Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

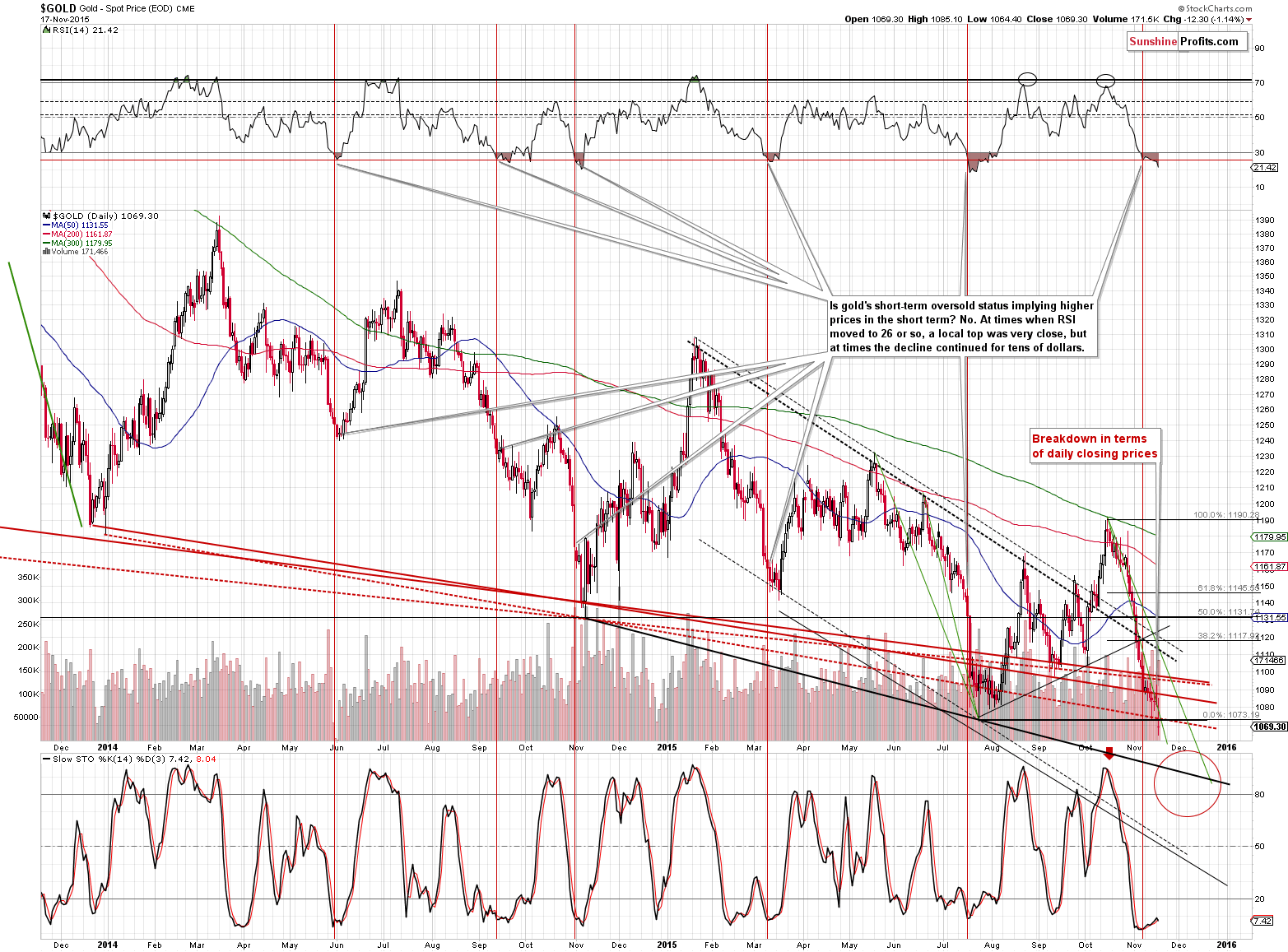

Gold closed below the previous 2015 intra-day lows and we now have breakdowns from all perspectives: intra-day, daily close and weekly close. Yesterday’s breakdown is not confirmed yet. There were, however, other important developments as well and together they paint a quite coherent picture for the precious metals sector.

Let’s take a look (charts courtesy of http://stockcharts.com).

In yesterday’s alert we commented on the above chart in the following way:

Gold seems to have indeed corrected to the $1,100 level, but the market was not strong enough to push the price above this level. Instead, gold reversed a few dollars below this level – at $1,097.40. What does this tell us in light of the above? That the corrective upswing may already be over. May – it’s not certain, so we are keeping the stop-loss (or, more precisely, profit-take) levels at their current values.

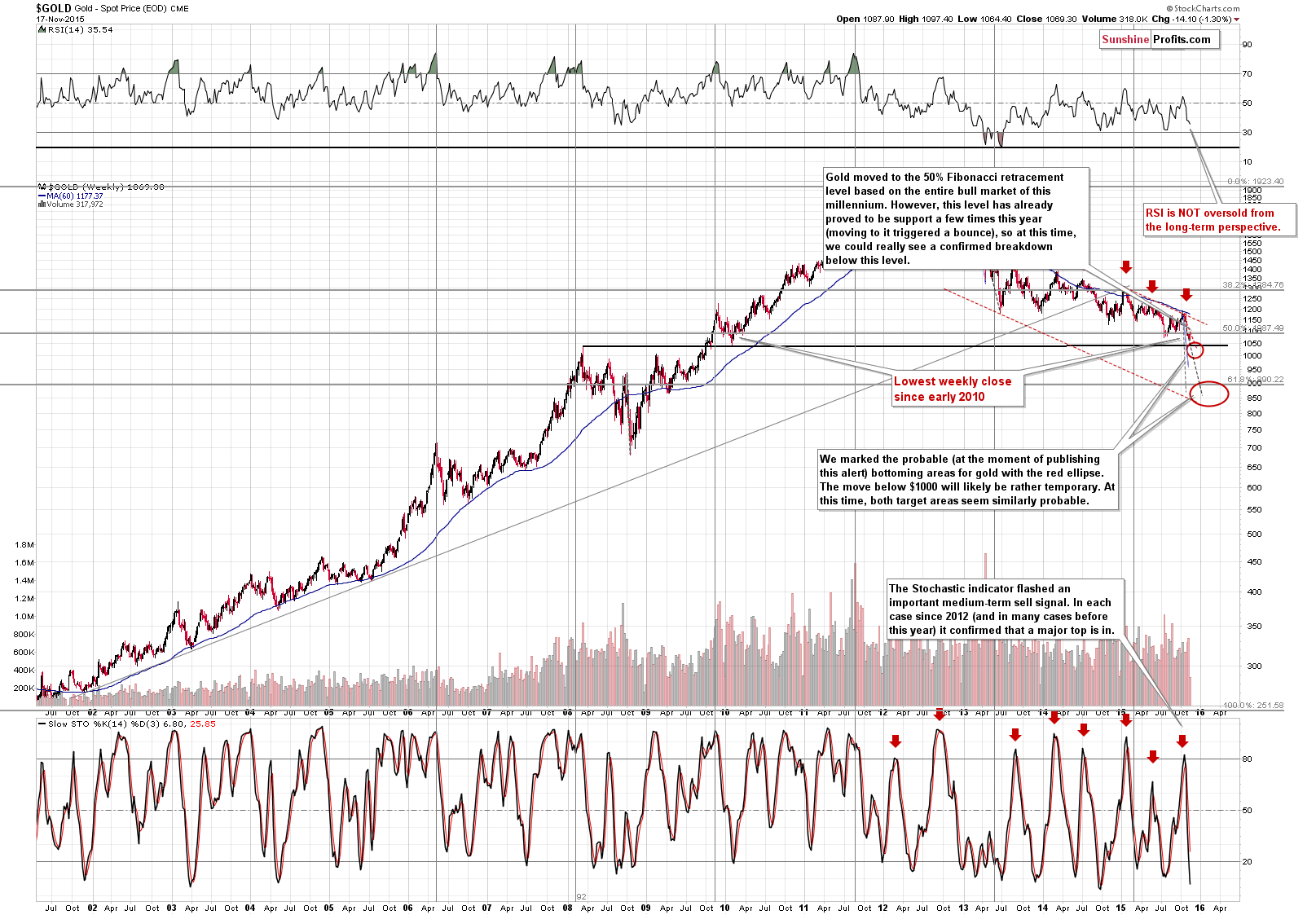

It seems that the corrective upswing was indeed very short-lived and gold continued to decline. Once again, those who believed that the final bottom in the precious metals sector was already in were proven wrong. We would like to take this opportunity to remind that we are thinking that the bottom is not in because a major decline (like the current one) has to end in a profound way, making most of the hard-core precious metals bulls give up. We haven’t seen something like that yet and there are multiple confirmations that we are constantly looking for. In other words, it is not the lack of fundamental factors that’s preventing gold from rallying and, consequently, additional bullish information (like QE2 in the Eurozone) will likely have only a temporary effect until the extreme pessimism is reached and markets can truly turn around. This moment is likely just several weeks or months away.

Will gold slide further in the short term? Most likely yes. Gold plunged lower on significant volume and closed below 2015 intra-day low. The breakdown is not confirmed yet, so the implications are not very bearish for the short term, but we think that they are bearish enough to keep the current short position intact. Besides, we already moved the stop-loss level to just above $1,100, so we are prepared for both minor (which we will ignore) and major (a stop-loss would take us out automatically) corrective upswings.

When do we exit the short positions? It depends on what happens – when we see some kind of strong bearish confirmation (like a major reversal + strong outperformance of mining stocks or any other major bullish factor) while gold is in our target area, we will likely send an alert with a confirmation that we are exiting the position and taking profits off the table. The initial target levels that we provide in the alerts are not profit-take levels (profit-take levels exit the position automatically) – our targets are just a “roadmap” of what we expect (but gold could slide to $1,000 or so instead of just moving to $1,050 and reversing) and we think that waiting for bullish confirmations is justified from the risk/reward point of view.

As you can see on the above chart, the next important support levels are the 2008 high ($1,033.90) and the 2010 low ($1,044.50). The next one is the $1,000 level. In our opinion, out of these levels, the $1000 level is the strongest. The mentioned 2008 and 2010 extremes are the intra-day ones. If we take the daily closing prices into account, we would get $1,004.30 and $1,052.80, respectively. The former (Mar. 18, 2008 high) makes the psychological barrier of $1,000 stronger, while $1,050 could result in a pause within the current decline. Either way, we will be monitoring the market for signs of the interim bottom as well as the final bottom.

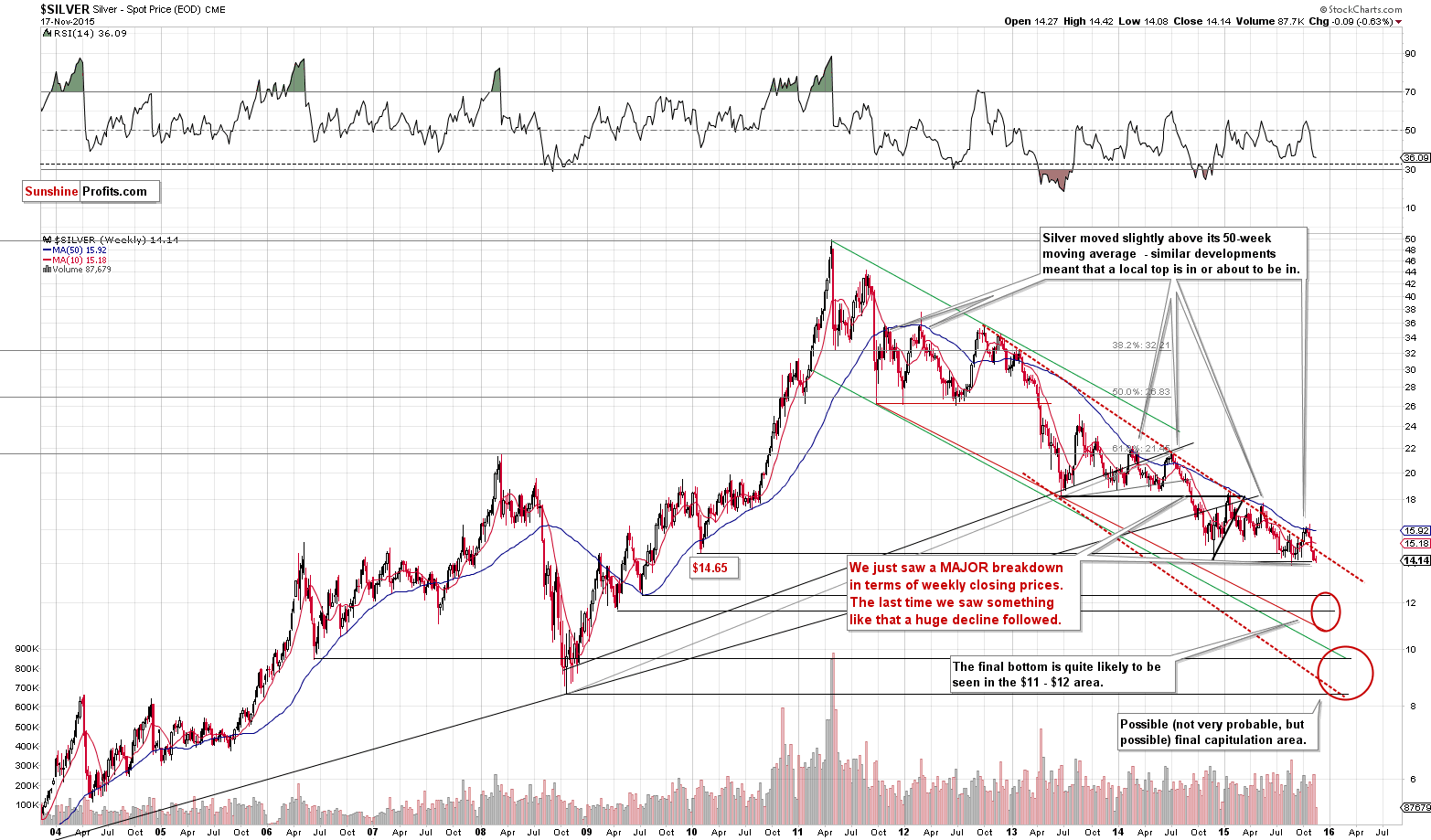

The decline in silver continues. The white metal hasn’t closed below the previous 2015 low yet (in terms of daily closing prices), so there’s nothing new to comment on here. The medium-term trend remains bearish.

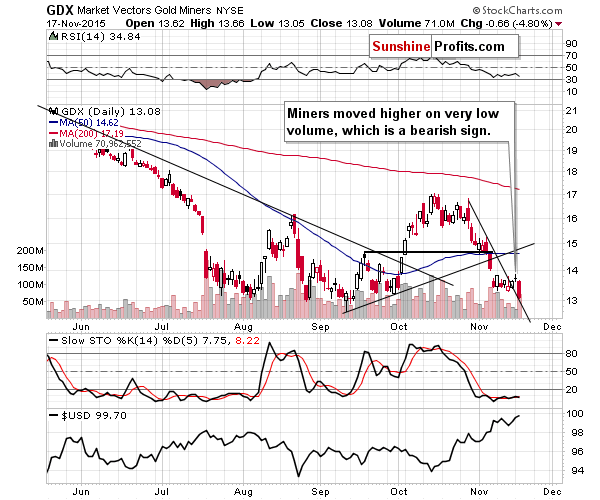

Now, the GDX ETF didn’t move below its previous 2015 low (it’s 4 cents above it), but both the HUI and XAU indices declined and closed below their respective 2015 lows and these indices are more important when it comes to monitoring breakdowns. The GDX ETF is important because it’s a proxy for the precious metals sector that allows us to analyze volume. Miners declined on significant volume yesterday, which is a bearish sign suggesting that the decline is not over yet.

Moreover, miners have been consolidating in a flag formation and the move that is likely to follow such a consolidation is likely to be similar to the one that preceded it (and the preceding decline took miners from about $17 to about $13.60). This would imply a move to about $11 in the GDX ETF.

Summing up, we saw major declines in gold and mining stocks (silver declined as well) and we saw a few important breakdowns and even though these moves were not confirmed, it seems that the decline is far from being over. We have been expecting to see lower prices and we first wrote about opening a short position when gold was at about $1,150, but even though the decline is already significant, it doesn’t seem that exiting the current short position is justified from the risk/reward perspective, because it seems that metals and miners have more room for declining and we haven’t seen important bullish signs just yet. It seems that the profits on this position will become even bigger before this trade is over.

We are adjusting our initial target price for gold lower due to the reasons outlined in today’s alert.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short position (full) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,012; stop-loss: $1,103, initial target price for the DGLD ETN: $109.27; stop loss for the DGLD ETN $85.51

- Silver: initial target price: $12.60; stop-loss: $14.73, initial target price for the DSLV ETN: $96.67; stop loss for DSLV ETN $61.00

- Mining stocks (price levels for the GDX ETF): initial target price: $11.57; stop-loss: $14.23, initial target price for the DUST ETF: $26.61; stop loss for the DUST ETF $17.55

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $16.27; stop-loss: $20.03

- JDST ETF: initial target price: $46.47; stop-loss: $29.71

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

U.S. retail sales barely rose in October. They increased 0.1 percent, below the expectations of a 0.3 percent rise. What does it mean for the gold market?

U.S. Retail Sales Weak in October. Will It Affect Gold?

=====

Hand-picked precious-metals-related links:

How a global solar drive will boost silver prices

Don’t bet on Asian middle class to lift gold, China pioneer says

=====

In other news:

US Consumer Price Index rose 0.2% in Oct, matching estimates

Prudential's Peters uses barbell as rate hike looms

Hedge-Fund Veteran Says Euro Slide Almost Over, UBS Agrees

Pimco Dethroned as Emerging-Market Bond King

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts