Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLZ21] No position currently justified on a risk/reward point of view.

- Natural Gas [NGX21] No position justified on a risk/reward point of view either.

My Dynamic Stock Watchlist is here.

The new front month contract (as we switched now to Dec’21) for WTI Crude Oil futures closed the week at $82 per barrel on Friday (Oct. 15th).

Fundamentally, nothing seems to be able to stop, in the short term, the surge in crude oil prices which continued to rise on Friday amid concerns over supply, since the WTI hit a new high in almost seven years.

In addition, the slight decline of the US dollar may signify a more marked optimism of the markets in the perspectives of a gradual recovery of the global economy.

OPEC+ remains stuck in its timetable for the gradual increase in production, thus tightening a market which suffers from insufficient supply.

If a return in global demand appears to be faster than that of supply (as we are getting close to the winter season and its cooler temperatures), more shipping and other requirements are needed.

WTI Crude Oil (CLZ21) Futures (December contract, daily chart)

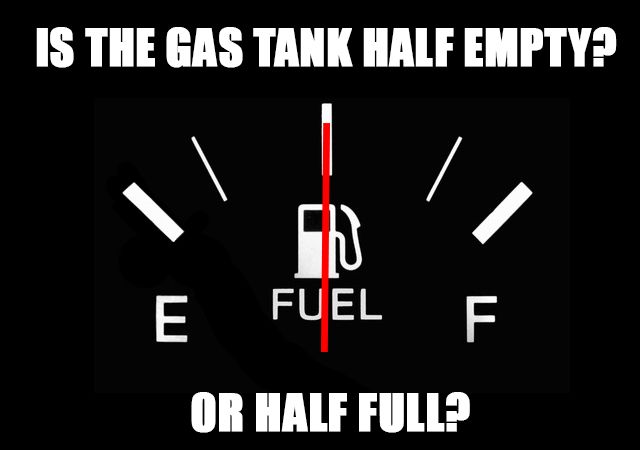

In summary, in times of uncertainty, we are wondering where the oil market is going to drive us with such directional moves. So far, it’s in the fast lane on the highway. However, the question now is: which exit is it going to take? $82? Or is it driving with a sufficiently full fuel tank in order to reach the psychological $100 exit? For now, let’s just enjoy the road and let us know what you think!

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLZ21] No position currently justified on a risk/reward point of view.

- Natural Gas [NGX21] No position justified on a risk/reward point of view either.

My Dynamic Stock Watchlist is here.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist