Please log in to read the entire text.

If you don’t have a login yet, please select your access package.

Economic contraction is unfolding – but how painful will it be? The deeper the recession, the better for gold.

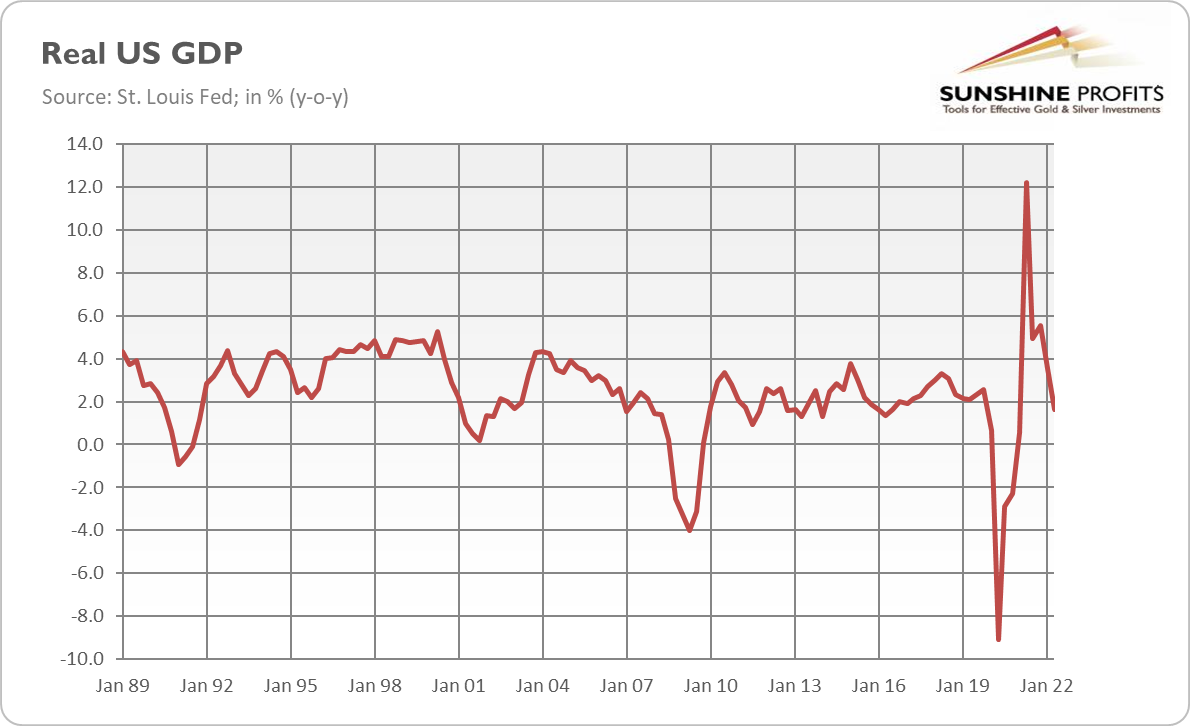

Let’s make it clear: an economic downturn is coming. We are already in a technical recession (GDP contracted in the first two quarters of this year), despite the White House’s attempts to change its definition.

A full-blown recession is just around the corner and will likely come out next year. At this point, another question is more interesting: how long will the pain last? Or, how deep will the contraction be? Will it be a short and shallow recession like in 1990-91 or in 2001, or a long and severe one like the Great Recession? Or maybe a short but deep one like the pandemic recession of 2020?

I don’t know . I forgot to take my crystal ball. However, I would exclude the last possibility, as the latest recession was mainly caused by the Great Lockdown – this is why it was so deep and short. This recession will be more normal – as long as recessions have anything to do with normality.

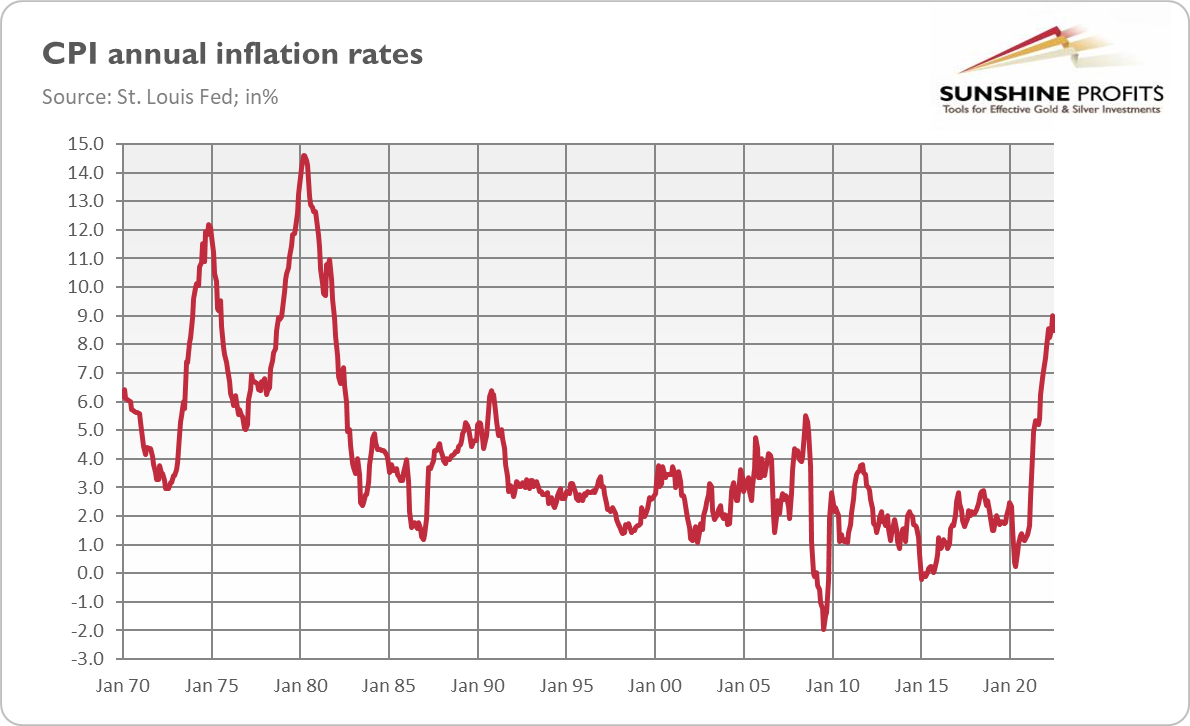

Actually, this won’t be a normal recession, as it will be accompanied by high inflation, which implies that we will experience stagflation. This is a strong argument for a deep recession. Why?

Well, the Fed is already engineering a recession (although Powell prefers talking about bringing demand and supply into balance) to slow inflation. Given how high inflation remains and how long the U.S. central bank has been in denial and inaction, it will have to continue its unprecedentedly large interest rate hikes. Such an aggressive tightening cycle could lead to a serious economic decline.

This is also what history suggests. There was no period of such high inflation that didn’t lead to a severe recession. There was a long recession in 1973-1975 and later a double-dip recession in the early 1980s. The recession of 1990-91 was milder, but inflation was lower, while the Fed’s reaction to it was faster.

Another argument that strengthens the pessimistic view is the size of monetary stimulus during the boom phase of this business cycle. The broad money supply increased by more than one fourth in 2020 in a response to the pandemic (see the chart below), as the central and commercial banks created trillions of dollars to tranquilize the population into accepting lockdowns. However, the higher the flight, the more painful the fall will be.

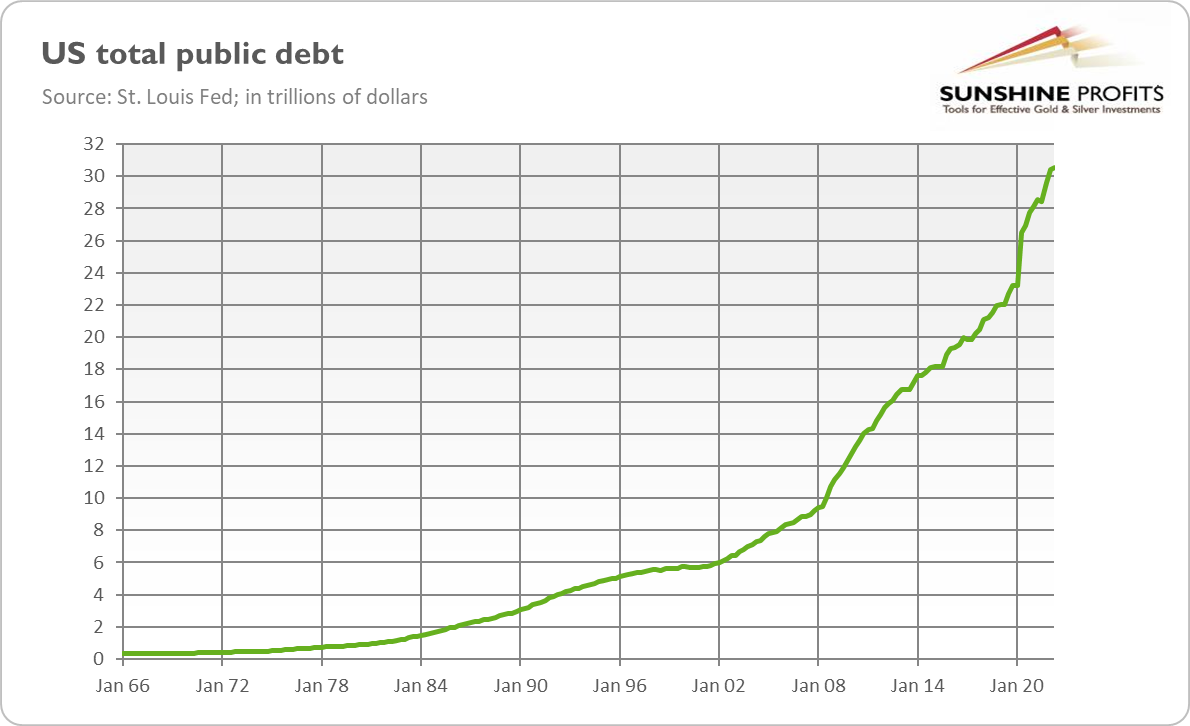

Last but not least, there is a lot of debt accumulated in the economy. The public debt is $30.6 trillion, or 124.7% of GDP, and there is also the private debt, which is actually larger than the public.

Thanks to recent declines, asset valuations are less stretched, but the financial system remains fragile. It’s true that banks are now in better shape than before the financial crisis of 2007-2009 and that they were rather unaffected by the pandemic. Hence, the replay of the Great Recession – when banks were severely hit, which resulted in a credit crunch – doesn’t have to occur.

However, there is so much debt that hikes in interest rates and withdrawal of liquidity in the form of quantitative tightening – not to mention any sudden events – could trigger a financial crash or an economic crisis.

What does it all mean for the gold market? Well, the mild recession, not to mention a soft landing, would be a relatively negative scenario for the yellow metal. It could still gain somewhat, but markets are forward-looking and when a recession is shallow, they would anticipate a quick recovery (which would rather support equities and other risky assets). The mild recession would also allow the Fed to stay relatively calm and to not fire all the monetary ammunition – while gold would prefer the U.S. central bank to go fully dovish.

On the other hand, a deep recession would be much better for gold. During severe economic downturns, moods are really pessimistic, and risk aversion is high. Hence, investors shift into safe-haven assets such as gold. What’s more, the Fed would then break out all available weapons to avoid a full economic catastrophe, even in the face of high inflation. This would create excellent conditions for gold to rally.

If a deep recession is accompanied by a financial crisis or sovereign-debt crisis, when confidence in a financial system and fiat money is ultra low, it would be a really perfect scenario for the yellow metal.

Which scenario is most likely? Given how high inflation is and how (relatively) aggressive the Fed’s tightening cycle is in response to price instability – the federal funds rate is historically still low, but the increase from 0-0.25 to 2.25-2.50% is huge in percentage terms (1800%) – I bet on a deep recession. It’s true that the boom phase was short, so not many malinvestments had time to show up, but there are many erroneous projects accumulated in the 2010s that were never corrected (some analysts even say about everything bubble).

A lot will depend on the path of inflation. If inflation decelerates relatively quickly and to an acceptable level, the Fed could announce a triumph over the inflationary beast (at least in the first battle) and reverse or at least pause interest rate hikes. Then, a recession could be relatively mild while its support for gold is positive but limited. However, if inflation remains stubbornly high, the Fed could continue its hiking cycle, which could trigger a potentially severe recession and make gold shine really bright.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the September Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.