banned. Would this occurrence or the rumor/threat of this action occurring push people back into the precious metals? How do you see this scenario playing out?

2. How do you think the precious metals will react to a long-drawn-out war in Ukraine/Europe (which could potentially morph into WW3 post-2026)?

3. How do you see the move of both Russia and China away from the SWIFT system affecting the precious metals? (China and Russia are accelerating their efforts to move to a new system in light of the recent Russian bans.)

A: Thank you. Here’s my take:

1. Well, as much as I don’t like to write it, I view the above scenario as likely. Cryptocurrencies pose a direct threat to the monetary system and the power that it grants to those that control it. Why wasn’t it banned, then? Because while it’s popular, it could get widespread adoption and then the monetary authorities could move to government cryptos that only they control.

Theoretically, there are many positives to a system where money is “intelligent” and “customizable”. For example, money that is provided as social support might be used for most products, but not for alcohol or other similar substances. Supporting a specific area could be made easy. Simply put, money spent there would be worth 30% more than elsewhere, so people would rush in to take advantage of the opportunity, thus supporting the area that they were supposed to support. For example, in the case of natural disasters, it would help the area recover.

However, there are also myriads of things that can go wrong in this system. You didn’t like my party’s narrative before the elections? Swooosh!, goes the magical monetary wand – and your money is now worth only 70% of what it was worth previously. “Hey, my company’s money should be worth more, because we’re so cool, and besides, look, here’s a bribe.”

Would you rather own this smart money or dumb old gold and silver that nobody can change? I’d personally go with both, but it would be more important to me than previously to have a bigger portion of my assets in physical gold and silver than before. Just in case someone with monetary power doesn’t like what I do, write, or think. Remember that those in power can change, so even by being a completely law-abiding citizen, who knows what the next government would think of that…

So, I think that ultimately it will make prices of precious metals move higher, but, of course, this is something that I see happening in the coming years, not in the next few weeks.

Who knows, maybe the global rise in interest rates (which is just starting) is supposed to make people dislike the current monetary system so that they not only are OK with the new crypto system, but they request it. Remember people shouting “Lock us down! Lock us down!” at the beginning of the pandemic?

2. Moving into a WW3 would like make the precious metals sector (especially gold) soar. However, I think that a stock-market-slide-led decline awaits us first – in the following weeks/months.

3. My reply here is exactly the same as when I replied to the question about Russia’s ban from the SWIFT system yesterday. Namely: This could work as you wrote above, but… history tells us that this would likely not be the case initially. Remember 2008? We had an international banking crisis (this doesn’t fully express what it was, but serves as a good summary), so the contagion effect was in full force, and what did gold do? It first declined significantly, along with the general stock market, and then came back up with a vengeance. While gold was declining, silver and mining stocks were also declining, particularly significantly. That’s in perfect tune with what I’m expecting to see in the future of the precious metals market.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Tries to Hold Above $2000 - Hard Landing Ahead?

March 8, 2022, 9:35 AMGold has hit $2,000 but is still struggling to maintain that historical level. It has already tried 8 times - will the ninth attempt succeed? Many indications make this doubtful.

Gold is attempting to break above the $2,000 milestone, and miners are trying to break above their declining resistance line. Will they manage to do so, and if so, how long will the rally last?

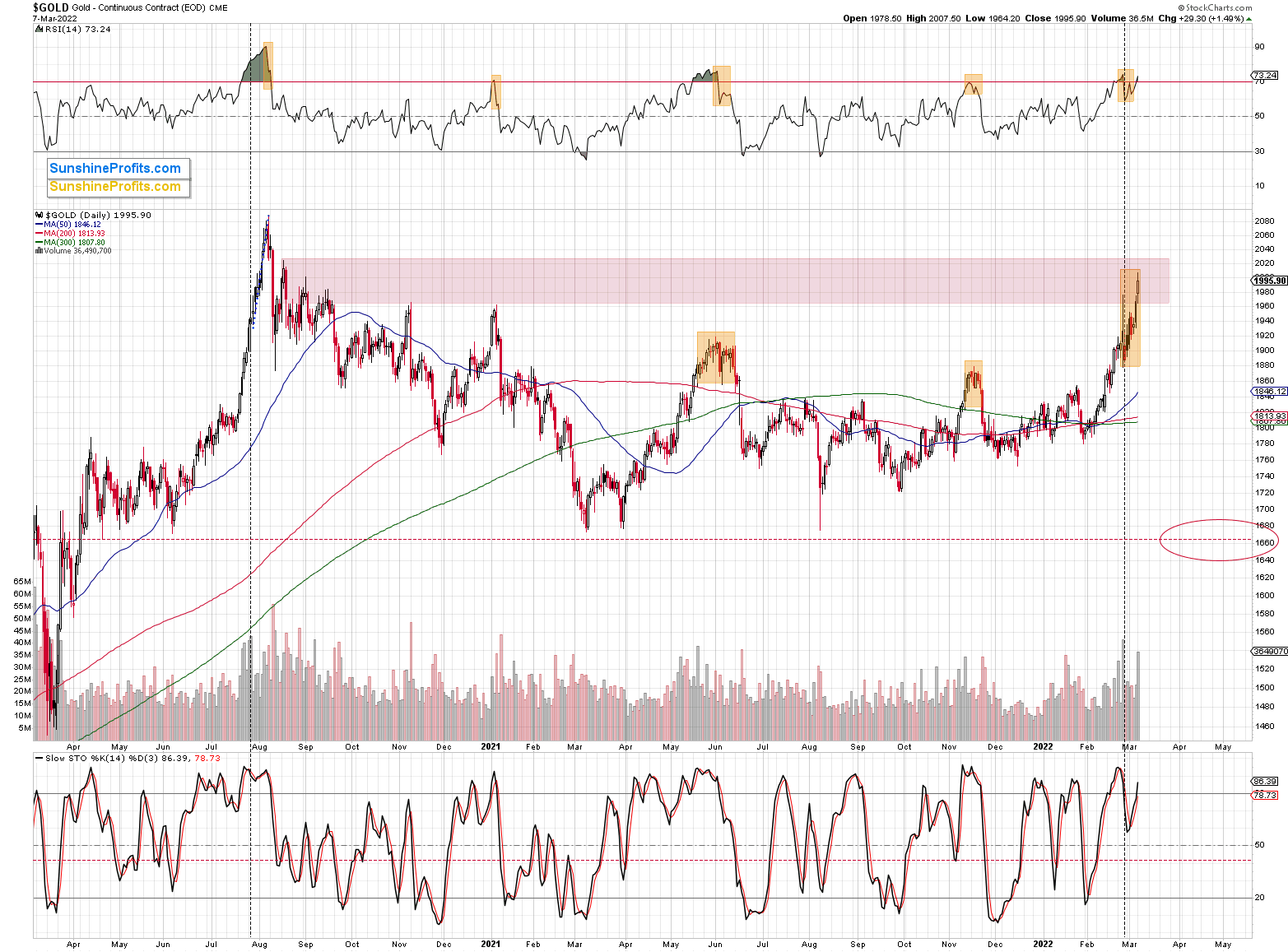

Yesterday, gold didn’t manage to close above the $2,000 level and it’s making another attempt to rally above it in today’s pre-market trading. However, will it be successful?

Given the RSI above 70 and the strength of the current resistance, it’s doubtful.

In fact, nothing has changed with regard to this likelihood since yesterday, so what I wrote about it in the previous Gold & Silver Trading Alert remains up-to-date:

Gold touched $2,000 in today’s pre-market trading, which is barely above its 2021 high and below its 2020 high. Crude oil is way above both analogous levels.

In other words, gold underperforms crude oil to a significant extent, just like in 2003.

Interestingly, back in 2003, gold topped when crude oil rallied about 40% from its short-term lows (the late-2002 low).

What happened next in 2003? Gold declined, and the moment when crude oil started to visibly outperform gold was also the beginning of a big decline in gold stocks.

That makes perfect sense on the fundamental level too. Gold miners’ share prices depend on their profits (just like it’s the case with any other company). Crude oil at higher levels means higher costs for the miners (the machinery has to be fueled, the equipment has to be transported, etc.). When costs (crude oil could be viewed as a proxy for them) are rising faster than revenues (gold could be viewed as a proxy for them), miners’ profits appear to be in danger; and investors don’t like this kind of danger, so they sell shares. Of course, there are many more factors that need to be taken into account, but I just wanted to emphasize one way in which the above-mentioned technical phenomenon is justified.

Back in 2003, gold stocks wiped out their entire war-concern-based rally, and the biggest part of the decline took just a bit more than a month. Let’s remember that back then, gold stocks were in a very strong medium- and long-term uptrend. Right now, mining stocks remain in a medium-term downtrend, so their decline could be bigger – they could give away their war-concern-based gains and then decline much more.

Mining stocks are not declining profoundly yet, but let’s keep in mind that history rhymes – it doesn’t repeat to the letter. As I emphasized previously today, back in 2003 and 2002, the tensions were building for a longer time, and it was relatively clear in advance that the U.S. attack was going to happen. This time, Russia claimed that it wouldn’t attack until the very last minute before the invasion. Consequently, the “we have to act now” is still likely to be present, and the dust hasn’t settled yet – everything appears to be unclear, and thus the markets are not returning to their previous trends. Yet.

However, as history shows, that is likely to happen. Either immediately, or shortly, as crude oil is already outperforming gold.

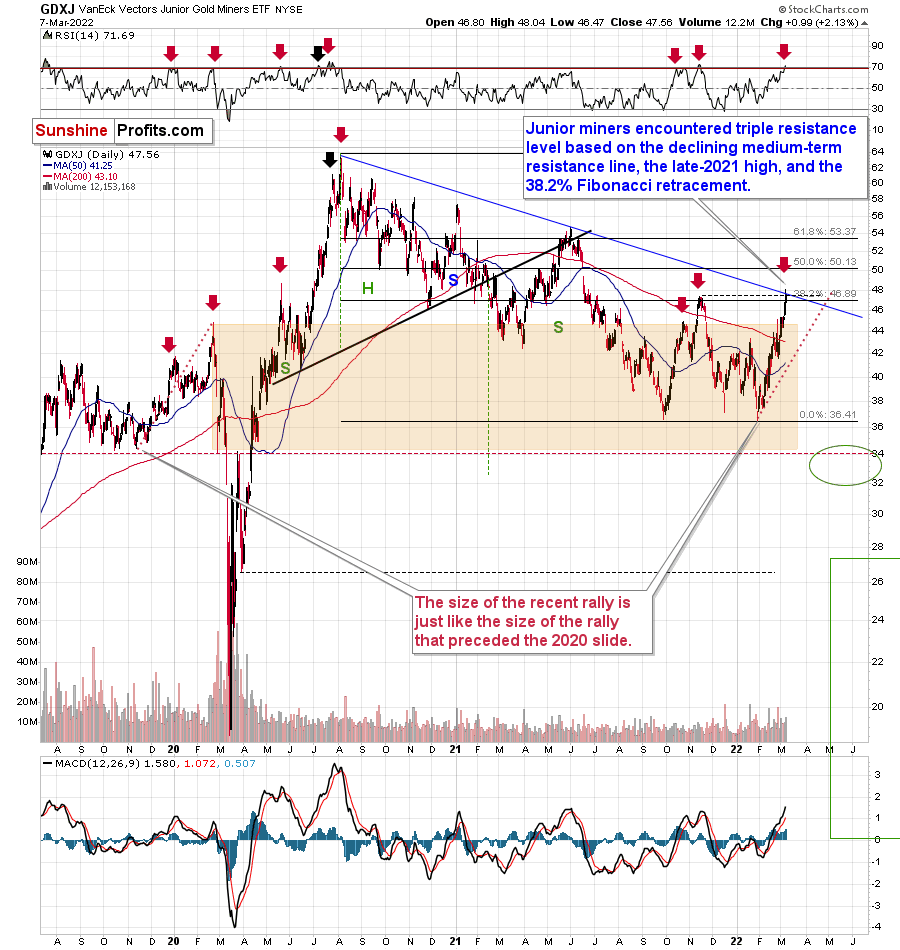

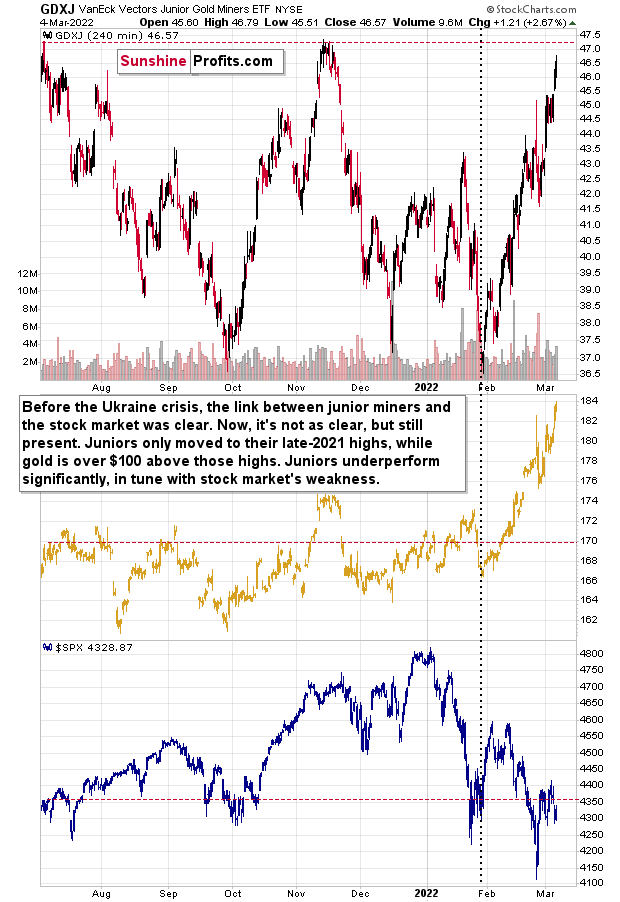

The above chart features the GDXJ ETF. As you can see, the junior miners moved to their very strong resistance provided by the declining resistance line. This resistance is further strengthened by the 38.2% Fibonacci retracement, and the previous (late-2021) high. This means that it’s particularly strong, and any breakout here would likely be invalidated shortly.

Given the clear sell signal from the RSI indicator, a turnaround here is even more likely. I marked the previous such signals to emphasize their efficiency. When the RSI was above 70, a top was in 6 out of 7 of the recent cases, and the remaining case was shortly before the final top, anyway.

This resistance seems to be analogous to the $2,000 level in gold.

By the way, please note that gold tried to break above $2,000 several times:

- twice in August 2020;

- twice in September 2020 (once moving above it, once moving just near this level);

- once in November 2020 (moving near this level);

- once in January 2021 (moving near this level);

- once in February 2022 (moving near this level).

These attempts failed in each of the 7 cases mentioned above. This is the eight attempt. Will this very strong resistance break this time?

Given how much crude oil has already soared, and how both markets used to react to war tensions in the case of oil-producing countries, it seems that the days of the rally are numbered.

Moving back to the GDXJ ETF, please note that while gold is moving close to its all-time highs, the junior miners are not doing anything like that. In fact, they barely moved slightly above their late-2021 high. They are not even close to their 2021 high, let alone their 2020 high. Instead, junior mining stocks are just a bit above their early-2020 high, from which their prices were more than cut in half in less than a month.

In other words, junior miners strongly underperform gold, which is a bearish sign. When gold finally declines – and it’s likely to, as geopolitical events tend to have only a temporary effect on prices, even if they’re substantial – junior miners will probably slide much more than gold.

One of the reasons is the likely decline in the general stock market.

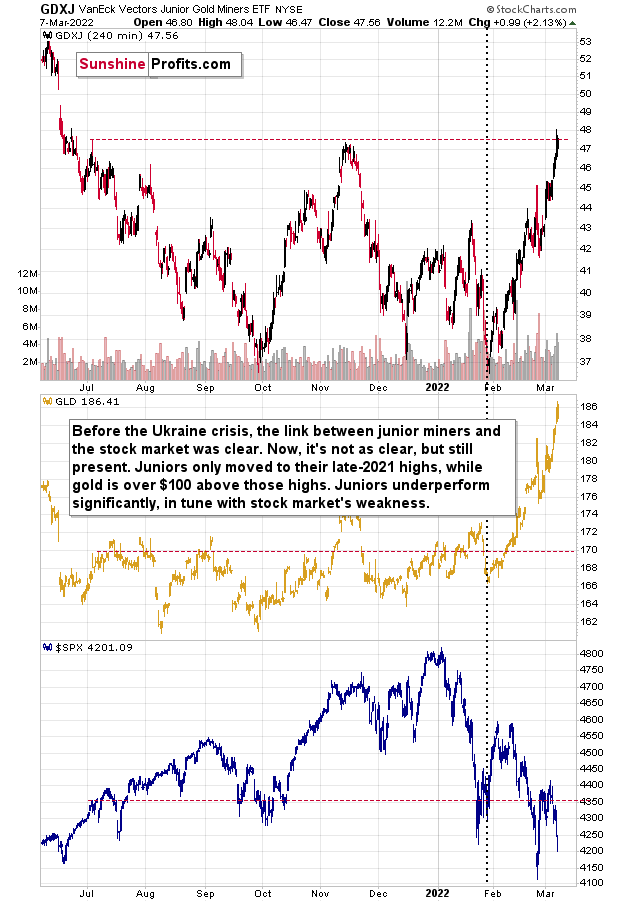

I recently received a question about the impact the general stock market has on mining stocks, as the latter moved higher despite stocks’ decline in recent weeks. So, let’s take a look at a chart that will feature junior mining stocks, the GLD ETF, and the S&P 500 Index.

Before the Ukraine crisis, the link between junior miners and the stock market was clear. Now, it's not as clear, but it’s still present. Juniors only moved to their late-2021 highs, while gold is over $100 above those highs. Juniors underperform significantly, in tune with the stock market's weakness.

The gold price is still the primary driver of mining stock prices – including junior mining stocks. After all, that’s what’s either being sold by the company (that produces gold) or in the properties that the company owns and explores (junior miners). As gold prices exploded in the last couple of weeks, junior miners practically had to follow. However, this doesn’t mean that the stock market’s influence is not present nor that it’s going to be unimportant going forward.

Conversely, the weak performance of the general stock market likely contributed to junior miners’ weakness relative to gold – the former didn’t rally as much as the latter. Since the weakness in the general stock market is likely to continue, and gold’s rally is likely to be reversed (again, what happened in the case of other military conflicts is in tune with history, not against it), junior miners are likely to decline much more profoundly than gold.

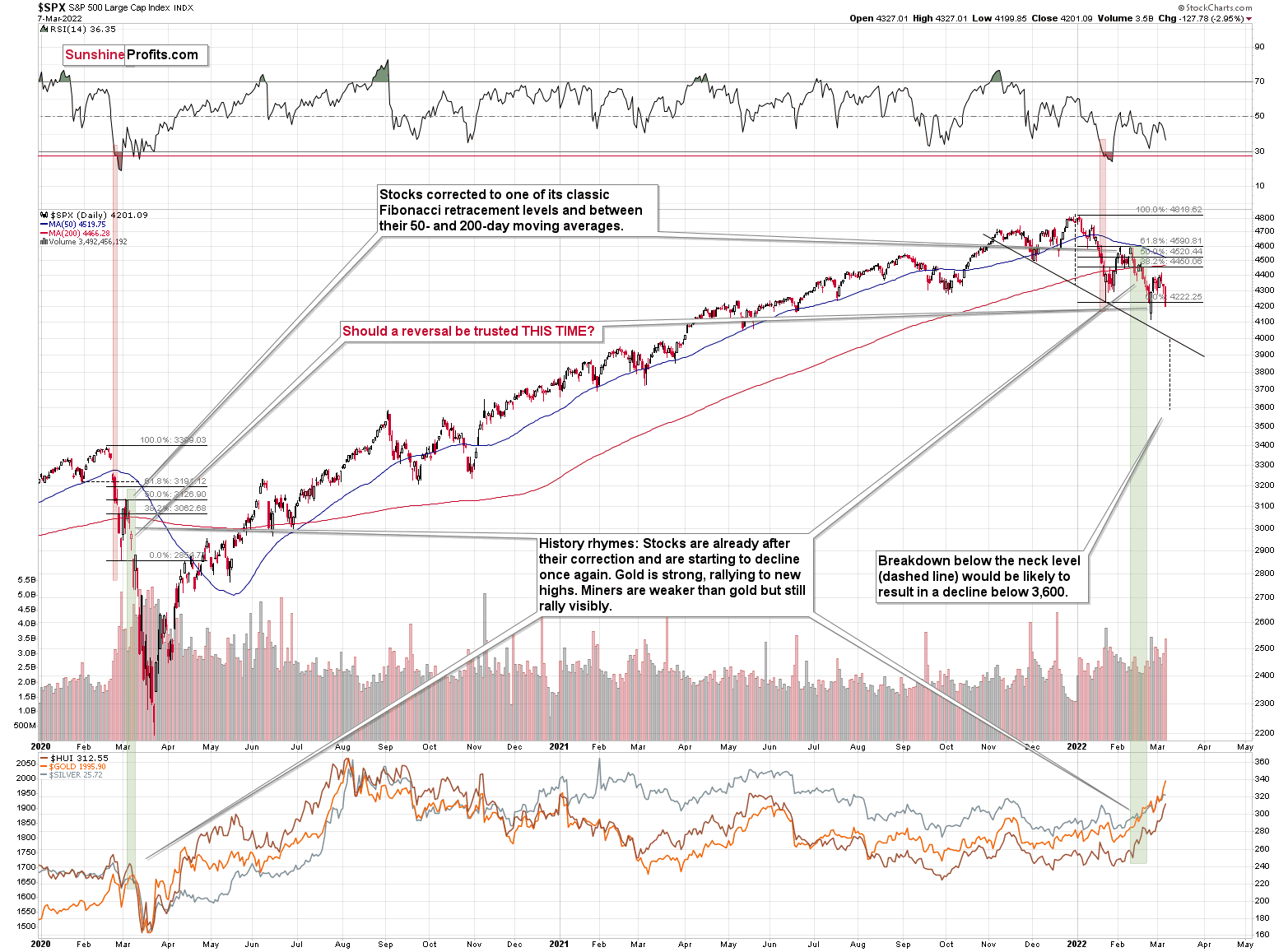

Speaking of the general stock market, it just closed at the lowest level since mid-2021.

The key thing about the above chart is that what we’ve seen this year is the biggest decline since 2020, and the size of the recent slide is comparable to what we saw as the initial wave down in 2020 – along with the subsequent correction. If these moves are analogous, the recent rebound was perfectly normal – there was one in early 2020 too. This also means that a much bigger decline is likely in the cards in the coming weeks, and that it’s already underway.

This would be likely to have a very negative impact on the precious metals market, in particular on junior mining stocks (initially) and silver (a bit later).

All in all, it seems that due to the technical resistance in gold and mining stocks, the sizable – but likely temporary (like other geopolitical-event-based-ones) – rally is likely to be reversed shortly. Then, as the situation in the general stock market deteriorates, junior miners would be likely to plunge in a spectacular manner.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

As Oil Overshadows Gold, Miners Will Lead Eventual Decline

March 7, 2022, 9:26 AMCrude oil did it again! Even though gold moved higher recently, crude oil soared so substantially that it stole practically the entire spotlight. Let’s take a look at it before moving to the precious metals sector.

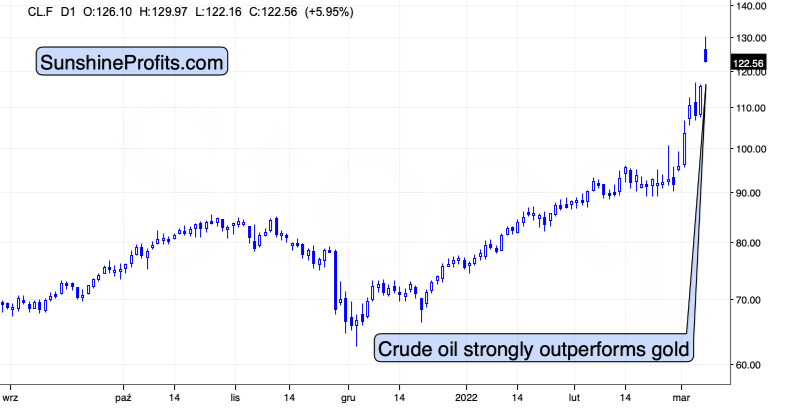

The price of crude oil soared by almost $40 in just a bit over a week! That’s over 40%. Gold rallied too, but the extent of the move higher is nothing compared to what we just saw in crude oil.

The black gold reversed on an intraday basis today, so we might have seen the top, but it’s far from being clear.

What is clear, however, is that crude oil is greatly outperforming gold.

This – as I’ve commented previously – has profound implications for precious metals investors:

As you may have noticed, crude oil shot up recently in a spectacular manner. This seems normal, as it’s a market with rather inflexible supply and demand, so disruptions in supply or threats thereof can impact the price in a substantial way. With Russia as one of the biggest crude oil producers, its invasion of Ukraine, and a number of sanctions imposed on the attacking country (some of them involving oil directly), it’s natural that crude oil reacts in a certain manner. The concern-based rally in gold is also understandable.

However, the relationship between wars, concerns, and prices of assets is not as straightforward as “there’s a war, so gold and crude oil will go up.” In order to learn more about this relationship, let’s examine the most similar situation in recent history to the current one, when oil supplies were at stake.

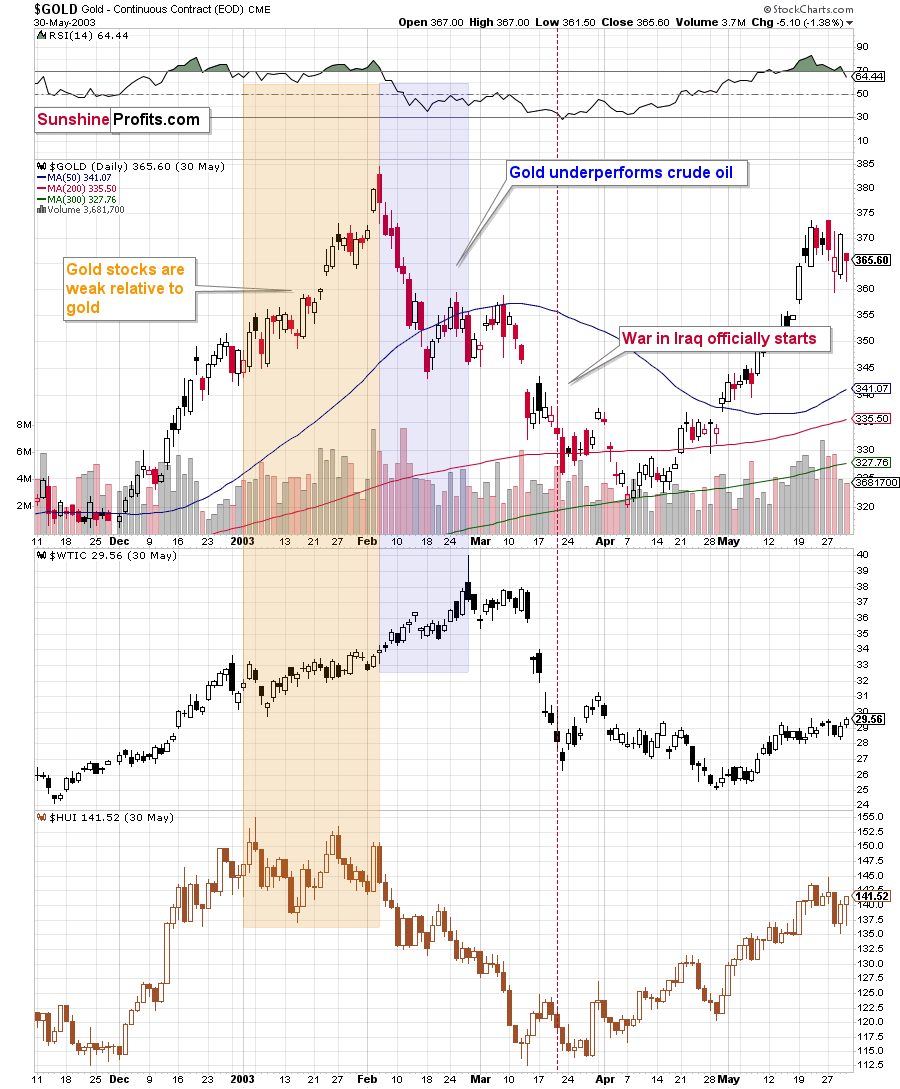

The war that I’m mentioning is the one between Iraq and the U.S. that started almost 20 years ago. Let’s see what happened in gold, oil, and gold stocks at that time.

The most interesting thing is that when the war officially started, the above-mentioned markets were already after a decline. However, that’s not that odd, when one considers the fact that back then, the tensions were building for a long time, and it was relatively clear in advance that the U.S. attack was going to happen. This time, Russia claimed that it wouldn’t attack until the very last minute before the invasion.

The point here, however, is that the markets rallied while the uncertainty and concerns were building up, and then declined when the situation was known and “stable.” I don’t mean that “war” was seen as stable, but rather that the outcome and how it affected the markets was rather obvious.

The other point is the specific way in which all three markets reacted to the war and the timing thereof.

Gold stocks rallied initially, but then were not that eager to follow gold higher, but that’s something that’s universal in the final stages of most rallies in the precious metals market. What’s most interesting here is that there was a time when crude oil rallied substantially, while gold was already declining.

Let me emphasize that once again: gold topped first, and then it underperformed while crude oil continued to soar substantially.

Fast forward to the current situation. What has happened recently?

Gold touched $2,000 in today’s pre-market trading, which is barely above its 2021 high and below its 2020 high. Crude oil is way above both analogous levels.

In other words, gold underperforms crude oil to a significant extent, just like in 2003.

Interestingly, back in 2003, gold topped when crude oil rallied about 40% from its short-term lows (the late-2002 low).

What happened next in 2003? Gold declined, and the moment when crude oil started to visibly outperform gold was also the beginning of a big decline in gold stocks.

That makes perfect sense on the fundamental level too. Gold miners’ share prices depend on their profits (just like it’s the case with any other company). Crude oil at higher levels means higher costs for the miners (the machinery has to be fueled, the equipment has to be transported, etc.). When costs (crude oil could be viewed as a proxy for them) are rising faster than revenues (gold could be viewed as a proxy for them), miners’ profits appear to be in danger; and investors don’t like this kind of danger, so they sell shares. Of course, there are many more factors that need to be taken into account, but I just wanted to emphasize one way in which the above-mentioned technical phenomenon is justified. The above doesn’t apply to silver as it’s a commodity, but it does apply to silver stocks.

Back in 2003, gold stocks wiped out their entire war-concern-based rally, and the biggest part of the decline took just a bit more than a month. Let’s remember that back then, gold stocks were in a very strong medium- and long-term uptrend. Right now, mining stocks remain in a medium-term downtrend, so their decline could be bigger – they could give away their war-concern-based gains and then decline much more.

Mining stocks are not declining profoundly yet, but let’s keep in mind that history rhymes – it doesn’t repeat to the letter. As I emphasized previously today, back in 2003 and 2002, the tensions were building for a longer time, and it was relatively clear in advance that the U.S. attack was going to happen. This time, Russia claimed that it wouldn’t attack until the very last minute before the invasion. Consequently, the “we have to act now” is still likely to be present, and the dust hasn’t settled yet – everything appears to be unclear, and thus the markets are not returning to their previous trends. Yet.

However, as history shows, that is likely to happen. Either immediately, or shortly, as crude oil is already outperforming gold.

The above chart features the GDXJ ETF in its London trading. As you can see, the junior miners moved to their very strong resistance provided by the declining resistance line. This resistance seems to be analogous to the $2,000 level in gold.

By the way, please note that gold tried to break above $2,000 several times:

- twice in August 2020;

- twice in September 2020 (once moving above it, once moving just near this level);

- once in November 2020 (moving near this level);

- once in January 2021 (moving near this level);

- once in February 2022 (moving near this level).

These attempts failed in each of the 7 cases mentioned above. This is the eight attempt. Will this very strong resistance break this time?

Given how much crude oil has already soared, and how both markets used to react to war tensions in the case of oil-producing countries, it seems that the days of the rally are numbered.

Moving back to the GDXJ ETF, please note that while gold is moving close to its all-time highs, the junior miners are not doing anything like that. In fact, they barely moved slightly above their late-2021 high. They are not even close to their 2021 high, let alone their 2020 high. Instead, junior mining stocks are just a bit above their early-2020 high, from which their prices were more than cut in half in less than a month.

In other words, junior miners strongly underperform gold, which is a bearish sign. When gold finally declines – and it’s likely to, as geopolitical events tend to have only a temporary effect on prices, even if they’re substantial – junior miners will probably slide much more than gold.

One of the reasons is the likely decline in the general stock market.

I recently received a question about the impact the general stock market has on mining stocks, as the latter moved higher despite stocks’ decline in recent weeks. So, let’s take a look at a chart that will feature junior mining stocks, the GLD ETF, and the S&P 500 Index.

Before the Ukraine crisis, the link between junior miners and the stock market was clear. Now, it's not as clear, but it’s still present. Juniors only moved to their late-2021 highs, while gold is over $100 above those highs. Juniors underperform significantly, in tune with the stock market's weakness.

The gold price is still the primary driver of mining stock prices – including junior mining stocks. After all, that’s what’s either being sold by the company (that produces gold) or in the properties that the company owns and explores (junior miners). As gold prices exploded in the last couple of weeks, junior miners practically had to follow. However, this doesn’t mean that the stock market’s influence is not present nor that it’s going to be unimportant going forward.

Conversely, the weak performance of the general stock market likely contributed to junior miners’ weakness relative to gold – the former didn’t rally as much as the latter. Since the weakness in the general stock market is likely to continue, and gold’s rally is likely to be reversed (again, what happened in the case of other military conflicts is in tune with history, not against it), junior miners are likely to decline much more profoundly than gold.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Stocks: Massive Drop Is Around the Corner

March 4, 2022, 7:27 AMMining stocks would likely suffer when the general stock market slides, and it seems that we won’t have to wait too long for that.

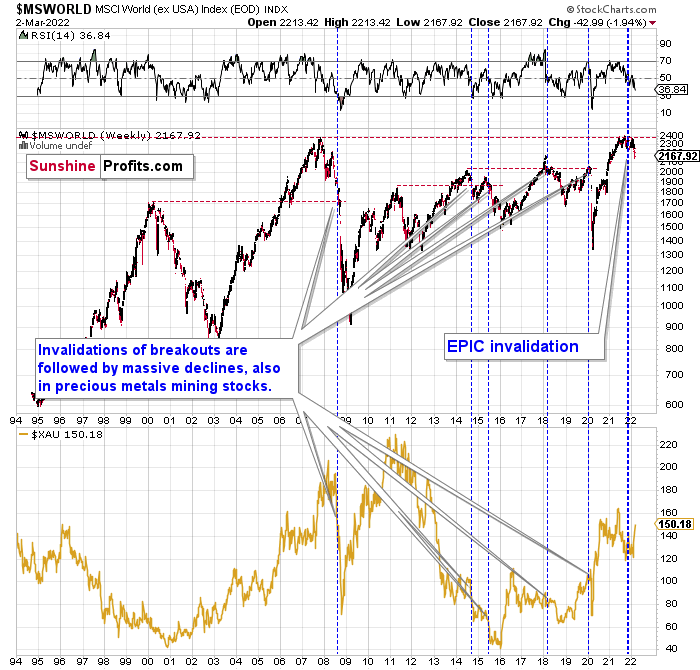

World stocks have already begun their decline, and based on the analogy to the previous invalidations, the decline is not likely to be small. In fact, it’s likely to be huge.

For context, I explained the ominous implications on Nov. 30. I wrote:

Something truly epic is happening in this chart. Namely, world stocks tried to soar above their 2007 high, they managed to do so and… they failed to hold the ground. Despite a few attempts, the breakout was invalidated. Given that there were a few attempts and that the previous high was the all-time high (so it doesn’t get more important than that), the invalidation is a truly critical development.

It's a strong sell signal for the medium- and quite possibly for the long term.

From our – precious metals investors’ and traders’ – point of view, this is also of critical importance. All previous important invalidations of breakouts in world stocks were followed by massive declines in the mining stocks (represented by the XAU Index).

Two of the four similar cases are the 2008 and 2020 declines. In all cases, the declines were huge, and the only reason why they appear “moderate” in the lower part of the above chart is that it has a “linear” and not “logarithmic” scale. You probably still remember how significant and painful (if you were long that is) the decline at the beginning of 2020 was.

Now, all those invalidations triggered big declines in the mining stocks, and we have “the mother of all stock market invalidations” at the moment, so the implications are not only bearish, but extremely bearish.

What does it mean? It means that it is time when being out of the short position in mining stocks to get a few extra dollars from immediate-term trades might be risky. The possibility that the omicron variant of Covid makes vaccination ineffective is too big to be ignored as well. If that happens, we might see 2020 all over again – to some extent. In this environment, it looks like the situation is “pennies to the upside and dollars to the downside” for mining stocks. Perhaps tens of dollars to the downside… You have been warned.

Here's how the situation currently looks from the U.S. point of view. The chart below features the S&P 500 futures.

The key thing about the above chart is that what we’ve seen this year is the biggest decline since 2020, and the size of the recent slide is comparable to what we saw as the initial wave down in 2020. If these moves are analogous, the current rebound is normal – there was one in early 2020 too. This also means that a much bigger decline is likely in the cards in the coming weeks.

The thing that we see with regard to the short term is that stocks moved above their declining resistance line. However, this line was already “broken” in a similar way earlier this year. The fact is that this “breakout” actually resulted in its invalidation and another wave down.

If history is about to rhyme with regard to both short-term and the analogy to 2020, the next move lower might be much bigger.

This would be likely to have a very negative impact on the precious metals market, in particular on junior mining stocks (initially) and silver (a bit later).

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM