Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

The most important event that we saw yesterday was the Fed’s decision to hike interest rates, so I’ll begin today’s analysis with the fundamentals.

Look Out Below

While the PMs hide behind the Russia-Ukraine conflict and still remain materially overvalued, their fundamental outlooks were dealt another blow on Mar. 16. To explain, I’ve been warning for months that surging inflation would elicit a hawkish shift from the Fed. With hawkish rhetoric morphing into hawkish policy on Mar. 16, the Fed raised interest rates by 25 basis points.

The FOMC’s monetary policy statement read:

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong.

“In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.”

Thus, while geopolitical conflict has distracted the PMs from domestic realities, a higher U.S. federal funds rate is bearish for their medium-term prospects. For context, liftoff increases the fundamental values of the USD Index and U.S. Treasury yields. Since these are the PMs’ main fundamental adversaries, they often move in the opposite direction.

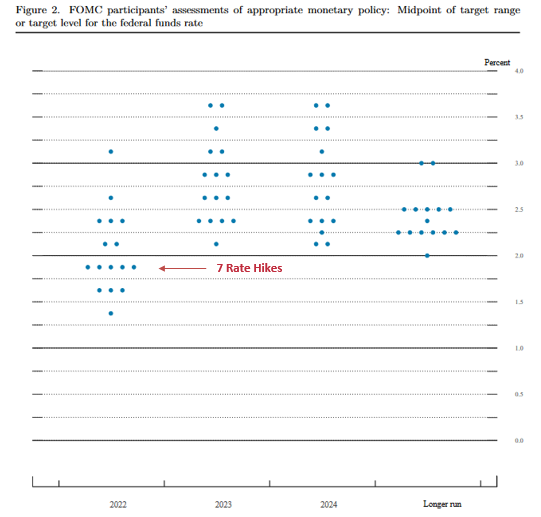

More importantly, though, while a 25 basis point rate hike on Mar. 16 was largely expected, the FOMC’s median dot plot still signals six more hikes in 2022.

Please see below:

To explain, the blue dots above depict FOMC officials’ expectations for the U.S. federal funds rate in 2022, 2023 and 2024. For context, one dot equals one FOMC participant. If you analyze the arrow labeled “7 Rate Hikes,” you can see that the median projection (five dots) is for the U.S. federal funds rate to hit 1.75% in 2022. As a result, that’s seven rate hikes in total, including the one recorded on Mar. 16.

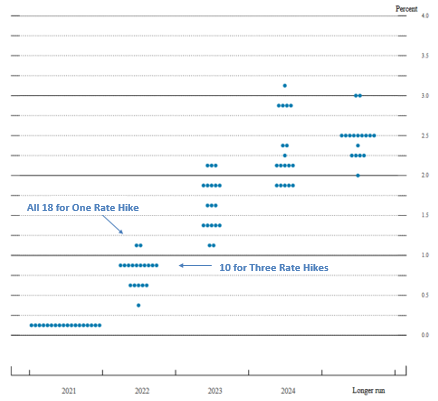

For context, the FOMC’s previous Summary of Economic Projections (SEP) had officials penciling in three rate hikes in 2022. I wrote on Dec. 16:

With all 18 members now expecting at least one rate hike in 2022, the median forecast (10 dots = 10 members) is for three rate hikes in 2022.

Please see below:

The bottom line? When the Fed drops the hawkish hammer, it shakes the PMs’ fundamental foundation. For example, surging inflation led to an upgrade of the FOMC’s PCE Index projection. Then, it led to a taper announcement being pulled forward by several months. Now, it’s led to an accelerated taper and has the majority of FOMC officials signaling three rate hikes in 2022.

Keep in mind: the accelerated taper will have little effect on inflation in the near term. In reality, the liquidity deceleration will take months to filter through the real economy. As a result, more hot CPI prints will likely hit the wire in the coming months and don’t be surprised if Fed officials ramp up the hawkish rhetoric in 2022.

To that point, Fed officials’ median estimate has gone from three rate hikes to seven rate hikes in three months. Moreover, with inflation still materially problematic, the FOMC also increased its Personal Consumption Expenditures (PCE) Index forecast.

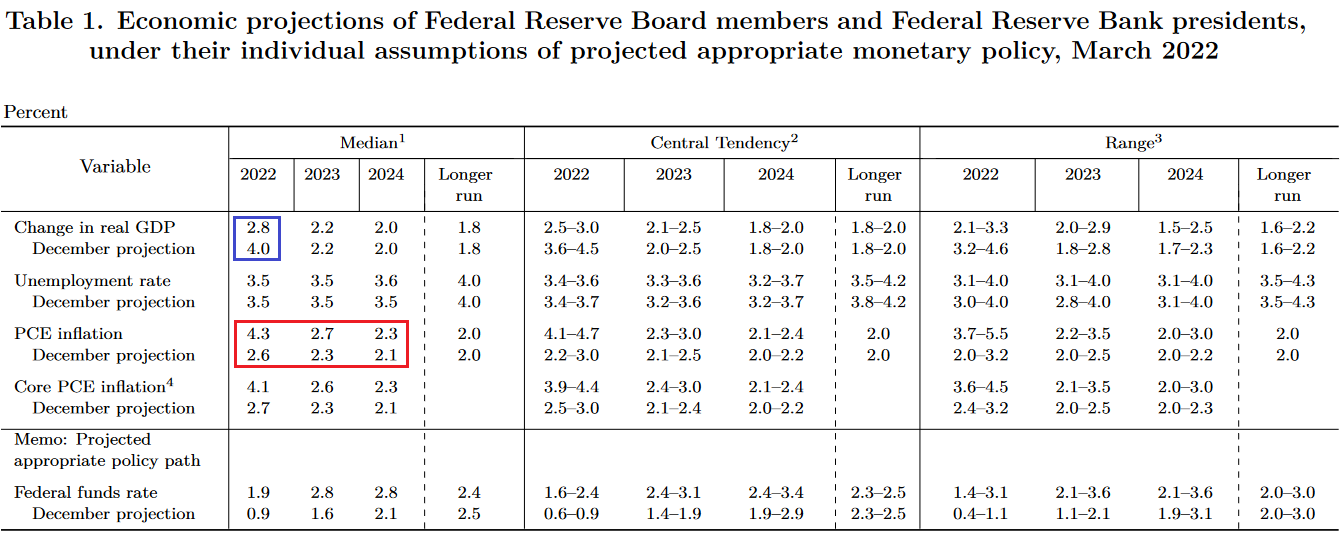

Please see below:

To explain, the red rectangle above depicts the FOMC’s PCE Index projections in 2022, 2023 and 2024. If you analyze the current values versus the December projections, you can see that all three increased. As a result, team “transitory” has finally realized what I was warning about throughout all of 2021.

On top of that, if you focus your attention on the blue box above, you can see that the FOMC reduced its real GDP growth forecast from 4% to 2.8%. Why is this noteworthy? Because the FOMC knows that it needs to reduce demand to calm inflation.

Remember, there is a cause-and-effect relationship here. If the FOMC lets the U.S. economy run hot, then inflation runs hot too. However, by raising interest rates to temper inflation, the growth side of the equation suffers. As a result, lowering its real GDP growth forecast is the FOMC’s way of letting investors know that it’s serious about reducing inflation.

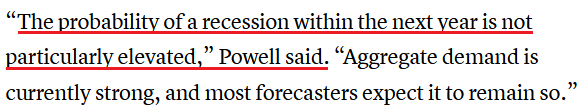

To that point, Fed Chairman Jerome Powell said during his press conference: “without price stability, you really can’t have a sustained period of maximum employment. The plan is to restore price stability while also sustaining a strong labor market. That is our intention and we believe we can do that. But we have to restore price stability.”

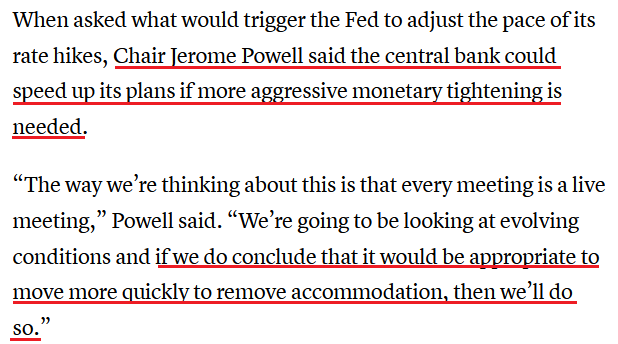

Furthermore, with the median dots projecting six more rate hikes and six FOMC meetings left in 2022, simple math implies that “every meeting is a live meeting.” However, with Powell uttering the words himself, the potential for six more rate hikes is profoundly bearish for the PMs.

Please see below:

In addition, Powell said: “We expect to announce the beginning of balance sheet reduction at an upcoming meeting.” However, in a nod to the financial markets, he added: “In making decisions about interest rates and the balance sheet, we will be mindful of the broader contexts in markets and in the economy, and we will use our tools to support financial and macroeconomic stability.”

More importantly, though, the critical development is Powell’s view of the U.S. economy. For context, I’ve been warning for months that U.S. economic growth and consumer spending remain resilient. I wrote on Mar. 15:

Whether it's Visa's U.S. Spending Momentum Index (SMI), the Chicago Fed's Weekly Index of Retail Trade projections, or the New York Fed's Survey of Consumer Expectations, plenty of data signals robust consumer spending. Moreover, whether it's JOLTs job openings, U.S. nonfarm payrolls, or the New York Fed's Survey of Consumer Expectations, plenty of data also signals a robust labor market.

As a result, the cocktail of inflation, employment and consumer spending is bullish for hawkish Fed policy and bearish for the PMs. Moreover, hawkish Fed policy is bullish for the USD Index and U.S. Treasury yields. Thus, while the PMs can hang their hats on the Russia-Ukraine conflict in the short term, their medium-term fundamentals continue to deteriorate.

The Fed vs. The Economy

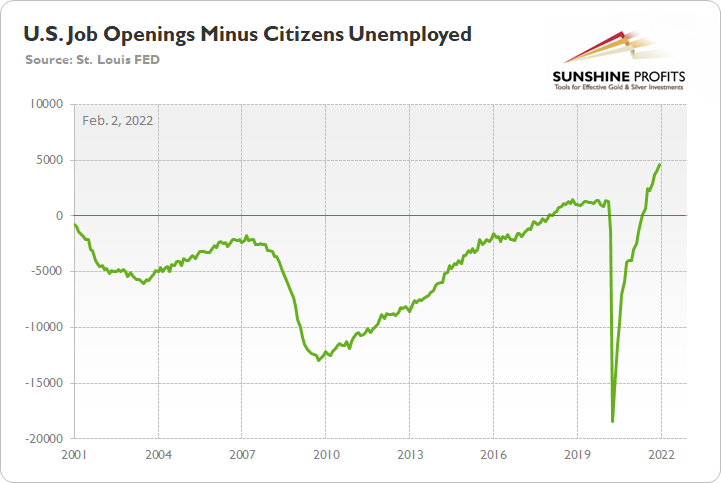

To that point, Powell noted during his press conference that there are ~1.7 job openings for every unemployed U.S. citizen. He added that “all signs are that this is a strong economy, one that will be able to flourish in the face of less accommodative monetary policy.”

As a result, does this sound like a man that’s about to perform a dovish 180?

For context, I noted the labor market strength on Feb. 2. I wrote:

Since Fed officials’ hawkish forecasts depend on the direction of inflation and the U.S. economy, the outlook for both remains resilient. Supporting the thesis, the U.S. Bureau of Labor Statistics (BLS) revealed on Feb. 1 that U.S. job openings came in at 10.925 million, ahead of the 10.300 million expected. Moreover, there are now 4.606 million more job openings in the U.S. than citizens unemployed.

Please see below:

Continuing the theme, while the Fed’s rate hike prospects have and will depend on the health of the U.S. economy, the latter has remained resilient throughout the Delta and Omicron variants’ spread. Moreover, with the warm weather approaching, the summer sun is bullish for the U.S. economy and for hawkish Fed policy. For context, I wrote on Jan. 31:

The U.S. economy is growing well ahead of its pre-pandemic trend. Moreover, while disruptions from the Omicron variant will likely slow growth in Q1, the outbreak should calm down when warmer weather arrives. With the season also allowing for patio dining, camping trips, and other outdoor activities that support economic growth, Q1’s weakness should be short-lived.

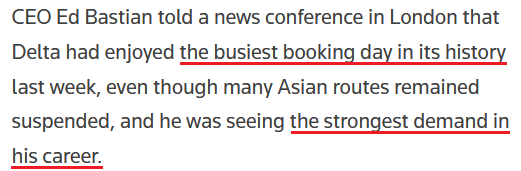

To that point, Delta Air Lines CEO Ed Bastian said on Mar. 15 that higher oil prices and coronavirus outbreaks have done little to deter consumers’ travel plans.

Please see below:

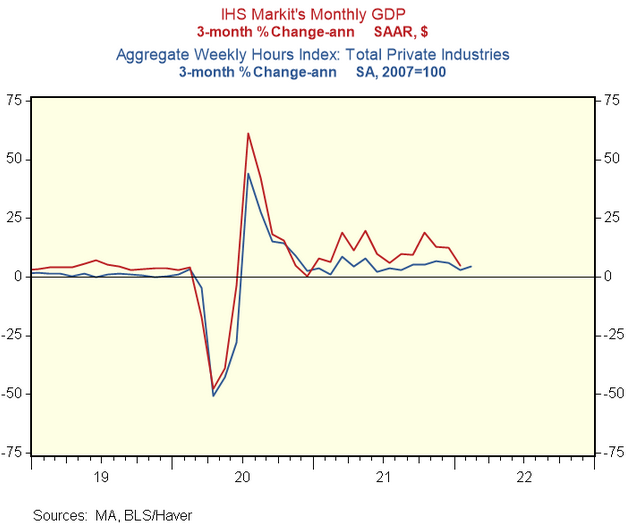

Finally, when making the connection between growth in hours worked and GDP growth, the data also signals a macroeconomic backdrop that supports a hawkish Fed.

Please see below:

To explain, the blue line above tracks the three-month annualized percentage change in weekly hours worked, while the red line above tracks the three-month annualized percentage change in IHS Markit’s monthly U.S. GDP. If you analyze the connection, you can see that they often follow in each other’s footsteps.

With hours worked running at a 4.4% annualized rate, it implies 4.4% GDP growth. As a result, plenty of fundamental ammunition supports more Fed rate hikes in the coming months.

The bottom line? While the PMs focus on the Russia-Ukraine conflict, they’re missing the forest through the trees. ith short-term gains likely to turn into medium-term pain, the domestic fundamental outlook is profoundly bearish. As such, a hawkish Fed, a strong USD Index, and higher U.S. Treasury yields should make this clear over the next few months.

In conclusion, the PMs were mixed on Mar. 16, as mining stocks followed the S&P 500. However, with bearish realities likely to emerge over the medium term, more downside should confront gold, silver and mining stocks. Moreover, with market-moving headlines starting to recede and whispers of a ceasefire creeping in, a de-escalation of the Russia-Ukraine conflict would likely amplify the speed of the PMs’ potential drawdowns.

Having said that, let’s segue to a question that I just received from one of my subscribers.

The question was about the rise in mining stocks and gold and how it was connected to what was happening in bond yields. Precisely, while short-term and medium-term yields moved higher, very long-term yields (the 30-year yields) dropped, implying that the Fed will need to lower the rates again, indicating a stagflationary environment in the future.

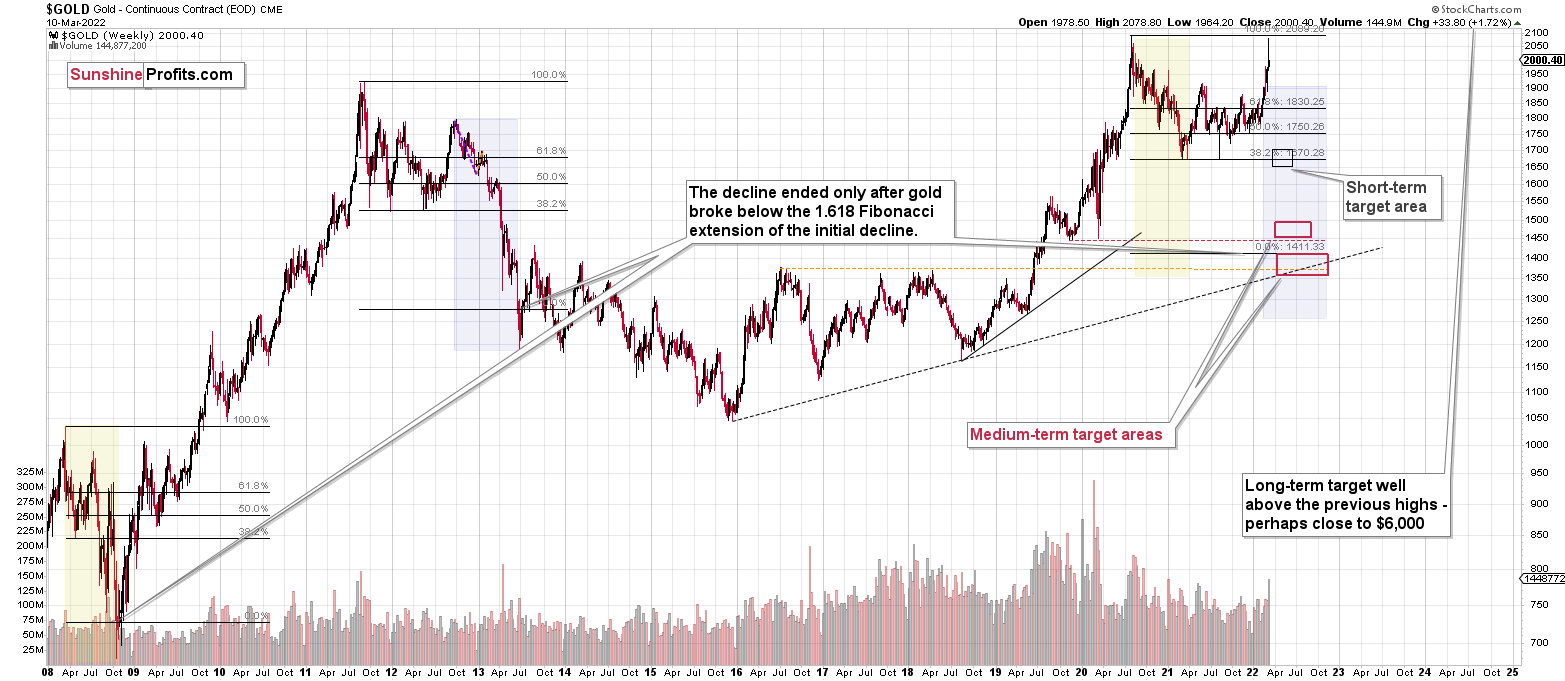

First of all, I agree that stagflation is likely in the cards, and I think that gold will perform similarly to how it did during the previous prolonged stagflation – in the 1970s. In other words, I think that gold will move much higher in the long run.

However, the market might have moved ahead of itself by rallying yesterday. After all, the Fed will still want to keep inflation under control (reminder: it has become very political!), and it will want commodity prices to slide in response to the foregoing. This means that the Fed will still likely make gold, silver, and mining stocks move lower in the near term.

In particular, silver and mining stocks are likely to decline along with commodities and stocks, just like what happened in 2008.

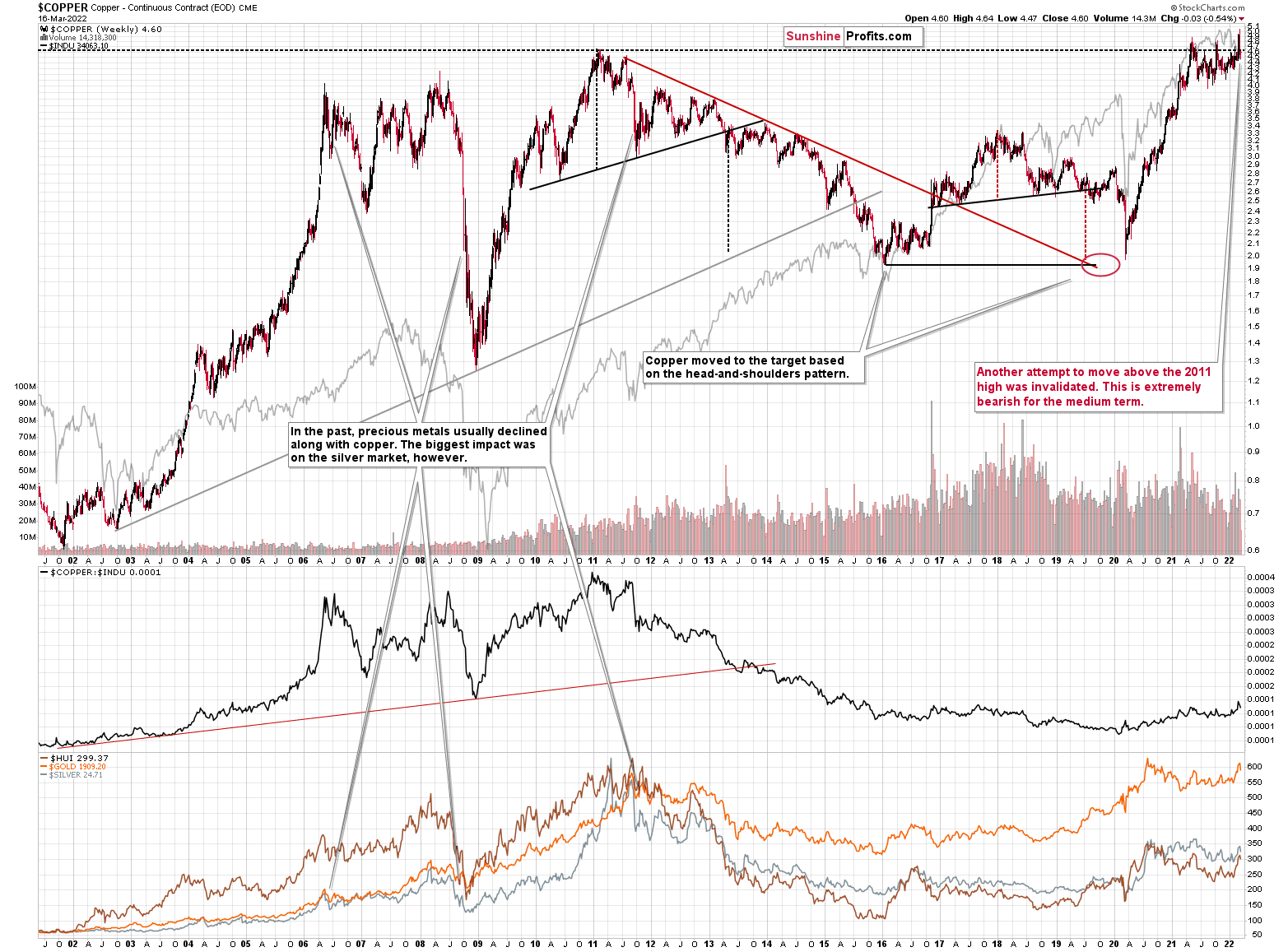

Speaking of commodities, let’s take a look at what’s happening in copper.

Copper invalidated another attempt to move above its 2011 high. This is a very strong technical sign that copper (one of the most popular commodities) is heading lower in the medium term.

Yes, it might be difficult to visualize this kind of move given the recent powerful upswing, but please note that it’s in perfect tune with the previous patterns.

The interest rates are going up, just like they did before the 2008 slide. What did copper do before the 2008 slide? It failed to break above the previous (2006) high, and it was the failure of the second attempt to break higher that triggered the powerful decline. What happened then? Gold declined, but silver and mining stocks truly plunged. The GDXJ was not trading at the time, so we’ll have to use a different proxy to see what this part of the mining stock sector did.

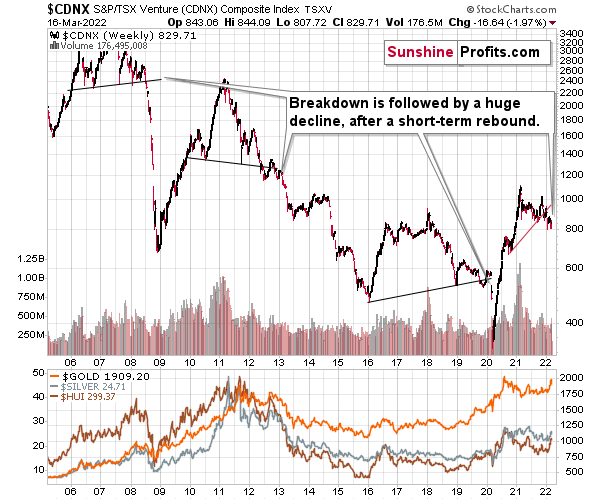

The Toronto Stock Exchange Venture Index includes multiple junior mining stocks. It also includes other companies, but juniors are a large part of it, and they truly plunged in 2008.

In fact, they plunged in a major way after breaking below their medium-term support lines and after an initial corrective upswing. Guess what – this index is after a major medium-term breakdown and a short-term corrective upswing. It’s likely ready to fall – and to fall hard.

So, what’s likely to happen? We’re about to see a huge slide, even if we don’t see it within the next few days.

In fact, the outlook for the next few days is rather unclear, as different groups of investors can interpret yesterday’s developments differently. However, once the dust settles, the precious metals sector is likely to go down significantly.

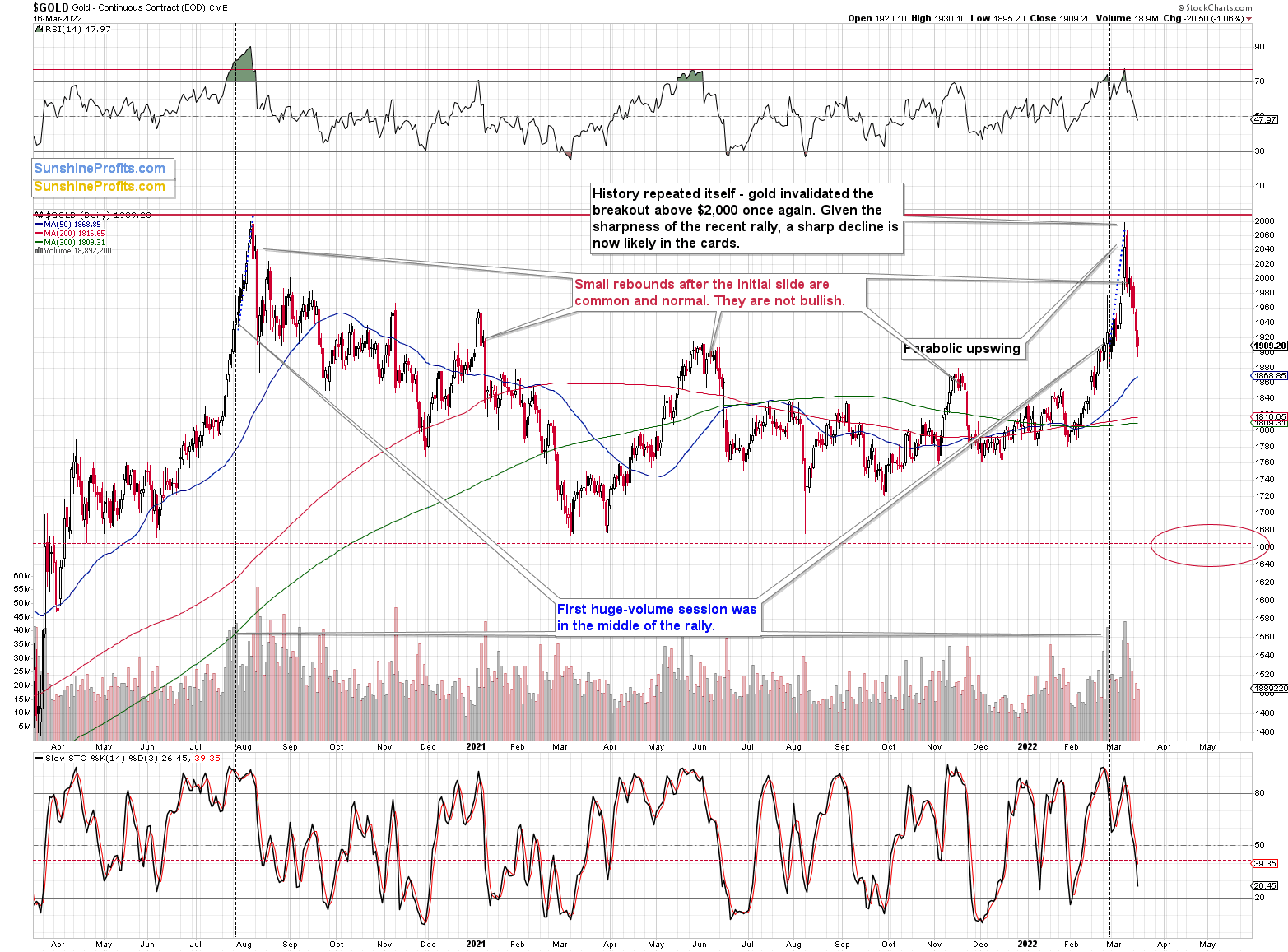

Gold is up in today’s pre-market trading, but please note that back in 2020, after the initial post-top slide, gold corrected even more significantly, and it wasn’t really bullish.

This time gold doesn’t have to rally to about $2,000 before declining once again, as this time the rally was based on war, and when we consider previous war-based rallies (U.S. invasion of Afghanistan, U.S. invasion of Iraq, Russia’s invasion of Crimea), we know that when the fear-and-uncertainty-based top was in, then the decline proceeded without bigger corrections.

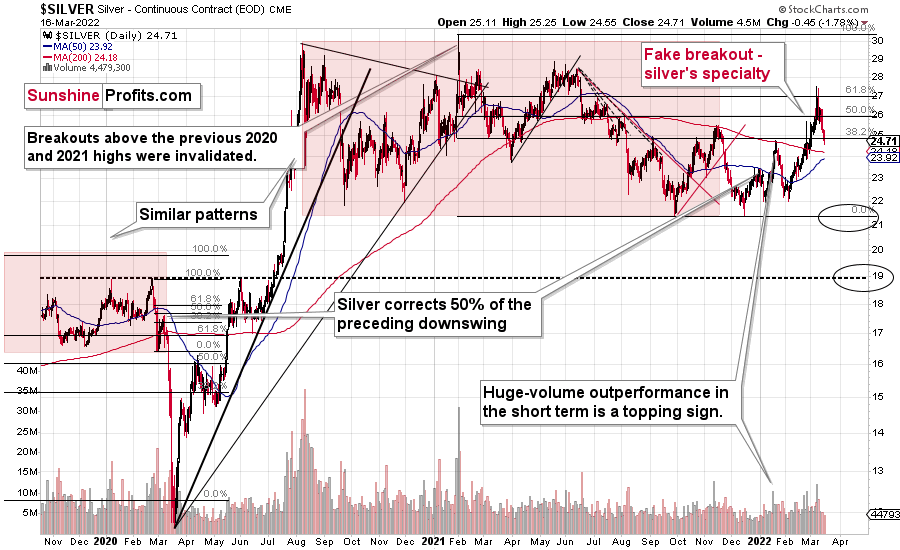

Silver corrected visibly in today’s pre-market trading too, but it doesn’t change anything either.

No market moves up or down in a straight line, and silver is no exception. A rally by ~$1 from intraday low to overnight high after a ~$3 decline is a relatively normal correction during a bigger decline.

As a result, nothing really changed in the above chart. At the moment of writing these words, silver is trading at its late-2021 highs in intraday terms. Consequently, it’s too early to say that we saw a new breakout above those levels. It seems more likely that this counter-trend rally is just a brief pause, before the invalidation-based decline fully ensues.

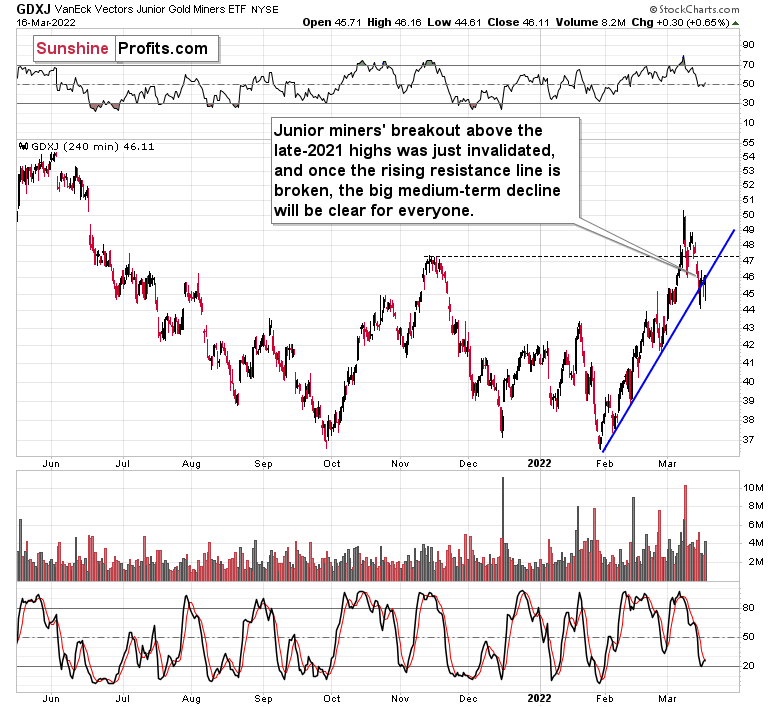

Junior miners’ performance remains in tune with my previous comments too.

In my previous analyses, I wrote the following:

Now, if we zoom in even further, we’ll see that miners moved to their very short-term rising support line.

This means that it won’t be that odd if we see some kind of breather right now, before the decline continues.

Given that the Fed’s interest rate decision and the following press conference are scheduled for Wednesday, it would be rather normal to see the markets’ hesitation on Tuesday. There might be some immediate-term volatility, but the big moves might wait for the interest rate decision.

Whatever that decision is, when the dust settles, junior miners are likely to decline further.

Indeed, we saw the market’s hesitation – the junior miners bounced back. The dust is still in the air, and juniors are tracking back-and-forth around their rising short-term support line. Again, after a short while, juniors’ decline is likely to continue.

All in all, technicals favor a decline in the precious metals sooner sector rather than later.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is now over or very close to being over , and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

- It seems that the first (bigger) stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Letters to the Editor

Q: I would be grateful if you indicated the best product to put me short in the junior miners.

Thank you.

A: I don’t know what kind of product you should choose, because I don’t know your investment preferences, risk tolerance, liquidity requirements, and so on. Telling you specifically what instrument to use could be viewed as investment advice. I can’t provide such.

In my opinion, however, it is generally a good idea (for beginning or intermediately-advanced traders/investors) to simply short the GDXJ ETF. It provides good diversification between individual junior mining stocks and it doesn’t have leverage that might make the value of the leveraged instrument decline over time if the decline doesn’t happen right away and instead we see some back and forth trading (like we did in the previous months). It seems very likely to me that this is finally it – that we won’t have to wait for the slide for much longer (and I’m using the leveraged instrument myself – the JDST), but please note that I can be wrong about it, as nobody can be 100% correct about market moves, and that I’m not a beginning or intermediately-advanced trader/investor myself (my risk tolerance is above average), so what I’m doing won’t necessarily apply to everyone (or to most).

The above is my opinion in general, not directed at anyone specifically.

Summary

Summing up, despite the recent rally in gold, the outlook for junior mining stocks remains exactly as I described previously.

Crude oil’s extreme outperformance, the stock market’s weakness, and critical medium-term resistance levels reached by gold (all-time high!) and junior mining stocks, all indicate that the tops are at hand or have just formed. The huge-volume reversals in gold and (especially) mining stocks, along with silver’s short-term outperformance, all point to lower precious metals prices in the following days/weeks. It seems that the top is in.

Investing and trading are difficult. If it was easy, most people would be making money – and they’re not. Right now, it’s most difficult to ignore the urge to “run for cover” if you physically don’t have to. The markets move on “buy the rumor and sell the fact.” This repeats over and over again in many (all?) markets, and we have direct analogies to similar situations in gold itself. Junior miners are likely to decline the most, also based on the massive declines that are likely to take place (in fact, they have already started) in the stock markets.

From the medium-term point of view, the two key long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from short positions are going to become truly epic in the coming months.

After the sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more in the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $34.63; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $14.98; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $25.48; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $38.28

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $11.79

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $29.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief