Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLZ21] No position currently justified on a risk/reward point of view.

- Natural Gas [NGX21] Long around $4.766-4.920 support (yellow rectangle) – with a stop below $4.615 and a target at $5.604 – see this article for details.

Did you miss our last article about the spiciest MLPs to trade? No problem, you can have a look at our selection through our dynamic stock watchlist!

After the surge, the WTI Crude Oil still faces some global risk sentiment strong enough to make it fly higher. Will it pop like a helium balloon?

Fundamental Analysis

It appears that oil prices are being supported by speculators who have ignored signs of a slowing economy around the world. Nonetheless, the black gold may face a bearish supply forecast soon, which could potentially put it at risk of a pullback.

Furthermore, with a disappointing GDP in China in the third quarter and industrial production falling in September in the United States, the world's two largest economies have lost momentum, which could affect the level of energy demand.

Consequently, this context of state interventionism on energy prices is likely to reduce the transfer of demand from the coal market to petroleum products, depriving the crude of one of its wings that lifted it for a number of weeks.

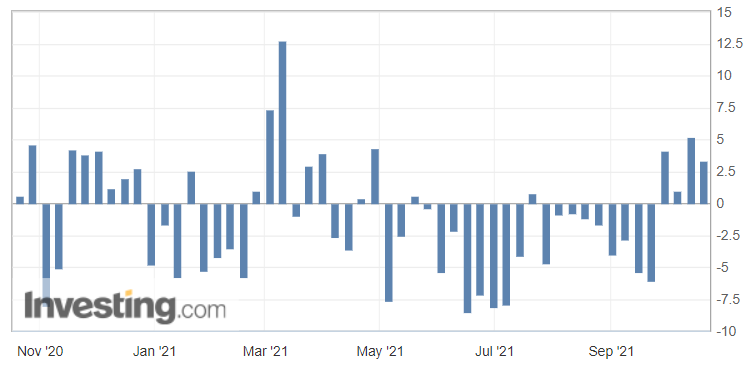

U.S. API Weekly Crude Oil Stock

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via Investing

Regarding the API figures published Tuesday, the increase in crude inventories (with 3.294 million barrels versus 2.233 million barrels expected) implies weaker demand and is normally bearish for crude prices.

However, we have to see whether or not these figures will be confirmed by the weekly Energy Information Administration's (EIA) report.

If that scenario is confirmed by the EIA’s figures later today, then the black gold may be set for a corrective wave, possibly back to previous support levels.

WTI Crude Oil (CLZ21) Futures (December contract, daily chart)

In conclusion, anything can happen in this market in the forthcoming days… Therefore, no position in the WTI Crude is justified from the risk-reward perspective at the moment.

As always, we’ll keep you, our subscribers, well-informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLZ21] No position currently justified on a risk/reward point of view.

- Natural Gas [NGX21] Long around $4.766-4.920 support (yellow rectangle) – with a stop below $4.615 and a target at $5.604 – see this article for details.

Did you miss our last article about the spiciest MLPs to trade? No problem, you can have a look at our selection through our dynamic stock watchlist!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist